S’pore firm EVOne charges ahead to solve EV needs – clients include DHL, NUS, bus operators

In recent years, the government has been very vocal about its stance to boost the adoption of electric vehicles (EVs) in Singapore, with an aim to phase out Internal Combustion Engine (ICE) vehicles by 2040.

In the Budget 2020 speech, Deputy Prime Minister Heng Swee Keat gave the clearest indication of the government’s commitment towards EVs. He said that the country is “placing a significant bet on EVs and leaning policy in that direction because it is the most promising (cleaner vehicle) technology”.

It has set aside S$30 million over the next five years for EV-related initiatives, such as measures to improve charging provision at private premises. This is meant to catalyse the partnership between the public and private sectors, and comes as Singapore is accelerating the development of its charging infrastructure.

It has also committed to building eight “EV-ready” towns in Singapore by 2025, and aims to deploy 60,000 charging points by 2030 — more than double its initial target of 28,000.

As Singapore ramps up its EV agenda and charging infrastructure, EVOne, a leading EV charging station supplier, stands to greatly benefit from this shift.

An end-to-end EV provider

EVOne’s parent group of companies originally focused on vehicle repair and servicing, but due to the changing vehicular landscape in Singapore, EVOne Charging was established in 2019.

EVOne is an all-in-one solutions provider for EV charging needs. Our aim is to make the shift into EVs as seamless and efficient as possible by providing our customers with a high-class customer service and reliable technical support.

– Leonard Tan, manager and co-founder of EVOne

While EVOne started out with the distribution of charging stations, and later expanded into chargers management platform software, it further expanded its wings and established an EV workshop in late 2019.

Currently, its core business model is both as a distribution/solution provider for EV chargers, as well as a Charging Point Operator (CPO). Their long-term expertise in EV chargers allows them to cater to customers, as well as operate its own charging stations which any public EV drivers can utilise.

According to Leonard, EVOne does not target a specific market segment, but rather, it serves anyone who needs an EV charger.

“We cover a full spectrum of needs and requirements, ranging from private use to commercial/industrial and company fleet use. We will provide customised solutions to each of our customers, depending on their needs,” he adds.

EVOne is also the sole distributor of the Hiconics (HiCi) 180kW DC Charger, which is the fastest TR25/LNO-approved EV charger in Singapore. Outputting up to 180kW of power, it can fully charge an EV in under 30 minutes depending on the EV battery.

Becoming a pioneer comes with many challenges

EVOne started up at a time when EV was still nascent, and ICE vehicles were dominating Singapore roads.

Many of the earlier struggles we faced were mostly regarding customer skepticism and how much of the EV technologies and standards are not mature yet. This led to many consumers wondering if it was the right time to make the investment into purchasing an EV charger and transition into EVs.

As such, our focus at the time was to help educate consumers about their possible choices, and provide solutions to many of their infrastructural-related worries; for example, regarding what upgrades they might need to EV-proof their facilities. This would give consumers more confidence in their choice to transition towards EVs.

– Leonard Tan, manager and co-founder of EVOne

Beyond infrastructural concerns, consumers are also worried about the cost of upgrading. These issues are what consumers worry about about the most, even till today.

To alleviate these financial woes, EVOne offers different pricing models to its customers. For example, they offer establishments the choice of not having to pay for the charger, and share the profits of charging instead.

“Additionally, our chargers are competitively-priced, with some of the lowest prices and highest kW output for DC chargers in Singapore. These solutions have allowed customers to transition into EVs with less worry and hassle,” he added.

Customers can use the EVOne mobile app to charge at its public EV charging stations, mostly located in the Western and Central parts of Singapore. It’s as simple as plugging in the the charging cable and scanning a QR code on the charger to begin the charging process.

Payment is also made seamless as the charging fee will be automatically deducted from the credit or debit card that’s linked to the app.

EVOne has installed close to 200 EV chargers in Singapore

In the last few months, Leonard said that the company has also seen a sharp increase in enquiries for installations and orders.

In a separate article, it was reported that EVOne has also been receiving more requests for proposals by condominium residents in the past year to install EV chargers.

So far, EVOne has installed close to 200 EV chargers in Singapore, both AC and DC types for personal and commercial use.

Some of its notable clients include logistics company DHL, waste management and recycling company 800 Super, National University of Singapore, as well as bus operators Go-Ahead Singapore and Tower Transit.

Commenting on the EV landscape in Singapore, he acknowledged that there has indeed been a greater uptake of EVs, but the speed of growth is very much dependent on government support.

“In the near future, EVOne will continue to expand our CPO locations to service the east side of Singapore and increase the number of CPO locations in the remaining areas we serve. We will also continue to introduce more game-changing and high-powered chargers to the market as technology develops, allowing Singaporeans to have a faster and hassle-free charging session.”

“Additionally, we aim to continue participating in major projects and expanding the HiCi charger presence in Singapore,” he summed up.

Featured Image Credit: EVOne Charging / Go-Ahead Singapore

Also Read: This S’pore startup built a “portable powerbank” for EVs – lets drivers charge anytime, anywhere

Scams are on the rise in S’pore, but it’s not the banks’ responsibility to compensate losses

Disclaimer: Opinions expressed below belong solely to the author.

Scams have been making the headlines quite frequently in recent months.

First, there was a phishing scam that targeted OCBC customers. Just a few months later, there was another one that targeted DBS customers instead.

In general, scams are becoming more commonplace — 2021 saw a 24 per cent increase in reported cases as compared to 2020, and while rates for other crimes declined overall, the increase in scams was so significant that Singapore’s overall crime levels drove up.

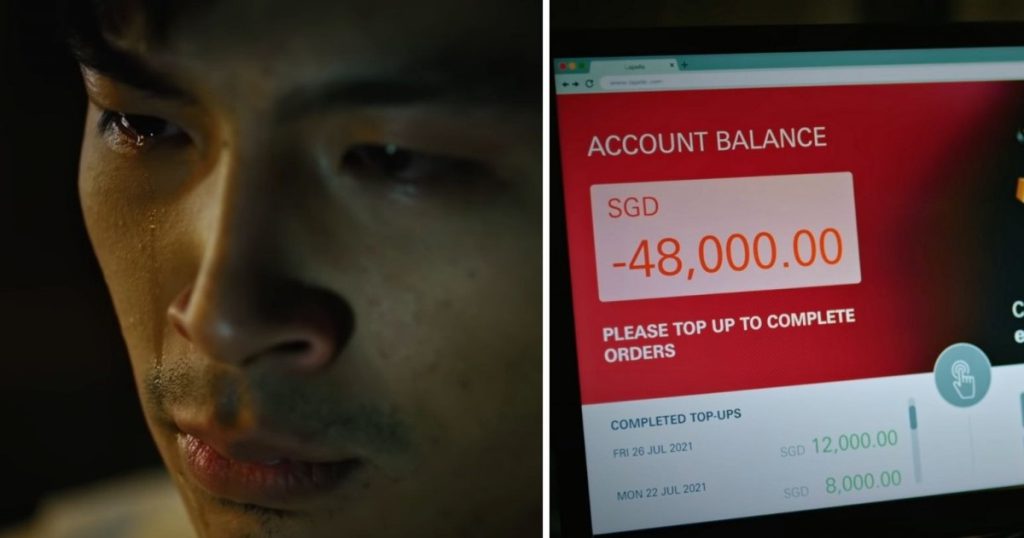

Even celebrities have not been spared — Singaporean rapper Yung Raja lost almost S$100,000 to an NFT scam earlier this year.

The increasing number of affected Singaporeans, as well as the high-profile targets, have caused quite the outcry.

In response, the Monetary Authority of Singapore (MAS) has announced that a framework for the equitable sharing of losses arising from scams is on the way.

In the meantime, the Association of Banks in Singapore has also put in place new guidelines in an attempt to try and reduce the amounts lost to scams. OCBC has even gone as far as to give customers access to a kill switch to freeze their accounts if they suspect that they have been scammed.

However, not everyone is satisfied. In particular, some have called for banks to bear all the losses from such scams, meaning that Singaporeans who fall victim to the scams should be compensated fully for the amount that they have lost.

Why should banks bear the losses?

For many consumers, this may seem fair. One of the reasons why consumers put money in banks is to keep their funds secure, so security is of course, one of the main responsibilities of the banks.

When scams occur and banks release funds into the possession of scammers, there is a case to be made that the banks have failed in this duty — they have failed to keep our funds safe, and the resulting loss should not accrue to the consumer, but to the service provider, which in this case is the bank. The scam therefore reflects an underinvestment in security on the bank’s part.

Certainly, if banks fail to adequately ensure the security of their customers’ funds, why should customers be held responsible when these funds are stolen? Instead, customers should be made whole, with banks compensating losses to customers due to their security oversights.

But at the same time, we should also consider that banks have been putting up greater security measures in an effort to prevent scams. So is it really true that banks are underinvesting in their digital security measures?

There are already several levels of verification that customers have to go through in order to access their accounts, and scammers also have to go through them in order to fraudulently transfer funds.

This means that scammers must first obtain the credentials of customers in order to access their accounts. If customers safeguard their own credentials properly, scammers would theoretically be unable to transfer any money out.

As such, customers must share some blame for the scams as well. No amount of infrastructure can guard against a lack of vigilance.

On top of this, there is a limit as to how much banks can increase security before it becomes a hassle. There will only be so much hassle that customers are willing to take before the alternative becomes preferable, a return to physical banking.

And lest we forget, scams also exist for physical banking. There will always be a cat-and-mouse game between scammers and banking security, whether it is online or offline.

While it is also true that making banks responsible for losses will likely incentivise them to invest in security, we must remember that when the only tool we have is a hammer, every problem looks like a nail.

Better ways to deal with scams need to be found, instead of simply hammering away with the one tool that we have.

Incentives and moral hazard arguments must be applied fairly

Some have also argued that if consumers share losses with banks, banks will simply find ways to shift the blame to consumers in an effort to reduce their own liability and losses.

This is certainly cause for concern. American insurance companies have come under the spotlight in popular culture for their willingness to play the blame game in an effort to reduce the amounts that they pay to customers.

If banks in Singapore were to do the same, it would be to the detriment of customers if they lose money to scams and banks refuse to accept any responsibility.

But to suggest the same situation would arise in Singapore simply because banks can blame consumers for their losses is ridiculous. As the saying goes, just because you can, doesn’t always mean you should.

Banks remain profit-driven institutions — they rely on customers to deposit funds, in order to reinvest these deposits for profit and pay customers’ interest payments. The difference is pocketed as profit.

While we may consider banks monolithic, uncaring entities in a country of cold, calculating efficiency, banks are ultimately still subject to competition with each other — offering better savings plans, interest rates, and terms of use.

For a bank to simply blame customers when they get scammed would mean harming their long term profits when consumers recognise the pattern of behaviour and switch to a different bank.

Unnecessary blame-shifting, therefore, would be a strategic business error on the part of the banks, and likely a fatal one.

Banks in Singapore have already shown that they are willing to take lower profits in order to compensate victims, even when the banks may not be entirely at fault. OCBC offered a one-time payout for scam victims, fully covering any losses from the phishing scam.

As MAS and OCBC have noted, this was a one-off payout that should not indicate how future scam losses should be settled.

The payout already sets a dangerous precedent. If consumers know that banks will cover their losses, there really is no incentive for them to remain vigilant.

Even though there may be lengthy investigations into the veracity of their claims of being scammed, customers will still get their money back at the end of the day, while banks suffer the loss on the customers’ behalf.

The cost of lax vigilance, therefore, is not placed where it should be, and it is of utmost importance that the cost is placed where it belongs.

The argument that there is a moral hazard in loss sharing cuts both ways — if we assume that moral hazard will exist for banks when they are able to offload blame onto customers, we must also assume moral hazard for customers who are secure in the knowledge that they will not suffer for their own lapses.

The way forward must therefore be one that constrains this moral hazard as much as possible, but forcing banks to bear all the losses from scams is definitely not a solution that satisfies this condition.

Is blame-shifting really something to be avoided at all costs?

While it may seem that blame-shifting is something that is inherently bad, it really should not be considered as such. In many cases, blame-shifting is necessary, and when dealing with how to equitably share losses from scams, it may actually work as a force for good.

In a court of law, lawyers present the best case for their clients — the case which presents their clients as fault-free as possible and shifts as much blame as possible to another party.

This is, ultimately, how the legal system works — it works on the strength of arguments to ensure that judgements are fair.

Blame shifting, therefore, is part of the game, within limits. Lawyers present the best case, but cannot present a false case, one that is not true.

What is to be avoided is excessive blame-shifting, and banks are already incentivised to avoid this.

Banks are already facing an unwinnable uphill battle and running lower profits in order to compensate victims and investigate claims. As consumers, while the pain of losing our hard-earned money is something that we wish to avoid, we should ultimately recognise that more often than not, we may have a part to play in causing the loss in the first place.

When banks bear all the losses, consumers have almost nothing to lose from their carelessness and this is an unfair scenario. While banks do their best to protect us, we must also do our part to protect ourselves.

At the end of the day, the banks are not the enemies of consumers — we both have a shared interest in protecting our property from those who would hope to unfairly acquire it.

But when our efforts fail, it is only right that an equitable sharing of losses is reached — one that encourages all parties to do better in the future.

Featured Image Credit: The Drum

Also Read: A look at S’pore’s COE policy and how it affects ride-hailing sector, firms with vehicle fleets

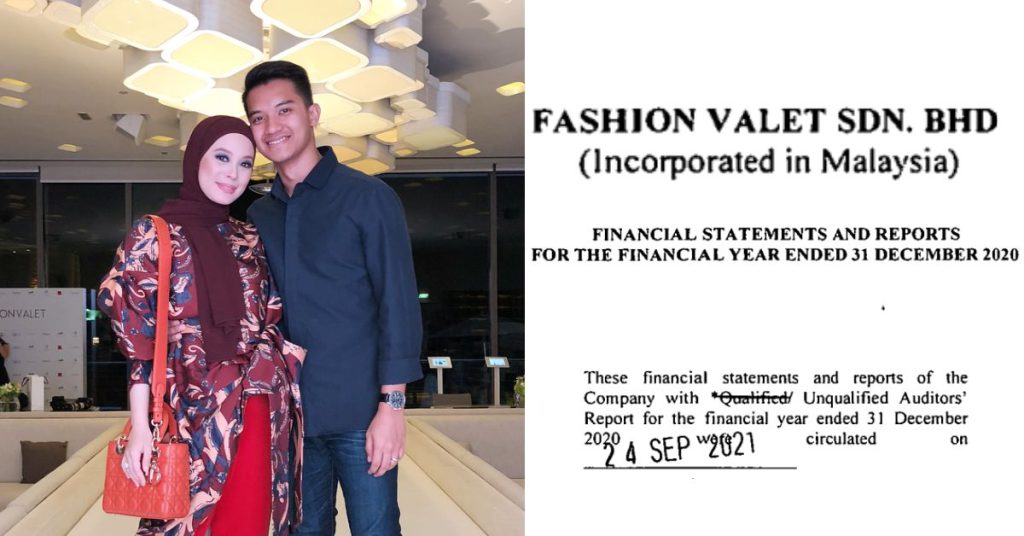

We bought FashionValet’s financial reports from SSM to verify recent allegations

On August 1, we reported on FashionValet’s closure and aspects of the company that were being scrutinised online.

In particular, we based our research around a Facebook post by Aliff Ahmad, co-founder of Scrut.my, who has been making posts about Fashion Valet for a few years now.

We soon realised that there were some numbers that just weren’t adding up, so we bought Fashion Valet Sdn Bhd’s publicly available reports on MyData SSM ourselves to find out the truth.

1. Aliff’s screenshots about the RM4.2 million dividends corroborated what we found

In Aliff’s Facebook post, he made multiple mentions that the founders of 30 Maple Sdn Bhd (the initial parent company behind dUCk, but more on this later) took RM4.2 million in dividends.

Along with the written post, he uploaded a screenshot that supposedly showed how the company had given out RM4.2 million worth of dividends in 2017.

According to the annual reports of 30 Maple that we purchased, the figures reported corroborated Aliff’s claims.

Another thing that Aliff posted that we found proof of as well was the RM2.283 million web development write-off in FashionValet’s 2017 annual report.

Editor’s Update: We’ve updated this point and its following argument to be factually accurate, as we had mistakenly pointed out that Aliff’s claim about the RM4.2 million dividends did not line up with our own findings. However, he was referring to 30 Maple’s documents, and not FashionValet’s, which we had originally compared his claims to.

2. Multiple errors were made in FashionValet’s 2017 annual report

Interestingly, though, if we were to look at 2018’s annual report, it states that the 2017 numbers have been “restated”. A restatement refers to a revision of a company’s previous financial statements to correct an error.

Some of the restated information seems to include the loss for the year. While the 2017 report said the loss before taxation was (RM10,696,373), the 2018 report said 2017’s loss before tax was (RM15,027,196).

In the 2018 report, 2017’s web development write-off was not mentioned in the “loss for the year” section, which looks at both 2017 and 2018’s activities.

According to the 2018 report, there are a few prior year adjustments made. First, the company and group had “omitted the contract liabilities arising from the loyalty points granted to customers in the previous years’ financial statements”.

In the screenshot above, Company refers to FashionValet, while Group refers to FashionValet and its subsidiaries.

Because of this, the contract liabilities for FashionValet and its Group were understated by RM943,709 and RM1,687,041 respectively.

Corresponding to this, the Company and Group’s revenue was overstated by RM743,332.

Another error to note involves the measurement of the Redeemable Convertible Preference Shares (RCPS).

In 2017’s annual report, there was an incorrect classification of RCPS as equity, when such shares are actually compound financial instruments that contain components of debt and equity, and should be assessed, measured, and classified separately as financial liabilities and equity.

Because of this error, the liability component of RCPS of the group and the company were understated by RM21,283,806 and RM28,370,362 respectively.

Correspondingly, the share premium was overstated by RM23,444,459 and RM27,851,956 for the Group and Company respectively.

3. In the most recent annual report, directors’ remuneration actually went down, and there were no added bonuses

In Aliff’s post, he mentioned that the directors’ allowance was increasing. However, if we look at the latest financial statement ending December 31, 2020, the directors’ remuneration went down. In 2019, it had been RM2,152,416, while in 2020 it was RM1,453,866.

The 2020 annual report also states that no director of the company has received nor become entitled to receive any benefit other than the remuneration “by reason of a contract made by the company or a related corporation with the director or with a firm of which the director is a member, or with a company in which the director has a substantial financial interest”.

4. 30 Maple was bought in 2018 for RM95 million

Aliff had pointed out in his post that Vivy Yusof’s popular brand, dUCk was in fact separate from FashionValet itself despite being seen as an inhouse brand by some.

So, in a recent article by SAYS, why did Vivy share that FashionValet now fully owns dUCk? Well, it’s true now, but that wasn’t always the case.

With a bit of digging around, we found that dUCk was actually under 30 Maple Sdn Bhd. But in FashionValet’s 2018 annual report, it was shown that 30 Maple (and subsequently, dUCk), was purchased by Fashion Valet Sdn Bhd in December 2018 for RM95 million by issuance of 851,686 new ordinary shares.

This might explain why Vivy had also told SAYS that it has been a decision to focus the business on dUCK and LILIT. since 2019, because by then, FashionValet had just fully acquired 30 Maple.

5. Offline sales plummeted in 2020, though online sales only differed slightly

In the article with SAYS, Vivy said FashionValet has been able to survive the pandemic for the past two years thanks to its decision to focus on dUCk and LILIT.

Indeed, looking at FashionValet’s revenue in 2020, we noticed it had decreased mostly in offline sales.

In 2019, the group’s offline sales were RM34,222,203, but that number went down to RM17,725,405 in 2020.

However, the group’s online sales remained mostly the same, with less than RM1 million difference between the two year’s online sales.

6. FashionValet has an accumulated loss of RM83 million as of the latest financial statements

According to the financial statements and reports for the financial year ending December 31, 2020, the company had made a loss of (RM12,371,305).

Furthermore, the company’s retained earnings were -RM83,442,646. A company with a negative retained earnings balance would signal “poor financial health”, according to Investopedia.

7. Khazanah and PNB’s involvement did improve the company’s profit margins

On August 5, 2022, Vivy Yusof made a statement to Malay Mail, saying: “Since Khazanah and PNB invested, the business has more than doubled in revenue, improved our profit margins and expanded to offline retail.”

We looked at FashionValet’s revenue over the years to ascertain whether this was true, keeping in mind that Khazanah and PNB were reported to have invested in the company around March 2018.

In 2017, before the two government-linked companies invested in FashionValet, the revenue was RM57,909,265. If Vivy is comparing that figure to the 2019 revenue of RM101,755,629, it would be slightly less than two times the profit.

However, it’s important to note that in 2020, the revenue went back down to RM84,495,919.

But we also have to consider the profit margin. We calculated the net profit by finding the profit as a percentage of the revenue, using FashionValet’s financial statements as the source.

In 2017, before PNB and Khazanah invested in the company, the profit margin we calculated was roughly -18.5%.

The next financial year (i.e. ending December 31, 2018) recorded a profit margin of -32.2%. PNB and Khazanah had invested earlier that year in March.

In 2019, though, the company improved its profit margin, which was around -15.7% at this point. In the financial year ending December 31, 2020, the company’s profit margin was around -14.6%.

If these are the figures Vivy was referring to in her statements to Malay Mail, then it seems that the figures align with what she said.

What’s next then?

As mentioned, FashionValet is invested by state investment funds such as Permodolan Nasional Berhad (PNB) and Khazanah Nasional.

According to Khazanah’s investment policy, its mandate is to grow Malaysia’s long-term wealth, i.e. to sustainably increase the value of investments while safeguarding financial capital injected into the fund.

With FashionValet’s negative retained earnings, it’s no wonder that members of the public are questioning Khazanah’s decision-making strategies behind its investments.

However, as pointed out by Vivy, FashionValet’s profit margin seems to be improving slowly, so perhaps Khazanah is truly focusing on the “long-term” aspect of its investment.

Whether the increased focus on growing dUCk and LILIT. will bear the results that Khazanah envisions, only time will tell.

- Read other articles we’ve written about FashionValet here.

- Read other articles we’ve written about Malaysian startups here.

Also Read: We sat down with our parents and asked what their greatest fears as a parent are

Featured Image Credit: FashionValet

airasia offers riders full-time jobs with RM3K/mth base pay, how are customers impacted?

The airasia Super App has announced on August 4 that it will be offering its airasia food and airasia xpress gig riders in Malaysia full-time employment, effective immediately.

As part of its commitment to giving delivery riders a better working environment and job stability, the recent employment news intends to enhance income opportunities.

airasia’s initiative is coming in as a timely one as well. The Star reported that a delivery rider strike is happening as of today (August 5), due to the lack of job security and unstable income.

Riders are asking for fair wages to compensate for their extended time and effort on the road to make up for the rising cost of living.

“As many people know, gig riders do not have anyone protecting their interests as it is not regulated and sometimes results in suppressed wages and almost no welfare benefits,” Regional Head of airasia food, Tan Suan Sear, told Vulcan Post.

“We want to do the right thing by being ahead of the industry. We want to provide surety of income and enable our delivery riders to carry out their duties safely and confidently.”

Inside the package

Claiming to be the first in Asia to transition its gig workers into full-timers, airasia food and airasia xpress riders will receive a base monthly salary of RM3,000. Based on performance, riders can also earn extra incentives.

This is in addition to a full suite of Allstar benefits. This will include EPF, SOCSO, medical coverage (covering spouses and children as well), annual leaves, travel benefits, and free personal accident coverage, amongst others.

There will also be career advancement opportunities across the entire Capital A organisation, the team told us.

“We don’t believe in contract staff and will now move towards employing all riders as full-time employees, receiving the same benefits that every Allstar receives,” CEO Tony Fernandes said in the press statement.

Being full-time employees, riders will have to clock in a minimum of eight hours according to their duty roster. Any additional orders completed will be part of their extra incentives as well.

“All riders’ activities will be tracked via the airasia Super App, which will give us a better understanding of its riders’ job take-up rate, performance, location, and other data that will help them complete their jobs better,” added Suan Sear.

The position is currently available to those in Klang Valley and Penang. It also offers an option for riders to join on a freelance basis where they will be paid according to trips.

As freelance riders, they will be compensated as per the number of orders completed per day.

Bringing them onboard

Currently, airasia has a fleet of over 20,000 riders registered on its platform regionally, according to Suan Sear.

Having already onboarded 20 permanent riders, the team will begin converting all its delivery riders into full-time employees while welcoming new ones to join.

airasia made clear during its press conference that it has no intention of limiting the number of applications.

Head of delivery, Lim Ben-Jie said at the launch event that the company will have a proper screening process before hiring the riders.

New riders joining as full-time riders will also undergo rider training and a three-month probation period.

The management team will evaluate each Allstar based on their performance in tandem to set targets and goals throughout their probation period.

Who bears the cost?

Because airasia will be paying each rider a base salary of RM3,000 a month, how will this affect its customers?

When probed, Suan Sear shared that airasia is expecting an improvement in completion rates and better services for its customers.

“Each rider will be professionally trained with the same level of quality as every cabin crew in our airline business to ensure that our riders deliver the same quality of service to our app users who order food or parcel deliveries,” he explained.

With full-time employment and guaranteed income, the team believes riders will no longer need to endure dangerous working conditions to fulfill ridiculous amounts of deliveries to earn enough.

“Now, they can deliver and meet their targets with safety and confidence,” Suan Sear hoped.

When asked if the delivery fees would be hiked up to afford airasia’s full-time riders, Suan Sear implied that this cost would be borne by the company.

“While operational costs will increase in the short-term, we are actually investing in our people, which we believe will bear fruit in the long term as they grow as Allstars,” he said.

-//-

While airasia may be the first to transition its gig workers into full-timers, GoGet Malaysia was likely the first to provide gig workers EPF through its app.

It’s encouraging to see more companies that base their business models around gig workers take the initiative to offer them some level of job security.

The strike by delivery riders mentioned above is a way of giving companies some awareness about the effects gig workers feel towards coping with the rising cost of living, and airasia’s efforts in improving these conditions are commendable.

Also Read: We sat down with our parents and asked what their greatest fears as a parent are

Unchartered waters: This duo works with Amazonians to bring ethically-harvested acai to S’pore

Açaí has taken healthy snacking to a whole new level. Its berries are packed with antioxidants, fibre, heart-healthy fats and calcium that not only aid in having a healthy, balanced diet, but look amazing in your smoothie bowls for the perfect Instagram post.

Most of the time, people in Singapore can find açaí in stores and cafes, or buy frozen açaí berries from supermarkets. But have you ever questioned where it comes from, and how are we impacting the environment when we consume it?

Selva Foods brings açaí directly from a single origin in the Amazon. “One of our main difference[s] is the flavour — a lot of our customers share that they can tell when a place serves Selva açaí,” says Cinthya Sayuri, the co-founder of Selva Foods.

Cinthya, who is of Japanese heritage and from Brazil, met her Singaporean partner Shaun Lim in Shanghai back in 2012, when they were both studying Chinese.

“We met, fell in love, I went back to Sao Paulo and he joined me there one year after. While experiencing life there, we thought why not bring açaí to Singapore? [Afterall], being a local, [it] makes it easier to go around the Amazon and source for the berries.”

That was what led to the founding of Selva Foods in 2015, which aims to bring açaí directly from the Amazon while respecting and honouring the communities there, living up to their brand name “Selva”, which means jungle in Portugese.

Taking a leap of faith

When Cinthya interned at an alcohol beverages corporation, she would often look out the window and watch the world go by.

“I had this feeling that I didn’t want to spend so much of my time and life inside an office working for a corporation, [and] if I invested as much time and effort into something of my own, it could be much more meaningful. It was a very idealistic thought at the time, but I saved some money, left the job, went to Shanghai, got a job there, met Shaun and the rest is history!” she shares.

Having lived in Brazil, she highlights that the people there have had access to açaí for decades, making açaí push carts, açaí kiosks, açaí in bakeries, restaurants and the likes, a common sight.

When Shaun moved to live with Cinthya in Brazil, he realised they could tap on Singapore as a test market for ideas and flavours since the açaí scene in Singapore wasn’t as developed back in 2014.

This prompted them to bring over local açaí produce from Brazil, with the aim of offering more food options that were not only healthy, but tasty.

“The whole idea of bringing it to Singapore was because we wanted to share something good with our friends and family,” says Cinthya, adding that setting up Selva Foods in Singapore could aid in their expansion into the rest of Southeast Asia.

However, despite Singapore’s thriving business landscape, Cinthya notes that they weren’t spared from challenges. Despite putting in an initial investment of US$45,000 (S$61,900), she shares that it took them a couple of years to break even.

I think the main [challenge] at the beginning was pushing a product no one knew about. We spent the first two years of the business doing a lot of sampling in farmers markets, yoga studios, music festivals, anything outdoors, to let people try and get a feeling of what açaí was and how it could be consumed.

– Cinthya Sayuri, co-founder of Selva Foods

She recalls the time when they used to produce the açaí overnight before packing and deliver them directly to consumers’ houses the next day. There were many sleepless nights, but the growing number of repeat orders and positive feedback kept them going.

Their first milestone was when they successfully developed their product, Açaí Ready To Serve, which allowed consumers to have açaí in a more convenient and ready-to-eat way. It was tailored to the local palate, and had a sorbet-like consistency.

However, Cinthya shares that creating and introducing a new product into the market has been an uphill task. Although there were a few experts they could turn to, they mainly relied on themselves to come up with new ways to innovate and improve their products.

Revitalising the Amazon with açaí

With the demand for açaí increasing the past few years, the açaí industry can potentially save forests — which are suffering due to land-clearing activities like cattle ranching or logging — by working directly with the local communities in the Amazon instead.

Cinthya highlights that even today, people who visit the Amazon can encounter illegal logging and forest burning to clear way for grazing.

This is why even though açaí can come from a farm, Selva Foods decided to harvest it directly from the Amazon forest in order to keep the forest alive.

By working with the local communities there, Selva Foods helps in increasing biodiversity while also being in tune with the lifestyle of the river communities that have been harvesting the açaí there for generations.

The local communities they work with are the Amazonian communities living by the river streams who harvest the açaí during the season.

“It’s knowledge and work passed from generation to generation”, says Cinthya. “The women usually work selecting the berries and blending the açaí for consumption. It’s quite interesting to see their simple houses with a chest freezer inside to store açaí.”

However, things took a downturn when the pandemic hit. “We couldn’t get açaí from the region for [a while] because the staff couldn’t go to the factory”, Cinthya shares, adding that they were also affected by the lack of shipments from Brazil to Singapore, which skyrocketed the cost of their logistics.

According to Cinthya, the Amazon region was one of the first ones to be affected with COVID-19 in Brazil. Due to the lack of infrastructure in more remote areas, the people suffered greatly.

“It was a really dark period in the Amazon for almost a year. COVID aggravated the economic social situation of those living there and exposed the lack of resources and government planning”.

To help the people of the Amazon, the duo held fundraisers in collaboration with local non-governmental organisations to buy food and medical supplies.

Championing sustainability

Thankfully, the market has started to stabilise and operations are almost back to normal. For açaí lovers, this means more varieties of açaí in the market.

At Selva Foods, other than açaí bowls and sorbets, there are also sustainably made “Selva Pops” which are made with ugly fruits — fruits that would have otherwise been discarded because of their blemished skin or simply due to an oversupply.

“[W]e mix açaí with ugly fruits, dip them in dark chocolate and cacao nibs or fruit peel, and pack them in biodegradable wraps made out of corn. Even the stickers we use are biodegradable”, Cinthya shares.

Over the years, Selva Foods has become a successful business fully set up around açaí, which Cinthya deems as a very affirming and endearing feat, considering how such a local Brazilian Amazonian food that she holds close to her heart is now spread in Singapore, especially when açaí wasn’t even part of the market five to seven years ago.

“Selva is our first venture and it’s been a crazy ride to create a business and a life together,” Cinthya notes.

Besides continuing bringing açaí from the Amazon to Singapore and supplying to dedicated açaí cafes here, Cinthya highlights that they plan to keep sharing the finest açaí with others, with hopes of bringing fulfilment to people by giving them healthier food choices that nourish both their bodies, and mother Earth.

“The goal is to bring açaí to the rest of Southeast Asia,” she concludes.

Featured image credit: Selva Foods

Also read: Revolut launches crypto trading in S’pore, exec shares more on its local crypto strategy

Casino gaming to farming: This S’porean grows greens for a living, supplies to over 50 stores

Artisan Green is recognised as one of Singapore’s leading indoor hydroponics farms, which is also the top supplier of locally-grown baby spinach.

Combining Artificial Intelligence (AI), automation, and machine learning, the only manpower it utilises comprises farming experts and horticulturists.

However, the founder of Artisan Green’s background is a far cry from agritech. Right after graduating from The University of Melbourne in 2009 with a degree majoring in economics and finance, Ray Poh jumped into the casino gaming industry.

Based out of Macau from 2010 to 2016, Ray worked in both a casino gaming manufacturing company — Weike Gaming Technology — that produces slot machines, electronic gaming tables and systems, as well as in a casino operations company.

A modern-day farmer

Ray spent most of his years in Melbourne prior to working out of Macau. After spending almost 15 years overseas, he yearned for time spent with his family and friends in Singapore.

When he was back in Singapore, he decided to research industries outside of gaming, with a focus on green and sustainable industries.

He knew he wanted to pursue something that was forward-looking, and would allow him to contribute meaningfully to the economy. It pushed him to research more on farming; in particular hydroponics and vertical farming.

Growing up in Singapore, farming is one of the furthest occupations from everyone’s minds. The possibility of bringing modern technology into the agriculture sector was something that piqued my interest.

– Ray Poh, founder of Artisan Green

He was inspired by how Singapore secured the nation’s water supply with its four national taps, adn this pushed him to brainstorm ideas on how to contribute to the nation’s food security.

Ray continued his deep dive into agriculture as a whole, attended courses, and built prototypes to grow produce. Through his own experimentation, he saw how food was grown from seed-to-table, and it motivated him to switch industries.

From seed to table

Located in Kallang, the indoor hydroponics farm specialises in baby leaf and herb production using Controlled Environment Agriculture techniques.

Presently, its baby leaf produce range includes its flagship product baby spinach, red baby kale, and a salad mix called Kallang Raw. Meanwhile, its herb range includes basil, chives, coriander, dill, mint, parsley, rosemary, and thyme.

The entire process from seed-to-table takes about three weeks.

It begins with procuring and testing of seed cultivars and finding out which one yields the best taste and yield for the operation.

Following which, they sow the seeds in their growth trays and germinate them for up to a week depending on the crop type. The seedlings are then left to grow for almost three weeks before running them through the harvesting machine.

Finally, the team sorts out the produce and packs them in their retail packaging, ready to be delivered to their customers.

However, coming from a non-agricultural background, Ray encountered many who doubted his ability to execute the building and operations of a farm.

Some suppliers would not entertain our team due to our farm’s infancy. We had to source widely to find our supplies. We also faced scaling issues when we began as I only had experience in growing produce in a small prototype system. Thus, we had to work out operational kinks in the first year.

– Ray Poh, founder of Artisan Green

Additionally, most farming machines were intended for larger-scale farms and were either too large or expensive for a small-scale operation. As such, Ray and his team had to think out of the box and source for machines in alternate industries to find something suited for their farm.

Melding machine learning with traditional techniques

Since Artisan’s inception, Ray and his team have been collating data in order to make sound decisions for the farm.

At a colleague’s suggestion, Ray applied AI to improve on their decision-making process. However, even with sufficient data, the process wasn’t fast enough to handle real-time situations.

A host of parameters go into growing plants. These include climate conditions such as temperature, wind speed, humidity and volatile organic compounds (VOC), as well as nutrient profiles — there are varying amounts of individual compounds that make up a nutrient solution.

Due to the amount of parameters, he and his team were looking at a multivariate problem that isn’t single-handedly solvable. To address the issue, Ray is working on creating a digital twin of a plant with a stored database of parameters.

This allows us to build a virtual farm to simulate the plants’ reactions to the different climate environment and nutrient formula that we can input into the model.

Coupled with the in-house precision nutrient injector that we developed, we’re also able to control the nutrient profiles at a per growth bed level on demand. Hence, we can look at the life cycle of the plant at a higher level of precision and create models of plants within our virtual farm.

– Ray Poh, founder of Artisan Green

The overall process is highly sustainable, since precision dosing only disperses what crops need. It also reduces fertiliser waste by 50 per cent and water usage by 90 per cent.

Combining the use of vertical farming techniques with a digital farming operating system is an ideal integration of science, engineering, and commercial viability — this is something Ray thinks the agritech industry has yet to achieve.

To ensure the technology is well-maintained, Ray and his team also track all their equipment and plan ahead for any possibility of machine failure.

They conduct regular maintenance and also make sure that they have spare parts on hand. Automation of the processes also safeguards against minimal mistakes that can occur due to human error.

Success measured in partnerships

According to Ray, he has invested a six-figure sum into the farm so far. Majority of the funds have been invested into R&D, especially since it is the core pillar of the business.

Taking into account pure farm operational expenses without the R&D, Ray said that they managed to break even in early 2022. He adds that their revenue has grown more than tenfold since 2018, and that they are now supplying to over 50 stores, including Fairprice Finest, Little Farms and RedMart.

We’ve also been sought out to consult for other farms due to the difficulties behind growing baby spinach indoors. Having such large international farms seek us out validates our scientific approach to farming, and reflects on our team’s expertise and hard work in this nascent industry.

– Ray Poh, founder of Artisan Green

To ensure that the business is profitable and sustainable, Ray said that it’s necessary for him to understand the ins and outs of running a farming operation, as well as how to grow their sales channels.

One of the biggest partnerships for Artisan has been NTUC Fairprice Finest. Ray and his team had approached them with samples for their committee to conduct a tasting session.

“Once we were onboard, we sold out weekly. Customers realised the difference in our fresh product as compared to imports,” he shares.

Onward to greener pastures

The growth of the business soon saw farm produce demand exceeding its supply. Currently, they’re in the midst of raising funds to build a new 5,400 metre-square farm by the end of 2022.

The new farm will be almost a 20-fold increase of Artisan’s current farm’s production capacity. Additionally, it will comprise full automation to increase productivity.

Ray and his team have also developed their own proprietary hardware to be integrated into their farming software operating system. This scalable and deployable technology will bring the farm further into the digital age.

Artisan also has plans to deploy its systems in greenhouses to be able to grow local vegetables for the mass market at an affordable price.

Our current focus is the regional market in Asia for the near term, as it is closer to home and easier for us to assess the viability of the farm. However, this does not preclude the option of expanding to other parts of the world.

We also intend to work on collaborations with other international partners in order to build more farms and also supply our technology to the world in future.

– Ray Poh, founder of Artisan Green

Despite his many business development plans, Ray acknowledges that local farms alone may not be able to produce for the entirety of consumption in Singapore.

“With many regulations governing the usage of land, finding a suitable site can be a challenge as one would have to navigate the rules set out by different government agencies. Therefore, being able to operate a large-scale farm can be a difficult and time-consuming undertaking even before construction occurs.”

However, he adds that it is still necessary for Singapore to be able to play a big part in contributing to a significant percentage of food supply. This is essential to mitigate any shortfall in supply from other countries.

Featured Image Credit: Artisan Green

Read More: Farm to table: This S’pore startup digitises agricultural supply chain to benefit F&B players

foodpanda M’sia is celebrating its 10-yr anniversary on Aug 12-14, here’s what fans can get

[This is a sponsored article with foodpanda.]

After 10 years of delivering meals to customers all around Malaysia, foodpanda will commemorate their decade-long service by hosting the panda paradise event at the Open Car Park, Sunway City Kuala Lumpur.

Open only to pandapro subscribers, the event starts from August 12 until August 14, 2022, during which you can take part in various lucky draws and contests to win exclusive prizes.

To keep everyone entertained, they will also be having exclusive performances from artists throughout the three-day event as well.

But before we get into how to join the event, let’s take a look back on what foodpanda’s milestones have been over the past decade.

Celebrating their 10-year service in Malaysia

First launched in Singapore by Lukas Nagel and Rico Wyder in 2012, foodpanda expanded their food delivery services to Malaysia later that year.

From 2012, they maintained a revenue growth between 60% to 70% year over year with the highest at 2017 at 100%.

In 2019, foodpanda upgraded their services to offer grocery deliveries by partnering up with major grocery chains such as Lotus’s, Watsons, and Guardian via shops on the foodpanda app. They launched pandamart the following year, too.

Around the same time, they also introduced their new subscription plan called pandapro. It provides subscribers with monthly vouchers, which include free deliveries and discounts on food and grocery deliveries.

Today, they’ve expanded their delivery coverage area to outside the Klang Valley, servicing Penang, Johor, East Malaysia, and more.

To support their growth, they’ve grown to have more than 300 employees, 30,000 riders, and over 25,000 participating merchants across Malaysia, they report.

Three days filled with contests and special appearances

From 5:30PM until 11:00PM on Friday, and 3:00PM to 11:00PM on Saturday, as well as Sunday, foodpanda will be hosting several activities like the pandamart sweep game, treasure hunt, and radio contest where you could stand a chance to win prizes.

But that’s not all, Pau-Pau, foodpanda’s mascot will also be making an appearance too throughout the event as well as special appearances by Joe Flizzow, Talitha Tan, DJ Kino, Aida Azrin, BATE and more.

There will be several merchants scattered around panda paradise too which including ZUS Coffee, Pin Tea, Emart24, Lim Fried Chicken, and more.

Keep in mind that the merchants there only accept payment via the foodpanda app using the “Pick Up” delivery method.

But, if you use the promo code “PANDA10” at check out, you can get 20% off your total purchase at the event.

In order to take part in these activities, you first need to first be a pandapro subscriber.

How do you become a pandapro subscriber?

In order to sign up for foodpanda’s subscription service, find the “Become a pandapro” tab after clicking into the top left menu of the app.

From there, you can make your choice of various plans.

Once you’re a pandapro subscriber, you’ll just need to show your subscription information as you enter panda paradise.

Beyond the three-day event, there are other benefits of being a pandapro subscriber too.

For example, you’ll be eligible for 12x free delivery vouchers with a minimum spend of RM25 per order, 20% discounts or more on delivery or self-pickup, and 20% off pandamart purchases over RM45.

If you prefer to dine in, you can get a 25% discount off your total bill when dining at any participating restaurants nationwide.

- Find out more about foodpanda here.

- Find out more about the panda paradise event here.

- Download and install the foodpanda app found on the Google Play Store or the Apple App Store.

Also Read: Here’s a quick guide on how to get a RM50 voucher by subscribing to foodpanda’s pandapro

Featured Image Credit: foodpanda

Charmed by the kopitiam staple ‘cham’, this 23 Y/O M’sian made a 3-in-1 version of it

There’s something to admire about student entrepreneurs. Juggling one’s studies while also worrying about how to build a business isn’t everyone’s cup of tea.

But this excited Aliff, a UKM student. While studying, he launched Charming Malaysia, a coffee and milk tea-based beverage.

The idea for the business was sparked by a conversation Aliff had with his two friends, who were drinking Cham Peng (a combination of iced coffee and tea) at the time.

Having never heard of this drink before, he tried it and found it to be unique and delicious.

“Hence, I decided to come up with a product that enables people to taste Cham anywhere at any time, instead of having to go to a kopitiam every time you want it,” shared Aliff.

His 3-in-1 product was born, with the brand name “Charming” representing the experience that one gets from the charm and beauty of the aroma of coffee and tea combined.

Charming his friends and family with Cham

Once the idea materialised, Aliff then decided to research Cham’s general taste and eventually came up with his own version of Cham. Then came the validation phase for his product, which he turned to family and friends for.

“The majority of the comments were positive ones, and that was when I realised that I should distribute this drink to others,” said Aliff.

Given that Charming is relatively new in the market, Aliff believes that patience is essential in creating demand.

Currently, Charming’s official website prices its 12 sachets of Cham at RM20.99. While some may argue that this may be above the average price of 3-in-1 drinks, Aliff has his reasons.

“After conducting a market survey, we found that our prices are still comparable to that of other brands that sell Cham,” justified Aliff.

Adding on, the founder stated that Charming includes two varieties of coffee beans, Robusta and Arabica and three varieties of tea, black, red, and green tea. With such a blend, consumers get more complexity and depth in flavour.

In further justifying his pricing for the product, Aliff mentioned that he had taken the production costs into consideration when determining the prices.

Focusing on marketing now

In terms of production, Charming collaborates with a factory owner to manufacture their 3-in-1 Cham sachets.

This enables the team to place their focus on spreading and promoting the brand as best as they can. For instance, for their one-month anniversary of operations, the team conducted a giveaway.

Participating in this giveaway were 214 participants and as a result, the beverage brand gained more than 200 new followers.

Aliff claimed that this marketing strategy proved that their methods were viable and effective. He also has plans on using other advertising methods such as influencer marketing, sponsoring sports events, and conducting free sample events.

“With the factory handling the production of Charming entirely, the challenging aspect would be finances, in my opinion,” shared Aliff.

Along the way, the brand faced some difficulties in finding investments. However, Aliff was quite positive that he would overcome this, stating that this was a common challenge for every entrepreneur.

Looking at the big picture

According to Aliff, there are only a few beverage brands that have introduced Cham into the Malaysian market, but they are hardly found in grocery stores.

“Therefore, Charming plans to drive the Malaysian market into embracing the Cham flavour as there are still so many who are unfamiliar with the taste,” said Aliff.

Moving forward, Charming has plans to introduce a new product, Kopi-O, which will give consumers a “kampung” taste.

Together with this, Charming will also be releasing a series of coffee flavours including cappuccino, mocha, and latte.

In further explaining his future plans, Aliff mentions that he has a five-year plan that will guide him into expanding Charming.

Within three years, he first intends for Charming to make its way into well-known grocery stores such as AEON Big and Lotus.

If that comes to fruition, then he’d like Charming to be stocked in as many Malaysian grocery stores as possible in the following years.

Also Read: Axdif: An HR management platform that solves communication, planning, & productivity issues

Featured Image Credit: Charming