In line with Singapore’s smart nation vision, there has been a big push for a cashless society in recent years.

Regardless, cash is still far from obsolete and is still ‘king’ today.

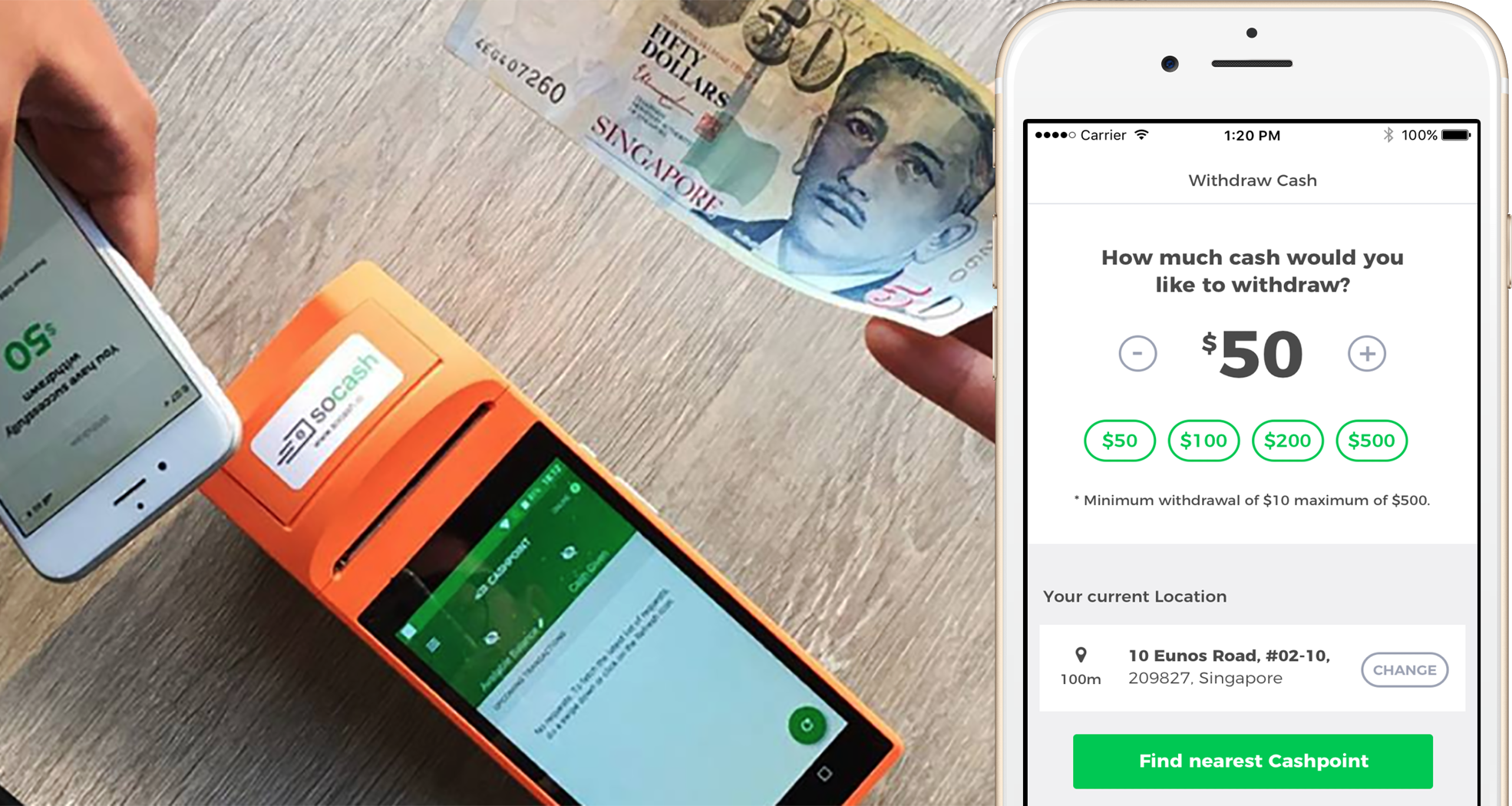

Launched in mid-2018, Singapore startup soCash converts small businesses like provision shops and cafes into ATMs, providing users with a more convenient way to obtain cash.

Today, soCash announced a partnership with ICBC (Industrial and Commercial Bank of China) to extend its services to all ICBC customers in Singapore.

This means ICBC customers can now perform basic banking services like cash withdrawal from neighbourhood shops using the soCash app.

More banking services will be rolled out progressively, according to soCash.

Meanwhile, ICBC Singapore said that this partnership will help them expand their local presence beyond their branches and ATMs.

Over 1,300 Locations Across Singapore

So how do you withdraw money using soCash?

Its technology plugs directly into the banks’ API, so you can simply place a cash order via the soCash app and select a nearby merchant to collect the cash from.

The app will automatically deduct the selected amount from the customer’s account.

The withdrawal is done digitally without the need for a card or even a PIN code.

Since starting up, soCash has partnered with other major banks like DBS, POSB and Standard Chartered.

Its cash network platform now comprises of more than 1,300 locations across Singapore, including retail chains like SPH Buzz, U Stars supermarket, iECON stores and 7-Eleven.

As virtual banks emerge in Asia and traditional banks embrace digital business models, there is a growing need of more O2O (Online to offline) networks. Our collaboration with ICBC demonstrates soCash’s ability to enable banks scale beyond the vintage branch and kiosk-based models.

– Hari Sivan, CEO of soCash

“With this launch, thousands of our partner shops now have the platform to offer ICBC’s product and services, generating new revenue opportunities for them.”

With this partnership, soCash can strengthen its distribution network and work towards internationalising its services.

It is currently gearing up for its expansion in Malaysia, Hong Kong, and Indonesia after securing the regulatory approvals for the launch.

Featured Image Credit: SoCash