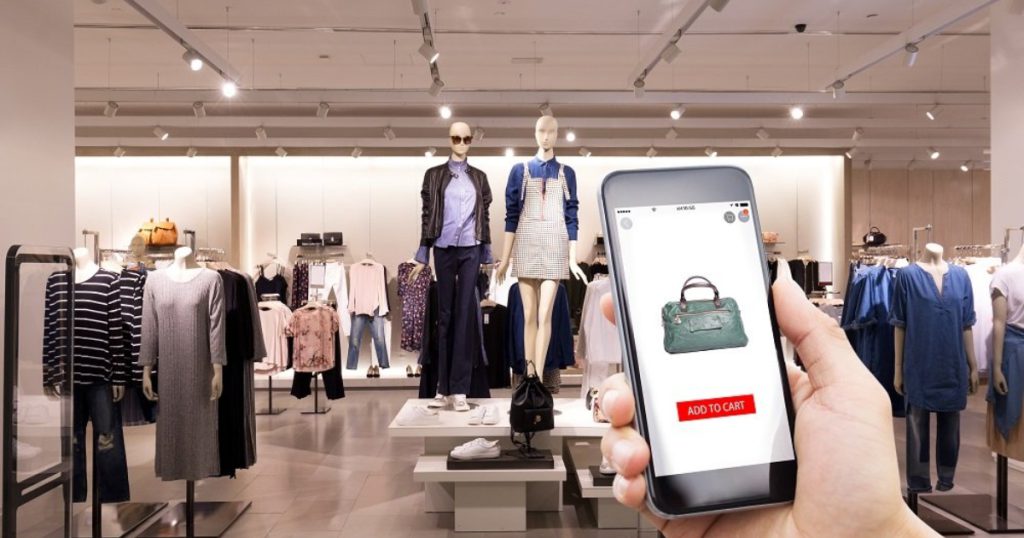

Singapore has been enhancing its digital economy in recent years, leading to e-commerce gaining a huge traction. With technological innovation and advancement, people have become more accustomed to buying and selling online.

Jan Gasparic is an online shopper himself. He read about a new food brand that met his dog’s special dietary requirements, but only found marketplace listings after a quick Google search, even though the product was actually available in his own neighbourhood.

This led him to start up Fairmart together with Daniil Moskovtsov, whom he met on the Entrepreneur First programme in Singapore.

Fairmart aims to address the inconveniences of finding out whether a store carried a specific product, and it does so by automating inventory visibility in retail stores and surfacing it in relevant discovery channels like Google and Facebook.

According to Jan, Singapore is an ideal market for e-commerce considering its small geography and highly-developed infrastructure. In fact, the annual retail sales in Singapore totalled to S$42 billion in 2021, with about 12 per cent accredited to e-commerce, ultimately serving as key sectors of Singapore’s economy.

Considering the need and push for digitalisation of businesses, many have started incorporating e-commerce strategies, but will the rise of e-commerce eventually lead to the demise of physical retail stores?

The e-commerce landscape in Singapore

To understand where the relevance of physical retail stores stand in comparison to e-commerce, it is first crucial to understand the e-commerce landscape in Singapore and why it has seen a higher adoption rate.

Founded in 2020, Cococart aims to be the simplest platform for users to digitise their businesses, and contributes to e-commerce growth by catering to the social commerce market’s needs of having an efficient automation of orders.

By creating an e-commerce store with Cococart, merchants can note their orders within minutes, leveraging the platform’s order management, analytics, promotion and mobile payment tools.

“It’s a simple, yet powerful, tool for optimising online and offline business”, says Derek Low, co-founder and CEO of Cococart.

Since their inception, Cococart’s merchant base has grown from mainly entrepreneurs who are starting their own businesses to accommodating brick-and-mortar retailers as well.

Cassandra Ong, Singapore Country Manager at Cococart, adds that as of 2022, they have been seeing a 20 per cent organic merchant growth in Singapore compared to the same period last year, with the number of consumers browsing shops on Cococart also doubling.

From our insights, we are hugely optimistic on the value of e-commerce and what it can bring to our merchants and businesses, as consumers are still browsing and shopping online. We also see that merchants and businesses are still jumping onto the e-commerce bandwagon.

– Cassandra Ong, Singapore Country Manager at Cococart

She highlights that e-commerce has become a popular strategy for businesses because it not only serves as an additional source of revenue, but also helps them leverage data to drive brand loyalty and awareness to a much wider audience.

Moreover, with access to customer insights, businesses can better understand consumer behaviour and use that understanding to further improve their solutions and create new products that would cater to their consumers’ preferences.

Considering the push for digitalisation and the drive towards incorporating advanced technology into one’s business strategy, it is no wonder that online customer acquisition cost (CAC) has grown 60 per cent from 2015 to 2020.

Since today’s consumers continue to become more digital-first, e-commerce has become more important than ever, as it allows businesses to cater to both sellers and their consumers.

COVID-19 saw closure of many physical stores

Then of course, came the onset of COVID-19. E-commerce was already on the rise before it emerged, but the pandemic was what really called the relevance of physical retail stores into question.

With lockdowns imposed, many physical stores were closed, proving to be a win for the e-commerce industry as it saw a tremendous boom during this period. For example, in the last two years of the pandemic, Shopee Mall saw an eight times increase in the number of users shopping online at least once a month across the region.

According to Jan, online retail sales proportions increased to a peak of 24 per cent during the pandemic compared to pre-pandemic levels of about six to eight per cent. The pandemic was truly a “once-in-a-lifetime accelerator of digital behaviours” that seemed to cement the belief that e-commerce was most relevant and crucial.

“From our perspective, the pandemic has made the case to most business owners that e-commerce can have some relevance to their business and spurred them to experiment,” he adds.

For Derek, who started selling his own homemade cheesecakes to make ends meet after losing his hotel business in Bali, having an e-commerce strategy was important, and that’s what made him decide to provide solutions for struggling businesses with Cococart.

“In less than two years, we’ve grown to support over 30,000 businesses in 100+ countries with more than one million orders”, he shares, adding that their merchants have earned over US$50 million.

Additionally, Cococart saw a 30 times growth in merchants and a 46 times growth in customers in 2021.

“The pandemic created a new generation of independent business owners, and these businesses are the fastest-growing segment in e-commerce,” Derek posits.

Seeing how strong the e-commerce wave has been, physical retail stores seem to have become an ancient relic, especially during the pandemic, which proved such means of shopping as almost unnecessary amidst the growth of e-commerce.

Is this signalling the possible demise of physical retail stores? What is the point of having a physical store anyway if a store already has an existing e-commerce strategy?

The relevance of physical stores in a post-pandemic scene

To grasp the demand for physical retail stores, we must then take a look at the post-pandemic situation, where physical stores have reopened amidst e-commerce. Interestingly, the online retail sales proportions that peaked during the pandemic have gone down to 12 per cent.

According to Shopify data in 2021, in-store shopping has been getting more popular ever since stores have begun to reopen. This growth is likely due to consumers who are now allowed to resume in-person shopping experiences, which they have been deprived of due to the pandemic.

This has led to 32 per cent of the brands they surveyed saying they would establish the use of in-person experiences in 2022, while 31 per cent of them said they planned on expanding their physical retail footprint. In other words, there is a resurgence in the demand for in-person shopping amidst e-commerce.

“[E]-commerce adoption appears to have a natural ceiling in most markets, even those such as Singapore that have natural predispositions towards e-commerce”, shares Jan, who suggests that while there may be market shifts towards e-commerce, “there is little evidence to support statements that the retail sector is doomed”.

In other words, despite the ubiquity of e-commerce, it doesn’t necessarily mean that all physical retail sales will ultimately be subsumed, or that physical retail stores have completely lost their relevance.

Now the question is, what gives physical retail stores the competitive edge compared to e-commerce? Why is it that physical retail stores are still of relevance despite the majority of users being accustomed to online shopping?

Derek feels that many businesses, especially restaurants will always need the physical store aspect to serve customers. “People like the experience of sitting in a restaurant for a meal, or meeting with friends in a café”.

As for other industries selling consumer goods like clothing, Derek believes that shoppers are enticed to shop in-store because the businesses have made use of their physical retail environment by making it unique, turning physical retail stores into an experience rather than just a place for physical transactions to be made.

Jan believes that what is changing is the increasingly digital shopper behaviour where shoppers search for products and services online first before viewing them in-store and ultimately making the purchase online. “This is evidenced by Google search trend data that clearly shows a long term shift towards ‘near-me’ results”, shares Jan.

A year ago, we saw the majority of purchases through Fairmart happen online. Since the spring of this year, we’ve seen our in-store conversions grow over 300 per cent as shoppers are increasingly using their online searches to determine in-store actions.

– Jan Gasparic, co-founder and CEO of Fairmart

Other factors include convenience — as consumers can drop by their favourite stores that are of close proximity on their way home or when they’re out with their day-to-day tasks — and the social element of physical shopping.

Despite e-commerce taking the centrestage in recent years, physical retail stores are likely never going to be completely phased out because consumers still need that in-person element that cannot be provided with e-commerce.

Thus, instead of viewing this situation as a competition between physical retail shopping and e-commerce, we need to understand how to balance the two elements. As Derek points out, “[p]eople are much more used to ordering online because of the pandemic. Even as we enter a post-pandemic landscape, this habit wouldn’t simply go away”.

Jan shares that giving shoppers the ability to buy via the channel they want is important, but it should not be a fixed option to offer only online or brick-and-mortar shopping experiences.

Sharing the same sentiment, Cassandra adds that they “foresee retailers taking on an omnichannel approach, driving revenue via their physical and online storefront”.

Developing an omnichannel presence

This shift towards having an omnichannel presence is already happening. Fairmart, an omnichannel solution that supports both online and in-store transactions, has consistently been growing at 15 per cent every month for the past year.

Businesses need to start incorporating e-commerce strategies to cater to consumers that have grown familiar with digital shopping especially during the pandemic. Derek observes that having omnichannel solutions would be beneficial since it can cater to both online- and offline-based consumers.

We see synergies in both channels working in tandem. It won’t be uncommon to see many physical shops adopt e-commerce as another channel to acquire sales, meeting customers where they’re at, especially if they prefer shopping online.

– Derek Low, CEO and co-founder at Cococart

Take for example the IMM virtual mall on Shopee that was launched in 2021. In collaboration with CapitaLand, it aims to enhance the accessibility of the digital economy and its benefits to consumers and businesses.

Connecting over 50 retailers and F&B establishments under IMM — Singapore’s largest outlet mall — to consumers on Shopee, retailers and F&B establishments are able to make use of more online marketing opportunities to drive revenue through a multi-channel strategy.

Essentially, the rise in e-commerce is understandable given the context of driving digital innovation and digitisation of businesses. However, physical spaces, physical stores and physical shopping will still hold value in consumers’ hearts, no matter how large the push for digitisation and e-commerce.

The key now, is for businesses to make use of both offline and online solutions to remain relevant through time. As Jan nicely encapsulates, “[p]hysical stores today cannot escape the need to have a digital presence, but that does not mean driving all sales to e-commerce”.

Featured image credit: AllBusiness