Disclaimer: Unless otherwise stated opinions expressed in the article belong solely to the author, who has no stake in any of the companies mentioned. It’s not meant to be investment advice and you should do your own research before you make any financial decisions.

Japan’s second wealthiest man and the CEO of SoftBank, Masayoshi Son, known for his bold tech investments (but also occasional stumbles) and opinions going against the grain, has just opined that Nvidia is still undervalued.

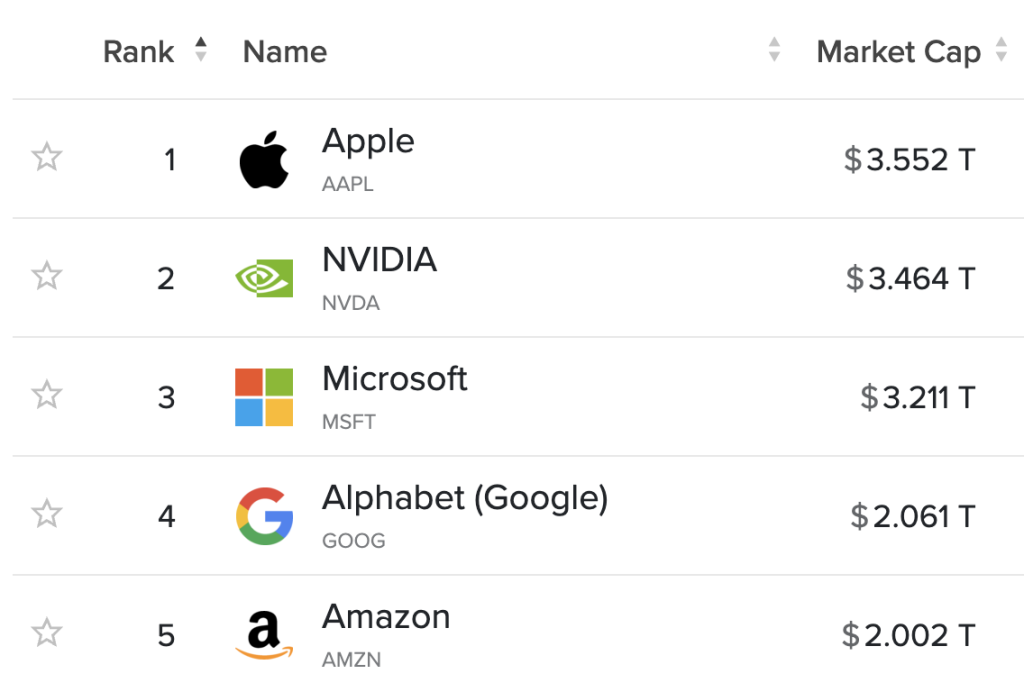

This is despite the company rebounding to nearly US$3.5 trillion, putting it marginally behind Apple among the world’s most valuable companies.

He voiced his observations yesterday during the Future Investment Initiative conference in Saudi Arabia, also known as the “Davos in the Desert”.

So, what are his predictions exactly?

9 trillion dollars

In response to the CNN’s Richard Quest’s question about the basis of his view, Son responded: “The future is much bigger.”

“What about the total generative AI future? What is the value of the future? […] Most negative guys say that AGI (Artificial General Intelligence), ASI (Artificial Super Intelligence) in 10 years, maybe only 5% of it [will be] actually useful. So I say: let’s accept the most negative critics’ view.”

Masayoshi Son

He then proceeded to explain that the costs of attaining AGI or ASI may require US$9 trillion dollars in capital expenditures on data centres, including as many as 200 million processing chips, as well as energy generation to power them.

“Small money.”

Masayoshi Son

This is because, even in the worst-case scenario, Son says, the 5% improvement is more than sufficient to justify the expense, since 5% of the global GDP in 10 years would be about… US$9 trillion dollars.

And that value becomes residual in the economy, so the world would recoup its entire AI investment in economic value generated in just one year — and then keep making it (and more) annually in the future.

The corporate profit from the returns on this investment could reach 50%, most of which will be, in Son’s view, collected by the top four companies in the business—an average of US$1 trillion in extra annual profit per business which, of course, includes Nvidia as the industry’s frontrunner.

The figure would absolutely dwarf the current trailing 12-month average of over US$50 billion that Nvidia is reporting today, even as it is likely to rise further next year, with the rollout of the new Blackwell products.

The unknowns

On the face of it, Son’s reasoning is pretty logical and straightforward. Since AI—especially advanced AGI or even ASI—is expected to transform virtually everything we do, it’s reasonable to expect it to raise our GDP globally and across different industries.

However, we cannot say quite the same when it comes to betting on specific businesses—as exhibited by Son himself.

In 2019, his Vision Fund sold its entire 4.9% stake in… Nvidia. Yes. It missed out on a US$170 billion share in the hottest business, selling it for pennies (even if it turned a profit at the time).

Hindsight is 20/20, as they say…

Moreover, as much as Jensen Huang’s behemoth is riding the AI wave today, the premium it puts on its chips, with AI cards costing as much as US$30,000 to US$40,000, is very painful to its customers who are devoting significant resources to finding alternatives which would reduce the expense.

One challenge comes from its rival in the GPU business, AMD, which is already selling its AI cards at a considerable discount, at around US$15,000 apiece (though they aren’t quite as capable yet).

But the ultimate goal for companies like OpenAI is to develop their own chips and become hardware independent:

This doesn’t necessarily mean Nvidia’s newfound cash cow is going to drop dead, but diversification would enable AI developers to bolster their bargaining power to get big discounts on chips that are currently in forever restricted supply.

After all, the Artificial Intelligence boom really only started two years ago, so forecasting what the market is going to look like a decade from now is really difficult.

While Nvidia is not going anywhere and is positioned to remain the market leader, the value it is able to extract as competition heats up can significantly decrease, reducing its financial performance and keeping a lid on its market capitalisation.

On the other hand, while AI companies are looking to enter Nvidia’s turf, Nvidia itself has launched its own AI model, becoming a competitor to its customers, before they can do the same to it on hardware.

So early into the race we can be certain of only one thing: that there’s a lot of money to be made in the AI business. As for who makes the most, however, that is a far tougher question to answer.

Featured Image Credit: FII Institute