- StashAway is an intelligent management wealth platform that is designed to build and protect wealth, it has been launched in Singapore last year and will be launching in Malaysia in the next few months.

- StashAway uses technology to bring sophisticated investing through an easy-to-use platform, and with incredibly low fees, no minimum balance, and unlimited withdrawals.

During my university days, one of my lecturers told me this: “Don’t put all your eggs in one basket.”

He then explained that in whatever we do, we should not concentrate all efforts and resources in one area as we could lose everything. One key area of this is where you invest your money.

However, with little to no knowledge of investing other than the stock simulator app on my phone, I don’t really know where to invest other than the mandatory EPF.

The dream would be that someone just takes my cash and helps me to invest without little or no strings attached. However, that rarely happens in our day and age of investment scams; it was reported that 500,000 Malaysians were scammed last year.

If I can’t fully trust humans, perhaps I can put my trust in machines and A.I. instead? That’s the idea behind robo-advisors, and one that is going to spread its wings to Malaysia is StashAway.

Dictionary Time: Robo-advisors collect information from clients online, and then use this data to provide financial advice or invest client assets with moderate to minimal human intervention. Using A.I., they work based on mathematical rules or algorithms.

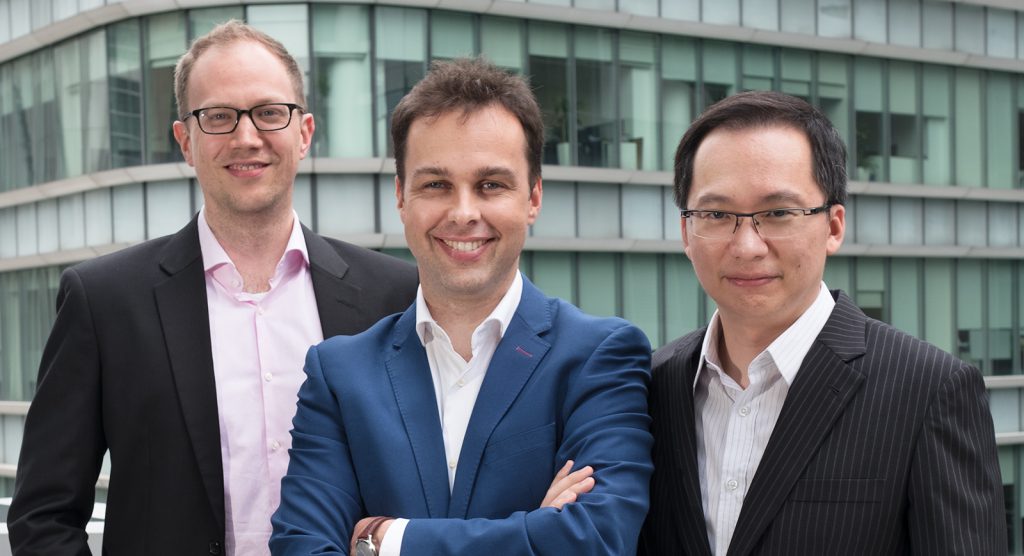

An Experienced Trio

StashAway was founded in 2016 by Michele Ferrario, Nino Ulsamer and Freddy Lim. The idea for StashAway came to Michele as he wanted to solve a major pain point of his own.

“At that point in time, I had been living in Singapore for 4 years and I found out that the financial services industry was not able to provide me with unbiased, good quality advice; I was simply bombarded with sales pitches for standard products with incredibly high fees,” said Michele.

After meeting up with Nino and Freddy, they realised that the trio combined had the skill set, experience, and drive to build a wealth manager that focused on the needs, preferences and also wealth of customers.

Michele spent half of his career in and around financial institutions and the other half building consumer internet companies. Nino is a seasoned founder and CTO of several tech startups, and Freddy Lim—StashAway’s Chief Investment Officer—had been an investment professional for 17 years with stints in CitiGroup, Morgan Stanley, Merrill Lynch, and Lehman Brothers.

How StashAway’s Robo-Advisor Works

StashAway’s goal is to help customers to grow and protect their wealth regardless of whether they are investing RM100 or RM1,000,000.

Their technology is meant to make investing accessible to anyone, combining an all-in-one platform, low fees, no minimum balance and unlimited withdrawals.

Customers can personalise their investment goals, whether they want to save for their children’s education, buy a home, or build their wealth. They also get a recommended portfolio that reflects their risk preferences, and an investment plan that helps them achieve their goals.

“Our investment strategy emphasises diversification and risk, two components that investors typically overlook because they are so laser-focused on returns. Through intelligent and dynamic portfolio diversification, we maximise returns while minimising the risk to which portfolios are exposed by a fraction of the risk that investors take with traditional advisors,” Michele added.

Although their known as a robo-advisor, their investment framework was constructed by actual humans with an expertise in portfolio management and cross-asset allocation. In other words, StashAway believes that artificial intelligence isn’t the underlying product; delivering a solid investment service is.

“Generally speaking, we see many exciting use-cases for Artificial Intelligence and Machine Learning in the area of giving adequate financial advice to our customers and personalisation, rather than in making investment decisions,” said Michele.

Building Trust

Although their 2 years of operating in Singapore have gone quite well, they do face the same challenges any young company operating in the financial services industry would—building trust with stakeholders, from the regulators, shareholders, customers, partners and more.

“Since the early days, we took the approach of focusing on substance over form, we thought and still think that by building a trustworthy organisation, we can earn our stakeholders’ trust. So far, this strategy is paying off, with the Monetary Authority Of Singapore (MAS) awarding us our license, and Malaysia’s Securities Commission finalising our license, and many many customers entrusting us with their savings,” he said.

StashAway’s portfolio has been tested over the past 10 years, which included the 2008 Global Financial Crisis, where their portfolio not only weathered the crisis but actually beat the KLCI while taking significantly less risk.

“Out of the portfolios with which we launched in July 2017, the highest-risk portfolio has earned gross returns of 7.68% USD, and our lowest-risk portfolio had 5.08% USD. In August 2018, we launched Higher-risk Portfolios; back tested for since launch, the portfolio that exposes investors to the highest risk earned 12.63% in USD terms,” added Michele.

To The Future

There have been plenty of highlights for the team since building StashAway from a piece of paper just 2 years ago. “Receiving our retail fund management license from MAS was a key milestone as it validated our business model and allowed us to bring StashAway to market.”

StashAway will be looking at expanding internationally and their first foray overseas will be to Malaysia. “We are working on building a strong foundation there, by having a team on the ground and customising our service to meet Malaysians’ investing needs,” said Michele.

“In a decade from now, I want to be able to look back and proudly claim that I was part of the team that revolutionised for the better how people invest in this region of the world.”

-//-

As StashAway will be launched in Malaysia in the coming months, it would be fairly interesting to see how it all works out.

There has been news of other robo-advisors looking to make their move into Malaysia, and we might even see local players rise.

As I have zero knowledge in investing, this would be a good opportunity for me to try a new investment avenue which is backed by technology and artificial intelligence. However, do note that investing always comes with a risk.

Generally, many seasoned investors pass out this piece of advice, “Only invest money you can afford to lose”. It would do well for us to abide by that.

- If you would like to get updates and know more about StashAway, you can find their website here.

Feature Image Credit: StashAway