Disclaimer: Unless otherwise stated, any opinions expressed below belong solely to the author.

As digital scams continue to plague our lives, it’s rare to hear about a success story in the whack-a-mole fight against them.

Fortunately, however, Singapore can claim just that against at least one category of scams, one which costs local mobile users tens of millions of dollars per year: malware scams.

Unfortunately, perhaps, it’s not because people have become more responsible or less gullible, given that local users attempted to install suspect applications on 200,000 devices around one million times this year alone—One million.

Malware scams involve users installing applications which compromise their security, hijack access to their bank accounts, or dupe victims into thinking they’re using a legitimate application when it isn’t.

These scams are a problem for Android devices, allowing users to sideload software instead of downloading through Google’s Play Store. This allows hackers to mislead people into allowing them unrestricted access to their phones or tablets and do what they please with them.

First anti-scam trial in the world

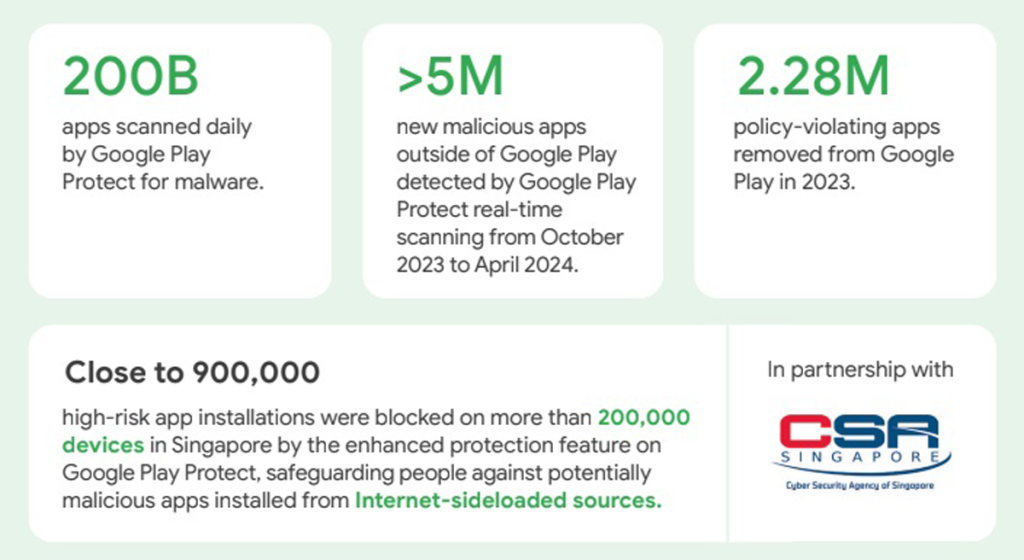

This February, in collaboration with Cyber Security Agency (CSA) of Singapore, Google rolled out a trial of a security feature which would monitor installations of sideloaded applications and actively block those which requested suspicious or excessive permissions on phones.

It was the first such joint program in the world and has worked remarkably well.

Last year, Singapore recorded 1900 cases of malware scams, with S$34 million stolen from unsuspecting victims.

This year, the count dropped to 95 for the first half of the year, with 60 in Q1 and just 35 in Q2, on track for a 90 per cent or more decrease. Although the number of attempted installations has reached almost 900,000 since the program began.

The amounts stolen this way in 2024 have dropped by close to 97 per cent, from over S$9 million to S$295,000 vs. the same period last year.

That’s why it’s safe to say that malware scams have practically gone extinct (although it should not be an excuse to let your guard down).

Other risks persist

Unfortunately, this is where good news ends since other scams continue to make an even bigger dent than in the past.

In the first half of 2024, Singaporeans have lost a combined amount of S$385 million in around 27,000 cases. That’s around 25 and 16 per cent more, respectively, compared to the same period in 2023 and on track to reach S$770 million for the full year, beating the high of S$660 million in 2022.

Most money was lost to government impersonation and investment scams, with an average of three times for the former, at close to S$120,000 vs. S$40,000 per case. Job scams persist, too, although the quantum averages S$15,000 per individual.

These three categories add up to around 75 per cent of all money stolen.

Most worryingly, in a whopping 86 per cent of the cases, criminals didn’t even have to gain control of victims’ bank accounts. Convincing them to send the money through manipulation and social engineering was enough.

There is, sadly, no software update that could fix human vulnerabilities, so education and common sense are the best protection we can deploy ourselves.

- Find out more about Google’s security feature here.

- Read other articles we’ve written on online scams here.

Featured Image Credit: Freepik