Disclaimer: Opinions expressed in this story belong solely to the author.

If crypto and Web3 were the tech buzzwords of 2022, then artificial intelligence (AI) and deepfakes certainly have this year on lock.

With the launch of generative AI tools, the technology has come into public view and is creating headlines by the day. The internet has been flooded with fake images – of the Pope wearing a puffer jacket – and when it comes to pressing issues, everyone wants to know what ChatGPT thinks.

There’s no doubt that some of this is driven by novelty. After all, ChatGPT doesn’t actually think for itself – not yet, at least. It’s trained on existing data and reiterates the information which it deems most appropriate.

Nonetheless, all over social media, it’s being treated as a sentient being with its own moral and political opinions. Much like the people trying to get rich off of memecoins last year, there’s now a great number trying to go viral with generative AI.

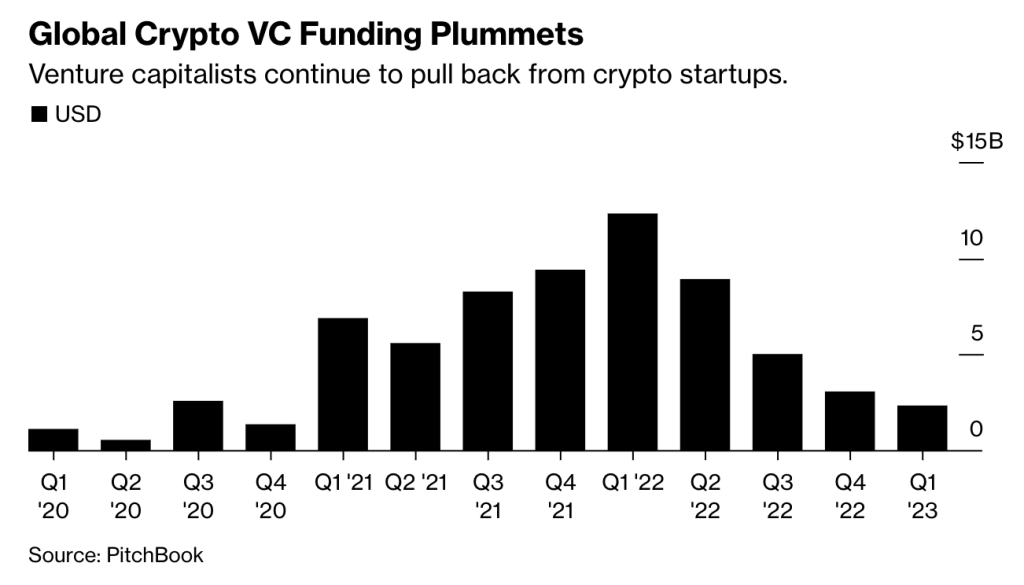

The funding landscape reveals a similar changing of the guard. In the first quarter of 2022, crypto venture capital (VC) investments reached an all-time-high, but they’ve been dwindling ever since. Following the market crash and broader economic downturn, investors have become far more cautious when looking at crypto projects.

This air of caution has impacted startups in other industries as well, with overall investments down across all funding stages.

According to research by Crunchbase, AI remains one of the few bright spots, accounting for almost 20 per cent of funding in the first quarter of 2023. This is largely courtesy of OpenAI, which received US$10 billion in investment from Microsoft this January.

Crypto lessons: hype versus utility

With the spotlight shining bright, it stands to reason whether AI is headed down the same path as crypto – fuelled by hype-driven investments and internet memes.

Looking back at the 2017 initial coin offering (ICO) boom — when crypto projects raised money by issuing their own cryptocurrencies – there’s a lot of money which could have been put to better use.

Over US$4 billion was raised through ICOs that year, according to the Wall Street Journal. However, 80 per cent of these ICOs turned out to be scams and out of those that weren’t, almost half failed within the first four months.

When it comes to AI, this doesn’t seem as likely. While there is an element of hype involved, AI projects are far more driven by utility.

There are apparent use-cases for generative tools in fields like copywriting, branding, graphic design, and beyond. This wasn’t the case for many crypto projects which found short-lived success.

NFTs and memecoins were often driven by community, with members rallying together to build interest. The utility was an afterthought and a fair amount of projects gambled on going viral through an Elon Musk or Shaquille O’Neal tweet.

In contrast, AI ventures have found institutional backing from the jump. Major tech companies such as Google and Microsoft are actively involved in the space and have invested billions in startups. Where crypto was met with skepticism, AI is readily viewed as an essential for the future of technology.

Today, the crypto industry is purging scams and money-grabs in favour of purpose-driven ideas. Utilities such as cross-border remittance and trade settlement are still being invested in despite the state of the market.

AI – despite grabbing the attention of the masses more recently – seems to be at a similar level of maturity. The industry has always been purpose-driven and the recent increase in investments is better explained by technological advancements than all the social media hype.

Is crypto headed to the grave?

Celebrities have given up their NFT profile pictures and Twitter’s forgetting all about Shiba Inu. Although bluechip coins like Bitcoin and Ethereum have been steadily recovering, they’re still well off their all-time-highs. For everyday investors – especially those who joined during the bull market – it’s not a stretch to think crypto is dying.

The reality might not be quite as dramatic. Crypto may no longer grant exponential net worth boosts, but blockchain technology still has very legitimate uses. For retail investors, this might become most apparent through tokenised investments.

With Project Guardian piloting tokenised bonds and companies like OpenEden looking into tokenised treasury bills, investors could soon have easier access to traditional financial instruments. Overseas transaction times may improve as well, once banks begin using blockchain for transaction settlement.

That being said, it’s not quite the same as the Bitcoin vision of a decentralised economy, where everyone took charge of their own finances and institutions were left to gather dust. Probably for good reason though – while there are risks to storing money with a bank, the crypto winters have made it clear that self-custody is no easy task either.

In 2022 alone, almost US$4 billion was lost to scams and hacks in the crypto space. There’s a constant need to be wary and if trouble does arise, there’s rarely anyone to turn to.

All things considered, crypto is more likely headed for a makeover than the morgue; and once the winter ends, there’ll be a safer environment for investors to return to.

Featured Image Credit: Reuters