[This is a paid article with HSBC.]

Despite Malaysia being one of the top 5 countries in terms of cost competitiveness for manufacturing, Malaysia was hit hard by the COVID pandemic. Supply chains were disrupted because of the lockdowns implemented all over the world in various ways.

Some manufacturers even had to shut their doors for good because they couldn’t get their hands on the supplies they needed. However, for the more seasoned veterans, this is not the first crisis they’ve encountered.

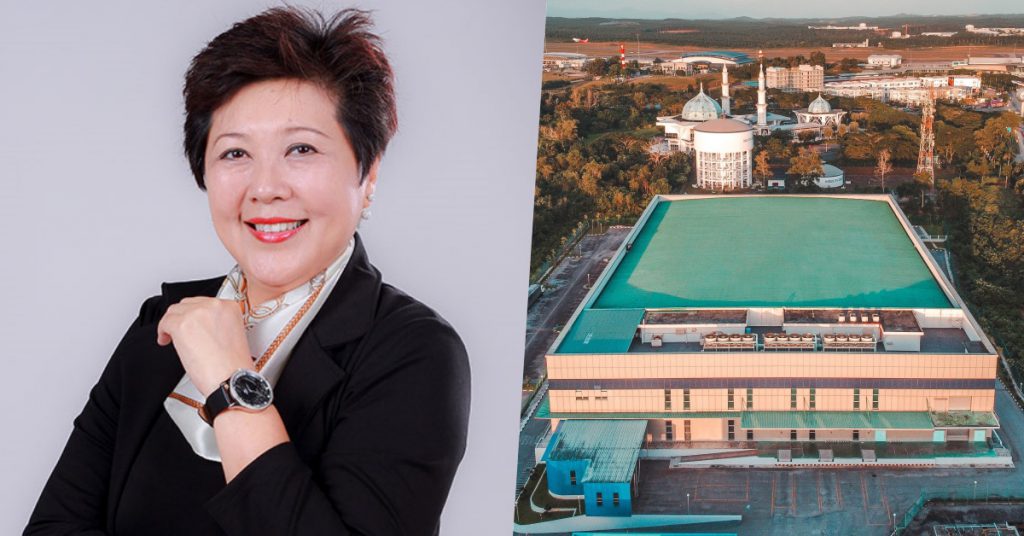

Cape EMS, a local provider of electronic manufacturing and precision machining services based in Johor Bahru struggled to stay afloat during its early years.

The Story Behind Cape EMS

Christina Tee, the founder and CEO of Cape EMS shared her company’s journey in an interview with HSBC.

With more than 30 years of experience, Christina is already a veteran in this industry with her last role as a Group CEO in a group of plastic manufacturing companies.

In the early years of running the business, there were times that Christina had to keep the company going by investing all of her personal savings into the company as a lot of upfront costs was needed to kick-start the operations.

Finding clients proved to be an issue too because Cape EMS operates in a sector that is extremely competitive and being a new and unknown entrant makes it more difficult.

Along the way, she recognised that there was a space that Cape EMS could fill. She observed that clients in the Wireless and Technology modules in the manufacturing sector constantly had issues that other providers couldn’t or wouldn’t solve internally.

Determined To Prove Their Capabilities

With the gusto to prove that they were the real deal, Cape EMS decided to form a complete manufacturing ecosystem to help their clients as quickly as they could.

The company worked diligently to solve the clients’ problems, even if it’s out of their usual job scope. They helped their clients with getting certification and even debugging R&D products.

Instead of looking at these tasks as a hassle, the company took it as an opportunity to learn and grow.

Because of this genuine interest in solving problems for customers, Cape EMS managed to build a good rapport with their clients, some of which had been with them since the very beginning.

Getting Help With Managing Finances

As orders started coming in and more industry players began to take notice of their quality of work, Cape EMS realised that they needed help with financial restructuring. This is when they approached HSBC to look for a solution.

Because of a general industry practice, Cape EMS usually don’t get paid by their clients upfront. They even have to wait for roughly 2 to 3 months after shipment before getting paid.

And this meant that they had to fork out their own money to pay their suppliers for raw materials and any spare parts.

But with the HSBC Receivables Financing, one of HSBC Business Banking solutions, Cape EMS could get access to cash as soon as they invoice their customers.

This meant that they no longer have to wait long for payments to arrive.

With immediate cash in hand, Cape EMS was able to sustain large amounts of orders without having to strain their day-to-day business cash flow.

Growing Past Their Original Targets

In 2017, Christina decided that it was time for Cape EMS to pursue bigger goals. So, they sold their most profitable line of business (the product line of modem and wireless products) to generate cash for further expansion.

With that sale, Cape EMS was able to divide the business into four areas:

- Wireless Infrastructure

- Smart Home Appliances

- E-cigarette / E-vape

- Smart Industrial Products

Despite diversifying and spreading out their resources at that time, Cape EMS still had a leg up over the competition. Their original motto of servicing clients remained unchanged.

Most of their clients come to them with designs in mind, but they do not know the ins-and-outs of manufacturing. So, this is where Cape EMS comes in to provide advice on how the designs can be improved for manufacturing.

Their clientele now extends to e-cigarette, robotic vacuum cleaners, and sensor manufacturers too.

When the company went through restructuring, HSBC came in to provide Cape EMS with the additional financing needed for their expansion into new business lines and new markets.

Aside from financing, credibility plays a huge role too when doing business, especially when it comes to the global arena. For a relatively young company such as Cape EMS, they leverage the brand strength of HSBC when they enter the global business scene and it has been extremely valuable to them.

“Our customers are worldwide and HSBC has a strong global footprint so it really helps when doing business with global customers. It gives us a lot of credibility and we are proud to tell our customers that HSBC is our main banker” said Christina.

Getting The Right Help That They Needed

Coming into 2020, there were interruptions to Cape EMS’ operations due to COVID-19. The situation was also worsened by the suppliers too. Most suppliers accepted cash only without extended loan terms.

To cope with that, Cape EMS approached HSBC and was provided with the Prihatin SJPP financing scheme within a month’s time. This gave Cape EMS a breakthrough in a rather challenging situation.

The restructuring back in 2017 proves to be fruitful and HSBC stepped in to help at the right time. The growing demand from the work-from-home trend such as wireless products and home appliances is driving new growth for Cape EMS today.

As for future plans, they are working on distributing new products such as Data Gathering System utility meters in new markets, and even coming out with their own line of products.

With such plans in place, Christina aims to grow Cape EMS into a company that’s 5 times bigger than what they are today.

“Through a dedicated Relationship Manager, HSBC offers more than financing by offering advice on how to navigate the industry that Cape EMS operates in. This proves to be valuable as Cape EMS was able to leverage the expertise that we have. By bringing to customers our wealth of experience, we can help our customers unlock growth and connect them to opportunities through our global network. The collaboration with Cape EMS exemplifies the benefits of our business banking solutions and how we can support the growth ambitions of our customers.”

Ranil Perrera, Country Head of Business Banking, HSBC Malaysia

- To find out more about HSBC Business Banking solutions, click here.

- Read up on what we’ve written about HSBC in the past here.

Featured Image Credit: MICCI / Cape EMS