Disclaimer: Opinions expressed below belong solely to the author. The article does not constitute financial advice. Author has no stake in Sea Ltd. or any competing company.

Sea Ltd’s stock cratered yesterday by nearly 30 per cent, following the company’s quarterly earnings call. This is despite posting US$331 million in profit beating estimates by 11.5 per cent on a revenue lower than 4.7 per cent than expected.

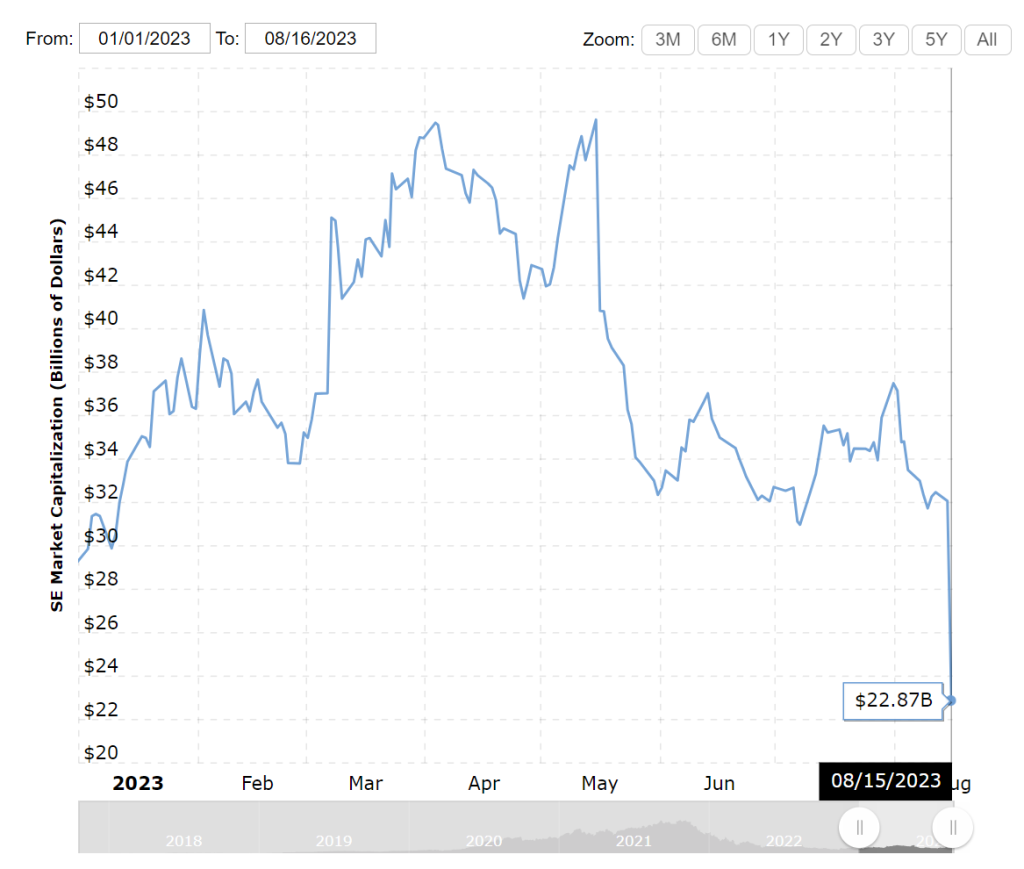

The collapse put the company in the red this year, at a loss of over 23 per cent since the beginning of 2023 and erased three years of market gains, putting it back where it was last seen in 2020.

Even more astonishingly, the fall wiped out US$9.2 billion — ~S$12.5 billion — out of its market capitalisation in just a single day, following a similar drop after the previous quarterly report which saw a S$10 billion wipeout in May.

Profit is not enough

I distinctly remember many people criticising Sea Ltd. during its growth years, when its stock hit record highs and valuation approached US$200 billion, that it was needlessly burning money as it failed to report profits.

At the time, it was losing as much as US$1 billion per quarter, but posted rapid growth which set the bar for investors’ expectations very high.

Today, paradoxically, as it has finally started making money — having collected over S$1.1 billion in profits in over the past three quarters — its value continues to drop.

In fact, not even beating earnings’ expectations could shield it from investor unhappiness.

How is that possible? Why was the company worth so much when it was burning through cash at obscene rates but is now falling when it is, seemingly, doing better than ever?

The truth is that shareholders make most of their money from growing valuation, not profits. Even if the company wanted to pay dividends, the few hundred million it makes per quarter wouldn’t offer much room to pay a meaningful amount of money to all of its stock owners.

Don’t get me wrong, dividends are nice to receive, but young companies are primarily about growth. If you buy in at the right time, you could multiply your investment by 10 to 20 times or more within just a few years. No amount in dividend payouts can trump that (assuming they would even be on the table).

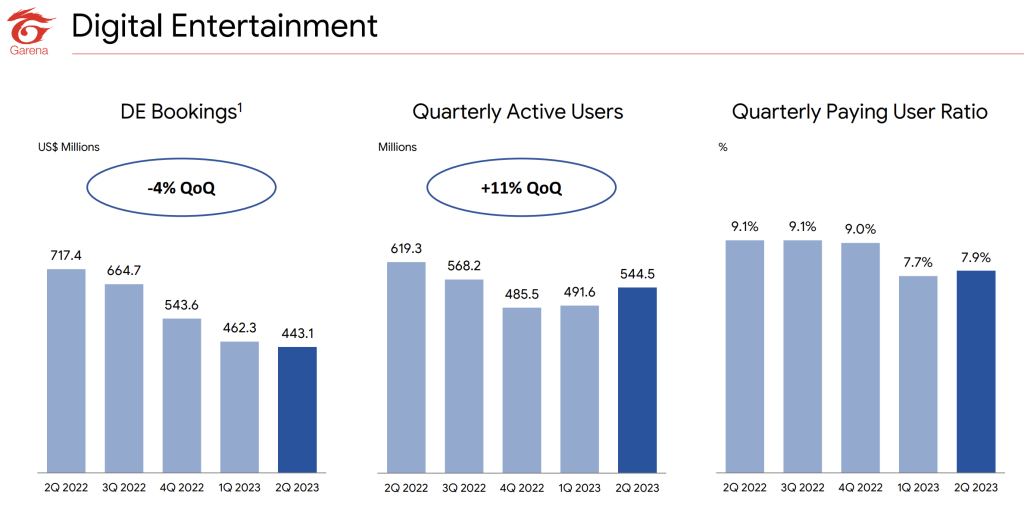

But as Sea Ltd. started cutting its expenses last year, the pace of its growth has also taken a tumble.

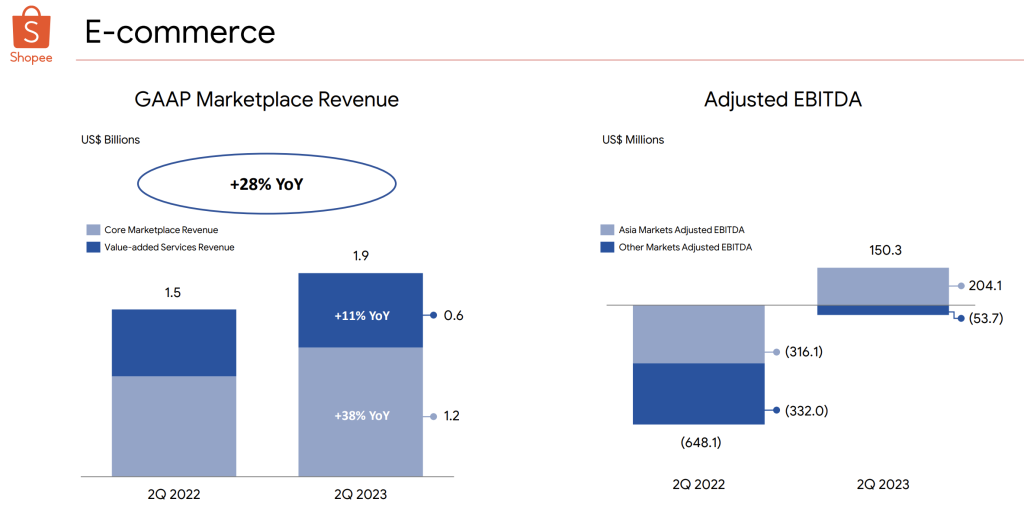

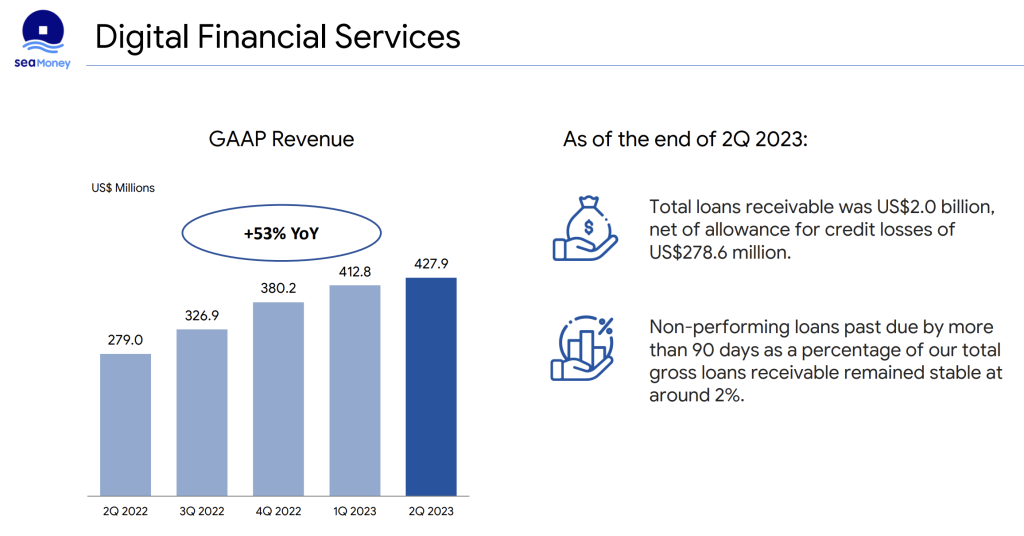

Garena continues bleeding revenue, Shopee’s growth is slowing, and its Digital Financial Services are not expanding quickly enough.

Business model faces a reality check

Growth companies attract capital on the presumption that once they attract enough people, they will be able to find ways to profitably monetise them, while continuing to expand at a relatively lower cost thanks to the brand recognition they have obtained in the process.

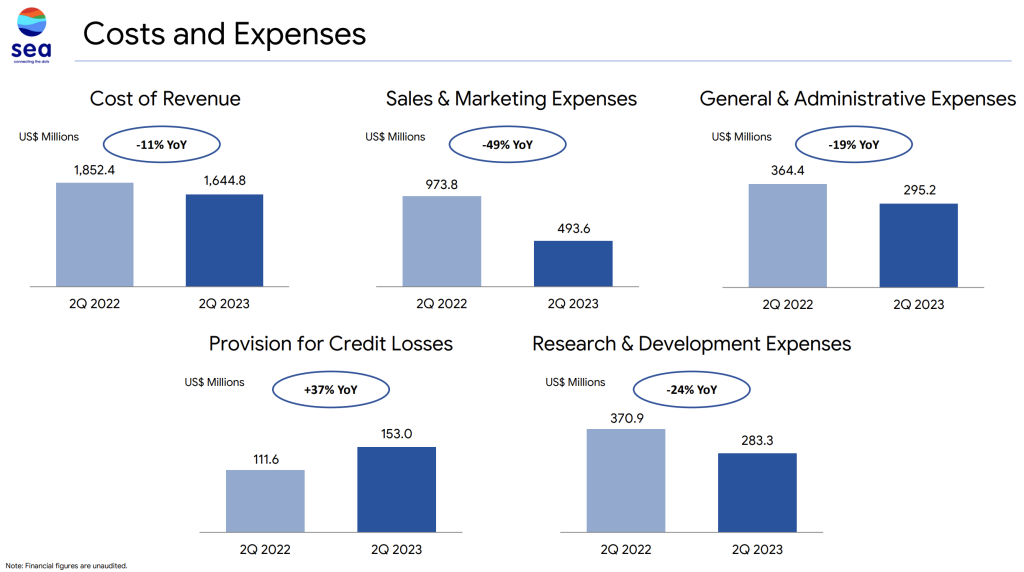

This model is now facing a reality check, as Sea reduced its marketing expenses by about 50 per cent, in search of savings in the past few quarters.

While these savings have accomplished the goal of putting the company in the black, they seem to have slowed growth too much for investors’ liking.

As a result, Sea is facing a devil’s choice now (though, to be fair, it was always expected to arrive at this point sooner or later): stick to making profits, or return to spending more money than it makes to grow its user base.

Forrest Li has already announced his decision.

Burning desire

We have started, and will continue, to ramp up our investments in growing the e-commerce business across our markets. Such investments will have impact on our bottomline and may result in losses for Shopee and our group as a whole in certain periods.

– Forrest Li, CEO of Sea Ltd.

The desire to grow the company won over profit-making, in the face of clear investor backlash exhibited by the massive sell-off of the stock yesterday.

As a result, we can expect Sea to return to burning money in the coming quarters, though likely not nearly at the pace seen in previous years, as raising new capital would be incredibly expensive, if not downright impossible at its current market valuation.

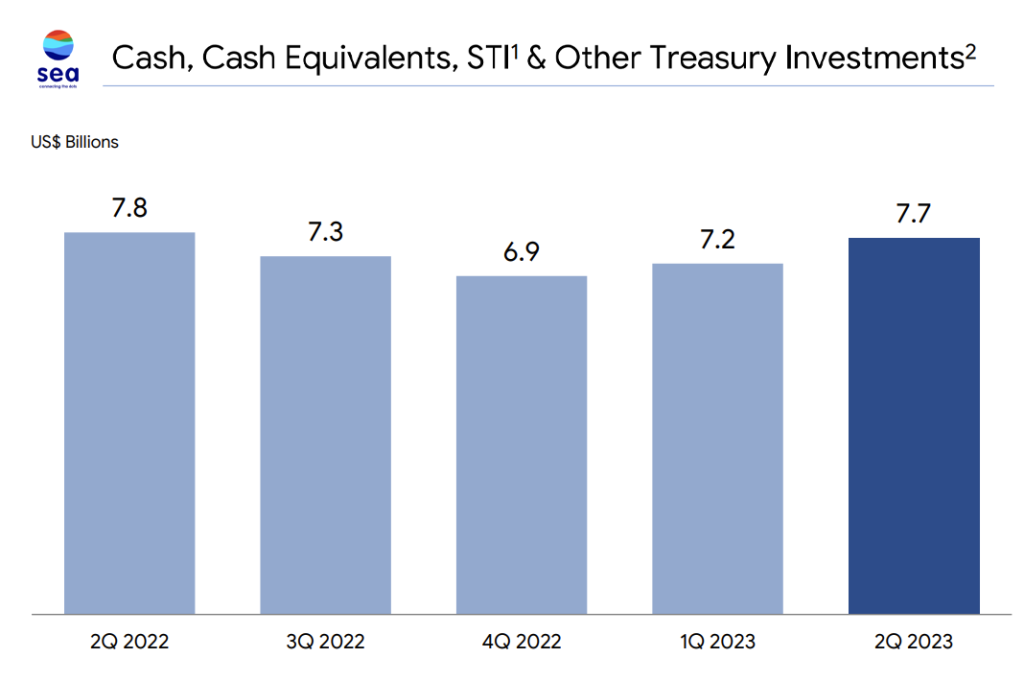

With close to US$8 billion in the bank, the company can afford to lose a billion or two per year, but not more, giving it a runway of three to four years before it may need to seek further external investment.

Perhaps, one bit of good news is that the cost-cutting exercise of the previous 12 months has provided evidence that, if forced by the circumstances, Sea can support itself.

At the same time, however, it has also established the outer bands of how it can perform in current global economic circumstances — limited, on one hand, by much reduced growth when profitable, and access to affordable financing on the other.

This, perhaps, explains best the reasons for yesterday’s sell-off, as at its reported growth rates the chances that it could multiply in value in the next few years appear to be lower than even a year or two ago — in spite of current profitability.

Cash, as it turns out, isn’t always king.

Featured Image Credit: Vulcan Post