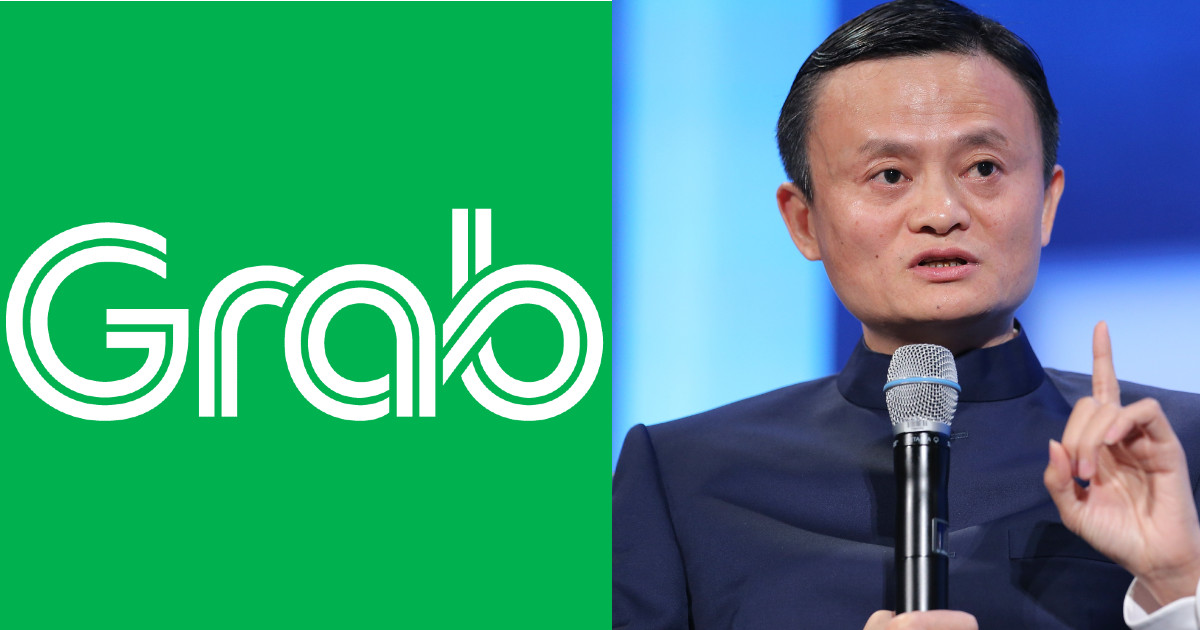

Alibaba is reportedly in talks to invest US$3 billion (S$4.1 billion) into Southeast Asian ride-hailing giant Grab Holdings. That’s a fifth of Grab’s last known valuation of US$14 billion (S$19.1 billion)

The e-commerce giant will be acquiring a percentage of the Grab stock held by Uber technologies.

The Chinese giant’s Grab acquisition gives it access to data on millions of users in eight countries, an extensive delivery fleet, and e-wallet and financial services.

The deal comes amidst Grab’s “long winter”, as Covid-19 upends the ride-hailing giant’s interview, said co-founder Tan Hooi Ling earlier this year.

CEO Anthony Tan also stated that the pandemic was the single biggest crisis to affect the unicorn.

Uber and Grab, the world’s biggest ride-hailing companies agreed to a truce to stay out of each other’s markets after years of costly battles.

In 2018, Uber gained a 23.2 per cent stake in Grab — this means that Grab is on the hook for approximately US$2 billion (S$2.7 billion) if it doesn’t go public by 2023.

SoftBank Group Corp is using its position as a major shareholder to push Uber to unload its stakes in Grab.

SoftBank, an investor in all the world’s largest ride-hailing companies, is also pushing Grab to make peace with Gojek, the Indonesian unicorn that has quickly turned into one of its biggest competitors.

Both Grab and GoJek are seeking a majority stake in the merged business in Indonesia, the largest and most promising market in Southeast Asia.

Featured Image Credits: Grab Facebook / Time