Honestbee currently owes about US$230 million (S$319 million) but it has since been under court protection from creditors.

In a court hearing held yesterday (March 26), honestbee was seeking to pass a scheme of arrangement that will restructure that debt, especially since it may potentially lose the support of its white night Brian Koo.

Koo’s venture capital firm Formation Group and its US-incorporated vehicle FLK Holdings was supposed to finance the startup’s restructuring, but they are reconsidering it due to “the worsening Covid-19 pandemic across the world and the resulting uncertainties.”

Honestbee sought a two-week adjournment “to clarify the position” of FLK and Formation and to potentially seek new investors for the company, but this was dismissed by the High Court.

This means that its string of over 1,000 creditors can now apply to wind up the company.

In addition, honestbee’s landlord LHN Space Resources can now reclaim the first level of 34 Boon Leat Terrace, which houses its habitat supermarket.

Is there then still any light at the end of the tunnel for honestbee?

Why Did Ong Lay Ann Choose To Be The CEO Of A Sinking Ship?

In a meeting with Vulcan Post on Tuesday (March 24), honestbee CEO Ong Lay Ann shared why he even joined the company in the first place, even when it was already showing signs of cracks then.

When he assumed the role of a CEO in July last year, Ong was fully aware that he has to do more than just “steer the company through this difficult time.”

As a “chief restructuring officer”, his job is to also turn the company around.

“It’s a difficult job,” he admits.

Most of his friends thought he was “crazy” to take on the role, but he simply sees it as another business challenge.

I’ve done a number of these turnarounds and restructuring before. I’ve got a track record of doing this. In Australia, I turned around a company pretty fast. I actually hired back the management that used to run it and (together), we built it from nothing … (till) it’s listed on the Australian Stock Exchange.

Today, I’m still the chairman and larger shareholder there. Along the way, we’ve acquired a few more businesses and today, it’s profitable.

– Ong Lay Ann, honestbee CEO

He adds that honestbee is indeed a “challenge” and a “mess” now, but he believes that there is still a lot of untapped potential so the desire to salvage the company is still alive.

Besides being a homegrown brand, honestbee is actually fulfilling a need and its tech does work, he stressed.

“There were pieces of it that make sense. It is going to be a big task to turn (honestbee) around and it’s even harder now with Covid-19 and all these things added to it, but have I given up hope? No.”

Ong could have very easily declared that the company has gone bust and not repay the creditors a single cent. By proposing a scheme of arrangement, honestbee is showing that it is trying to repay some of their debt — either by cash or equity.

While creditors might not be getting back all the money owed to them, they will at least be receiving some money as well as shares in honestbee.

This is why it’s imperative for him to turn the company around, but it’s clear that he can’t do it without Koo’s help.

According to Ong, honestbee is relying on FLK Holdings — a SPV owned by Koo and Formation — to fund its operations.

They were the ones that worked with me to basically turn the business around and funded (it). That’s the way to turn it around, and that’s why they’re making the offer.

At this moment, that’s the offer that I have on the table. I have not received a better offer or competing offers from anyone else so this is likely the only chance that all the creditors have which is why it’s very important that we maintain (ties) and stay engaged with FLK, Formation and Brian Koo, because they would be the lifeline for the company.

– Ong Lay Ann, honestbee CEO

What’s Next For honestbee?

As someone who is tasked at restructuring the company, what’s Ong’s current and future plans for honestbee?

Based on media reports, honestbee is shifting its focus to a quick-service restaurant (QSR). Particularly, it is planning to open a pizza joint along Upper East Coast Road.

You might ask why a pizza joint? (It was simply) because we had a spare pizza oven — it wasn’t, you know, a brilliant idea or anything.

It was a pizza oven that honestbee had bought and fully paid for, that’s been sitting in a warehouse before I joined. We are just using the existing assets and we wanted to set up something that we think has potential.

– Ong Lay Ann, honestbee CEO

The pizza joint will be operating out of a shophouse that’s owned by Ong himself.

He explained that no one wants to rent to honestbee — “that’s the reality.” Moreover, since honestbee is already financially distressed, it cannot afford to put up a rental guarantee or a prepaid rental for 12 months.

Beyond Singapore, Ong revealed that honestbee has plans to restart its online grocery delivery business in Malaysia, Thailand and the Philippines.

When asked why they are eyeing these three markets in particular, Ong said that they have “strong support from various partners in the markets.”

In fact, in each of these markets, they have various large supermarket groups that are prepared to partner them.

Ong also reflected on what went wrong in Singapore that caused its online grocery delivery business to fail.

Honestbee (at the core) is a tech company, so that tech needs to sit on top of a supermarket infrastructure in order to provide and facilitate that delivery. We only do the delivery portion.

Where honestbee went wrong in Singapore was we lost the network — which was NTUC — and then we tried to do it ourselves. When you have one single store, it’s never going to be a successful model because you’ll be competing with NTUC, Cold Storage, Sheng Siong (and the likes).

– Ong Lay Ann, honestbee CEO

He also reasoned that honestbee was previously too ambitious as it ran seven different businesses in eight countries. “That’s a recipe for disaster,” he noted.

In retrospect, honestbee should first establish themselves in any one vertical before expanding to all verticals in all markets.

This is why Ong has picked three key markets which he thinks has the best chance of restart; and is focusing on just one vertical which they have the core advantage on, which is groceries.

How Will They Move Forward With No Funding?

Separate to the potential funding from Koo, honestbee was also anticipating a cash injection of around $50 million from a “retail conglomerate”, although that deal has stalled due to Covid-19 and restructuring concerns.

“This was a deal with one of the other markets that we were looking to establish in. Korea is not a market that we have launched in so we actually have zero customers (there), which is why it’s not in our relaunch plan,” said Ong.

“But if that partnership or joint venture with the supermarket group does happen, then we would launch in Korea as well.”

Vietnam too, could be another potential market, said Ong, adding that honestbee is open to launch in markets where there are people who are willing to partner them.

The reality is that, with no funding, honestbee cannot move forward with its grand plans to restructure the business and start afresh with new ventures.

Coupled with no court protection, honestbee will be sued left and right with creditors demanding repayment, bleeding the startup dry. Needless to say, it’s already in the red right now, so it’s safe to say that its hopes for revival is very slim.

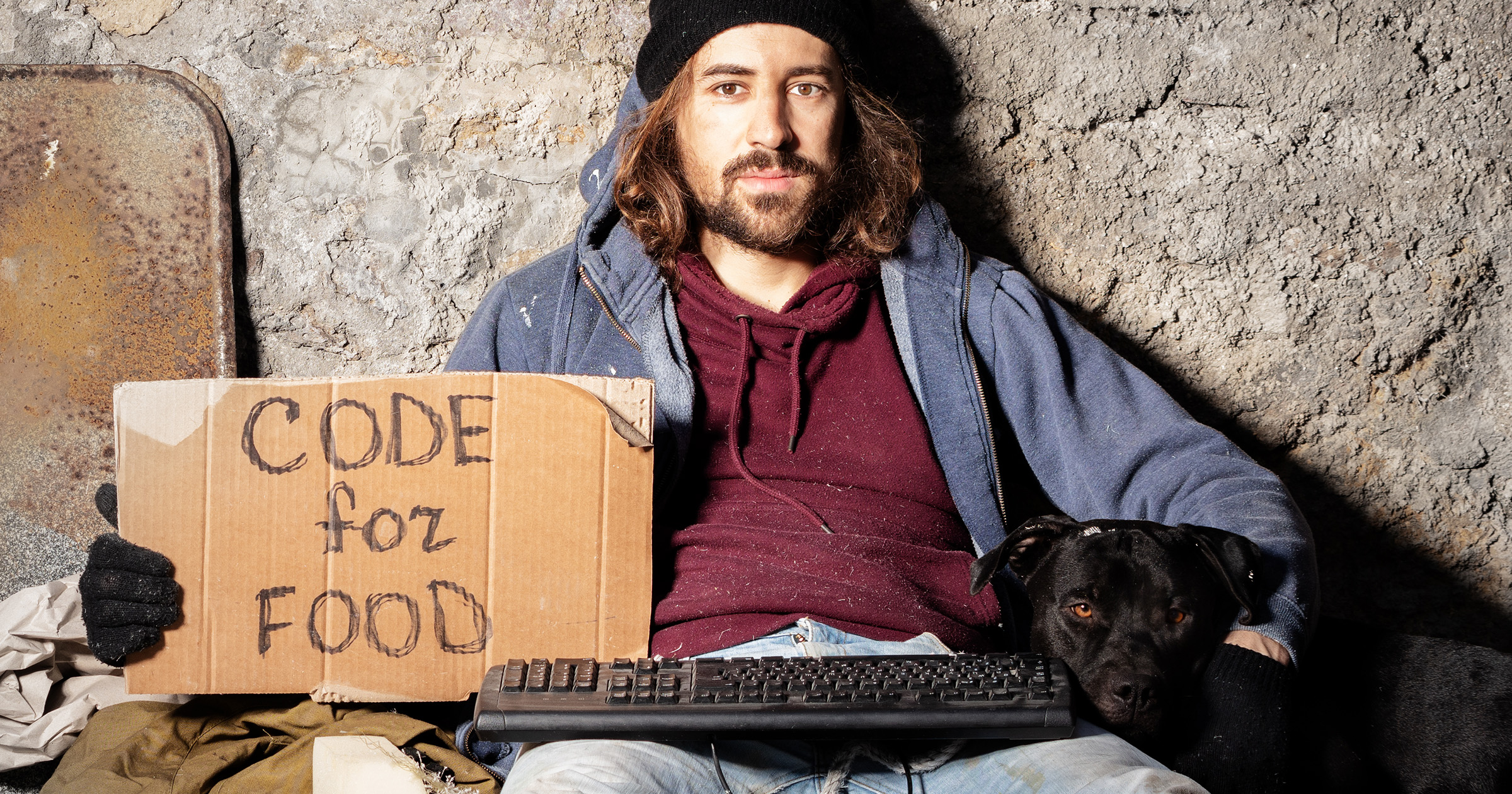

Featured Image Credit: DealStreetAsia / Marketing Interactive