In this year’s Budget 2021 speech, Mr Heng Swee Keat first announced that he will be extending the Goods and Services Tax (GST) to imported low-value goods.

Under proposed changes to the Goods and Services Tax Act made through the Goods and Service Tax (Amendment Bill), the Ministry of Finance (MOF) announced today (October 4) that GST is set to be imposed for all imported goods from 2023.

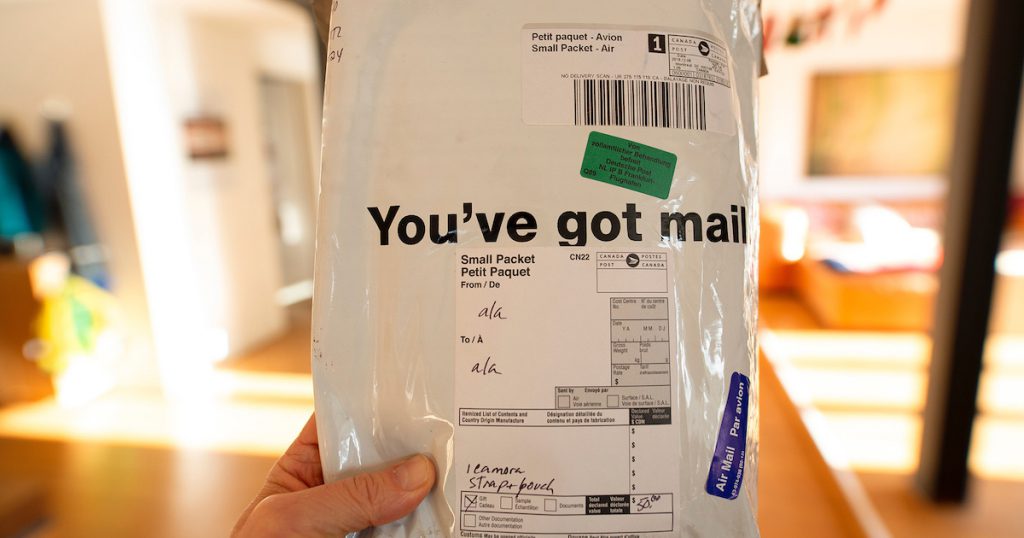

GST could be introduced from 1 January 2023 on low-value goods imported via air or post, and business-to-consumer (B2C) imported non-digital services such as live interaction with overseas providers of educational learning and telemedicine.

Currently, these imported goods and services are not subject to GST. Instead, GST is only paid for goods that are bought in Singapore.

Mr Heng previously said that several jurisdictions, including Australia, New Zealand and the European Union, have implemented or announced plans to implement the equivalent of GST on such goods.

The extension of GST to such imported low-value goods and business-to-consumer imported non-digital services complements the existing GST measures on business-to-business imported services and business-to-consumer imported digital services that took effect from January 1 last year.

Together, they ensure a level playing field for our local businesses to be competitive. Overseas suppliers of goods and services will be subject to the same GST treatment as local suppliers. This change also keeps our GST system resilient in a growing digital economy.

– Ministry of Finance

VP Label puts together all the best local products for you to discover in one place. Join us in supporting homegrown Singaporean brands:

Featured Image Credit: Dollars and Sense