The Association of Banks in Singapore (ABS) announced yesterday (27 Jun) the launch of PayNow, a new peer-to-peer funds transfer service that will allow customers to send and receive funds from one bank to another by simply using their mobile number or NRIC.

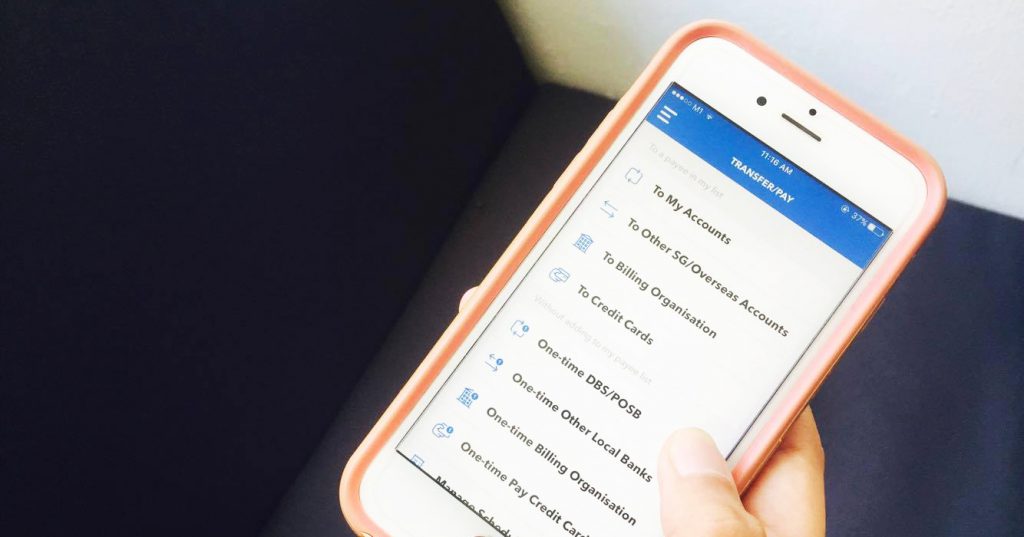

The service will be launched from 8am on 10 Jul this year, and customers of seven participating banks – Citibank, DBS Bank/POSB, HSBC, Maybank, OCBC Bank, Standard Chartered Bank, and United Overseas Bank would be able to use it without leaving the various internet banking platforms or mobile banking apps.

The seven participating banks are said to cover about 90% of total retail transaction volume, according to ABS director Ong-Ang Ai Boon, so PayNow is likely to benefit most customers in Singapore.

Unlike DBS’ PayLah!, there would also be no need for a mobile wallet to conduct transactions.

The service will be free, and made available all day, every day.

PayNow will use FAST (Fast And Secure Transfers), the service that, since March 2014, has been letting customers transfer funds from one bank to another almost instantly.

To note though, the service will only cover transactions in Singapore dollars, and within Singapore boundaries.

In Line With Cashless Push By The Government

The launch comes in line with the push towards innovation in payments by the government.

In February, Prime Minister Lee Hsien Loong talked about how we “need a good electronic payment system”.

“If you compare (what we have) with other countries, there is a lot more we have to learn. We have not gone as far as we need in order to do cashless payments in hawker centres, in shops, between people. I was complaining to my permanent secretaries the other day. The ministers have lunch once a week together, we pay for our own lunch and there is one minister in charge of making a collection. We made a great step forward when he said: “I do not want to receive cash anymore, please write me cheques.” The permanent secretaries told me they are one step ahead, they use PayLah, which is a DBS application. But it shows how non-pervasive it is and what the potential is if we can get it through.“

Finance Minister Heng Swee Keat also mentioned at ABS’ 44th annual dinner last night that a Payments Council led by the Monetary Authority of Singapore (MAS) will be set up in the move towards a Smart Nation and cashless society.

The Council will be made up of 18 representatives from banks, payment companies, industry associations and businesses.

The Question Of Security

In its press release, ABS assures that the service will “adopt the same high security standards established by the banking industry in Singapore for funds transfer including FAST”.

To ensure that funds don’t end up going to the wrong person, the sender would also be able to see the recipient’s name before confirming the transfer. Any changes in mobile numbers should also be reported immediately, so that banks can automatically de-link the old number from the bank account.

Are you excited for the new service, and would you use it when it’s officially launched?

Also Read: These S’porean Bosses Ventured Out Of Their Comfort Zones And Found Their True Calling