Disclaimer: Any opinions expressed below belong solely to the author.

The dreaded second step up in Singapore’s GST increase is upon us, with the tax increasing to 9 per cent from 1 January 2024. Many citizens and politicians have been opposing or protesting the hike from 7 per cent, which was still the rate last year.

But, upon closer look, most people have nothing to complain about, really.

Like most taxes in Singapore, GST is designed in a way that burdens wealthy consumers most — while the broader society, comprising millions of regular Singaporeans, stands to benefit.

To accurately understand the impact of taxation, we first have to consider what it buys us. And, in Singapore, it’s not only infrastructure, education or healthcare, but considerably more.

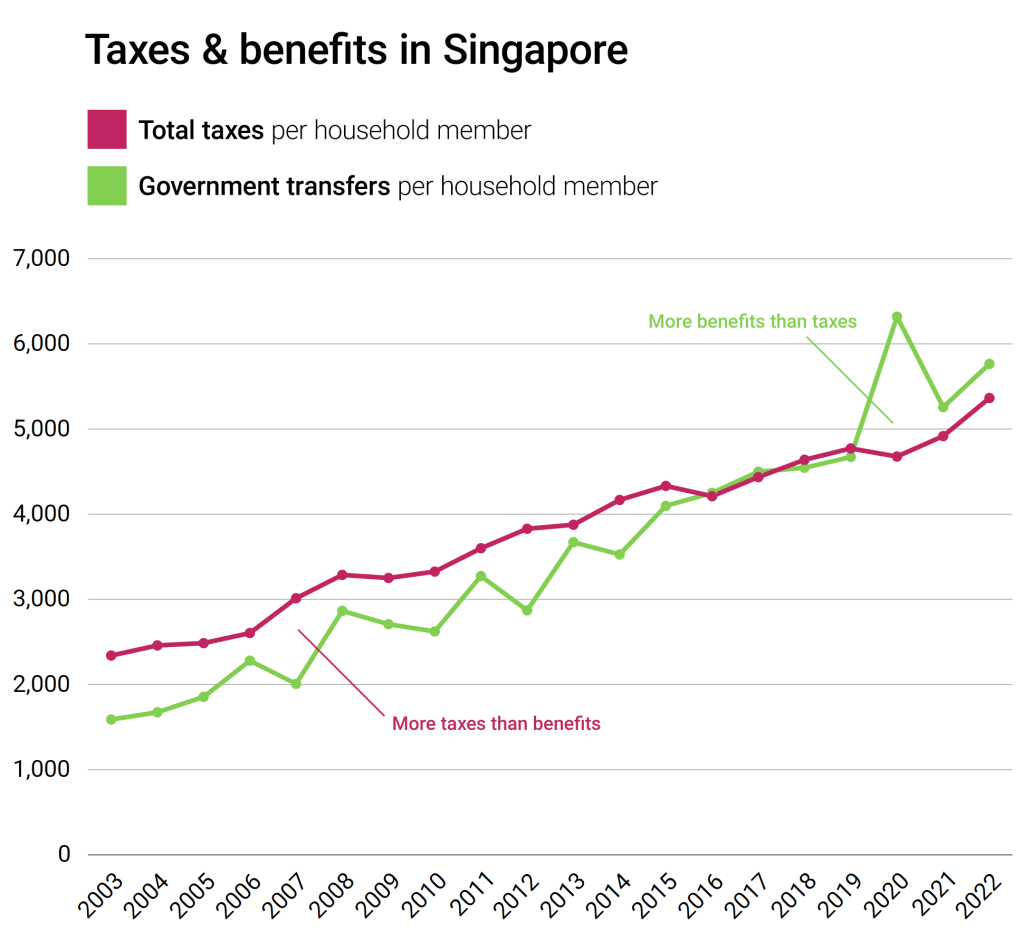

So much more, in fact, that on average, all Singapore residents receive more in government benefits than they pay in all personal taxes combined.

More than what you paid for

In 2022, the Singapore government collected an average of S$5,364 per household member across all households in the country, but paid out S$5,765 in various support schemes.

This figure is even more impressive considering that the Top 10% of the wealthiest households pay approximately 80 per cent of all income taxes, and the Top 20% contribute to about half in GST receipts.

In other words, since the above figures are only averages, it means that the vast majority of Singaporeans pay even less in taxes per household member, while receiving considerably more in return.

Please bear in mind that taxes refer to all taxes that resident households pay, including GST.

In other words, on balance, most Singaporean households not only already do not pay any taxes, but actually receive a net positive return from the government.

Eagle-eyed readers will point out that it’s obviously a result of the COVID-19 outbreak in 2020, when the government boosted support for the public and implemented additional measures to address rising living costs due to global inflation over the past year or so.

And that is true, of course — the pandemic has clearly led to higher spending. But the average between taxes paid and transfers received already reached parity in 2016, and had been quite near it in the previous few years.

In other words, since the richest have always paid disproportionately more, most Singaporeans had already been in a net positive position for a decade before the virus locked us all down for two years, with the money steadily redistributed from the wealthiest residents down.

This is confirmed by another set of figures, which averages government transfers by the type of dwelling occupied by recipients.

Occupants of the smallest HDB flats tend to be the least well-off (and may frequently be elderly), so it’s not a surprise that they receive by far the most money — whether for education, health, old age, utilities, or any other category.

But, as you can also notice, the benefits received are at least around the average for the entire nation for almost everybody living up to a 5R HDB.

This means that condominium and landed property owners are the ones paying significantly more (as there are considerably fewer of them too), so that pretty much everybody living in public housing has their own taxes offset by the transfers received from the state.

Of course, it’s not unexpected since those who live in private housing in Singapore are usually quite a bit wealthier than the rest.

But what it also shows us is that they effectively fund public benefits for everybody else — as much as 70 to 80 per cent of the society, considering that this is how many Singaporeans live in HDB apartments.

GST? What GST?

The tax/benefit situation in Singapore is such that the government could, technically, abolish all personal and consumption taxes (and corresponding benefits, of course) and, on average, everybody would still receive a few hundred dollars per year extra.

Mind you, please note that it doesn’t even include expenses on infrastructure or defence — these do not even require your taxes to be paid for.

Of course, in this scenario, the individual situation would change greatly since the richest would end up receiving massive tax relief while most Singaporeans would lose enormous state support in healthcare, education or housing grants and subsidies, along with countless other benefits.

But this is why there are personal taxes — and why GST is going up — to get a few billion dollars more out of the richest spenders in Singapore, while most of the society continues to enjoy having their tax bills offset by handouts financing some of their most crucial needs.

Unless you’re a Top 20% taxpayer living in a condo or bungalow, the coming GST hike won’t really affect you. For every dollar you pay in taxes, you receive more than a dollar back. Not a bad deal.