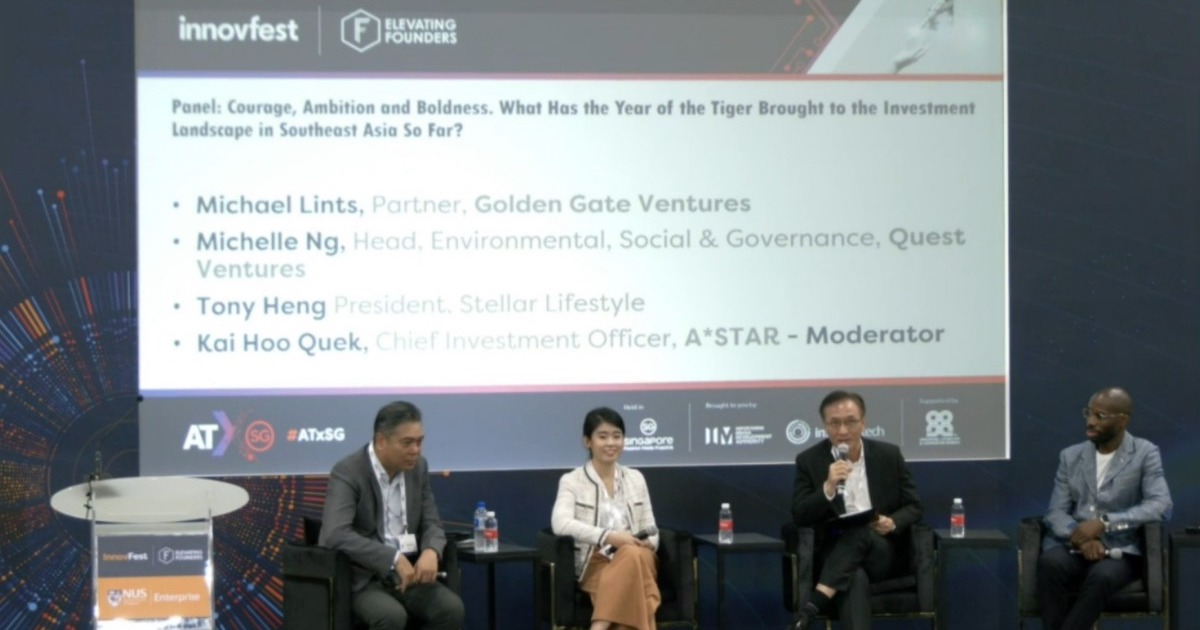

At the Asia Tech x Singapore 2022 event held yesterday (June 1), one particular keynote discussed the regional investment trends and what that means for startups in this landscape.

The panel — which is made up of venture capitalists as well as executives of A*STAR and SMRT Corporation Ltd — gave their insights on the tech and investment space in Singapore.

It is a relatively poignant time for such an event as many are expecting a market correction for tech stocks, global instability is on the rise, and to top it off, Sequoia Capital released a memo recently about the need for startups to cut costs and expect tough times ahead — these topics were all keenly noted by the panellists.

The time for high valuations is over

As the bear market returns, venture capital firms are no longer willing to simply burn through cash and allow companies to raise capital at high valuations without asking questions.

Michael Lints, a partner at Golden Gate Ventures, observed that investors are being more cautious, and that the narratives and mindsets for venture capital firms have changed from one of “growth at all costs” to one of finding the “path to profitability”.

In concrete terms, what startups can expect is that they will need to tighten their belts.

Michelle Ng, head of Environmental, Social, and Governance (ESG) at Quest Ventures, concurred with Michael, suggesting that during this stage, startups cannot expect valuations to be as generous as they were before.

We are looking at a decent three, maybe five times valuation (for startups raising funds in subsequent rounds). If you raise at a very high valuation at the early stage, you have to be careful about how you’re going to raise at the next round.

– Michelle Ng, head of ESG at Quest Ventures

She also advised founders to be prudent with spending, and to cut down on operational costs as much as possible.

Consider social impacts for an edge

While businesses are indeed created for profit, that does not mean that profit is the only thing that matters for investors and businesses.

Several panelists urged startups to better consider the ESG aspects of their businesses, and hinted that it might provide greater incentives for investors to fund these startups.

In particular, the panelists singled out social impacts as needing the greatest attention — climate technology and environmental impacts are often well-considered, while social and human impacts are neglected.

Tony Heng, head of SMRT’s commercial business, highlighted that medical tech startups require extra attention.

All companies need to score on their ESG… I think a lot of focus is on the environment and rushing to carbon neutrality, but the social part is where I think is not getting enough focus. I think if startups are able to focus on those areas, that will give them an opportunity against those who are racing towards sustainability in the government.

– Tony Heng, head of SMRT’s commercial business

On this point, an audience member queried about the trade-offs between profits and ESG goals, and how much venture capital firms like Quest Ventures might consider the importance of ESG.

The reply was that profitability and sustainability are not actually mutually exclusive, and that any business that wants to be successful also needs to be sustainable.

If you look at the long term, they (profitability and sustainability) actually converge, even though in the short-term you (businesses) might be trying to cut some profit to address some impacts. But if you look at the long run, it will make sense for the company to be profitable in the next 50 to 100 years.

– Michelle Ng, head of ESG at Quest Ventures

Singapore is important, but there are bigger fish in the ocean

While Singapore is a hub for innovation and startups, it is far from the only one and startups in the region have been attracting significant attention for themselves as well.

Panelists listed Indonesia as a key competitor, and noted that while the bulk of funds lies in Singapore and Indonesia for many venture capital firms in Southeast Asia, there are other up-and-coming countries where startups are beginning to spring up.

Vietnam in particular, is also a newcomer on the startup scene and has been attracting capital from Japan and Korea. In fact, the amount of funding for Vietnamese startups increased some 40 times over the past few years — from 40 million in 2017, to 2.1 billion in 2021.

The panelists also noted differences between the startups from different countries, pinpointing Singaporean startups as often remaining local, while Indonesian startups often start locally and then expand across the region.

While Vietnamese startups have yet to do so, the panelists were optimistic about the future of the Vietnamese startup scene.

Singapore has had a position of economic dominance in the region over the past several decades but as the panellists reveal, that may soon come to an end.

In the short term, this could mean lower valuations for startups and greater difficulty in surviving or doing business. But in the long term, that could mean a less pronounced competitive edge, or even economic decline.

However, there is still hope. The panelists also noted that there are still areas of interest with regards to ESG that are not receiving sufficient attention, and startups would do well to address these concerns.

At the end of the day, Singapore has an advantage in terms of the maturity of our ecosystem, but we must not allow ourselves to rest on our laurels, lest we ignore the up-and-coming challengers to our preeminent position.

Featured Image Credit: Asia Tech x Singapore / Screenshot by Vulcan Post