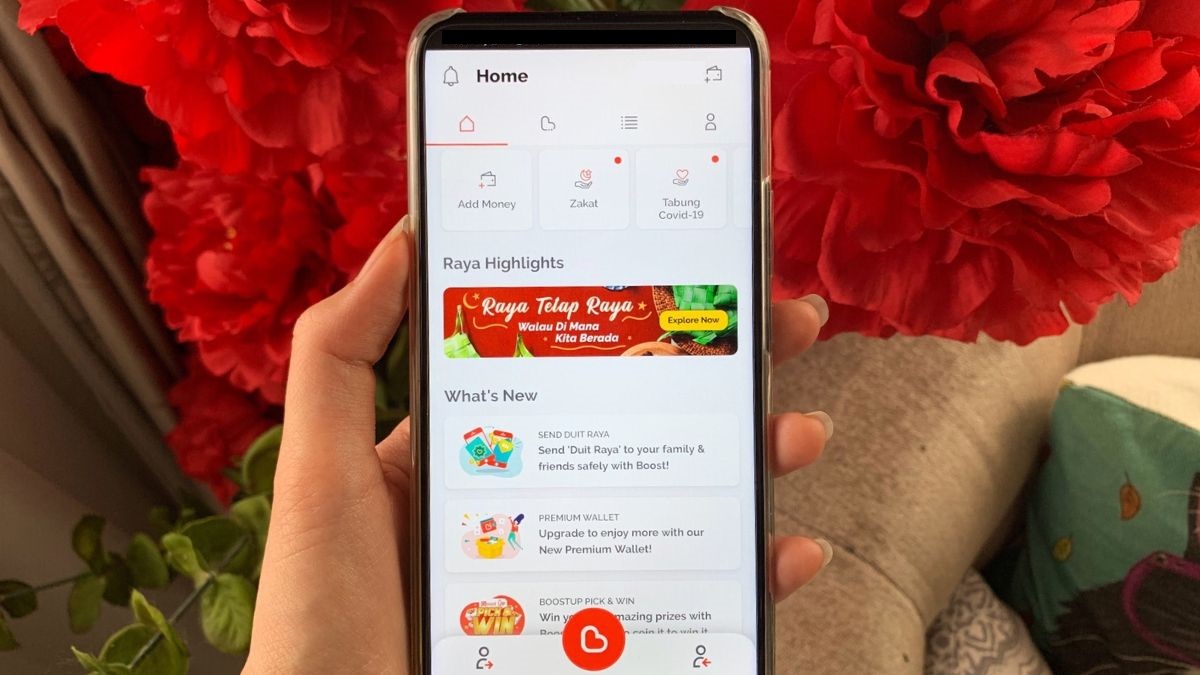

On May 17, 2020, Boost e-wallet sent out an update to its users to inform them of changes that they would be implementing for the wallet sizes of Basic and Premium Wallet users.

The changes are effective starting May 18, 2020, and in essence, the wallet sizes have been increased.

Basic Wallet users previously had a limit of RM200, which meant that users were only able to reload or top-up a maximum of RM200 each time. Now, that limit has been increased to RM1,000.

Likewise, the limit for Premium Wallet users has been increased from RM1,500 to RM4,999.

Following the update, some other changes besides wallet size were also made. Here’s what you need to know.

For Basic Wallet Users

Those of us who are using the Basic Wallet will experience these changes starting May 18:

- You can now top up a maximum of RM1,000, as mentioned earlier,

- The monthly transaction limit for payments has been increased from RM1,000 to RM2,000,

- To register as a new user, you only need to provide your mobile number now, instead of basic identification documents which were previously needed,

- You can no longer carry out Electronic Money Transfers (sending money from your Boost account to your family or friends’ Boost account).

For Premium Wallet Users

Those of us who are using the Premium Wallet will experience these changes starting May 18:

- You can now top up a maximum of RM4,999, as mentioned earlier,

- The monthly transaction limit for payments and Electronic Money transfers combined is RM4,999 in total,

- You can only have 1 Premium Wallet per ID,

- In the event that you have more than 1 Premium Wallet, you had to have chosen your preferred one by May 18, and the remaining wallets will now be treated as Basic Wallets,

- If you didn’t choose your preferred Premium Wallet by May 18, all the wallets are now treated as Basic Wallets.

No More Cash Out Feature

Previously, Boost would allow users to cash out money from their Boost accounts into their bank accounts.

However, as shared in an in-app announcement, they would now be disabling this feature.

Both new wallet users (new Premium and new Basic Wallet) will not be able to make fund transfers out to banks to ensure users’ funds are safely kept within the wallet, and to avoid the risks of having unauthorised transactions to a third-party account.

Boost’s current average active user spend per week has increased 3x compared to December 2018, which led to the decision to increase wallet sizes.

But with so many of us online shopping, the e-wallet is pre-empting the possible rise in fraud and scam cases. Thus, this new safety precaution was built into the e-wallet to prevent e-wallet users from becoming victims.

“With this new security measure in place, even if a scammer manages to trick users into revealing their account details, they would not be able to transfer out and steal their victim’s money,” the Boost representative told Vulcan Post.

If you had received a notification about the cash out option getting disabled and had transferred money from your e-wallet to your bank account by May 17, you’ll still receive the money within 3-5 working days.

Upgrading From A Basic Wallet To A Premium Wallet

Whether you’re a new user to Boost or had all of your Premium Wallets turned into Basic ones, here’s how to upgrade.

According to Boost, you’d have to submit your mobile number, name as per ID, preferred name, email address, ID number or if necessary, ID documentation (only MyKad, MyPR or a valid passport is accepted).

You would then need to add cash into your wallet at least once with a minimum of RM10.

After that, Boost will vet your application for acceptance or rejection.

Some Other New Features

For Ramadhan, Boost analysed how the MCO would make it difficult for users to pay zakat.

Hence, they’ve been working with several state-level zakat collection agencies and now offer that payment feature within the Boost app.

Boost is also launching a Partners Wallet that will allow its partners to retain loyal customers through Boost, providing them with exclusive discounts and rewards.

During the MCO, Boost Payment Link was rolled out to aid local businesses in contactless payments, replacing payment via scanning a QR code with a simple link sent through WhatsApp, email, or regular messages.

22/05/2020 Update: The article has been updated with responses from Boost to clarify certain things.

- You can read more on what we’ve written about Boost here.