Tony Fernandes was gifted a Jay Chou NFT that cost about RM14K

Last week, NFTs of Syed Saddiq’s face were put up for grabs on NFT marketplace OpenSea. He’s selling them for charity, in hopes of raising funds for flood relief efforts, and more, down the road.

More recently, another high-profile Malaysian whose name is synonymous with AirAsia has hopped onto the NFT train. Newsflash: Tony Fernandes was gifted an NFT from Jay Chou’s collection called PhantaBear, and it was bought by his gifter for 1 ETH (about RM14,000 at the time of writing).

“My first NFT gift. Thank you man from South Asia. Watch airasia on Internet 3.0,” wrote Tony Fernandes in an Instagram post breaking the news.

Over on OpenSea, we’re able to see the transactions that took place for Tony to become the owner of PHANTA BEAR #1281.

Looking at the transaction details of PHANTA BEAR #1281, you can see that the user “AC8C10” bought the NFT from someone named “tantan_” and transferred the ownership to “EB2DA4”. EB2DA4 is presumably Toney Fernandes, based on his Instagram post claiming ownership of the NFT.

Going into the AC8C10 profile, you’ll notice that they own the “bigpayme.eth” Ethereum Name Service (ENS). But it would be a stretch at this point in time to immediately assume that AC8C10 is affiliated with BigPay in any way.

Dictionary Time: ENS is an Ethereum-based project that allows users to display long Ethereum public addresses in a simplified text-based way. This makes it easier to share, use, and remember addresses and other data.

That is, unless BigPay itself uses this domain in the future, or if there are future transactions from this account that points us to BigPay or AirAsia.

However, Tony’s Instagram caption for his NFT post does have our curiosity piqued. “Watch airasia on Internet 3.0″—could we assume that he’s teasing or hinting at a possibility that AirAsia will enter the NFT space? Only time will tell, we suppose.

If it does, then off the top of our heads, some possible ways the brand could utilise NFTs would be through releasing merchandise bundled with NFTs, or even coming up with AllStar avatars for the metaverse.

We know that the brand isn’t averse to trying out new things, with some examples being the launch of its virtual idol in 2021 and its AI chatbot AVA back in 2019.

But for now, all we can say with confidence is that Tony is affiliated with the wallet, “0xeb2da416dee2b7fa45c9723a1c66478d47a3fe3b”, and we’ll definitely be keeping an eye on any future transactions it’s involved in.

- Read more NFT related articles here.

Also Read: 6 reasons why this LG 4K Smart OLED TV can be a conversation starter in your living room

Featured Image Credit: Tony Fernandes

Shell launches cross-border charging network in Johor but M’sian EV owners aren’t too excited

Back in March 2021, Shell and Porsche Asia Pacific (Porsche) had announced their plans to launch a cross-border, high performance charging (HPC) network for electric vehicles (EVs). Called the Shell Recharge HPC, it’s said to be Southeast Asia’s first.

Once implemented, it would offer EV owners the convenience of travelling from Singapore all the way up to Thailand through Peninsular Malaysia without worrying about range anxiety.

Did you know: Range anxiety is an EV owner’s fear that their battery does not have sufficient charge for the vehicle to reach its final destination or that a charge point won’t be available for charging “on the road.”

This HPC network will consist of 12 charging points spread out across 6 Shell stations located along the North-South Expressway in Malaysia.

The first charging point has now been launched at the Shell station in Tangkak Lay-By (South Bound), Johor. Next up to get a charging point will likely be Pagoh Rest Area (South Bound), located in Muar, Johor.

After Johor, the other Malaysian states that will be home to the HPC network include Negeri Sembilan and Perak.

According to reports, all these charging stations should be fully operational by H2 2022.

For convenient EV charging along highways

The stations are equipped with 180kW direct current (DC) chargers that Shell states can charge an EV from 0% to 80% in 30 minutes, depending on an EV’s model and capacity.

If there’s only one car charging, it could benefit from the full 180kW rate, if there are 2 cars, both get a 90kW rate.

3 payment tiers are available for EV owners to choose from:

- Standard Rate (pay per use, no subscription) – RM20/5 mins.

- Gold Member (1-year subscription) – RM12/5 mins for the first 25 mins, and RM5/5 mins thereafter. (Applicable for the first 10 hours per annum.)

- Platinum Member (3-year subscription, complimentary with the purchase of a Porsche Taycan) – RM10/5 mins for the first 25 mins, and RM5/5 mins thereafter. (Applicable for the first 12 hours per annum.)

Each tier comes with a RM4 confirmation fee, and offers varying discounts and additional benefits, with more details available here.

The bookings and payments will be made through the ParkEasy app. Upon confirmation of a reservation, the parking bay with the charging station will be held for you for up to one hour before your arrival.

Yet Malaysian EV owners’ sentiments appear lukewarm

Taking a look at a local FB group for EV enthusiasts and owners, MyEVOC, I was surprised to see that their overall reaction to this news leaned more on the “meh” side.

(To be clear, this group does not represent the overall population of Malaysian EV owners, but it still gives us some insight into what the community thinks of this HPC network.)

As for why? Well, there seem to be a couple of reasons. The most common one I saw was that the prices quoted by Shell are considered hefty.

Particularly because it’s charging owners by 5-minute intervals (aka time taken to charge your EV) instead of per kW, the latter of which some owners prefer.

The basis for that argument also lies in how each EV has its own charging curve. For those unfamiliar with the lingo, a charging curve basically refers to how the charging rate of an EV changes over a duration of time.

As an EV gets fuller, it charges more slowly. For an EV that’s sitting at just above 10% battery, it may juice up fast and utilise the full 180kW rate Shell offers.

But once it hits the 50% or above range, this rate may get slower, which means it will no longer benefit from the 180kW rate. All these % figures are dependent on your EV model.

By then, an owner is simply overpaying for less kW to continue charging their EV, since they’re charged based on the time they spend plugged in.

Furthermore, this is assuming the EV model in question is able to even consume 180kW of charge in the first place, since some older models cap their charge intake at a much lower kW.

When we last interviewed a few EV owners about their own journeys about making the switch from petrol, they shared that charging stations (or the lack thereof) weren’t a big issue.

Not every owner may be equipped with their own portable chargers (that require a 3-pin wall-mounted socket to work) though. So, in a pinch, Shell’s HPC network would still come in clutch for a juice-up on the go.

Also Read: 6 reasons why this LG 4K Smart OLED TV can be a conversation starter in your living room

Featured Image Credit: Shell

Does cryptocurrency offer higher average returns than the S’porean stock market?

An index ETF tracks the performance of a segment in a financial market. It’s made up of a portfolio of stocks and allows investors to diversify their holdings across them. In theory, this reduces market risk.

Future returns aren’t dependant on the performance of any one company, but rather, the market segment as a whole.

At the start of 2021, Twitter user @TenIndex followed this principle while investing in cryptocurrency. On January 1, he invested US$100 into each of the top ten traded cryptocurrencies at the time. He then left the investment untouched for the entire year.

The idea behind this experiment was to see if passively investing in cryptocurrency would yield higher returns than the stock market.

What happened to the investment?

At the end of 2021, TenIndex recorded a net gain of 292 per cent on his initial investment. His portfolio of US$1,000 was now worth US$3,921.

Nine of the coins which he had invested in recorded net gains individually as well. Tether (USDT) was the only odd one out of the bunch.

Being a stablecoin, Tether’s value is tied to that of the US dollar. Thus, its very purpose is to be worth US$1 per coin.

The highest gainer in TenIndex’s portfolio was Binance Coin, which went up over 1,200 per cent in value. Ethereum, Ripple, Polkadot and Cardano all recorded three-figure percentage gains as well.

Litecoin and Bitcoin Cash (a derivative of Bitcoin) were the worst performers, only recording gains of 16 and 26 per cent respectively.

How does this compare to Singapore-listed index ETFs?

The Straits Times Index (STI) ETF is often recommended as a safe and smart investment for beginner investors in Singapore. It tracks the performance of the top 30 companies listed on the Singapore Exchange, including firms such as Singapore Airlines, ComfortDelGro, DBS Bank, and Singtel.

In 2021, the value of the STI ETF rose by around 10.3 per cent. This means a US$1,000 investment at the start of the year would’ve been worth US$1,103 by the end.

It is also worth noting that the STI ETF is a weighted index. Investments aren’t split equally across all 30 companies on the index. In fact, DBS, OCBC, and UOB make up almost 44 per cent of the weight.

Most other ETFs listed on SGX track indexes from other markets around the world.

Last year, one of the best performers among these ETFs was the SDPR S&P500. It tracks the S&P500, which is a gauge of the top 500 publicly traded companies in the US stock market.

A US$1,000 dollar investment in this ETF would have turned to around US$1,265 over the course of 2021. In other words, a return of around 26.5 per cent.

This return was far above the standard for the S&P500. Over the past 50 years, the index’s value has grown at an average of 10.83 per cent.

Does this mean cryptocurrency is the way to go?

Not necessarily. It simply means that the crypto market performed incredibly well in 2021.

After all, investing in any of the top ten cryptocurrencies (apart from Tether) would’ve guaranteed a profit over the course of the year.

For a more convincing argument, it’s important to look at a larger sample of historical data. Thankfully, TenIndex has been investing US$100 into the top 10 cryptocurrencies (at the time) every year since 2018.

In 2018, the value of his portfolio dropped from US$1,000 to US$151 — an 84 per cent loss as compared to a 6.2 per cent loss on the S&P500. It’s worth noting though, that entering the crypto market at the start of 2018 meant buying into all-time highs.

In 2019, TenIndex’s portfolio recorded a gain of two per cent and was worth US$1,017 at the end of the year. The S&P500 went up 29 per cent that year.

Finally, in 2020, TenIndex’s portfolio went from US$1,000 from US$2,394.70 — a 139.47 per cent increase as compared to the S&P500’s 16 per cent.

How risky is a crypto index fund investment?

Cryptocurrency can be incredibly volatile, however reading into these results at face value might not tell the entire truth.

Although TenIndex’s 2018 portfolio was worth US$151 at the end of the year, its value had shot back up to US$1,341 by the end of 2021. His 2019 portfolio would be worth around US$6,000 today as well.

This experiment doesn’t necessarily prove that passive investing in cryptocurrency is a safe bet, even in the form of an index fund. However, it does offer ways through which a crypto portfolio can be made less risky.

For example, leaving Tether aside, five out of the top 10 cryptocurrencies in 2018 were still in the top 10 in 2021. Four of them — Bitcoin, Ethereum, Ripple, and Bitcoin Cash — never left the top 10 over the course of all four years.

Investing in projects which have proven their longevity in this volatile space could be one of the strategies to a safer portfolio.

For those interested in finding out more, TenIndex posts monthly updates about all his index portfolios on his blog. Although there are no objective conclusions to be drawn here, these findings can help inform a wiser investment strategy for new and existing holders alike.

Featured Image Credit: CoinGeek

Also Read: Is S’pore crypto-friendly? Here’s how MAS’ regulations could impact businesses and investors

A mother and her son-in-law built the M’sian F&B empire we know today as Serai Group

They say getting into business with family can get messy. While it may be true for some, we’ve seen local companies navigate the potential challenges and grow into popular brands.

One such Malaysian brand is the F&B company, Serai Group. Over its 3 decades of operations, one mother and her son-in-law have expanded the restaurant business, even birthing new brands under the group.

A question of eating for free

The story starts with Rina Abdullah, a former air stewardess with Malaysian Airlines, who’s the founder of Serai Group. Married to a hotelier, it was commonplace for the couple to move from one state to another.

It wasn’t until her eldest daughter, Qistina Taff was ready to begin primary school that Rina decided it would be best to settle down. Thus, they moved from Johor to Shah Alam, intending to stay there for good.

That was where Rina would embark on her entrepreneurial journey. And it all started with a simple question, when Qistina probed, “Mama, why don’t you open a restaurant? Then, we can eat for free,” Rina recalled in an interview with Top 10 of Malaysia.

The family were big fans of Thai cuisine and often frequented such restaurants, so it only felt fitting that they would venture into F&B through the cuisine.

With free time on her hands, Rina set to work and launched Serai Thai in 1990. Things worked out in their favour despite the competition, and she reported that the eatery was well-received by the residents in Shah Alam.

Growing the brand name

By 2006, Qistina, who had returned home from Australia with an undergraduate degree in Interior Design, decided it was time to expand the brand. The move was aided by her husband, Najib Abdul Hamid, who joined the family business.

Najib himself has a long portfolio of working his way up as a head chef in hotels and restaurants in Australia, where he resided for 11 years.

The restaurant business was expanded by 2010, taking on the Serai Group name. Embracing the name “Serai”, which means lemongrass in Malay, was a deliberate decision made by the team as the first restaurant was already a recognised homegrown brand.

Over 3 decades, the first Serai Thai restaurant in Shah Alam still remains, with 7 more outlets around the Klang Valley serving 3 generations of customers from all walks of life.

The start of larger ambitions

5 years after Serai Group became more stable as a business, Jibby & Co was launched at Empire Gallery, Subang, with a glasshouse concept designed by Qistina. The restaurant serves antipodean (Australia and New Zealand) food, with your usual Big Breakfast, poached eggs, and “The Hangover” to be found on the menu.

Since then, the group has expanded with more restaurants under the Jibby brand, a nickname that Najib went by in Australia.

Jibby East serves up Pan Asian and Western offerings. Decorated with eye-catching mural artworks and neon lights, the restaurant presumably targets a younger and contemporary group as its audience.

Meanwhile, Jibby Chow creates its interpretation of Chinese cuisines, such as offering a spin on chilli crabs with fried mantou, and steamed fish in soya sauce sourced from Bentong.

Jibby by the Park takes on a greenhouse concept, where customers are actually surrounded by the greenery of Desa Park City.

BLONDE at Damansara Heights and Chum Chum Pizzeria at SS15 are 2 of the brand’s newer outlets, with the former serving Australian cuisine with a local twist and the latter crafting handmade pizzas.

“Every new outlet is our pride and joy. Each brand is designed from scratch, from the concept and menu to design and food presentation,” said Qistina in an interview with Prestige.

However, a lack of manpower, maintaining consistency in their food, and ensuring that their brand is staying relevant with present trends were a few challenges she also pointed out in running an F&B business. Thus, the team dedicates plenty of time visiting the various outlets or supervising the production line to overcome these hurdles.

Dishes and concepts are inspired by the family’s travels abroad, but Qistina advised that simply replicating a successful concept overseas isn’t enough. “Know your local market and fill up the gaps. Something that works overseas may not necessarily work locally,” she shared in the interview.

A whole family affair

With Rina as the group’s founder, her son-in-law as the managing director, Qistina heading interior design, and Atiqah, Rina’s 3rd child, managing the social media of the brand, Serai Group is a whole family affair.

Based on reports, the company is said to cultivate a family-like work culture with its hundreds of employees too, and some of its staff have been around since Serai Group’s early days.

Between 2019 to 2020, Rina joined hands with her former company, Malaysia Airlines, to become its food and beverage partner in a promotion. Through the partnership, Enrich members (the airlines’ membership programme) got to earn one point for every Ringgit spent at Serai Group’s restaurants.

In late 2021, Serai Group shared that it planned on setting up a restaurant in London. “We don’t just want to be a local champion. We want to establish the business in the international arena,” Najib had said.

As of today, there appears to be no indication that a London-based Serai Group restaurant exists yet, so it’s likely that it’s either still being built, or that plans have been delayed or changed.

Nonetheless, with a strong local presence after more than 30 years of operations, the popularity of Serai Group’s restaurants would likely not die down anytime soon.

In fact, the team is already reported to be opening several more outlets in KLIA via a partnership with SSP Group and Travel Food Services.

If international Serai Group restaurants don’t pan out as planned yet, this will be a good opportunity for the local F&B empire to delight the tastebuds of global travellers anyway.

Also Read: We reflect on how the pandemic has changed our payment habits, to plan wisely for 2022

Featured Image Credit: Rina Abdullah and Najib Abdul Hamid of Serai Group

From toasted bread .jpegs to multi-million dollar art sales: Recapping the NFT rise in S’pore

Over the past few years, Singapore has welcomed blockchain technology with open hands. It comes as no surprise then that the country has witnessed some of the most exciting developments in the NFT space.

Although they’ve been floating around the internet since 2014, NFTs really took the world by storm at the start of 2021. They recorded a total sales volume of around US$20 billion over the course of the year. This was an increase of over 20,000 per cent as compared to 2020.

In fact, the single largest NFT purchase in 2021 — worth US$69.7 million — was worth more than half the sales of the previous year, combined.

This phenomenal growth saw investors pouring money into the industry. NFTs went from being perceived as a vehicle for internet memes to a goldmine of untapped potential.

As 2022 begins to find its footing, more and more businesses seem to be exploring this ever-changing space. Here are the key NFT developments from the past year, which signal what’s in store for Singapore’s future in the metaverse.

S’porean entrepreneur spends US$69.7 million on Beeple NFT

March 2021 marked a monumental occasion when NFTs finally broke through and took over mainstream media.

Digital artist Beeple auctioned an NFT collage made up of 5,000 of his artworks. He had started the project in 2007 and committed himself to creating a new piece of art every single day.

The final product, titled ‘Everydays — the first 5,000 days’ sold for US$69.7 million. This made it the most expensive piece of digital art ever sold.

Although anonymous at the time of purchase, the buyer chose to reveal himself soon after. Singapore-based entrepreneur Vignesh Sundaresan told CNBC that he’d purchased the NFT because it would go down as a significant piece of art history. He was prepared to bid even higher if it had been needed.

The sale of the Beeple NFT was reported around the world and paved the way for NFTs to become the worldwide phenomenon which they are today.

NFT marketplaces make up for shopping mall closures

Although the pandemic caused physical stores and shopping malls to shut down, NFT marketplaces had no issues getting off the ground.

In July 2021, Singapore-based NFT marketplace Mintable raised US$13 million in Series A funding. Investors included Mark Cuban, a billionaire entrepreneur and NBA team owner; Ripple Labs, the company behind the XRP cryptocurrency; and MetaPurse, an NFT investment fund backed by Vignesh Sundaresan (the one who bought the Beeple NFT).

Mintable has since launched NFTs in collaboration with companies such as BAPE and CNBC. The highest-selling NFT collection on the platform was released along with NFL quarterback Trevor Lawrence, which sold for around US$230,000.

Brytehall was another Singaporean NFT platform which came to fruition in 2021. It was created to bring luxury art and fashion into the metaverse.

The platform hosted its first auction in December in partnership with American bicycle company Specialized. ‘enishi-E: The Living Bicycle’ was sold for US$50,000.

Created by the founders of Media Publishares, Brytehall was also responsible for launching NFT collections by Vogue and Esquire in Singapore.

The newest edition to Singapore’s NFT scene is ARC, an exclusive digital community founded by Kiat Lim, the son of Singaporean billionaire Peter Lim. ARC has ambitions to launch its very own iteration of the metaverse in the near future.

Singapore’s first large-scale NFT exhibition is held at a Freeport

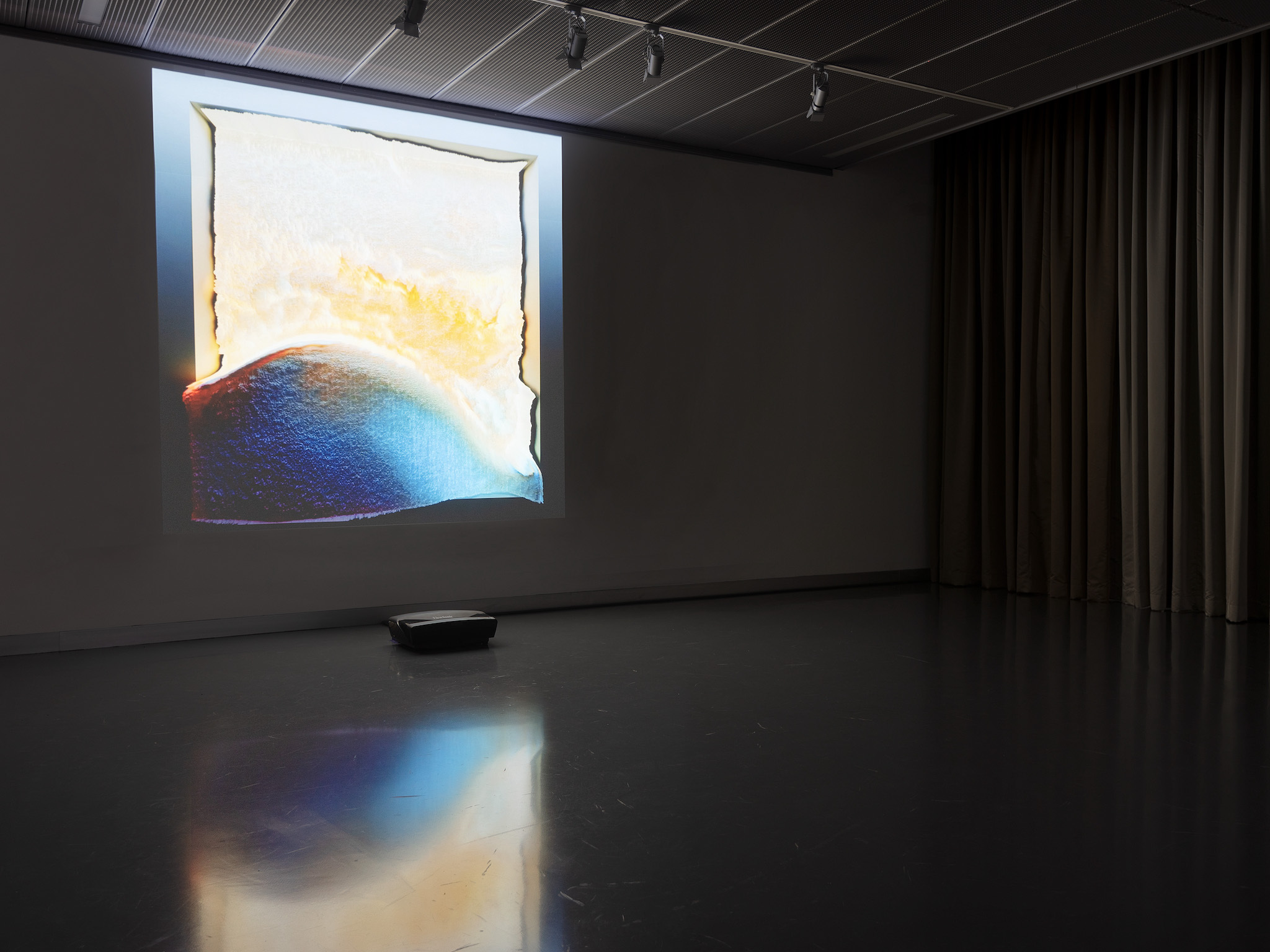

In November 2021, Singaporean crypto exchange Coinhako teamed up with research centre Appetite to put on the country’s first NFT exhibition.

It was titled Right Click + Save, a reference to everyone’s first skepticism when it comes to NFTs: “Buy a .jpeg? But I could just right-click and press save.”

The exhibition looked into the evolution of digital art and NFT culture through seminal works by creators such as Andy Warhol, Beeple, and Refik Anadol.

Out of intended irony, Right Click + Save was hosted at Le Freeport.

Freeport is an extremely private storage facility, which are used to facilitate trade in high-value goods such as art and jewellery. They exist as special economic zones where normal tax and customs rules don’t apply. These facilities have often been subject to money laundering allegations.

NFTs too, have faced similar criticisms. With their value being entirely subjective and their utility not always apparent, skeptics have often written NFTs off as tools for money laundering.

Print media ensures that it’ll live on forever

After all the time they spent writing about NFTs, Singaporean media outlets couldn’t help but capitalise on the trend themselves.

In August 2021, Vogue Singapore released a collection of 40,000 mystery boxes on Binance. Each box costs US$20 and contained one of 10 different artworks depicting an astronaut exploring a famous city.

The entire collection sold out overnight and was one of Binance’s fastest ever mystery box sales.

Later in the year, Vogue Singapore ventured into NFTs yet again, with a collection that featured works by renowned creatives such as Shavonne Wong and Chad Knight. The collection also featured an exclusive collaboration with luxury fashion house Balmain.

Separately, The Straits Times raised over US$15,000 in charity proceeds from its debut NFT collection. The highest price sale featured the image of a Straits Times column titled ‘Own a piece of the metaverse’.

Also included in the collection was an artwork called ‘The permanence of cats’ — a parody of Salvador Dali’s ‘The persistence of memory’, with all the watches replaced by cats.

Esquire Singapore hopped on the NFT wave at the end of the year in partnership with The Dematerialised. The lifestyle title released an NFT sneaker collection designed by Singaporean artist Tobyato. Exploring phygital concepts in the metaverse, the rarest of the NFT sneakers were sold along with physical replicas.

Local artists find a new creative outlet

2021 was a particularly tough year for artists in Singapore. At the height of the pandemic, a survey by Milieu Insight revealed just how much the country valued creative pursuits.

Not a lot, it turned out. 71 per cent of respondents felt that the job of an artist was the least essential of all. Those in creative roles were among the first to be laid off as businesses went through a period of downturn.

For some creators, NFTs provided an outlet to continue pursuing their passions.

Singaporean artist Chanel Lee quit the corporate world to release her own NFT collection featuring 7,600 artworks of toasted bread.

Alan Seng left a tech start-up and teamed up with art student Marc Yap to launch digital trading cards. Their ‘Dark Zodiac’ collection made over US$1 million within the first hour of launch.

Fashion photographer Shavonne Wong also began selling her 3D art as NFTs and made sales of over US$60,000 in 2021.

Are NFTs here to stay?

It’s tough to imagine an industry worth over US$40 billion vanishing overnight. Over the past year, NFTs have faced the wrath of skeptics and come out of it unscathed.

Today, the utility for these tokens has grown beyond just collectible art. NFTs are being used as vouchers, governance tools, and virtual real estate.

It’s tough to predict the future of a space so dynamic, or what form NFTs might take on next, but it feels safe to say that they’ll be around for quite some time to come.

[iframe_vp_product src="https://vulcanpost.com/label/embed-all/" id="iframe1"]

Featured Image Credit: Reuters

Also Read: From Binance.sg’s exit to digital dollar: Here are S’pore’s key crypto developments in H2 2021