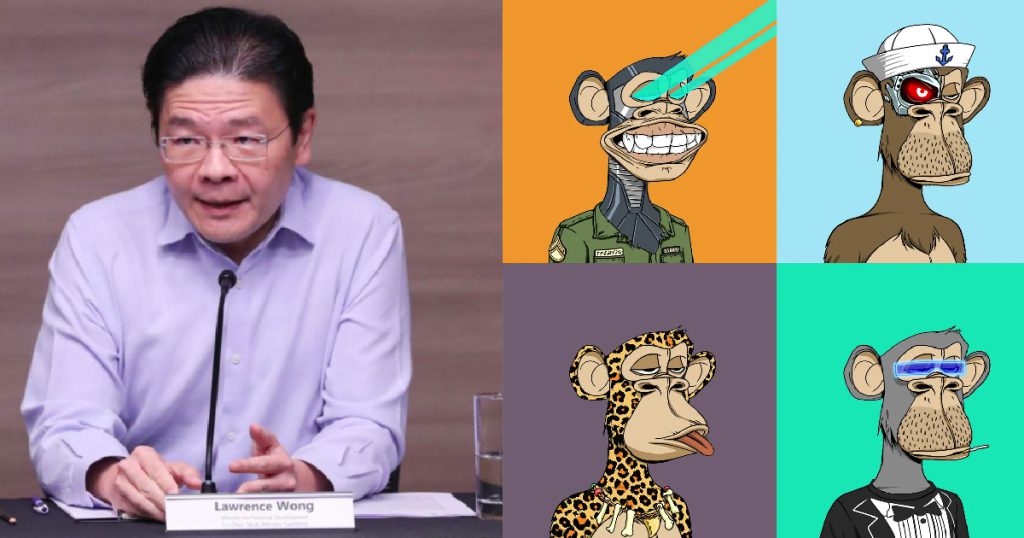

Earlier this month, Finance Minister Lawrence Wong announced that Singaporeans who derive income from NFT transactions and tradings would be subject to prevailing income tax rules. This falls in line with the treatment of cryptocurrency trading in Singapore, which has seen similar regulations since 2019.

As a hot topic of discussion with local NFT communities, there have been a number of arguments made in support of this development as well as against it. Here’s a look at the possible implications of income tax treatment for NFTs.

Legitimising NFTs as an asset class

Since their emergence, NFTs have been met with a high degree of scepticism among non-crypto natives. On face value, they seem to be nothing more than profile pictures. This has raised questions about their utility, and the NFT trend has often been written off as a fad.

The reality is far more complex though. While early NFT projects failed to offer value to holders, they served as a proof-of-concept which has since seen major developments. Today, NFTs are being used for a variety of purposes.

For example, events have started using them as a replacement for traditional tickets. This is useful since NFTs have established platforms for secondary sale. Normally, if you buy a concert ticket secondhand, it’s incredibly tough to verify if it’s real or fake. With NFTs however, frauds and black market sales can be eliminated.

NFTs are also being used as a mechanism to raise funds for games, creative ventures, and even charity. Holders have access to a wider variety of investments which would traditionally be out of reach.

By buying an NFT of a gaming platform such as Ethlas, holders get to support its development, make use of its services, and also share future profits.

These utilities aren’t widely discussed in mainstream media. The narrative still revolves around the large amounts of money being invested in this space for seemingly no reason. This can dissuade new entrants, especially as they have to do a fair amount of research to discover and understand NFT use-cases.

The fact that Singapore is subjecting NFTs to the same income tax treatment as other well-recognised asset classes – such as equities and real estate – could help shift the scales. It’s a sign that NFTs are being recognised as legitimate assets from a regulatory perspective.

Consumers aren’t being actively discouraged or prohibited from entering the space, and this wouldn’t be the case if NFTs were only good for scams and Ponzi schemes.

Capital gains remain untouched

As with other investments, the Inland Revenue Authority of Singapore (IRAS) recognise a distinction between investment income and capital gains when it comes to NFTs. In case of the latter, any realised profits will not be subject to taxes.

With that in mind, Singapore remains a haven for crypto and NFT investments. The lack of capital gains taxation sets it apart from countries such as the US and UK, where rates can be as high as 20 per cent. In India, investors are subject to a blanket 30 per cent tax on any profits derived from virtual currencies.

That being said, investors in Singapore might be left confused trying to determine which category their profits fall under.

As per the Income Tax Act, there are a number of factors which must be taken into consideration. These include the length of ownership, frequency of transactions, and the motive for trading, among others.

There’s no explicit line separating capital and investment gains. It’s a subjective consideration made on a case-by-case basis.

With NFTs, this process could prove to be immensely complex. For example, say you buy an NFT for 1ETH (Ethereum), which is worth S$2,500 at the time. A week later, you sell it for a loss at 0.9ETH, however the value of ETH has gone up to S$3,000. This means that you actually end up realising a profit of S$200.

Would this be taxable? It’s tough to say. On one hand, since you flipped the NFT in a week, it isn’t likely to have been a capital investment. But then again, in terms of ETH, you recorded a loss on your sale.

These complexities might be addressed over time, but for now, it’s building up to be a confusing tax season for crypto investors in Singapore.

A move against financial crimes

Over the past few years, Singapore has been fortifying the entry and exit points to the decentralised world. Crypto exchanges have been pushed to enforce strict KYC measures, and the travel rule has been implemented.

Income tax treatment for NFTs could serve as another line of defence against financial crimes. After all, NFTs have often come under scrutiny for facilitating money laundering, and scammers have also gotten away with millions of dollars acquired through fake NFT projects.

It will now be tougher for such criminals to convert their cryptocurrency back to fiat money. They’ll be required to declare the gains they’ve made, and the authorities will have an easier time identifying illicit transactions.

On the other hand, this measure might not help much while the funds are still stored in the form of crypto.

At present, decentralised wallets – which aren’t linked to the user’s personal identity – can be used to hide funds. It remains to be seen how the IRAS will deal with those who attempt to evade taxes by keeping their value on the blockchain.

Shop and support the best homegrown brands on VP Label now:

Featured Image Credit: Lawrence Wong / Bored Ape Yacht Club

Also Read: Why are so many young investors now drawn to cryptocurrencies and NFTs?