Disclaimer: Opinions expressed below belong solely to the author.

In a painful fall from grace, the once viral low-cost e-commerce marketplace Wish is to be acquired by Singapore’s Qoo10 for just US$173 million in cash.

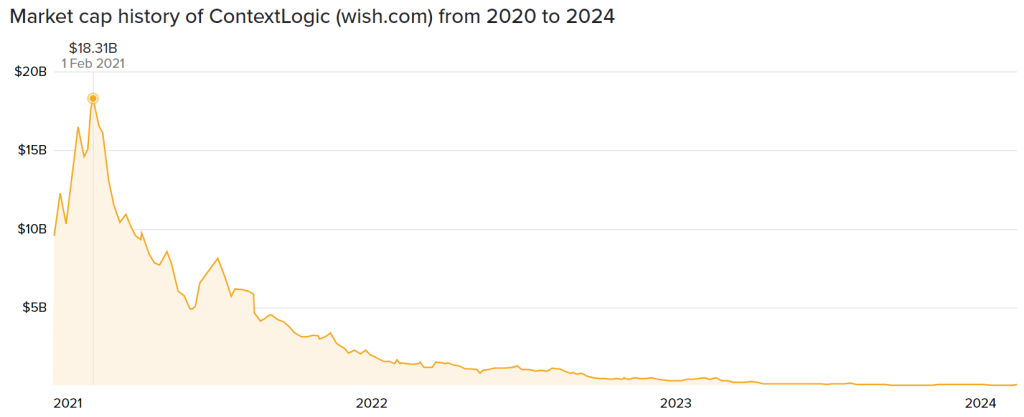

Almost exactly 3 years ago, in February 2021, the company’s value peaked at over US$18 billion, following its IPO in December 2020. It was mostly downhill from there.

Following fierce competition from other platforms sourcing impossibly cheap goods from China – like Aliexpress, Shein or recently Temu, among others – and a scandal which revealed that Wish itself ran a fake store, scamming its own users to collect data, the company lost 99% of value in little over 2 years.

“There were unbelievable bargains on “bestdeeal9,” a store hosted on the e-commerce platform Wish, including a $2,700 smart TV being sold for $1 and a gaming computer advertised for $1.30.

But none of the offers were real, and Wish knew it.

The company, an online novelty emporium that had more than $2 billion in sales last year by dangling hard-to-believe discounts, created “bestdeeal9” as an experiment. Listings that had been removed for violating Wish policies were reposted on “bestdeeal9” and used in part to track whether shoppers complained when their orders never arrived.“

The New York Times, July 2022

Q(u)oo Vadis?

So, where is this going? For Wish and its investors, it’s just a way to get back as much money as possible, chiefly from the accumulated net operating losses, worth a total of US$2.7 billion, which can be channelled into a new business (reducing its future tax liabilities).

ContextLogic (CL), Wish’s publicly traded parent, will remain in operation. Only Wish’s assets and liabilities will be sold to Qoo10. CL will effectively become a clean slate with US$2.7 billion in future tax deductions.

Meanwhile, for Qoo10 it’s a deal that considerably increases its international reach, assuming it can monetise it.

The Singapore-based marketplace is present in multiple countries in Southeast Asia, as well as Japan, South Korea, Hong Kong and China.

The bulk of its business, however, is carried through 3 marketplaces: Japan, Korea and Singapore.

According to Similarweb, the Japanese site receives between 12 and 14 million visits per month, followed by 2 million in Korea and 1.5 million in Singapore.

The acquisition of Wish should at least double these figures, opening opportunities for Qoo10 to reach substantially more diverse customer groups worldwide.

Besides that, the Wish brand surely carries some residual value, even if it’s been tainted by the company’s questionable history. A relaunch could once again attract visitors, and there are hundreds of millions around the world who have had some dealings with it in the past.

Under new management, with a new product offering and improved customer service, it may fly yet again. If that goes to plan, then Qoo10 could make a leap from its currently highly localised and relatively small operations onto the global stage.

We can only wish them all the best.