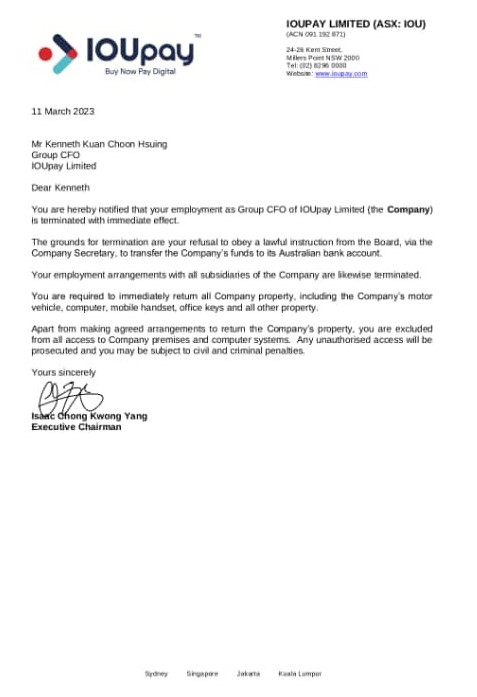

Stop hogging cafes: Here’s a price list of the co-working spaces in S’pore, starting from $5/hr

Last November, 23-year-old content creator Yoga, attended the Singapore Fintech Festival. She was searching for a quiet space to finish her reporting and estimated she would need about two hours.

Not realising there was a media centre, Yoga headed to a café near the event venue. It is a natural and convenient move for many of us when we think of getting some work done in the public. Yet Yoga found that the cafes were already packed with patrons and the only available seat did not allow her to charge her laptop.

Just when she was wondering what would be the next best fit, Yoga stumbled upon a working pod, which is a rather fancy term for an office work booth.

It’s a cordoned off space, now commonly found in a shopping mall, set up with WiFi access, charging points, and all that’s needed for a semblance of privacy and peace.

Yoga hopped on it without thinking twice.

However, to her dismay, the overall upkeep of the working pod she found herself in, was subpar. Not only was the ventilation bad, but she also found crumpled pieces of papers on the floor and hair on the table. Yoga felt like she was in a stuffy sauna upon entering and 40 minutes into her work, she was perspiring heavily and feeling claustrophobic.

While the working pod’s soundproof feature was great for better concentration, passersby could still peek through the semi-transparent door which made her uncomfortable at times. If all these weren’t bad enough, Yoga was truly surprised by what she needed to pay — she was charged about S$15 for a 1.5-hour use.

A growing demand

Co-working spaces first appeared in Singapore in 2011, as a contemporary solution for early-day tech businesses that were conscious about paying monthly office rental.

It soon sprouted up into a trend. Many buy into the idea that traditional workspaces were meant for dinosaurs, which don’t facilitate networking, collaboration, and flexibility.

Property consultancy CBRE said in a report published last November that the demand for flexible workspaces in Singapore has rebounded from an average of 50 to 60 per cent during the pandemic, to an average of 80 to 90 per cent in the third quarter of 2022.

The recovery was mainly attributed to the reopening of borders and the return to office-based work arrangements.

By 2030, market experts predict that co-working space will increase from 10 to 15 per cent of total office supply across Southeast Asia, compared to the present five per cent. Despite the growing demand, escalating expenses due to inflation, property rents and cleaning and utility costs are driving co-working space operators to adopt a higher price tag.

To help you avoid any unpleasant surprises like Yoga’s, we have researched and compiled a list of co-working spaces in Singapore that suit different needs, budget and location.

How much do co-working spaces cost?

Understandably, co-working spaces in the heartlands are economical (i.e. a private pod starting at S$5/hour) compared to those in the centralised locations (i.e. a hot desk starting at S$8/hour).

Although centralised locations offer convenience, not everyone enjoys commuting to busy areas and paying for expensive lunches. Regardless, if you’re looking for something affordable yet comfortable, at least you know there are available options.

Most co-working spaces offer complimentary use of the meeting rooms, printing services, meals, and other miscellaneous services to those who have signed on a longer lease.

Some co-working spaces (such as Cosy Corner and Staytion, to name a few) are made available to students and other members of the public. Others like MOX is especially designed for ‘creative-preneurs’, while The Cocoon Space is popular among designers as it’s located within Singapore Fashion Council.

Cross Coop and One&Co are co-working spaces that offer services in Japanese, while Gather Cowork is pet-friendly. Additionally, The Workshop, The Hive, and other co-working spaces have on-site photography and broadcasting studios.

Converge Spot aims to facilitate connections between small businesses. Spaceship is a unique co-working space that also provides storage solutions in their warehouse, and Ucommune offers customisable event spaces that can be used for various community activities.

If you are brand-driven and/or a frequent traveller, JustCo and WeWork have membership plans that allow you to work from all locations around the world. Some of the co-working spaces are massive (like Distrii for example), while others are homely or convenient (like Staytion, which is housed inside the MRT station).

So, even if you don’t exactly know what you are looking for, the bare minimum you can do is to assess how susceptible you are to background noise (i.e., typing sounds, people moving themselves or the furniture around, non-stop talking etc.) and non-essential socialising (i.e., needing to stop work once every 10 minutes because people walking past say hi and ask what are you working on).

Despite the growing demand for co-working spaces in Singapore and researchers believing that those who work in one thrive better, it’s important to remember that not everyone may find them to be the ideal solution.

While co-working spaces may offer greater flexibility, networking opportunities, and a sense of community, they can also be more expensive than traditional office spaces. Ultimately, whether or not co-working spaces are the right fit for you or your business will depend on a variety of factors, including your budget, working style, and personal preferences.

Feature Image Credit: Hush Office/JustCo

Also Read: This S’pore startup turns MRT ‘stay-tions’ into co-working spaces so you can work on-the-go

People are willing to pay up to RM5,000 per class at this M’sian baking workshop, here’s why

Having a baker in your family tends to make for a sweet treat.

Not only will your house smell wonderful from all the baked goods, but you’ll also have delicious desserts at arm’s length.

But for Amelia, the perks of having a baker brother extended far beyond that.

He’s the reason she launched a company offering baking classes called Hands on Workshop, after all.

And it’s not just any baking workshop. The brand invites celebrity chefs from around the world, where the cost for one baking class could go up to RM5,000.

But how did it all begin?

They got to cracking (eggs)

Amelia’s brother, who graduated from pastry school, was running an online home-based business. Some time later, he invited a renowned baker from Clifford, Australia to host a baking class.

As someone with a keen eye for attractive pastries and a love for café hopping, Amelia took notice of the opportunity and converted it into a new passion project. This materialised as Hands on Workshop.

She started inviting renowned baking personalities to host advanced classes for bakers looking to upskill themselves.

The instructors came from all over the world, such as Taiwan, France, Korea, and the UK. The then-new company rented a small space in Petaling Jaya and refurbished it to be suitable for classes.

It wasn’t an easy journey, as Amelia didn’t have any entrepreneurial background before starting Hands on Workshop. But she took advantage of her experience in sales and marketing to grow the brand.

“The business was started from scratch and we worked our way up in the industry,” she described.

In the beginning, word about the workshops was spread through social media, especially Instagram. This has not changed since then, Amelia shared.

The team currently boasts four other full-time members, and will hopefully expand in due time.

Baking up a storm

Baking lessons are not uncommon in Malaysia, with brands like Bakebe and ABC Cooking Studio also offering them. But Amelia stated that Hands on Workshop was one of the few pioneering it online locally in 2016.

To date, she proudly shared that Hands on Workshop has hosted nearly 100 baking and decorating masterclasses.

Some of the brand’s more renowned instructors include names like Chef Jung Hayeon who is known for her fresh cream cakes, Chef Joakim Prat who has nine Michelin stars under his belt, and Christopher Thé who created the viral strawberry watermelon cake.

Although Hands on Workshop started out as a space for experienced bakers to improve their crafts, this all changed when the COVID-19 pandemic hit.

The movement restrictions in place made it difficult for people to join lessons and for international chefs to fly in.

So the brand began selling cakes to tide themselves over during the pandemic, and continues to create cakes today.

Once people were allowed to participate in group activities again, Hands on Workshop physically reopened its doors and welcomed a larger demographic than before.

Editor’s Update: Information in the above paragraphs have been edited to reflect greater accuracy.

Besides masterclasses, the brand also started offering beginner classes to novices and other individuals who were interested in the craft.

The diversification of lessons helped grow its customer base to include home bakers and everyday people looking to pick up a new skill.

So you could say that the pandemic actually allowed Amelia and her team to better strategise for the brand’s expansion.

A business on the rise

Some might remark that the starting price of RM400 for beginner classes is steep in comparison to another baking workshop like Bakebe (RM150). But the variation in costs could be due to the ingredients used, the instructor’s expertise, and the overall experience.

For context, Bakebe is a co-baking space where participants learn to bake with peers through digital instructions, which might also mean lower operation costs. Overall, the experience can be quite different compared to having an instructor physically present.

As for the masterclasses with international chefs, the founder shared that prices could go up to RM5,000, depending on the topic and the skills learnt in each baking workshop.

It doesn’t seem to deter passionate students, though. “Most bakers are always looking to upskill,” Amelia commented.

Most of the participants of the masterclasses happen to be established bakers in their own rights. So perhaps it’s a justified cost for people who are already in the industry, or those looking to seriously upskill themselves.

As such, it’s probably safe to say that Hands on Workshop has found their niche and will continue to grow.

Another target demographic they’re currently hoping to appeal to is children, through kid-friendly classes. With the rise of Montessori education starting from home, Amelia believes that the market potential seems to be there.

She also thinks that such workshops could help to cultivate children’s passion from a young age and shape their characters.

With all of its current offerings, the brand could become a way to propel more Malaysian confectionary artists onto the global stage, like the Pastry World Cup.

- Learn more about Hands on Workshop here.

- Read other articles we’ve written about Malaysian startups here.

Also Read: Navigate hybrid work’s pain points like productivity & security issues via this webinar

Featured Image Credit: Hands on Workshop

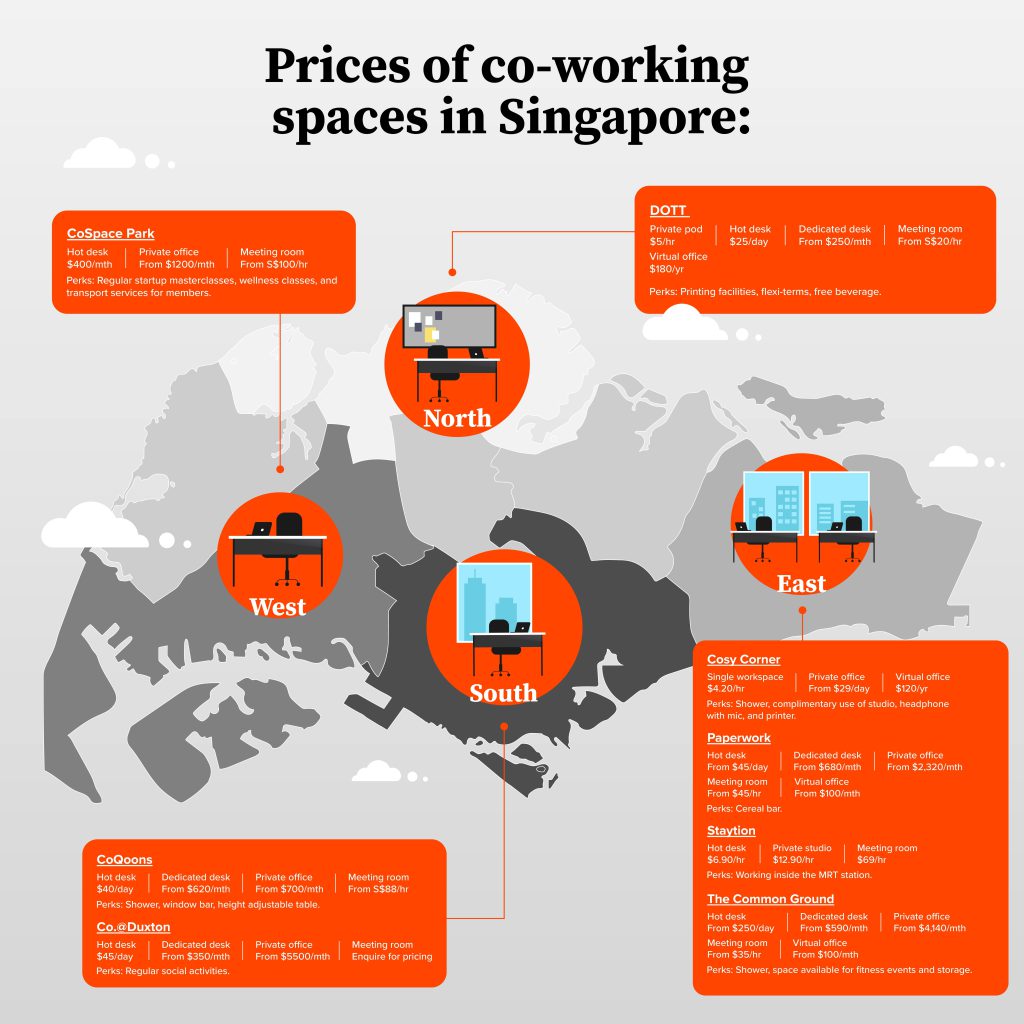

For my 21st birthday, I planned my eventual passing with this M’sian death preparation app

It’s a little surreal, planning out my death, especially just a few days after my 21st birthday.

(To be clear, when I say death preparation, I mean sorting out end-of-life stuff like wills and wishes, not actively participating in my demise.)

You might be thinking that I’m too young to be doing this, and I hope you’re right. I’m mostly healthy, but you never know what will happen next.

There will also be those superstitious few who think that this is “taboo” and pantang. I wouldn’t say I’m particularly sensitive when it comes to the topic of death. Sure, I don’t like ruminating over it for too long or I might get a bit weepy, but I won’t clam up when it comes to discussions surrounding it.

Still, there’s something a little bit daunting when it comes to imagining and preparing for a world without you in it. Not just for your own sake, but for your loved ones.

Just thinking about that—how my loved ones might and will outlive me—makes my heart twinge a little.

But death preparation isn’t meant to be a morbid topic; rather, its goal is to ensure that when you pass on, your loved ones can bury you the way you wished you would, your assets can be delegated as per your will, and more.

Done correctly, death preparation is meant to prevent family disharmony during a time of grieving. This is exactly what local deathtech startup Bereev wants to help with.

Let’s get prepping

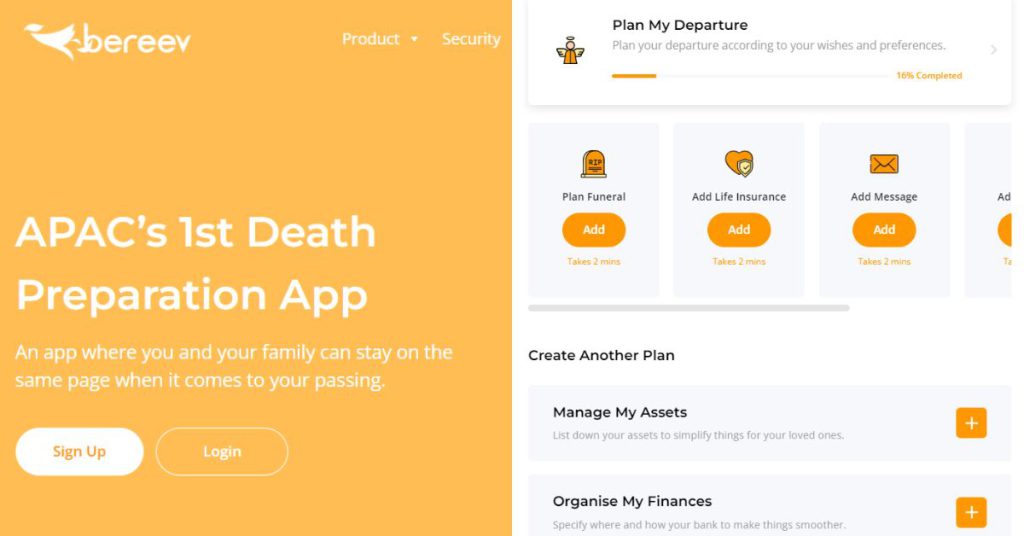

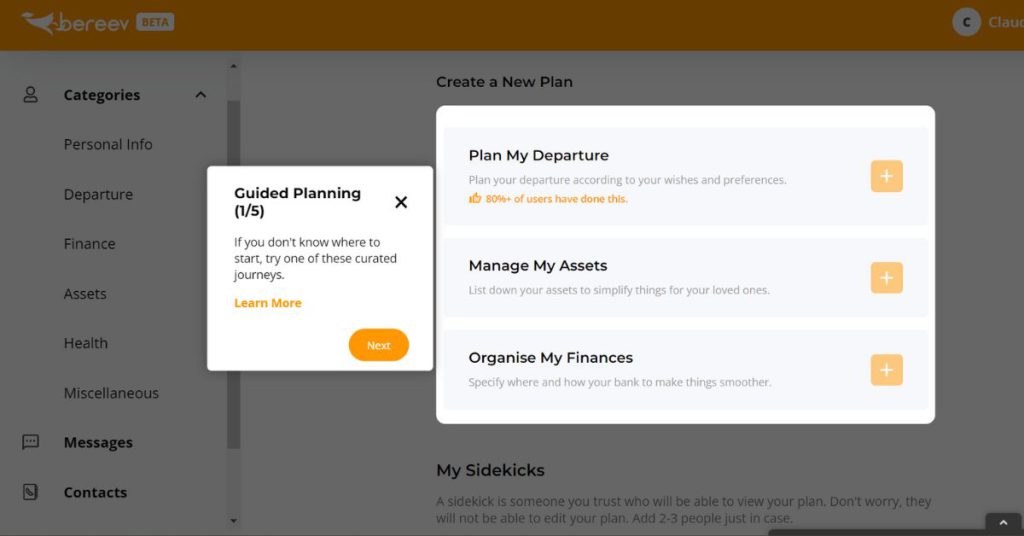

Bereev’s setup process is simple, unassuming. You go to the website and you choose a pricing plan—for the purposes of this review, Bereev’s founder, Izumi, graciously gave me access to a lifetime account, which would otherwise be RM699.

If you’re not ready or looking to commit to a full plan, Bereev also offers a lite option which is free. Here’s how it differs:

Like any other platform, it requires some basic information such as your name, phone number, birthday (the most recent year I can select is 2005, which means you have to be 18+ to use Bereev), and all that standard stuff.

You’re also prompted to select whether you’re Muslim or non-Muslim. On the non-Muslim mode, you have the option to add your will under the departure tab. This is hidden on the Muslim mode, where you’ll instead have the option to add your Wasiat and Hibah.

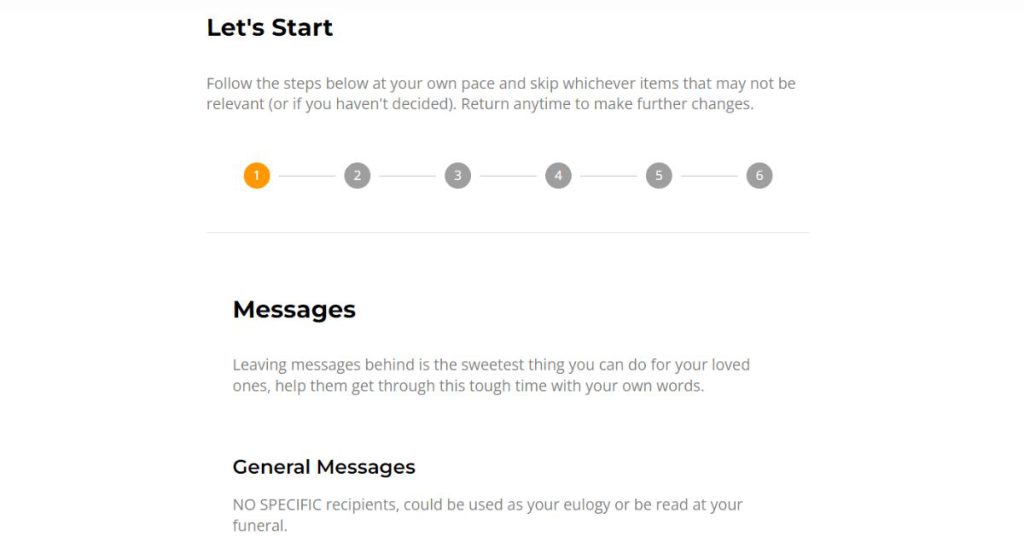

After verifying my email address, I was led straight into the app and given a few quick notes telling me where to start.

A nice thing about Bereev is that it seems to require you to log back in every single time, asking for your password as well as double authentication, so you can keep all your death-related secrets and plans uncompromised.

A lot harder than anticipated

As a writer, words usually come easy to me, so I didn’t really think it would be difficult to write some heartfelt messages to leave for my loved ones.

But staring at Bereev’s page prompting me to write some words that might be read during my funeral, I found myself facing a bit of a writer’s block.

What can I say, I wondered, to comfort the people I love when I’m no longer there?

Can I really tell them I’ve lived a full life, at the ripe age of 21? Am I really ready to tell them not to worry and to chin up and to move on? Not to sound narcissistic, but can anything I say be enough to soothe the loss?

However, I guess the point isn’t so much to say what they need to hear but what I’ve never been able to say. If not now, then when, right?

Having to come up with a memorial photo is a little scary. And what to put on my tombstone, too. I think the main challenge with all this is just how final it feels, even though I can technically come back and change it.

But I suppose what’s worse is to make my loved ones make all these decisions for me. This comes back to the whole point of Bereev, which is to make our passing a little bit easier on our family and friends.

The bureaucracy of dying

Aside from helping you and your loved ones work through various emotions, a big part of Bereev is to sort out the actual technicalities of dying.

People who have experienced loss will know there’s actually quite a web of complex paperwork to go through when one passes. It was exactly this issue that inspired Izumi to start Bereev.

As mentioned, Bereev allows you add your will. But beyond that, it also lets you add a wealth (pun intended) of finance-related questions.

Between RM70 billion and RM90 billion in assets in Malaysia have been frozen as of 2020, Utusan Malaysia had reported. Their owners reportedly died without making wills or any proper inheritance plans, and family members of the deceased do not have sufficient information to do something about it.

With this in mind, Bereev will ask users to input how many bank accounts they have and who it’s with. It’ll also ask whether you have credit cards, loans or mortgages, and any other financial products such as life insurance, investments, retirement plans, or businesses.

Under the Assets tab, you can enter any properties, vehicles, devices, and digital assets you might own.

I don’t own any properties yet, so this part was mostly left blank.

Clicking into the Health portion, I came across something I never even thought about. Here, you can add your medical records, which to me seemed a little unimportant if I’ve already passed.

However, by providing access to your medical information, you’re allowing your descendants to have a better understanding of their health.

In the Miscellaneous tab, there is an additional portion where you can provide information on any pets you have, ensuring that they can be cared for when you move on.

Guiding your next of kin through a tough time

Once everything is done, it’s time for one of the hardest parts of this journey—sending your preparations to someone.

Bereev calls these people your “Sidekicks”, and it means someone you trust who’ll be able to view your plan.

I think this part is really tricky. Sending it to a very close loved one might just make them sad or worried, but it wouldn’t make sense to share it with some distant acquaintance.

It’s also a little sad when I think, what if the person I send this to passes first? In the Plus version, you can share your profile with an unlimited number of people, though, so there’s comfort in that.

All in all, I believe Bereev has done a good job of compiling and organising everything that might be handy after you pass. But is the app itself necessary? Wouldn’t it be sufficient to just write down all your thoughts and bank account details somewhere in a document?

That might be true, but I think Bereev’s interface helps to make the whole process less daunting and more approachable for both yourself as well as your loved ones, with less chance of any scattered documents getting lost over time.

With that said, the full version of Bereev can seem pricey to start with, but the Lite version gives users a good way to dip their toes into death preparation before they fully commit.

Especially for younger folks, it’s easy to look at this whole thing as very unnecessary. But it’s even more ridiculous to pretend that death isn’t literally a possible outcome every single day we live (knock on wood).

Using this death preparation app, I’ve been able to do a lot of introspection. While there were a few moments of sadness and grief for something that hasn’t even happened yet, I now feel a little more at ease and comforted by the topic of death and my dying.

More than just making sure your loved ones will be on the same page as you, Bereev is a way for you to reflect upon the kind of life you want to lead and the things you want to leave behind.

As I turn 21 and start a new chapter in my life, this has been the most valuable part out of this experience.

Also Read: 6 ways to manage and protect your precious banking access from online hacks or scams

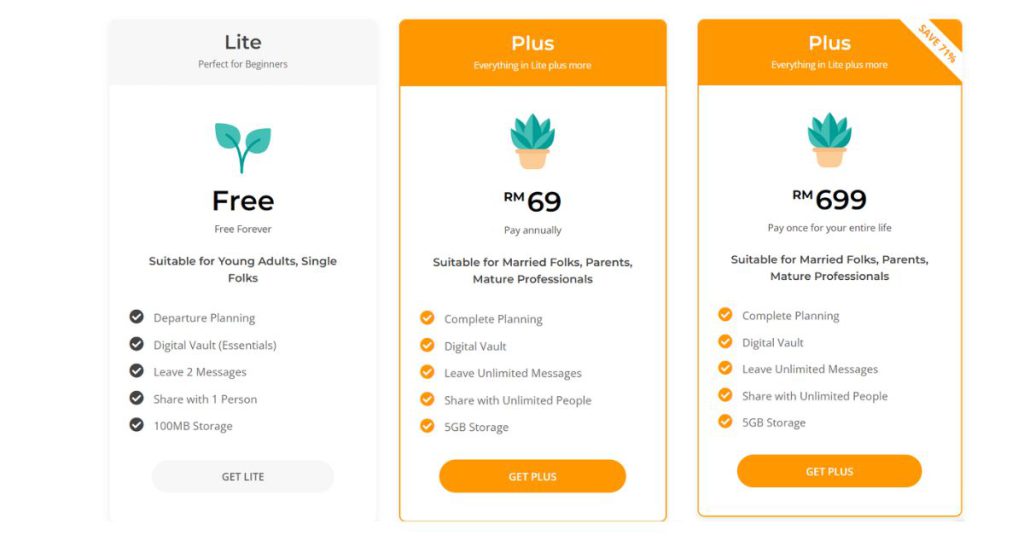

myIOU allegedly fires management team amidst ex-CFO’s suspected fraud investigation

Malaysian BNPL company IOU Pay (Asia) Sdn Bhd (IOUpay) has allegedly terminated its entire management team and dismissed 60% of its staff by offering voluntary resignation, an ex-staff of IOUpay told Vulcan Post.

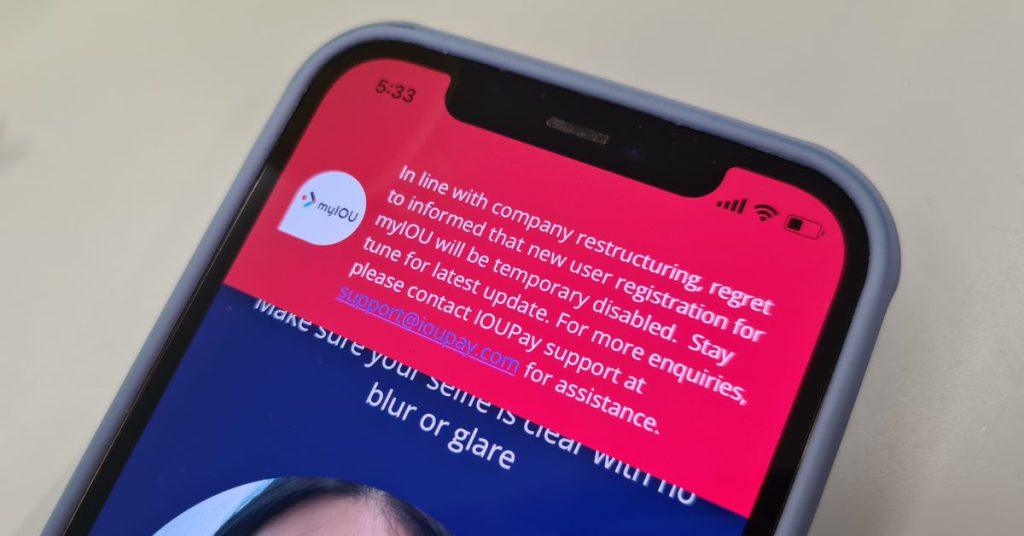

Meanwhile, IOU Pay’s BNPL app, myIOU, has seemingly been down for a week or so for users.

On Facebook, the myIOU team has been replying with the following message to commenters who claim they are unable create accounts:

“In line with company restructuring, regret to inform that new user registration for myIOU will be disabled. For more enquiries, please contact our team at support@ioupay.com.”

On March 21, Vulcan Post also tried to set up an account with myIOU but was unable to get past the identity verification process.

Allegedly not paying merchants

According to the ex-staff member, since last week, there have allegedly been no transactions made within the app.

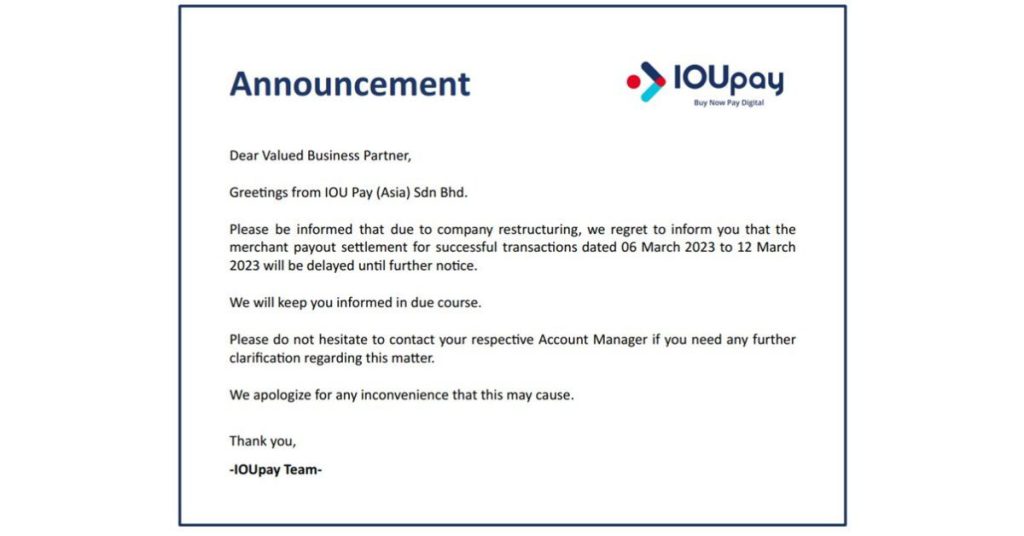

The merchants of myIOU have only been informed by one notice from the BNPL app. No other explanation has been given. The notice given is the following picture:

A representative from a popular merchant on myIOU had verified this claim with Vulcan Post, but updated us on March 22 that payments have finally been made.

However, Vulcan Post has not been able to confirm whether smaller, less popular merchants have faced the same payment issues and whether these issues have been completely resolved.

The ex-staff member also claimed that the BNPL company is not paying merchants on its platform despite still charging consumers who have committed to a purchase.

The ex-staff member believes myIOU consumers are not being informed of the current issues—there has been no newsletter, social media postings, or app notifications.

As such, they hope consumers and merchants will be aware of the situation at hand and proceed cautiously with using not just the myIOU app but any BNPL schemes.

Allegations of fraud, breach of duties

The issues seem to have started March 16 when IOUpay Ltd, IOUpay’s listed company, halted its trading.

Not much has been written on the subject, but Australian publication The Australian reported that IOUpay Ltd had requested for the trading suspension from the ASX on March 16.

This was after allegedly finding its former group chief financial officer, Kenneth Kuan Choong Hsuing, involved in a significant fraud. He was subsequently dismissed from his duties.

According to The Australian, IOUpay Ltd’s company secretary, Ben Reichel, wrote in a letter that IOUpay needed the halt to deal with “serious financial irregularities” it had found in its Malaysian business.

“The suspension is necessary in order for the company to manage its continuous disclosure obligations to provide an update in relation to the fraud investigation and discussions with its financiers,” Reichel was quoted as writing.

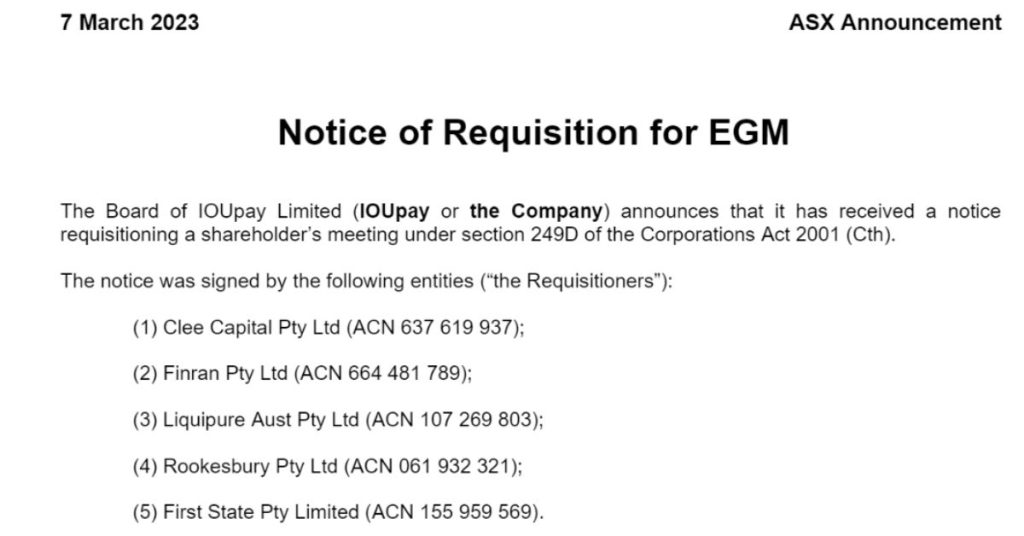

Prior to Kuan’s termination, the Board of IOUpay Ltd had received a shareholder notice to hold an extraordinary general meeting (EGM) with a request to remove the current Board of Directors.

The ex-staff member told Vulcan Post that at the same time, IOUpay received several documents that alleged the Group Managing Director Aaron Lee Chin Wee’s breach of duties.

The ex-staff member claimed the CFO, Kuan, had then reported this immediately by emailing the Board in order to suspend Aaron Lee for an investigation.

However, the Board has not suspended Aaron’s role. Rather, it proceeded to terminate Kuan.

The ex-staff member also shared a document addressed to Kuan from Isaac Chong Kwong Yang, the executive chairman, dated March 11, 2023.

The letter announced that the CFO’s employment was terminated with immediate effect on the grounds of “refusal to obey a lawful instruction from the board, via the Company Secretary, to transfer the Company’s funds to its Australian bank account”.

An earlier announcement of this dismissal is publicly available on listcorp.com. Here, it says Kuan was dismissed following a preliminary review by the executive chairman of cost levels and financial performance in the Company’s Malaysian business.

The document also stated that the executive chairman, Chong, will assume the role of CFO on an interim basis.

According to another document on listcorp.com, Chong was only appointed as the executive chairman on March 9, 2023.

Legal actions ensue

On March 22, IOUpay Ltd released a market update stating Kuan is being investigated by Malaysian police authorities. Recovery efforts are also said to be underway in relation to the misappropriation of company funds.

Later the same day, the company also announced it has been served with legal proceedings in the Federal Court of Australia by Clee Capital Pty Ltd.

Clee Capital is a shareholder of IOUpay and is representing the group of shareholders seeking to remove the Board and install its own nominated directors.

The legal claim includes a witness statement by the former CFO, Kuan, who is assisting Clee Capital in this legal action.

The orders sought by Clee Capital, if granted, will prohibit IOUpay Ltd from being able to obtain loans or any capital injections.

The announcement from the BNPL company ended by stating that IOUpay Ltd will be resisting the legal application.

As this story is still progressing, Vulcan Post will be updating the article with any further updates.

- Read other articles we’ve written about Malaysian startups here.

Also Read: 6 ways to manage and protect your precious banking access from online hacks or scams

68% of S’pore firms “very likely” to cut jobs if recession hits – but one profession is safe

Disclaimer: Opinions expressed below belong solely to the author.

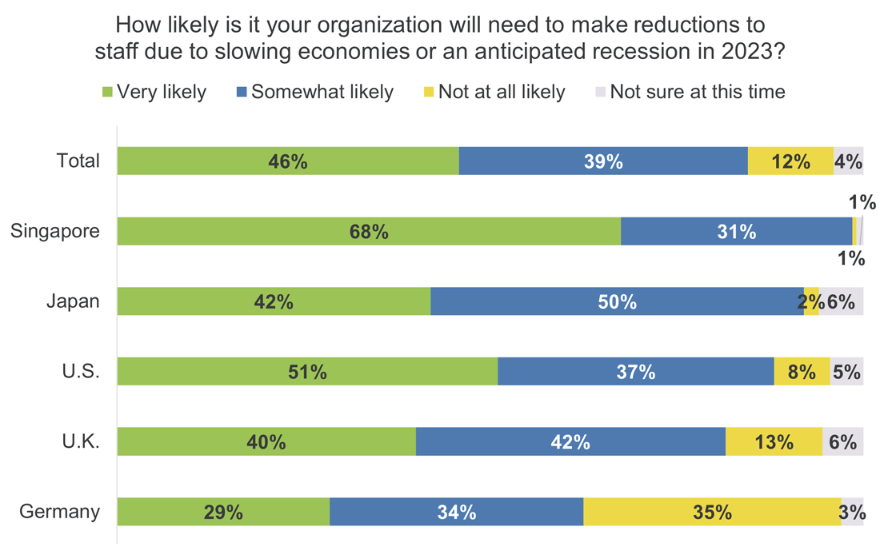

According to a recent survey by (ISC)2, conducted among C-level executives in Singapore, Japan, US, UK and Germany, 85 per cent of them expect layoffs in case of economic slowdown or outright recession this year.

Out of 99 per cent in the city-state, 68 per cent are saying it’s “very likely”.

However, before we delve deeper into what it means, we have to bear in mind a few caveats of the study.

First of all, obviously this doesn’t represent absolutely all employers in Singapore (or elsewhere), but rather companies large enough to employ proper C-level suite of executives.

Secondly, due to the cybersecurity focus of (ISC)2, it focuses on companies with sizeable IT departments and some security staff on board.

Finally, the sample of 1,000 people across five countries (200 each), means the results may not be very precise — though that’s less of a concern in a small country like Singapore.

Still, while I would not bet money on these figures being relevant across the entire economy, it does not mean they are not useful in gauging sentiments of employers, particularly decision-makers in larger businesses.

Under attack

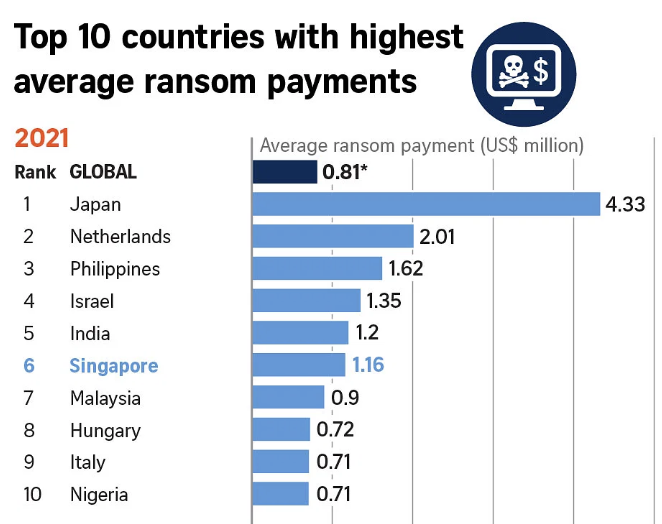

According to a different survey, published last year by Cybereason, 80 per cent of polled companies in Singapore reported being a victim of a ransomware attack in the past two years, with an average ransom paid of S$1.5 million.

“…among the Singapore participants, 85 per cent reported being hit again with a second ransomware attack — despite having paid the ransom. Of that number, 88 per cent said the second attack came in less than a month; 62 per cent said that the threat actors demanded a higher ransom amount.“

It is not surprising then to see the following responses among CXOs today:

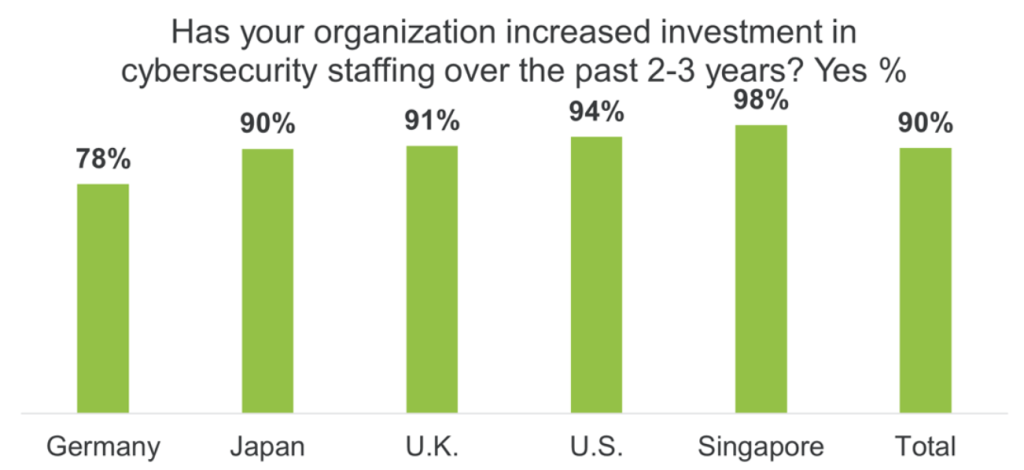

98 per cent of Singaporean executives reported investing more in cybersecurity in the past two to three years — virtually all of them (and sentiments are largely similar in other countries).

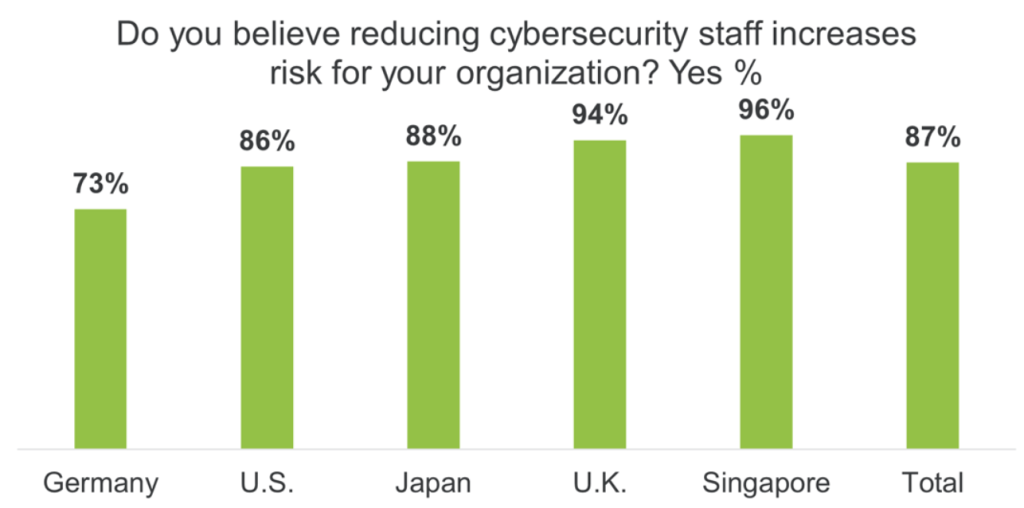

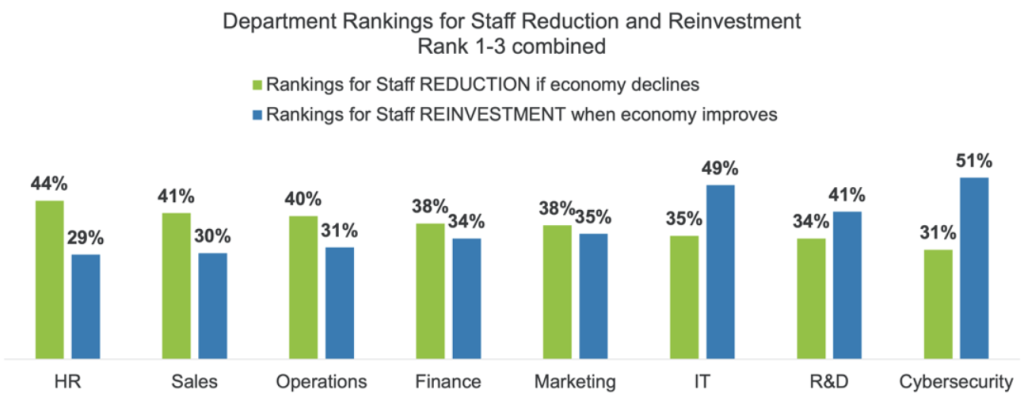

As a result, among all respondents, cybersecurity, followed by IT, professionals are the least likely to be laid off in case of an economic crisis, while non-technical departments are the first to go.

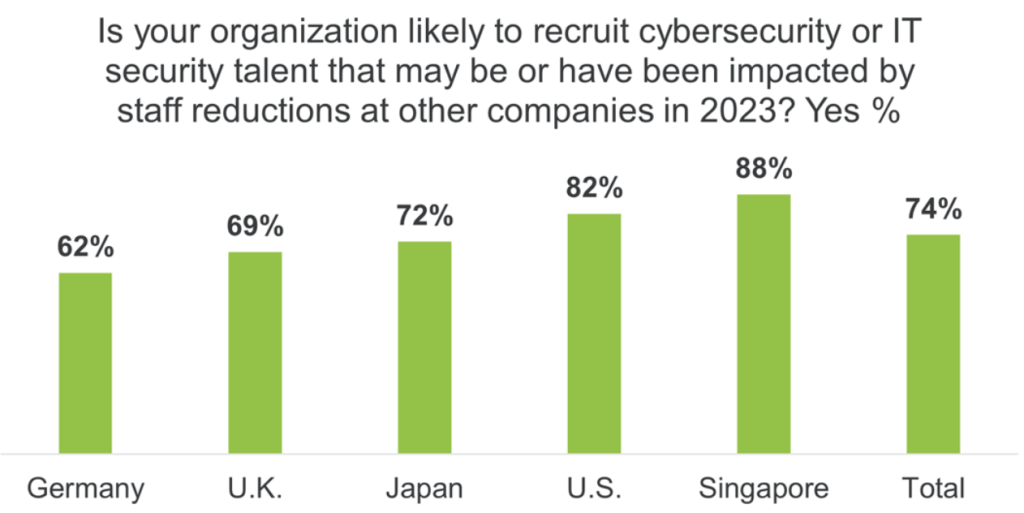

Moreover, not only are cybersecurity professionals the least likely to lose their jobs, but they are also the most likely to land a new one even if the worst happens, as a whopping 88 per cent of Singaporean executives would be eager to employ them amid talent shortage:

Lesson for all professions

If you’re not an IT security professional, you might think these findings do not apply to you and that you just have to brace yourself for the storm that a recession would certainly unleash. But there’s a good takeaway for everyone here.

Fundamentally, every job is a service performed in exchange for money. And that service has some value for the business, justifying the investment in staff and resources.

The reason cybersecurity staff are in a more secure position is that it is simply much easier to show this value.

Given that businesses risk millions of dollars in ransoms and losses due to disruptions of their operations, investing in a qualified security team is a no-brainer. Their value is very clear because of what’s at stake. You could hire a dozen professionals, paid S$100,000 per year, and that still would be less than a single ransomware hack.

But it does not mean other jobs do not contribute to the company, of course. It may just be harder to show it — but not impossible.

The more data you collect about your job, about your performance and, especially, about the monetary input (if possible) that your actions have had for the business, the more secure your position in the business will be — particularly when employers are forced to optimise their spending amid an economic downturn.

So, if you’re concerned about your future, the best thing to prepare for the worst is to start collecting this information, facts, milestones, figures, and ensure it makes its way to people who may decide your future.

Someone will have to go, but it doesn’t have to be you.

Featured Image Credit: Depositphotos

Also Read: Why cybersecurity is one of Singapore’s most in-demand jobs in 2023