Millennials are a bunch of people who spend what they earn. It’s a brave statement to make—but I would know seeing since I am one myself. Savings is a lovely prospect hidden somewhere at the back of our brains, constantly nudging us to eventually do it, but we often only get around to it when we have matured in our career or have an urgent item to save up for.

Our parents would be a great example of the ones who would think ahead and save up for the future from their first paycheck itself. It’s a difference in mindset between both generations, and it would also explain why they would be particular about their spending and investments. It would also explain why they have more savings, investments and insurance in the first place—things which millennials usually pay less attention to.

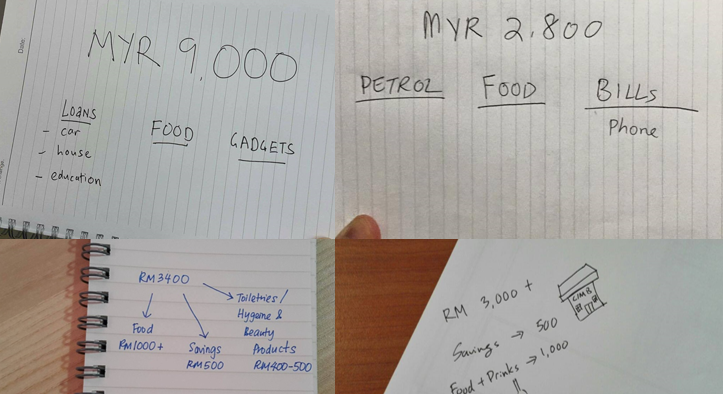

In order to test out this hypothesis, we asked 10 millennials aged between 22-35 what their current salary is and what is their biggest expenditure per month. It was a good way to see what actually really drains our bank account each month and to finally solve the age old question of “Where did my money go to?”

No names or occupations are disclosed in this article so as to protect the person’s privacy, and all salaries stated are of an estimate only.

Millennial #1

Millennial #2

Millennial #3

Millennial #4

Millennial #5

Millennial #6

Millennial #7

Millennial #8

Millennial #9

Millennial #10

Breaking It Down

Some obvious observations is that most millennials, based on this simple survey, tend to spend the majority of their salary—up to 40%—on food. I see this stark difference in the way my parents and I spend on food as well. While I am more open to paying extra for healthy food to be delivered to my office during lunch hour, my parents on the other hand may not be so receptive to pay for that service.

A common second portion goes to expenses that are related to loans (car, education) and rental fees. This is a category that is usually the bane of a student or young working adult; can’t do without it, hate paying for it.

Next two common expense categories are transportation and savings. With the cost of living increasing recently, it’s no wonder that petrol and toll costs would take a larger chunk of our pay compared to the last decade. Even more so since a fresh graduate’s pay nowadays isn’t increasing as quickly as their expenses, which is very unfortunate.

Generation Gap

It’s evident to see how millennials have their own set of priorities and what they would spend on is typically the same across the board, regardless of the amount of their paychecks. Whether paying for their meals, transportation, or accommodation, these are the items which we would normally consider as the short term “pay now” items; but what about items which are more “long term” in nature?

Not many millennials would anticipate illness or death, and it might even sound morbid to think about what could happen in the next few decades down the road. Don’t feel bad about that. As millennials, we are used to having things relatively easier than our forefathers. For example, now some millennials have the options of choosing their career based on passion, and they are more willing to quit a job to pursue another one that might be more fulfilling, or has better work culture.

Do you think that our parents had that same luxury of choice? Very unlikely. They did any job they could get their hands on for the sake of the family. Passion, work culture, and company perks like having a foosball and ping pong table in their office were highly unheard of. They worked and earned money with the future in mind; on the other hand, millennials think of the “now”, carpe diem, #YOLO, etc.

This difference could be one of the leading factors why we would rarely think of illnesses, diseases, and other unforeseen tragedies.

One popular misconception for insurance plans is that we’d have to fork out a few hundred Ringgit a month for it. This couldn’t be further from the truth. Fact of the matter is, we have complete control over how much we want to pitch in every month.

There are various kinds of health insurance available for us to choose from and with AXA’s 200 CancerCare policy (www.110cancercare.com), it could be as low as RM1.50 per day! Yes, no joke. RM1.50.

That’s like cheaper than buying food from the Nasi Kandar at your local neighbourhood.

Some may be thinking that this RM1.50 plan won’t cover much, maybe only the really bare necessities, but apparently not either. The policy provides cancer protection features, like financial support of up to 200% Cancer Sum Insured, and guaranteed premium fixed for 20 years (you won’t be forced to pay extra for your insurance plan after several years).

What’s more, with access to AXA Care Benefit, you can get full support and assistance via 24/7 concierge services arrangement, psychological and dietary consultation, hair and wig care services, transport arrangements, and even access to regular insightful cancer prevention knowledge and expert advice.

So basically, you can still allocate money for your yummy food. I mean, you did work hard for it, didn’t you?

Age Is Not A Factor

“I’m still young and healthy mahh!”

Then 28-year-old Choo Mei Sze, a TV host, emcee and writer, was earning a steady 5-figure monthly salary. Even so, she was not prepared for the financial burden that came with the news of her cancer.

“The truth is, we were not prepared for this. When the surgeon told us how much the surgery cost, we were shocked,” she told The Star.

She, unlike many others, had a happy ending to her circumstances. Her family and friends pitched in to help and her insurance agent’s supervisor lent a helping hand in getting her case resolved. Plus, thanks to a very wise and experienced doctor, her surgery was successful and her colostomy was reversed.

Since cancer is an illness that knows no age, it helps to look for insurance packages that are curated specially to prepare for it financially, emotionally and mentally; and thanks to AXA’s 200 CancerCare policy (www.110cancercare.com), thank goodness it’s only RM1.50 a day. Go here and fill up a form to get a free quote.

Feel like you should do your part to fight cancer but don’t know how to? There’s one simple way you can help that doesn’t involve any donation! All you have to do is share the blog post that’s on the www.110cancercare.com website and AXA AFFIN will donate RM1 to the National Cancer Society of Malaysia for EVERY share.

This money will be used for their Cancer Information System (CIS) to help patients, survivors, and caretakers who are suffering from cancer. 1 share may not sound like much, but a small droplet is able to create a ripple effect that cancer patients will no doubt thank you for. After all, every little bit counts when times get hard.