Disclaimer: Opinions expressed below belong solely to the author.

It’s usually difficult to quantify trust. We all know it’s good to be trusted and it makes other people more likely to engage with you — whether as an individual, organisation or an entire country.

Sure, a trustworthy nation typically sees more investment, better employment opportunities, higher wages and so on. But it’s hard to dissect the exact impact trustworthiness has on any specific area, since it is something that is acquired over years — and its benefits are, similarly, accumulated over long periods of time.

However, the extreme jolt that the global pandemic shook the world with over the past three years, revealed just how dependable Singapore is in the eyes of global investors — and, uniquely, allowed us to quantify the scale of their trust in dollars.

Safe haven

Singapore is well-known for its port facilities — a crucial node in global trade — but it’s an even more impressive (and safe) harbour for money, attracting billions of dollars in foreign investment each year.

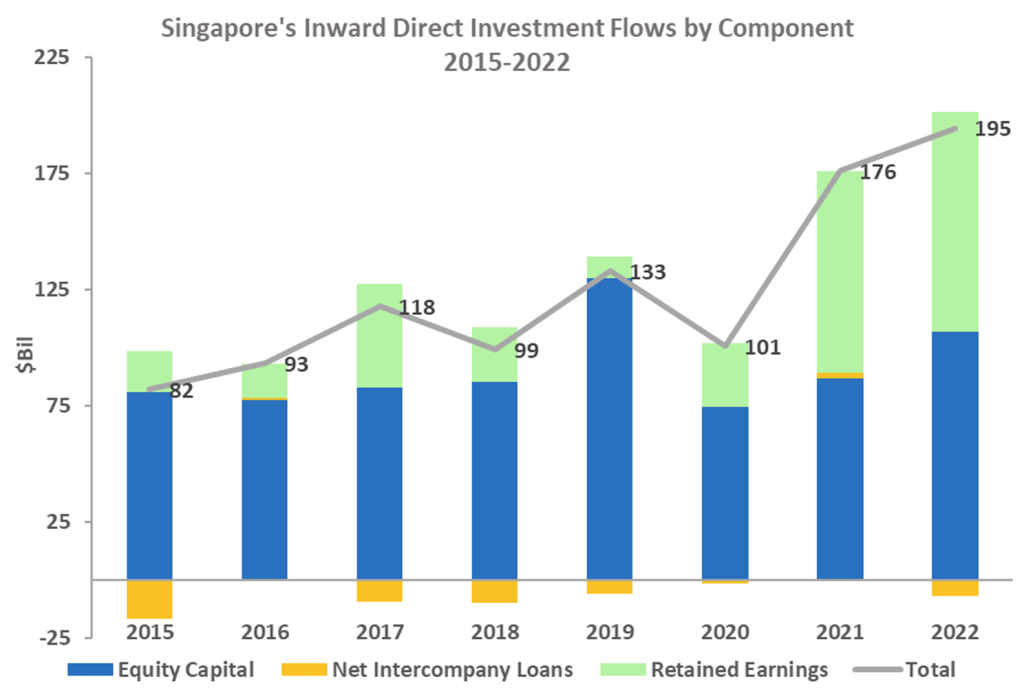

Net inward direct investment flows into Singapore before the pandemic reached around S$100 billion annually, with considerable swings in each respective year (between S$82 and S$133 billion).

In 2022, however, they soared to S$195 billion, beating the previous record of S$176 billion in 2021 — in both cases, boosted by earnings retained in the city-state (in green).

While prior to Covid-19, foreign investors typically left behind an average of S$20 billion in earnings per year, over the past two years it was a whopping S$90 billion — for a total of over S$180 billion, or S$140 billion over what could reasonably have been expected in normal circumstances.

As it turns out, amid the global uncertainty caused by the pandemic, coupled with subsequent economic crisis, soaring inflation, Russian invasion of Ukraine and Beijing’s tightening grip on Hong Kong, Singapore is a peaceful oasis to keep your money safe in.

So safe, in fact, that repatriation of funds back to whichever country a particular company came from was, clearly, is considered less attractive than usual.

Singapore recorded a boost in investment flows from all regions except North America, likely because the USD is considered a crisis-proof currency.

In Asia, however, nobody can really trump SGD, which has steadily held its value against every other competitor — and local government is likely held in higher regard than all others in the region, even by foreigners.

Why move your money outside of the only place on the continent that can reasonably protect the worth of what you’ve earned?

Because Singapore expertly navigated the rough waters of the pandemic, avoided economic cratering, protected its currency and was one of the first nations to show how to live with Covid, its payoff was the massive haul left behind by foreign investors for both local investment (where applicable) as well as management by Singapore’s robust financial sector.

This has been amplified by the political turmoil in Hong Kong (coupled with unpredictable, prolonged lockdowns), Beijing’s crackdown on the rich elite and Xi Jinping’s geopolitical ambitions in Taiwan, which keep piling on the tensions with the West, sending regular tremors across East Asia.

Where else can the money go for cover in this part of the world?

Of course, the city-state has long had an excellent reputation but its decisive handling of the Covid crisis, both economically and medically — e.g. locking down when necessary and reopening once vaccination milestones were hit (using the best available treatments) without the blowback experienced e.g. in Hong Kong which resulted in thousands of unnecessary deaths there — served to further reassure foreign investors of Singapore’s dependability, at a time when everybody else was cracking under pressure.

Featured Image Credit: Depositphotos