We predict these 5 consortiums will win the M’sian digital banking licences, here’s why

With us already one month into Q1 2022, the time for Malaysia to announce its first five digital banks is drawing near. A digital banking licence in Malaysia could provide non-bank companies the ability to conduct all banking services through platforms like an app.

For a brief explainer, digital banking essentially opens up the horizon of financial technology beyond online banking.

Think whatever you can do online now (checking your balance, financial statement, transferring funds, etc.), expanded to include opening up a new bank account online, applying for loans, and more, without having to visit a physical bank. Learn more in our introduction to digital banking here.

Out of the 29 applicants vying for the licence, only a maximum of 5 consortia will be chosen by Bank Negara Malaysia (BNM).

Successful applicants that meet all criteria will be expected to contribute towards greater financial inclusion in Malaysia. This will be done by offering products and services to address market gaps in the underserved and unserved segments, including retail, along with micro, small, and medium enterprises (micro SMEs).

More specifically, BNM is looking to identify 3 types of digital banks amongst applicants:

- Specialists – Targeting a specific customer segment with tailored product offerings;

- Ecosystem players – Leveraging brand, channel footprint, and pre-existing customer base from non-banking services;

- Innovative basic banking providers – Offering simple products for everyday banking while using technology for in-depth customer insights and hyper-personalisation.

Not forgetting that Malaysia is running on a dual banking system, those that get the licence must comply with Financial Services Act (FSA) and Islamic Financial Services Act (IFSA) regulations.

From what we can see, applicants with a local traditional bank in their consortium may not be at the forefront of getting a digital banking license. This is because incumbent banks are already permitted to provide their services online, and would not need a new licence to operate in the digital banking space.

Furthermore, those with a digital banking license in countries such as Singapore could be more favourable as a digital bank in Malaysia as well. In doing so, the consortium could leverage its user base and provide access for expansions in larger overseas markets.

Now that we’ve run through the criteria and set some expectations, here are the 5 consortia, arranged alphabetically, that we think have the best chance of getting a digital banking license.

1. BigPay consortium with MIDF and Ikhlas Capital

Who they are: BigPay is a financial service by airasia Digital that provides users who register through its free app with a prepaid debit card that can be used wherever Visa or Mastercard are globally accepted.

The fintech app has partnered with financial services, Malaysian Industrial Development Finance Berhad (MIDF), and Ikhlas Capital, a Singapore-based private equity fund manager to apply for a digital banking license.

Their potential: MIDF is focused on providing services in the areas of investment banking, asset management, and development finance while Ikhlas Capital has over US$300 million of assets under management.

This points to a potential for the consortium to have the assets and capital to build products and services aiding underserved markets in Malaysia, including individuals and businesses. Not to mention, BigPay has recorded 1 million card users as of December 2021, pointing to a market primed for its digital banking services.

Aside from being a portfolio company of one of Malaysia’s three unicorns, if BigPay were to be granted a digital banking licence, it’d be a homegrown success story that’ll do Malaysia proud.

Potential challenges: BigPay faces the ongoing issue of numerous scammers that have marred its reputation.

Considering Malaysia’s digital banks are meant to serve communities with low financial literacy, becoming a digital bank puts a bigger target on BigPay’s back.

To combat this, BigPay’s team has set up marketing campaigns and warnings to educate users against such scammers. Internal safeguards such as the launch of virtual cards which can be easily deactivated and deleted have also been placed to catch and shut down scammers before they appear.

The company has reportedly seen a sharp decline in scam cases and overall complaints sent in by users, suggesting that these efforts are currently working.

2. Grab-Singtel consortium with Malaysian investors

Who they are: Grab needs no introduction, what with the Nasdaq listed company’s super app taking over the country during the lockdowns. Meanwhile, Singtel is a Singaporean telecommunications conglomerate.

Their potential: The Grab-Singtel consortium has already secured its digital banking licence in Singapore.

Having raised US$300 million for its financial services arm Grab Financial Group, the company has the capital to grow its financial services. It also has the resources and customer data to strengthen and personalise its current offerings within GrabPay, PayLater, and insurance.

In Singapore, Grab has a financing programme that provides drivers, merchants, and enterprises greater access to financial services. If localised for the Malaysian market as well, it can benefit local gig workers along with micro SMEs, fulfilling the expectations of a digital bank as outlined by BNM.

Potential challenges: It’s worth noting that BNM’s digital banking licensing framework highlighted a preference where the controlling equity in the licensed digital bank is held by Malaysians.

With Grab and Singtel headquartered in Singapore, it suggests that the Malaysian investors that are part of the consortium are meant to check this box for regulatory purposes.

But it’s also interesting to note that Maybank has a 30% indirect stake in the company that operates GrabPay in Malaysia, so this could sway the stakes in the consortium’s favour.

Grab did not confirm the other Malaysian parties that are part of this consortium. However, the company said that it aims to continue spurring economic empowerment for Malaysians through its digital bank.

3. iFAST consortium with Yillion Group, Koperasi Angkatan Tentera Malaysia, THZ Alliance, and 99 Speedmart

Who they are: Despite an unsuccessful digital banking licence bid in Singapore, Singaporean financial services company iFAST, along with China’s digital bank, Yillion Group, have put in their attempt for the framework in Malaysia.

THZ Alliance (THZ) is an investment firm founded by Tengku Dato’ Dr Hishammuddin Zaizi, who is a cousin of the Sultan of Selangor. Koperasi Angkatan Tentera Malaysia (KATM) is a cooperative organisation for Malaysian military personnel.

99 Speedmart is a convenience store brand best known for its affordable prices with 1,500 stores around the country.

If the application succeeds, the Singaporean fintech company will lead the consortium with a 40% stake, while the beneficial equity ownership of the consortium will be 57% Malaysian.

Their potential: iFAST is a wealth management fintech platform that is one of Malaysia’s only fully digital equity stockbroking services.

Dictionary time: Stockbroking is a service which gives retail and institutional investors the opportunity to buy and sell equities.

The fintech platform also has the means to open access to provide credit for businesses. This can help SMEs drive their growth as they overcome financing barriers related to documentation, cash flow issues, strict credit criteria, and limited use of traditional financial services.

Yillion Group’s experience as a digital bank in China also poses its own benefits. Its ability to provide small-amount deposits and easy loans to individual customers in consumption scenarios such as purchasing food, clothing, housing, and transportation makes it an attractive choice to win the digital banking license.

Such loans are also given to micro SMEs and merchants that provide goods and services to common people. With this service, underserved market segments like the B40 population can have access to loans and investment opportunities.

Together with Malaysian companies like 99 Speedmart, the consortium has the reach and existing customer base from B40 populations.

Not forgetting that KATM and THZ supply governmental relations, the latter’s website has made a dedicated page advertising the benefits the consortium presents if chosen as a digital bank.

4. Sea Group-YTL

Who they are: The parent company of Shopee, Sea Group also has a game developer and payments company under it. Listed on the New York Stock Exchange (NYSE), it serves customers worldwide.

The Singapore-based company is bidding for a digital banking licence with Malaysian conglomerate YTL Group. Its activities span hotels, property, technology, infrastructure, and more. The group’s core business has US$17.1 billion in total assets.

Their potential: Sea Group has already secured a digital banking license in Singapore. Its fintech ventures in Malaysia include ShopeePay and SPayLater, which have a wide regional user base.

In Q2 of 2021, Shopee Malaysia amassed approximately 54 million users per month, indicating its relevance and strong brand presence in the local market. Not to mention, it has large data sets of customer behaviours and trends on how Malaysians spend their money.

Securing a digital banking licence will enable Sea Group to create personalised financial solutions that will be applicable to the needs of Malaysian consumers. With a local conglomerate under the consortium’s belt too, one could say this pushes them ahead of a contender like Grab.

5. AEON Credit Service and AEON Financial Service

Who they are: AEON Credit Service is a non-bank financial institution (NBFI) providing services such as the issuance of credit cards, easy payment schemes, personal financing, and insurance.

To roll out its digital banking services, it will be partnering with its parent company, AEON Financial Service which holds a 60% stake in the consortium.

Their potential: AEON as a brand is a household name in Malaysia, with AEON Credit Service having a 25-year track record operating on our shores.

With over 4 million customers, an ecosystem of 65 retail outlets, various card products, along with personal and vehicle financing, the group has its own infrastructure already built up.

Leveraging its existing resources from customers and their data, industries, talents, technology, internally-generated funds, the NBFI should face little issue developing personalised products to fulfil BNM’s push for financial inclusion as a digital bank.

-//-

Sunway being a household name with activities in healthcare, property, retail, leisure, and remittance makes the Malaysian conglomerate’s consortium with LinkLogis and Bangkok Bank a strong contender as well.

Furthermore, it has a 51% stake in Credit Bureau Malaysia, which could play a valuable role in securing it a digital banking licence.

Ultimately though, all we can do at this point in time is share our predictions with information we already have. Only time will tell if our research-based predictions ring true, or if BNM will surprise us all with its final pick of the five digital banks.

- Read other articles we’ve written on digital banking here.

Also Read: We reflect on how the pandemic has changed our payment habits, to plan wisely for 2022

Featured Image Credit: Anthony Tan, CEO and co-founder of Grab / Salim Dhanani, CEO and co-founder of BigPay / Forrest Li, CEO of SEA Group

2022 is here, your business could lose out if you don’t become data-capable soon

[This is a sponsored article with MDEC.]

According to the International Data Centre, Malaysia’s data-driven spending is estimated to be worth RM7.9 billion in 2025.

In order for our local enterprises to get a slice of the pie, the National Fourth Industrial Revolution (4IR) Policy dictates they must first adopt digital transformation by excelling in the 5 foundational technologies of 4IR.

Note: The 5 foundational technologies of 4IR are artificial intelligence (AI), the Internet of things (IoT), blockchain, cloud computing and big data analytics, and advanced materials and technologies.

Providing the impetus for Malaysian businesses to evolve in this aspect is MDEC and their ambition to drive greater adoption of data and AI technologies such as IoT, big data analytics and AI among local businesses.

The initiative is also in line with the Malaysia Digital Economy Blueprint (MyDIGITAL) agenda that aims to develop Malaysia into a digitally-driven nation by 2030.

Here are some case studies of companies working with the agency to help individuals or businesses gain knowledge, develop a workforce, and receive guidance around the topics of data and AI.

Using data to reduce wastage and create new products

Innergia Labs and their SYCARDA solution provide insights to businesses about their sales data as well as inventory. The company’s CEO Vernon Chua highlighted why it’s important for an establishment to keep track of these metrics during the pandemic, especially for F&B outlets.

Food wastage remains a very real problem as certain eateries don’t know the right amount of ingredients to order and keep, because they don’t know of or understand the shifting consumption patterns.

SYCARDA helps by capturing real-time transactions at point-of-sale (POS) systems and automatically aggregating sales data into reports. These let businesses monitor and manage store performances to make quick improvements.

For example, an F&B chain was able to use data pertaining to their customers’ food pairing options to develop an off-peak menu. This generated extra sales and the company made RM400,000 more in monthly revenues.

Meanwhile, a pharmacy chain utilising SYCARDA managed to quicken the process of compiling their weekly reports, using just 3 hours instead of 24.

Looking ahead to 2022: Consumer behaviours have no doubt changed dramatically since the pandemic, Vernon noted. And although this means that businesses must now have an online presence, he believes that a convergence of both offline and online businesses is the future.

When that happens, managing and monitoring a business’ performance becomes doubly difficult. Therefore, increasing the importance of data technology for companies, especially SMEs.

“These tools are there to support businesses in their effectiveness and efficiency. They are no longer the sole domain of big companies; smaller businesses can afford [to] and should implement them as well,” said Vernon.

Using data to develop AI solutions that increase task efficiency

TM Research & Development (TM R&D) is a government-approved R&D company and an innovation arm for Telekom Malaysia Berhad (TM).

The company developed its own Open Innovative Platform (OIP), a one-stop, cloud-native data-sharing platform that enables digital innovation with features like a data hub, smart service hub, IoT management, and more.

Through OIP, the SPICE.ai solution was born. It is an AI-driven customer experience platform that enables telcos to reduce user complaints, widen the usage of digital channels, and perform self-troubleshooting which result in efficient customer call handling.

During the pandemic, SPICE.ai accurately helped frontliners at call centres to enhance customer experience and cut down call handling time by one minute.

Looking ahead to 2022: CEO Dr Sharlene Thiagarajah explained, “Data and analytics are key to digital transformation efforts. Yet, fewer than 50% of documented corporate strategies mention data and analytics as components for delivering enterprise value”.

Now, things must change. She believes it’s important for businesses to adopt data and AI technologies in order to be part of the digital economy that’s expected to contribute 22.6% to Malaysia’s GDP by 2025.

Using data to drive sales while saving costs

BigLedger offers cloud-native, AI-based apps called “applets” that can handle the complexities of various business processes such as enterprise resource planning (ERP) systems, customer relationship management (CRM), POS, warehouse management, logistics, and more.

Various applets can be mixed and matched to suit the needs of a business, which means these companies don’t have to break the bank on huge complex systems.

The solution draws information from a unified data warehouse called the Operational Data Lake platform that makes information easy to access and manage remotely.

As a result, BigLedger’s clients save at least 10% of manpower costs after implementing the Operational Data Lake.

Looking ahead to 2022: BigLedger’s CEO Vincent Lee foresees highly successful enterprises adopting AI solutions in the areas of CRM, merchandising, customer service, logistics, and marketing.

2022 is the year many businesses are rebooting, consumer behaviours change, and digital transformation accelerated by at least 10 years.

To properly navigate it, Vincent believes that data technology is essential for businesses to not “fly blindly” in the aforementioned areas.

Also Read: Adobe’s only platinum partner in Malaysia: 4 things they do differently for businesses

Featured Image Credit: Innergia Labs

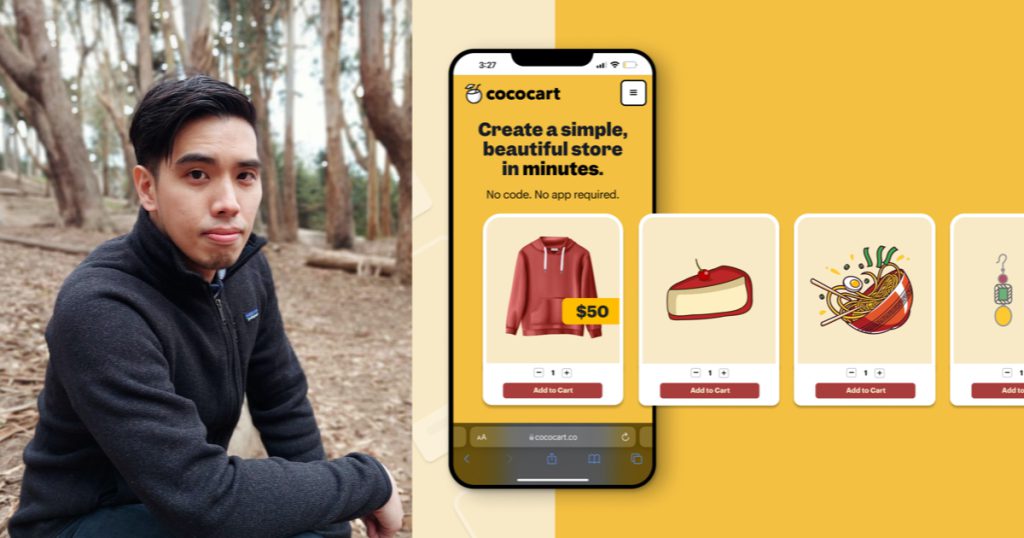

How S’pore startup Cococart helps over 20K businesses earn over US$15M with its online platform

Shopping online has become ingrained as the way to get things done. That’s because people stay within the confines of their home these days as part of safe distancing measures and the default working arrangement was to work from home.

For many businesses, owning an e-commerce website is a necessity to keep sales coming in and to stay afloat.

That was the case for 31-year-old Derek Low when the pandemic caused him to shut his Bali hotel business in 2020. He found himself selling homemade cheesecakes online in Singapore to make ends meet.

While the UC Berkeley Computer Science graduate had the skillsets to create his own e-commerce platform to take orders, he realised other similar home-based businesses had difficulty doing the same.

Surprised that there was no existing e-commerce platform to help users quickly accept online orders without a mobile app or are not charging “high” fees and commissions, Derek and his fellow co-founder Lim Zhicong got together to build a one-stop ordering platform called Cococart in Aug 2020.

Today, Cococart supports more than 200,000 businesses across 80 countries, helping merchants accept upwards of 500,000 orders amounting to US$15 million.

The business is just getting started as it competes with global players, but the growth seen so far has been encouraging. For comparison, WooCommerce, the e-commerce plugin for WordPress, had an estimated 3.8 million merchants in 2021, while competitor Shopify had 1.7 million merchants globally across 175 countries in the same year.

“We built this platform to help other businesses accept online orders…With Cococart, they can set up a website with no learning curve,” said Derek, co-founder and Chief Executive Officer of Cococart.

Supporting small businesses amid Covid-19

Derek said that Cococart’s selling point is that merchants can create a website to collect orders for their products online without the need for any coding experience.

The onboarding process is also not much of a hassle. The merchants just have to visit Cococart’s website and create a unique link for their business. After uploading their products, delivery, and payment methods, they can share their link and start accepting orders.

Every aspect of the online ordering process – from order management to mobile payment solutions – is settled by Cococart. For merchants, this avoids what Derek described as a “logistical headache”.

We let businesses focus on growing their sales and delighting their customers. We know it’s difficult enough to start a new business, and we want to help fellow business owners succeed by taking away the grunt work of running their business.

– Derek Lim, co-founder and CEO of Cococart

He added that consumers these days expect to be able to quickly and easily order from their phones – which explains why Cococart has picked up steam in the past year.

In fact, the startup saw a “30 times growth in merchants and 46 times growth in customers” in 2021. Derek also attributed the growth in merchants on their platform to the increase in people starting their own side hustles online amid the pandemic.

“Like myself, many people who lost their jobs turned to side hustles online, which then became their main source of income…The pandemic created a new generation of independent business owners, and these businesses are the fastest-growing segment in e-commerce,” Derek said.

He cited INDOCIN – one of Cococart’s top merchants – as one such example.

The Indonesian eatery was a one-man show operating out of its own kitchen when it first joined the platform in 2020. Today, it has expanded into a team of 24 staff operating out of a commercial kitchen and a retail outlet.

Tapping on the e-commerce boom

While the Covid-19 situation is shifting towards becoming endemic, Derek believes that it’ll have no impact on Cococart’s ongoing growth. “People are much more used to ordering online because of the pandemic. Even as we enter an endemic, this habit won’t go away,” he said.

“In fact, with retail businesses opening, we’ve seen many of them using Cococart too. We’re now used by all types of businesses due to the flexibility of our product,” Derek claimed.

Cococart has plans to further expand its fully-remote team, which is spread across 10 countries. It has also been accepted into Y Combinator’s Summer 21 Batch — a startup accelerator that has produced the likes of Airbnb, Stripe, and Dropbox.

The co-founder added that the company’s goal is to serve the 200 million small businesses globally that rely on phone calls or WhatsApp messages to collect orders, which in his view takes up “so many hours of time which could be better spent growing the business”.

“There are still so many challenges in starting and running a business that we want to solve, from deliveries to supply chain to financing,” he said.

“Our goal is to define the next generation of commerce.”

Shop and support the best homegrown brands on VP Label now:

[iframe_vp_product src="https://vulcanpost.com/label/embed-all/" id="iframe1"]

Feature Image Credit: Cococart

Also Read: This 32-year-old S’porean sells balloons for a living – biz turns profitable in under 2 years