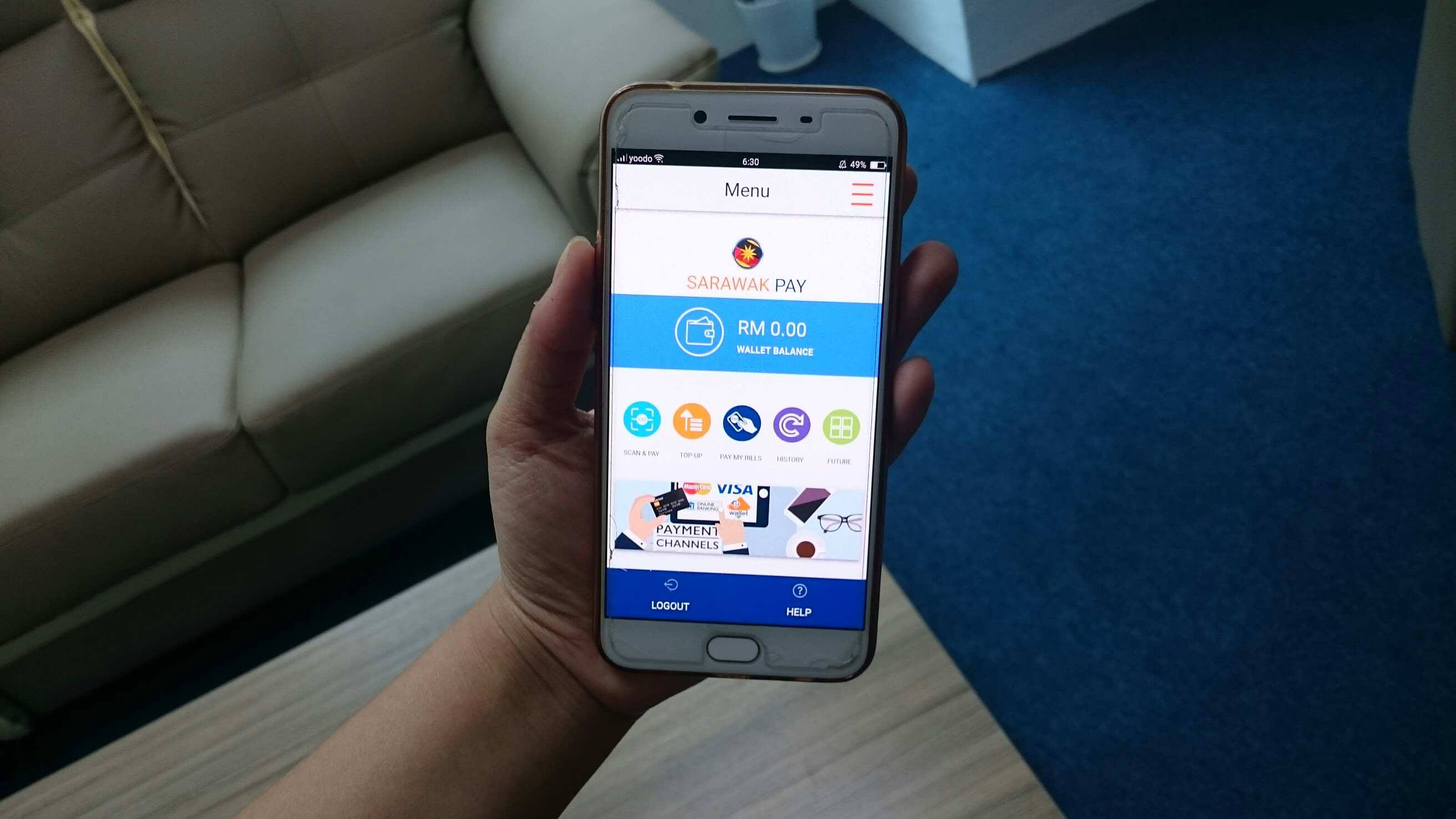

- As part of their ambitious digital economy push, Sarawak launched the Sarawak Pay app, for bill payments.

- Eventually, the vision is for Sarawakians to use it for all of their cash transactions, from buying things in the market to big businesses using it for their business dealings.

- Before that though, the government has to grow the nation’s internet infrastructure, and educate those in the rural areas on the platform.

Sarawak Pay was launched last November, with Abang Johari, Chief Minister of Sarawak, making bold predictions of how Sarawak’s economy might change thanks to the launch of this initiative. The e-wallet is supported by Bank Negara Malaysia as well.

To Abang Johari, the Digital Economy is about ideas to organise society in a more efficient way, while still protecting personal information and privacy, and about applying technology in a cost-effective manner.

But where role does Sarawak Pay play in all of this and what else will it grow to?

The team is headed by Dr. Zaidi, the General Manager of the Sarawak Multimedia Authority which oversees Sarawak’s digital economy initiatives. We spoke to them for their insight on where the e-wallet might be heading to.

What exactly is Sarawak Pay?

Sarawak Pay is actually a sister of PayBills Malaysia (which does exactly what you think), and the team describes it as the financial backbone to drive the state’s digital economy agenda. The platform already has approximately 20,000 users at the time of writing.

For now, the Sarawak Pay platform has more than 30 billers and service providers on board, from various government agencies and their subsidiaries providing online payments for things like utilities, assessments, land rent and premiums, buying goods and services, and others.

The app supports payments either via internet banking, debit or credit card, and even payments using electronic money.

One of the platform’s functionalities includes scanning and paying using QR codes, getting bills through the app, even paying for multiple bills in one go. Signup and use of the app is free as well for consumers.

The platform was developed as a goodwill investment by some of the state’s subsidiary companies, and they monetise by getting a minimal fee for every transaction (at no cost to the user).

The plan is to eventually get merchants on board the platform as well, with the objective of having citizens use the platform for their day-to-day use.

The company that handles Sarawak Pay, SiliconNet Technologies, has approximately a decade of experience running an online payments system under PayBills Malaysia and PayBills Sarawak.

They’ve also developed a payment gateway called Payment Galaxy (also available on Sarawak Pay) for use on those platforms, and white-labeled to other government agencies as well.

Where is it heading to?

Eventually, Sarawak Pay’s functionalities will extend to wallet transfers, going dutch on payments (like Venmo), remittances, cross-border payments, and even Business-to-Business and Customer-to-Business transactions.

Of course for that to happen, Bank Negara will have to approve of the e-wallet having more than RM3,000 in its system first.

“There are those working outside of Sarawak who would like to remit money back home to mum. The mum could be using Sarawak Pay so they could potentially remit money into the mum’s wallet,” said the team.

But it can be difficult for an older citizen like that mum to use the platform, between authentication of cards, accounts, to approvals.

To address that, Sarawak is looking into developing a digital identification for all Sarawakians.

“That could complement Sarawak Pay and be our eKYC, so we don’t need so many authentification steps for the poor guys on the streets who are just trying to get things done.”

“We don’t want to make people sign up every time they want services with the government. Instead of signing up for 10 different services, they can sign up one time, and use the same profile data everywhere.”

The ID could also help Sarawak develop big data, analytics, and so on, especially if all transactions are held on one platform.

The state has a vision where Sarawak Pay will become a virtual bank for its citizens, similar to how Amazon may move forward.

With Sarawak Pay as a base, the state will be embarking on a 47-action plan that would impact 29 economic sectors,

There are infrastructures that need to be built first.

Sarawak is not blind to one of the key issues in moving this plan forward—internet connectivity across the state.

“Internet availability, especially broadband, is limited to the town center and urban areas. Rural areas in the village, some of them don’t even have water, how are you going to serve these people?”

This is especially true since Sarawak also has a vision towards closing down a certain number of bill payment counters to help save taxpayer money.

So for Sarawak Pay to truly see ubiquitous use across the state, the state has plans to improve the internet infrastructure across Sarawak, including penetration to the rural areas probably by 2020.

But the team is still realistic about the challenge this poses. After all, Sarawak alone is almost the same size as the whole of Peninsular Malaysia.

Sarawak is also utilising NGOs to help educate rural Sarawakians.

Of their various programmes like organising talks, roadshows and NGO collaborations, the team has the most faith in the latter.

“They have a higher trust in NGOs because those are the people they see and interact with them. Community leaders. Those are the people that we are approaching.”

“It’s more effective than to splash it on newsprint, which doesn’t capture them because they are not in the audience.”

“The adoption can take a while for these people. One of the challenges is adopting is the day-to-day usage.”

Sarawakians are also concerned about the security of the app. To reassure them, the team brings up their TrustMark certification which they’ve had since their PayBills days, which is reviewed once every two years.

But what’s the point?

The state hopes to use Sarawak Pay as a strategy to elevate the income of the people. On the government’s side, electronic-based payments could result in savings amounting to 1% of a country’s GDP, thanks to lower retail payment costs.

The costs saved could include costs of doing bill tallying, engaging security firms to transit physical cash, and on a taxpayer-saving level, less cost to print out the physical currencies.

It is also to compete in an economic landscape that is very definitively getting more and more digital. At this point, it’s either follow the trend or get swept up by the currents.

Infrastructure is a key issue for sure, but it will definitely take the right kind of education for users not only to port over to e-wallets, but to prioritise the use of Sarawak Pay when there are so many other options becoming available in the market now.

There are also future concerns. Could the platform eventually support all of the transactions they plan to bring on? Would those in the rural areas or the older generation be able to adopt this technology for their daily life once it becomes crucial for any commerce?

The Sarawak government probably has these factors in mind in the development of their new economic push, and we certainly wish the state all the best in their ambitious plans.

- The Sarawak Pay app can be downloaded on both Google Play and the Apple App Store.