You don’t have to come from a finance background or an admin background to understand that documents are a pain. This is especially difficult if you have both softcopies and hardcopies of different information to keep track of at the same time.

Even if your files are well-organised, getting them there in the first place is not an easy task.

Firegent isn’t about that life.

Instead, they want you to just throw all of your documents at their intelligent A.I. and let it handle the rest.

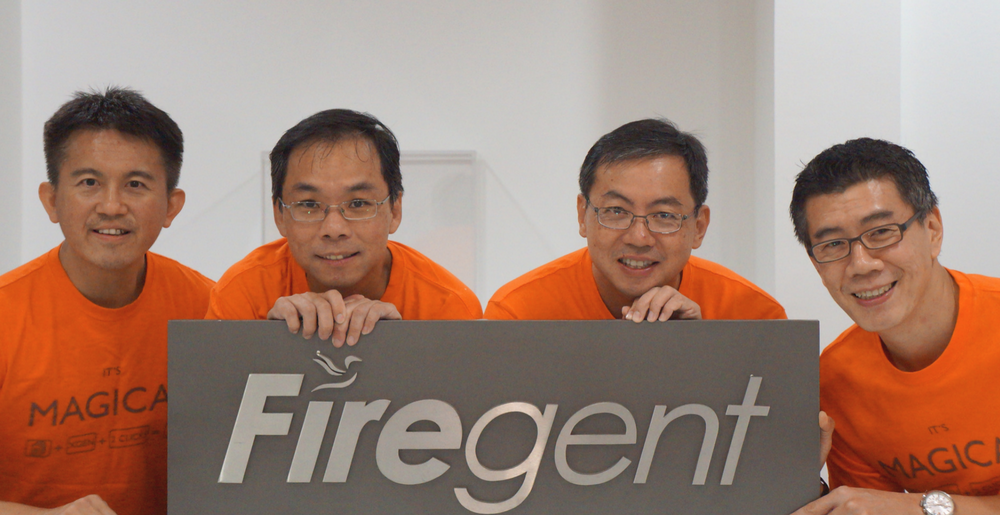

Coming from a rigid finance background, the founders of Firegent relate to the woes of keeping track of so many documents.

And it’s not just an issue of looking for the data.

Jay, as an investment analyst, collected raw data and turned it into usable trends and analyses. Of course, it was all part of the job, but it was very time-consuming.

Most of the founders spent a combined 30 years or so working in large conglomerates and investment banks, so their experience varied from everywhere between building enterprise-level solutions to investment advice.

“Even though I have access to terminal that provides financial information, it is rigid. It doesn’t allow for the collection of other data I needed. Hence, I ended up with using Excel for most of my analysis.”

“So, I thought to myself that there has to be a super-easy way to collect data from various sources and be able to perform real-time analysis without the need of a technical programmer in between of that process. Unfortunately there was none and that is when we decided to start Firegent.”

Co-founders Alan and Danny echoed his experience. Alan told us that the Bloomberg terminal they depended on for financial analysis provided some spotty data that forced them to go back and recheck the facts.

Danny lamented that the same Bloomberg terminal from his past as a Research Manager at a stockbroking firm didn’t usually spit out all of the data he needed.

Realising and suffering from the gap in the market, these three left their cushy finance jobs to test the startup waters with Firegent.

Calling folders a 20th-century technology, Firegent’s A.I. removes the need for you to trawl through folder after folder to find the right file.

Instead, it’s able to find the right file for you simply based on some keywords or even half-remembered phrases.

Immediately striking is Firegent’s ability to glean information even from physical documents that have been scanned into your computer, but it’s also able to arrange and manage documents from Word, PDFs and Excel as well.

In fact, it can do you one better and actually churn all of the documents and data derived from this process into analysis.

The A.I. is able to derive everything from trends, analytics, comparing stocks from one warehouse to another all on command, automatically and almost instantly.

It took the team 6 years to develop an intelligent A.I. that is affectionately named XGen—and 6 figures worth of money has gone into its inception.

It’s able to intuitively automate data extraction and real-time analysis, while still being user-friendly enough for even newbies to figure out.

Danny chimed in to say that, “What’s amazing is when we mixed the pages of two documents together like shuffling a deck of cards. XGen is able to intelligently differentiate which page belongs to which document and arrange them in their page order.”

“We wanted to build a solution that is ‘human-like’ and able envisage problems during processing and resolve them without depending on human intervention.”

– Danny of Firegent

The first version of the A.I. had been developed 3 1/2 years in.

The original plan was to build a software component that big businesses could just adopt into their existing systems, but as Alan told us, “the result was disappointing”.

So they scrapped that, and went instead for artificial intelligence that could just automate all of that tediousness. This scored them their first deal with a global commodity trading company based in London. At the time, they were pretty much only profitable because it was just them, deploying smaller-scale projects for their customers—or as the big boys call it, ‘ramen profitable’.

“When we acquired our very first customer, our solution was very rough around the edges,” said Jay.

The clients were having trouble gathering data from contracts fast enough to hedge their bets in a volatile USA market, and millions of dollars were at risk. Instead, they took a bet on what was then an untested Malaysian startup, convinced that the founders’ finance backgrounds could tide them over.

“As it turns out, building the platform was the easier part. Finding a product/market fit has been the real challenge.”

Since their product could fit so many industries, they understandably get a lot of inquiries from all around.

“The problem is, often times, each industry has its own specific requirements and require certain tweaks to our solution. These tweaks can quickly drain our limited resources and incapacitate our continuous product enhancements.”

The team made the hard decision to winnow down their resources into just focusing on Fintech, but this might just be their goldmine.

“We have recently deployed our solution to a major bank and we are learning, from our perspective, that banks are transforming from an operational efficient environment to an information-rich environment. The ability to gather information from internal and external sources efficiently is pivotal in this transformation,” said Jay.

Also Read: Check Out These 8 Tips From A Pro Photographer That Will Spice Up Your Instafood Game