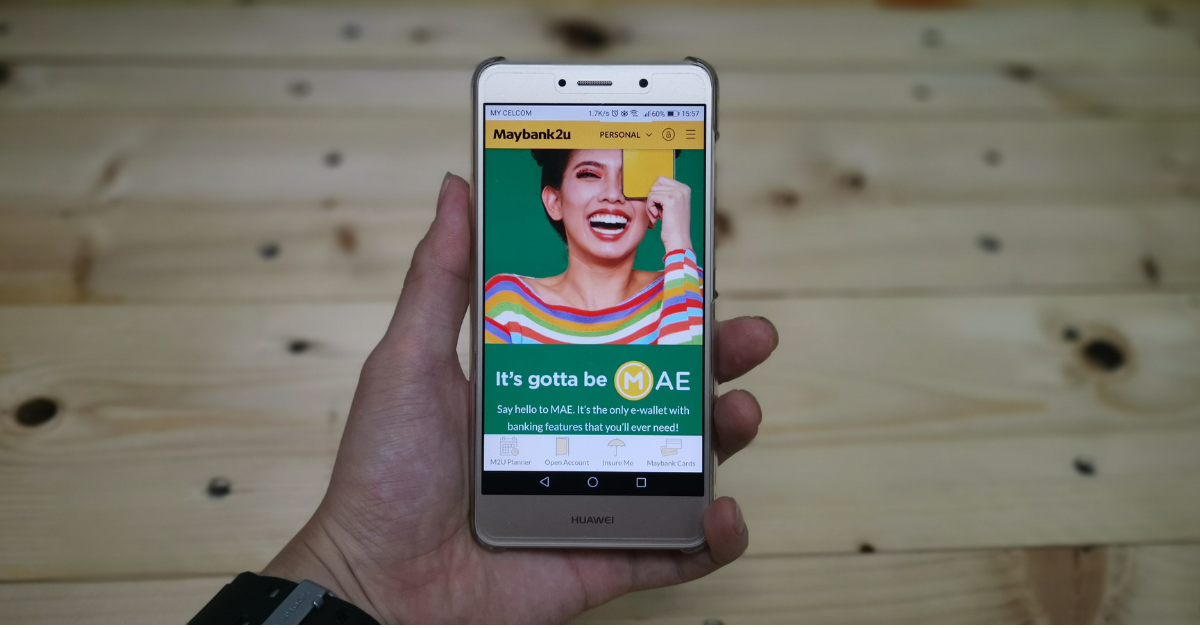

Today, if you’re the sort of person who keeps your apps regularly updated, you might have noticed an addition to your Maybank app (assuming that you are an existing Maybank customer).

Once you decide that you do want to say hello to Mae, you’re taken to a sign-up screen, where you are asked to fill in 3 simple details:

- Your email address

- Your state

- An invite code (optional)

If you’re not an existing Maybank customer, MAE is also open to you. However, the sign-up process will be more rigorous, and you will need to provide additional information such as your passport/IC details, your phone number, full name and other standard KYC (Know Your Customer) procedures.

Once that has been done, you’ll have access to your basic MAE interface. Two of the prominent features you’ll see is “Money In” and “Money Out”.

When it comes to “Money In”, topping up is fairly simple. If you already have a Maybank account, the transfer process should look quite familiar to you.

Do note that you’ll need to top up at least RM10 into the wallet to activate it.

Besides transferring from your original Maybank bank account, you can also top up via Maybank Cash Deposit Machines or over-the-counter (at Maybank branches).

Once that’s done, you can use MAE for:

- Online e-commerce purchases

- Maybank Pay

- Samsung Pay

- Performing payment using QRPay

- Paying your bills and performing prepaid top ups

- Accessing to Maybank2u billers

- Purchasing movie and flight tickets through a single app

- Splitting bills with or requesting money from friends and family

As MAE is part of Maybank’s original app, you can even toggle back and forth to your other accounts and MAE very seamlessly.

But Why Set Up Another E-Wallet?

At a first glance, MAE does not seem to have much to offer, if you’re already an existing Maybank user. The integration of movie ticket purchases (using WeTix, which you may recognise from Boost, Touch ‘n Go eWallet or WeChat Pay) is useful, but not enough reason to sign up for MAE in itself.

If you’re not a Maybank customer, then the advantages are clearer.

Signing up with MAE will get you a virtual card number, complete with an expiry date and CVV. If you were unable to access services such as online shopping in the past (due to being unbanked, or because you lacked a credit card), MAE is relatively easy way in.

However, like Grab’s GrabPay, MAE doesn’t require prior Maybank users to download yet another app—and signing up is relatively painless and easy.

And because Malaysians have been conditioned to expect discounts, promos and freebies from e-wallets, MAE also has its own take on all of those.

However, as a really new aspect of the Maybank app, I do find the rewards and promo section a bit lacking.

Take the promos for instance. At the moment, they lack information on what exactly the promotions are (do I get a discount? A top-up? A free drink?). Although there already seem to be quite a lot of merchants listed, it’s still not clear what the advantages of using MAE are.

There’s also a mini-game, Money MAE-Hem, which appeared when I first downloaded the app. It’s a fairly simple game where you tap coins to earn coins, and avoid bombs while you’re at it. Your winnings are added to your MAE balance (I earned 72 cents, and my colleague got 30 cents).

As far as I could understand, you got a new MAE-Hem entry every time someone uses your invite code. However, I am unable to verify this as the game was removed from the app as this article was being written.

Update at 6:06 PM, 4/3/2019: After publishing, the game has since returned to the app.

MAE’s info page on Maybank’s website does hint at future rewards to come, once all their promotional campaigns are activated.

And yes, closing the MAE account is possible, but will require that you go into a bank, according to the FAQs on Maybank’s website.

In summary, do I think normal users should get on board and activate MAE? Perhaps hold off a little until the product is fully-fledged and stable.

For everyone else, perhaps only download it if you’re an e-wallet enthusiast, or a prior Maybank user. But I would recommend holding out a bit longer, as that might mean you’ll get some extra rewards upon sign-up—in the current ecosystem, that’s normally the case when e-wallets are trying to drive adoption.

- To find out more about MAE, you can check out Maybank’s website here.