Disclaimer: Any opinions expressed below belong solely to the author.

Singapore’s Temasek has just announced plans to invest up to US$30 billion (S$40 billion) in the USA over the next five years, in an effort to capture a greater share of the artificial intelligence boom which is expected to shape how the world works in the future.

It’s also an effort to shift its funds away from China, whose capital markets are in stagnating following a series of regulatory crackdowns by Beijing and increasingly tighter restrictions, which have added a large degree of uncertainty to investing activity.

S$40 billion is more than 10 per cent of Temasek’s entire portfolio and very nearly as much as it currently holds in all of its China-registered companies (which make up 13 per cent).

“It’s an incredibly deep and broad capital market in the U.S. The U.S. is really at the forefront of everything that’s happening from the AI perspective.”

Jane Atherton, Temasek’s head of North America, for Reuters.

Artificial Intelligence — real returns

Temasek is no stranger to artificial intelligence and it’s been rumoured earlier this year that the fund is interested in OpenAI. And while it hasn’t acquired a stake in the company it has joined a smaller S$337 million fund which invests in AI businesses, including the maker of ChatGPT.

The announcement of a S$40 billion trove focused on new technologies reveals a bullish attitude, following several periods of expansion in the American stock markets, which saw some companies’ valuations skyrocket in the past 2 years (most notably Nvidia, the chipmaking monopoly underpinning AI’s rapid rise, which has ballooned to over US$3 trillion at one point).

On the other hand, the predicted time span for the deployment of the funds—five years—suggests a degree of caution, given how rapid the rise has been and warnings that the tech market is in a bubble that may be about to burst.

This is not an indictment against artificial intelligence but rather an observation that every transformational technology—no matter how useful or valuable it was—has gone through a similar cycle of rapid ascendancy and even faster collapse, leaving behind only those best prepared (remember the Dot-com crash of 2000?).

There’s clearly money to be made in AI, and will be for many years to come, but at this point it’s better to be a bit more conservative. This is probably why Temasek, while signalling its intent and deep pockets, is not planning to spend it all at once.

Leaving China — for good?

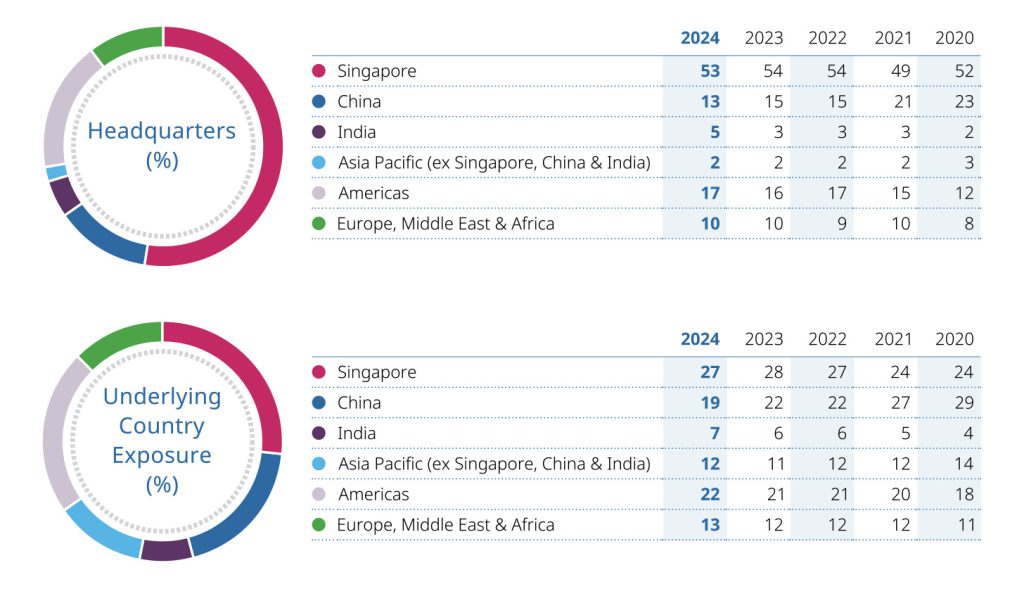

As recently as 2020, China was Temasek’s main exposure, with 29 per cent of its investments tied in some way to the country.

This has now shrunk to 19 per cent, relegating China to 3rd place, behind Singapore and Americas.

Four years ago, nearly a quarter of the companies in the portfolio were based in China — today, it’s little over one in eight, a drop by almost a half in proportion.

“Geopolitics always plays a role”

Jane Atherton, Temasek’s head of North America, for Reuters.

With Beijing exercising much stricter controls following the controversy ahead of Jack Ma’s Ant Group’s cancelled IPO in 2020 and unrelated but also detrimental cratering of the property sector in China, the country has become hostile to investors.

Politics, not economics is dictating the rules now, meaning that any investment is inherently unpredictable, as its outcome depends not on market forces and company performance but equally, or even more so, on the whims of the local political elite.

With tens of billions from Temasek’s coffers now heading to the US, we can expect its exposure to China dwindle and divestments accelerate.

And while it’s unlikely that the withdrawal will be complete, the share of Chinese assets in the fund’s portfolio is bound to soon become negligible.

Given the political situation in Beijing, Temasek’s divorce from China may endure for years, if not decades, depending on how long Xi Jinping can dictate the course. But even if he changes his mind or is eventually replaced by someone else, the structural changes to China’s Asset Management Industry will take a lot of time to repair.

The trade war between US and China doesn’t make matters easier, as the latter is being deprived of access to the most cutting-edge technologies, naturally keeping its companies behind the developed West, especially in the field of AI.

This is why there really is no other destination for Temasek’s billions other than the US, which is leading the way and making sure it maintains its competitive advantages. The likely change in the White House this November, with the expected return of Donald Trump, is only going to cement the status quo.