When it comes to MAS’ overall vision for Singapore’s fintech sector, their focus lies on three key pillars: community, collaboration and capabilities.

Speaking today (November 7) for the first time at the Singapore Fintech Festival (SFF) 2024, Chia Der Jiun, Managing Director of the Monetary Authority of Singapore (MAS), highlighted how these pillars are the key to shaping the fintech ecosystem in Singapore.

At its core, MAS aims to foster a thriving fintech community that connects innovators, not just in Singapore but also across the globe—and Chia believes this year’s Fintech Festival speaks for itself.

900 speakers, tens of thousands of participants—there is a very thriving community of Fintech startups and firms in Singapore and now all around the region coming together for this event, so this is one clear manifestation of this network and this community.

Chia Der Jun, Managing Director of MAS

He added that the recent launch of the Global Financial Technology Network (GFTN), announced by MAS Chairman Ravi Menon yesterday, marks a “new level of mission” to expand and deepen this community on a global scale.

But building a community is just the first step—collaboration is just as equally important to achieving MAS’ vision. Having initially fostered innovation through sandboxes, MAS is now advancing partnerships by creating consortia with industry stakeholders, regulators, and policymakers.

This collaborative approach has been crucial in areas such as sustainability, digital assets, and even artificial intelligence (AI).

We are actively forming consortia with industry, with federal regulators, policy makers, coming together to solve problems. So that has been most evident in several areas—we have had this in the sustainability area, we have had this in the digital assets area, which is currently where we are focusing a lot of our time.

Also, for AI, it has been a collaborative approach through the industry to try to understand the risks better and start to identify the issues. So that has been our approach, and I think that has been helpful in scaling the impact.

Chia Der Jun, Managing Director of MAS

To drive growth in fintech, MAS is prioritising building capabilities across key areas that they have identified to be “hugely impactful”, which include payments and digital asset tokenisation.

“We have focused our attention on [these industries], and we’re taking steps to put in place the building blocks to help them grow and overcome some of their challenges and pain points.”

With these efforts in place, how is Singapore staying ahead in the competitive fintech landscape?

Improving interoperability of domestic and cross-border payments systems

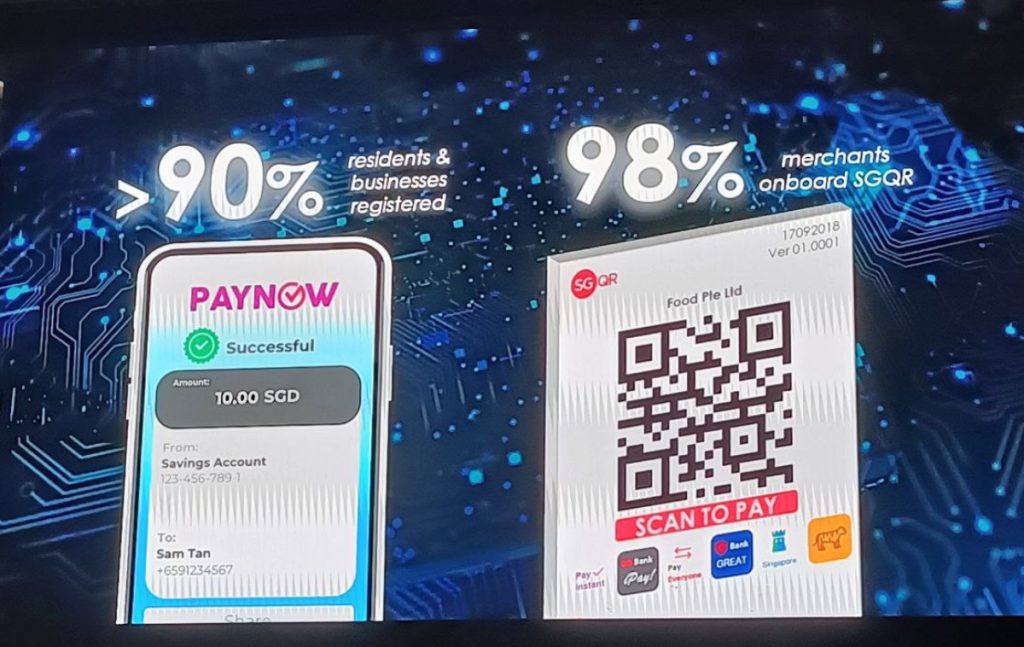

Payments and payment solutions are among the growth drivers in the fintech space. Singapore’s current domestic payment systems “perform well”, with consumer sign-ups exceeding 90% and merchant QR code adoption approaching 100%, but Chia still believes that they are “not seamless”.

“The problem we need to solve now is interoperability,” said Chia. “A merchant may not have [integrated] different payment schemes, and so if [they’re] only on one payment scheme, then [they] can only accept customers of that payment scheme.”

To overcome this, payment services provider Network for Electronic Transfers (NETS) has announced the islandwide rollout of the Singapore Quick Response Code Scheme (SGQR+) today, following a successful pilot by MAS at SFF last year.

This will enable consumers to use a single QR code for payments, simplifying transactions across multiple digital wallets and banking apps.

Cross-border payments, on the other hand, have presented a “different challenge.” In 2021, Singapore saw a breakthrough when it managed to link its fast payments system with Thailand—individuals in the two countries are able to transfer money using just a mobile number.

However this took two years to establish. The city-state now has several such linkages with countries like Malaysia and India, but scaling this further will take time.

To accelerate progress, MAS, together with the Bank for International Settlements, has embarked on Project Nexus with ASEAN countries to build a system that connects multiple domestic instant payment systems between countries, aiming to address the challenges of speed, cost, access and transparency.

As Project Nexus moves towards live implementation stages, the central banks collaborating on the initiative announced yesterday that they will be setting up a managing entity called the Nexus Scheme Organisation (NSO) in Singapore.

Commercialising asset tokenisation

Asset tokenisation is the process where digital tokens are created on a blockchain to represent digital or physical assets.

The total tokenised market capitalisation across asset classes could reach about US$2 trillion by 2030—but while MAS recognises the potential of the sector, the challenge is: how do we get there?

The solution, according to Chia, is again, through a collaborative approach with Project Guardian and Global Layer One.

MAS and key financial institutions in Singapore have piloted innovative asset tokenisation use cases through Project Guardian. The partnership has provided a platform for central banks, regulators, and financial institutions to understand the risks and opportunities that come with asset tokenisation.

They have also established key workstreams to set up standards and frameworks for important asset classes, such as fixed income, foreign exchange, and asset and wealth management.

When tokenised assets are traded on blockchains, this process is done via digital currencies called settlement assets, but a key challenge lies in ensuing that they are of “high quality”.

In this vein, MAS has set up a regulatory framework for stablecoins—one of the major settlement assets for transactions on blockchains—that outlines the essential attributes of a well-regulated, sound stablecoin.

We are inviting people to make use of this and issue stablecoins that comply with this regulation. The regulatory attributes are finalised, and we are now working on legislation. It is not quite ready, but we are having conversations with those issuers.

Chia Der Jun, Managing Director of MAS

Beyond this, there must be a shared ledger infrastructure to scale these markets effectively on a global scale. This ledger must be able to host multiple types of tokenised financial assets, adhere to regulatory standards, and respect the policy autonomy of participating jurisdictions.

That is where Global Layer One comes in—another industry consortium that has been set up, consisting a core group of global banks and market infrastructure providers, that are working to provide solutions in this area.

Navigating generative AI

AI has brought about significant transformation to various industries and sectors, including within financial institutions. But this also brings about challenges, including those related to data leakages, verifiability and and accuracy.

Rather than immediately imposing strict regulations, MAS has opted for a collaborative, capability-building approach.

“The first thing that we did with generative AI is not to come in with regulation, but to set up another industry consortium,” Chia said. “So the focus and the purpose of this is to build up capabilities—both industry and regulatory.”

With Project MindForge, MAS has collaborated with financial industry participants, banks, and technology partners, and have identified the risks associated with generative AI. “The next stage we’re working [on] with the consortium [now] is knowing the risks, and what it mean for governance?”

On the regulatory front, MAS is currently working towards a set of guidance on managing risks associated with AI models. The goal of this is to ensure that they are used effectively, sustainably, and responsibly.

Sustainable finance and quantum technology

Looking ahead, Chia highlighted two sectors with significant potential in the fintech industry: sustainable finance and quantum computing.

As climate change continues to pose increasing threats, policy directions are shifting towards sustainability. For example, Singapore has announced plans to raise its carbon tax over the next seven years.

In line with this, companies and financial institutions are increasingly investing in their sustainability goals, with sustainable fund inflows continuing to grow.

However, capabilities need to be continually developed, said Chia. “We don’t want capabilities to be a bottleneck.” To “keep the momentum going”, regulatory actions, such as mandated climate disclosures, will play a key role.

To help companies in this regard, MAS and GFTN have launched Gprnt—a platform designed to simplify, and automate data collection, enabling even small companies to be able to start gathering data for climate disclosures.

While the process of achieving sustainability targets may take several years, he believes it is crucial to start this journey now to sustain long-term progress.

When it comes to quantum computing, Chia is certain that “it’s not too early” to start focusing on the sector. “Let’s be very clear about this—quantum computers are still in the lab, but is it too early? No, it’s not too early, especially on the security front.”

We have been warned about hackers already doing harvesting of data so that they can break it later when quantum technology is fully available. So, it’s not too early, we have to look into security, post quantum encryption, as well as quantum key distribution.

Chia Der Jun, Managing Director of MAS

MAS is already exploring these areas, experimenting with the technology to enhance security.

- Read other articles we’ve written on Singapore’s government technology here.

Featured Image Credit: Singapore Fintech Festival