We are seeing more activities from Grab’s financial arm as it inches closer and closer to start its digibank operations in 2022.

Over the course of the year, Grab Financial has been signing up with more payment gateways — like AsiaPay, FOMO Pay, and Revenue Group — to boost the acceptance and adoption of its GrabPay wallet among merchants regionally.

In October, it expanded its merchant services, including offering more “buy now pay later” (BNPL) options. The financial services segment of Grab is also slowly and surely entering the crypto space.

Purchase digital assets on Coinhako via GrabPay

In September, local crypto exchange Coinhako announced a partnership with GrabPay, allowing users to purchase digital assets instantly on the platform via the payment service.

In the media statement, Coinhako said that GrabPay as a payment service “beats the deposit queue” and allows users to “buy crypto instantly”.

Payments are processed immediately and only requires users to enter a six-digit OTP sent directly to their mobile number to complete the transaction.

A flat service fee of 2.5 per cent for crypto deals using GrabPay is required, which covers both payment processing and trading fees. However, GrabReward points are not issued for such purchases.

Pay for crypto trades via TripleA and GrabPay

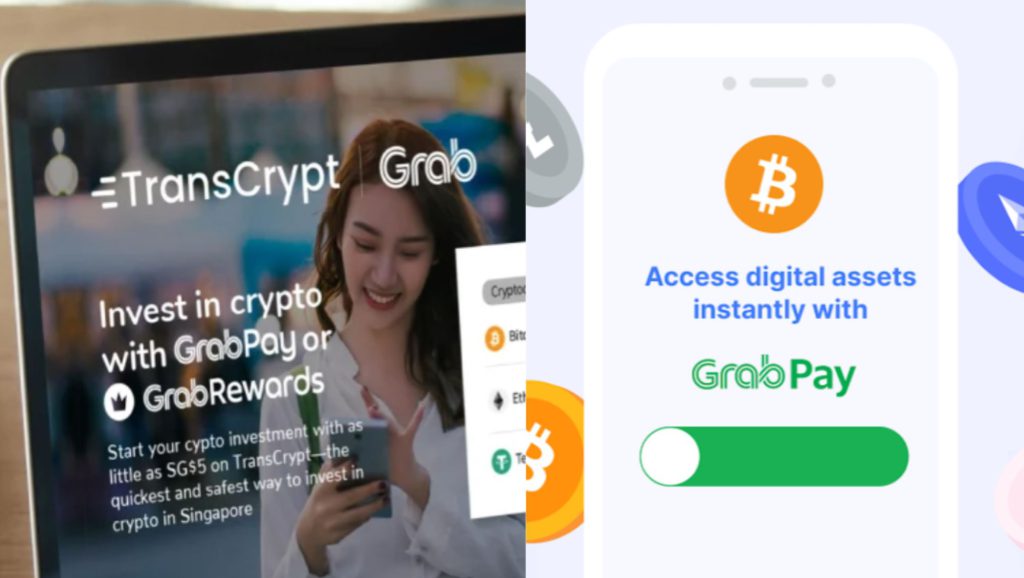

In another announcement made in October, Grab partnered with crypto payments provider TripleA to enable crypto investing for TransCrypt users.

The collaboration allows users to buy crypto via GrabPay through TransCrypt, a TripleA brand.

In the TripleA announcement, Grab Financial Group’s Head of GrabPay Wong Wenbin commented that Grab recognises the growing interest in cryptocurrencies, and its partnership demonstrates its “openness to thoughtful collaborations in this space”.

“Working with players like TripleA who are recognised by the regulator also affirms our commitment to widen our offerings for our users in a safe and measured way,” Wenbin added.

According to TripleA’s research, one out of 10 people in Singapore own crypto. That’s quite a lot of people if you exclude those who are underaged and seniors who may not be tech-inclined. TripleA estimates that over 550,000 people in the Republic own crypto.

Grab’s “early start” in crypto space follows its competitors

The move into the crypto space is understandable, as these digital assets have gained mainstream interest this year. Participants have flocked to the nascent market to place their bets on tokens that have the potential to grow or for purely speculative purposes.

Bitcoin also soared to an all-time-high this year, hitting nearly US$69,000 per token last month.

Singapore is noted to be one of the few countries that openly support cryptocurrencies and blockchain projects. Its crypto-friendlier regulations have been paving the way for the industry to grow and the fast pace of asset digitalisation is also a place of opportunity.

Therefore, it’s not a surprise that Grab also wants to get an “early start” in this space, since even a physical bank like DBS has been active and showing its support for the digital asset via trading and digital custody capabilities.

The latest traditional local bank to signal it’s support for crypto is OCBC, which said it’s looking at the crypto space seriously.

Gaming company Razer is also exploring a potential entry into the crypto space via its FinTech unit. The group’s CEO had said that there is a nascent opportunity for Razer in the cryptocurrency space, and has been hiring key personnel to research on prospects.

So what will Grab Financial focus on?

It is likely that the FinTech arm of Grab will proceed cautiously into the crypto space. A few reasons why that will be so:

1. It is partnering “safe” crypto companies

So far, the two known announcements reveal that Grab is working with companies that are recognised and approved by the Singapore central bank.

Coinhako recently got an in-principle approval from the Monetary Authority of Singapore (MAS) to offer digital payment token services, this means it will be a government-licensed entity that’s legally allowed to run its crypto business in the country.

TripleA is Singapore-based and was founded in 2017, and it’s a business that is considered established in the short crypto scene. Just this week, it also received an in-principle approval from MAS to offer digital payment token services.

2. It needs to adhere to financial regulations imposed on its own service

Under its frequently asked questions site, the tech giant clearly states that the GrabPay Card cannot be used at merchants that may not be following the regulatory guidelines for Anti-Money Laundering or Counter Financing of Terrorism in Singapore.

Merchants involved in services such as cryptocurrency trading, lottery or sports betting are not supported.

This reveals that Grab has a team that’s monitoring such activities and will block transactions from sites or stores that are not following regulatory guidelines.

To refresh the minds of some, GrabPay operates payment services that are licensed under the Payment Services Act.

It allows users to keep prepaid electronic money in the Grab app but there are limits set by the MAS to protect users and prevent misuse.

Basic users can have an e-wallet that holds a maximum amount of S$1,000. Premium users who complete their user identification process on the Grab app, are entitled to a maximum wallet amount of S$5,000.

There’s also an annual transaction cap of S$30,000 for premium users and S$5,000 for basic users.

3. It has other core businesses to focus on

The FinTech arm may be a new growth segment, but it’s still important for Grab to focus mainly on its core capabilities where it has the leading market share.

Grab’s specialty is in ride-hailing. It was founded in 2012 to provide this service, and has almost 10 years of experience under its belt. To add to that, its food delivery arm GrabFood has been around for four years.

In the latest e-Conomy report 2021 from Google, Temasek, and Bain & Company, it revealed that the food delivery industry in Southeast Asia grew 33 per cent from a year ago in Gross Merchandise Value.

Food delivery is set to be a supporting pillar for SEA’s internet economy GMV to reach US$1 trillion by 2030.

Although Grab has the vision to be an everyday app for SEA consumers’ daily needs — transport, food, delivery, and payments — it has to fire all cylinders to make this vision work.

The best method for this approach is to be slow and steady.

Taking a leaf from conglomerates that have their fingers dipped in a couple of horizontal industries, it takes time to build that trust with consumers and create a dependable household brand.

It is unlikely that Grab will dive head first into the risky crypto space without thinking and its moves will be calculated and cautious.

How will these influence its digibank come 2022?

It looks like Grab is taking a conservative stance in its crypto push for now, and depending on how the crypto market swings for 2022, it will move according to the changes.

As per the bid that was won by the Grab and Singtel consortium to operate a digital full bank according to the licence provided by the MAS in December 2020, Grab maintains a 60 per cent stake in the consortium entity while Singtel retains a 40 per cent stake.

Operations are set to take place next year and Grab has been hiring extensively to build the digibank business.

It sees itself as Singapore’s “next-generation” digital bank, and its role is to open up access to “easy to understand” and “relevant” financial services, as per Grab Group CEO and co-founder Anthony Tan’s message when they won the bid.

Tan had said that the digital bank aims to “empower more people to gain better control of their money and achieve better economic outcomes for themselves, their businesses and families”.

At the time, Grab Financial’s Senior MD Reuben Lai also shared that the digital full bank licence is a strong step towards financially empowering Singaporeans.

If trades for crypto continue with its momentum this year into next year, then consumers will essentially need reliable services that can provide safe transfers to complete such transactions.

Grab might see itself fitting into the schematics to serve everyday customers in that way.

For now, crypto activities look to be limited to certain companies. According to Grab’s Terms of Service, there’s actually a list of prohibited transactions for its GrabPay eWallet.

Under Section 7 (Acceptable Use Policy), users are not allowed to use the GrabPay wallet for Cryptocurrency, Bitcoin, online currency, gaming coins, online gold and similar virtual assets.

Earlier this year, GrabPay warned users in Malaysia not to buy crypto and virtual assets with their eWallets. The announcement appears to have been made after Binance, a cryptocurrency platform, had announced that eWallets can be used to buy cryptocurrency such as Bitcoin through its peer-to-peer platform.

For those activities that are deemed unsuitable, Grab has shown that it won’t hesitate to declare its disassociation from them to protect its operations as a FinTech entity, even if there’s money to be made.

Featured Image Credit: TripleA, Coinhako