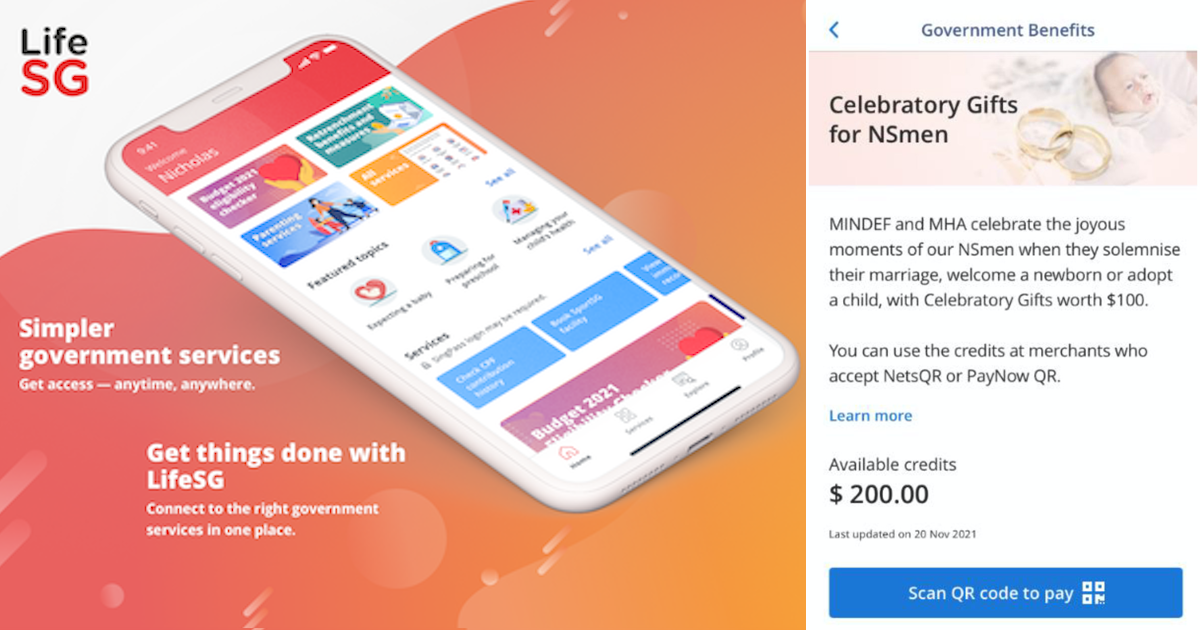

Government agencies in Singapore can now tap onto a new e-wallet feature called GovWallet to better facilitate distributing payouts to citizens.

It is not a standalone application and will allow users to receive vouchers or credits from government schemes directly on apps integrated with the e-wallet feature, cutting down on the need for paper vouchers.

This was one of the several key announcements mentioned during the debate on the Smart Nation and Digital Government Group’s (SNDGG) spending plans today (March 2).

Through GovWallet, payouts can be deposited into citizens’ PayNow accounts, and vouchers can be used at 164,000 registered merchants that accept PayNow e-payments.

Government agencies can also specify the type of merchants users can spend their credits or vouchers at, such as heartland stores or merchants that meet healthy lifestyle standards, said SNDGG in a factsheet.

Designed to be convenient and seamless, GovWallet’s adoption of PayNow’s e-payment infrastructure will make fund transfers instant, and merchants already onboard PayNow will not need to make additional sign-ups.

“For citizens, GovWallet improves the user experience significantly by digitalising the process of collecting physical vouchers or redeeming credits from government schemes. What used to take multiple steps and even a visit to a service touchpoint can now be done anytime, anywhere,” said SNDGG

“GovWallet also improves inclusion because even people without bank accounts can view and utilise their government payouts via apps like LifeSG.”

The GovWallet feature is currently used by the Ministry of Defence via the LifeSG app to disburse national service recognition benefits to 35,000 operationally ready national servicemen.

The Central Provident Fund Board has also adopted GovWallet to administer the Workface Income Supplement scheme to over 6,200 recipients.

The GovWallet team hopes to tap into the NETs payment ecosystem — which is accepted by over 42,000 merchants in Singapore — to provide more options for citizens to use their credits or vouchers.

Digital driving license, more languages on SingPass

The Singpass app — the national identity authentication app which allows Singaporeans to access a suite of personal information — will also see new features added.

From March 7, users will be able to access their digital driving license through the app.

Since November 2021, users have been able to access their digital identity card through the app. Healthcare professionals also have had access to their digital practising certificates since January this year.

Since Feburary, SNDGG has made Singpass available in three additional languages — Malay, Mandarin and Tamil. Additionally, SNDGG is working with government agencies to offer multilingual notifications for messages in the Singpass app inbox.

Business users with valid Corppass accounts will also see additional benefits from using Singpass.

By end March, they will be able to access their company profile and related information, such as business registration, shareholder information and information about awarded government contracts.

SNDGG said it will continue to use technology to solve everyday challenges of people living in Singapore, and it “strives to build a brighter, more inclusive and secure digital future for Singapore”.

Featured Image Credit: LifeSG / SNDGG