- Automatic direct debit payments are a normal process for large corporations, but SMEs usually find difficulty in accessing this feature due to the cumbersome paperwork.

- Curlec wants to fix this issue by bringing the direct debit application process online, to both speed up the process and reduce rejection rates—for both individual payments and application approvals.

- They’ve invested RM1 million into the startup, and are currently raising funds to grow their team.

If you’ve invested RM1 million into your startup, then you definitely have to believe in your offering, to last beyond that 90% startup failure rate. Fortunately for Curlec, B2B (business-to-business) startups seem to fare on the better side of that statistic.

This fintech company’s claim to fame is that they “redefined the customer experience for direct debit”.

“There is a common misconception (especially with us all based in the Klang Valley) that Malaysians are very credit card reliant. This isn’t the case.”

– Co-founder, Zac Liew

“Less than 20% of the population have a credit card. This is compared to over 80% of Malaysians that have a bank account, a very high penetration rate when compared to other countries.”

This is where Curlec comes in, as a Malaysian fintech startup that wants to get more businesses savvy to direct debit—where merchants are able to directly deduct any fees from a customer’s bank account. This way, merchants do not have to rely on the expensive card networks, or on customers remembering to do it manually.

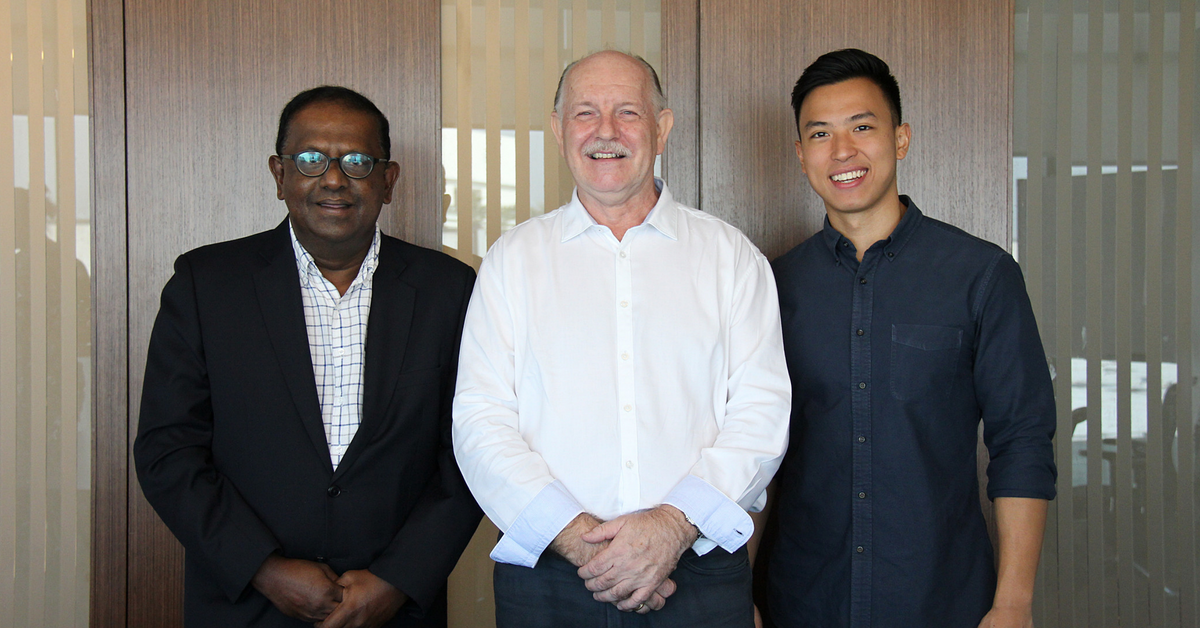

The founding team is made up of Zac Liew and Steve Kucia, both 26 years old and 62 years old respectively.

“We are not your traditional start up. Our founders are 26 and 62 the exact inverse, we often joke that we should hashtag 2662,” said Zac.

Both are very familiar with direct debits, having been working on an integrated workflow system for PayNet (the new name of MEPS & MyClear’s merged company).

They are joined with chairman Raj Lorenz, formerly CEO of GHL. In fact, Curlec lists GHL as one of the customers for their services.

And they’re gunning for the underserved SMEs of Malaysia.

Curlec’s aim is not towards big corporations who already have the resources to set up these systems with banks. Instead, Curlec wants to open the doors automatic debit deductions for SMEs—like boutique gyms, monthly baby essentials subscription services, monthly pet food subscription services, just to name a few.

The goal is to give them a chance to stand on an equal footing with large corporations.

“SMEs in Malaysia have traditionally been overlooked by banks. Direct debit is widely used in other markets around the world but in Malaysia, volumes and penetration rate have been very low,” said Zac.

The secret behind why SMEs are underserved lies behind the eight layers of bureaucracy and paperwork all direct debit applications have to go through.

This paper trail could take between 1 month to 8 weeks to process, on average.

Curlec instead offers to streamline that process through tech.

Instead of having to send in mandate applications through paperwork, Curlec allows merchants have this all done online, and with a 100% approval rate, instead of the usual 70%.

“In the paper world, mandates get rejected primarily due to signatures not matching those on a bank’s record. We eliminate the need for signatures through our online authentication, and rejection rates become 0% with Curlec,” explained Zac.

On top of that, Curlec is able to do all of this without being on a card network, like Visa or Mastercard. This, according to Zac, helps reduce rejection rates from credit or debit cards, and are cheaper to boot.

“When a customer signs up to a direct debit, they are not only giving authorisation to a business to collect payments from their account, they are also giving an instruction to their bank to allow that business to collect payments from them,” explained Zac.

Curlec is also able to integrate with a merchant’s existing software.

Since banks are fully aware of why these deductions are taking place, they’re less likely to reject automatic payments due to “suspicious transactions”. All of this helps merchants experience smoother cashflow.

One downside is that merchants will have to fight harder to convince the generally suspicious Malaysians on the benefits of automatic debit deductions.

That being said though, Curlec does have a consumer side of the business.

Consumers who sign up to pay their monthly bills through Curlec get to view a straightforward, no-frills website listing all of their recurring payments—with details like its frequency, merchant name, person in charge and status, among others.

On top of allowing customers to more easily track their expenses and automate bill payments, it also helps customers to manage and cancel recurring payments all on one platform.

This of course, will only truly be helpful if Curlec is able to achieve a high penetration, even into the large corporations.

But they seem to be on the right track.

Just a few months into their launch, Curlec already processed their first RM1 million of transactions.

Validated, the team is able to grind through despite their difficulties in dealing with the usual problems with banks—having to deal with their slowness due to legacy systems and the very bureaucratic processes they aim to help solve.

“This is in total contrast to fintech companies who are agile, quick and nimble when bringing ideas to life. We plan to overcome this by working collaboratively with banks and by using our tech focus, we can help to smoothen out their existing processes and improve efficiency,” said Zac.

Currently, Curlec is focused on doubling down on their software development—”there is always something you can do better,” said Zac.

“In saying that, our immediate future plans are to work with as many subscription management and accounting software companies as possible, to integrate our system to theirs. The more of these we do, the more processes we can automate.”

Curlec is also in the midst of their funding round, to help build up their currently modest team. Early this year, they also announced that Curlec will be going through an equity crowdfunding round via pitchIN some time in 2018.

- You can find out more about Curlec or get in touch with the team on their website.

Feature Image Credit: Curlec