[This is a sponsored article with Grab.]

Proper financial planning sounds easy, only spend what you can, right? While that may have been true before the pandemic, staying cooped up for nearly two years has had an effect on all of our spending habits.

According to reports, instances of revenge spending among young adults are on the rise. This new type of spending is attributed to people who splurge excessively on things they used to enjoy and spending uncharacteristically on new experiences that they’ve put off before.

Because hindsight is 20/20 and we want to help you avoid this problem, I spoke to my colleagues about their worst revenge spends this past year in hopes that you can avoid some of our mistakes.

Marcus, Content Director

During MCO1.0 I took up cooking for the first time and really enjoyed it. I continued cooking and managed to save a lot of money on dining out. When MCO2.0 was announced, I’ll admit I got a little lazy, but still, I persevered and cooked dinner and lunch for every meal for my family.

When the MCO2.0 was finally lifted in August I’d had enough of cooking and ordered my meals constantly. On a particularly lazy month in November, my transactions for meals alone hit over RM1,000!

Needless to say, I immediately dusted off my spending journal, forcefully picked up my wok and started cooking again.

Sarah, Managing Director

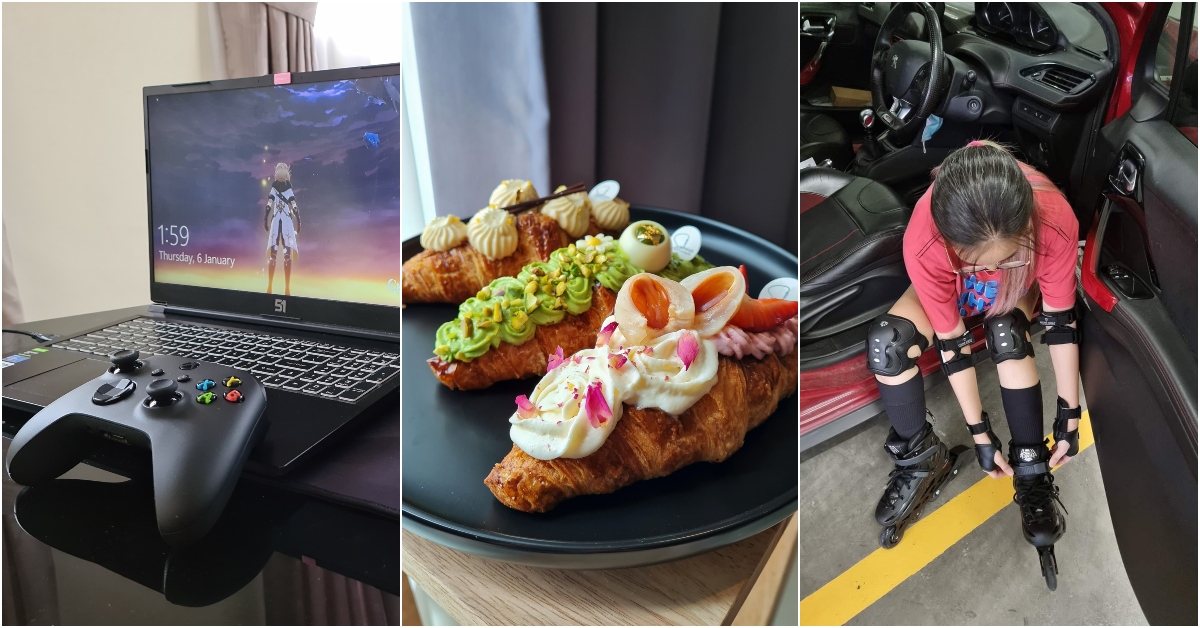

I spent RM500 on rollerblades—and I don’t even like exercising! I bought it during the pandemic because I thought, “Well, I can’t go out to exercise at the gym, I’ll just rollerblade around my carpark.”

How many times did I actually use them? Three times. And now they’re back in the box.

Also, I fell down and hit my hand really hard and I got really painful elbow aches for almost two months. I should have known I’m too old (and lazy) for this workout.

Anyone looking to buy a pair of preloved rollerblades?

Sade, Managing Editor

So this was around 2020 when I wasn’t going out a lot and I was saving on travel costs (petrol, toll, parking, etc.). At the time, I was playing a lot more games because if I couldn’t live a real life, I could at least live a virtual life.

Specifically, I started getting into Genshin Impact and I played it on mobile at first but I wanted an upgrade so obviously I needed a gaming laptop. Because I was already so invested in the game, in the span of one week I made quite an impulsive decision to buy a gaming laptop.

I just asked some tech expert friends for recommendations—I didn’t even do my own research—and they mentioned a model for RM3,800 that was good, so I bought it.

Normally, I would do lots of research and make sure I was getting a good price and bargain, but at that time I thought, if it makes me happy, why not?

It’s definitely not how I would normally spend pre-pandemic, and now, during the post-pandemic, I don’t think I’d be so lenient with my money anymore. That period between 2020 to mid-2021 was definitely an exception when it came to my spending.

What could they have done differently?

We’re all victims of our impulses sometimes, so it’s good to know how you can avoid costly financial decisions. According to this budgeting hack, you should put impulse buys on a time out.

This means, if you’re in a physical store, you walk around a bit more before you purchase that item. If you’re shopping online, leave the item in the cart for a week or two. If you find that it still sparks joy, go ahead and purchase it.

Another useful budgeting hack is to count the hours it would take for you to buy an item. For example, the fully spec’d iPhone 13 Pro Max will cost you RM7,599. If you earn RM3,000 a month, that’s two and half months of work, or 450 hours of work. When thinking about it this way, is it really worth the hours?

Finally, as most Vulcan Post staffers are pretty frugal and these three stories were the best I could find, I found out that Rikco, our Business Development Executive, also made a big purchase recently but he managed to spend lavishly but in a manageable way.

Save now, pay later

Rikco recently purchased a pair of Apple AirPods Pro worth RM849 for only RM199.75 upfront using PayLater by Grab leaving him with more cash in hand for emergencies.

“I usually like to think for a while before buying things, like for this AirPods for example, I thought about it for a while and since I was eligible to use PayLater, I decided to use that and pay. I secured an RM50 discount by using PayLater too,” Rikco revealed.

With PayLater, you can also lump together smaller items such as food, groceries, and utilities into a bill that you can split into four-monthly instalments. If you’d rather pay it in one payment, you can too.

To help you stay on top of your finances, the app will also show you an itemised view of your repayments periods and amounts so you can plan your budget better.

Getting started with Grab PayLater

In order to utilise the service, you’ll need to be at least a Silver-tier member (accumulate at least 200 GrabReward Points) and have made three transactions on the app in the recent month.

Besides food, e-hailing rides, and groceries, you can also purchase items from Grab’s partnering merchants such as Lilit, Zalora, All IT Hypermarket (like Rikco did), and more. The full list of merchants can be found within the app.

PayLater automatically deducts funds in the beginning of the next month from your GrabPay Wallet, so you don’t have to worry about late payments as long as you have enough money in your Wallet.

Plus, when making your first repayment using PayLater, you’ll also receive GrabRewards Points that can be used to offset future transactions.

-//-

Planning your finances properly in 2022 has become even more crucial, especially with the onset of newer COVID variants, recent floods, and reintroduction of gatherings for festive celebrations.

As mentioned before, the best way to keep your coffers in check is to always be on top of your spending.

BNPL services like PayLater offer one way to keep your expenses in check, but like any service, it should be used with discretion. Rack up too many incremental payments and you’ll pay for it later.