Disclaimer: Any opinions expressed below belong solely to the author. No information published below should be treated as financial advice.

Despite growing competition in the e-commerce segment, Sea Ltd. has managed to achieve its first profitable year since going public in 2017. A fairly modest US$162 million in net income last year compared favourably against the loss of US$1.7 billion in 2022.

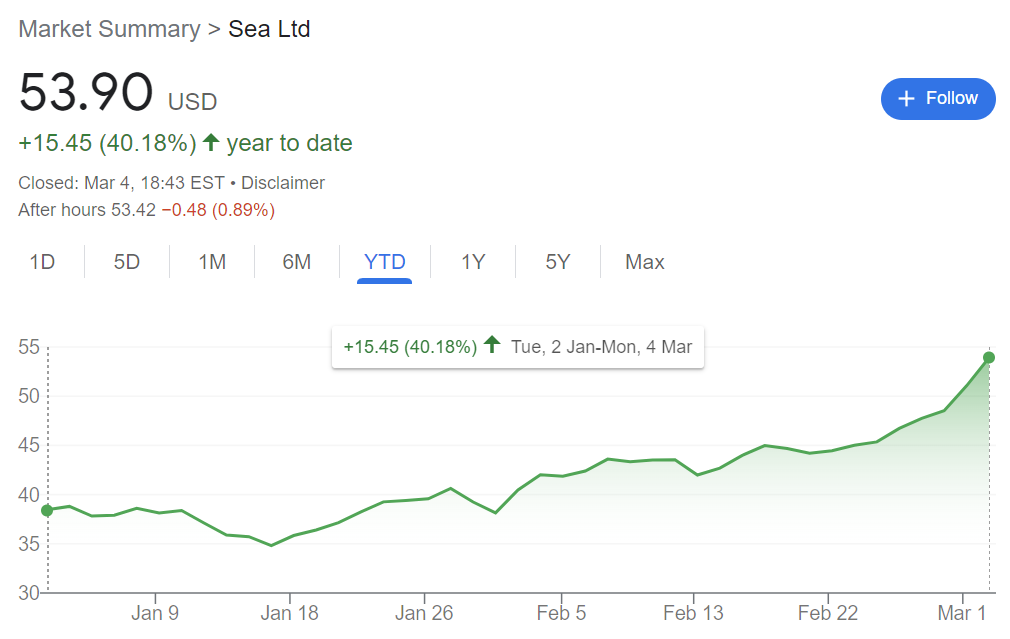

The stock market reacted positively, jumping as much as 11 per cent during yesterday’s session, before closing the day at 5.6 per cent, as some investors cashed their gains out.

This bump has pushed the year-to-date rally for Sea Ltd. stock beyond 40 per cent over just 2 months, reflecting a return of optimism about its future.

Shopee fends off competitors

Interestingly, the positive result was achieved despite a reversal of cost-cutting policy, which saw sales & marketing expenses plummet in late 2022.

In the 4th quarter of 2023 the company spent more than twice on promotional activities than it did the year before, approaching US$1 billion, driven mainly by the response to competition from Chinese companies like Temu.

This has helped to boost quarterly orders by 46 per cent and the Gross Merchandise Value by over US$5 billion compared to the Q4 of 2022.

Thanks to strong quarterly performance Shopee managed avoid statistical stagnation for the entire 2023, as without the additional 800 million orders in Q4 it would have struggled to show annual growth.

This is likely to become a recurring theme for Sea for the foreseeable future, as it tries to balance the need to spend enough to drive purchases and staying profitable in a time of restricted access to cheap capital.

In this context, perhaps the best news to come out of the company is that it has managed to grow its cash reserves by another US$1.6 billion this year, showing that liquidity should not be a problem (although it still can’t spend nearly as much as it did before the onset of global inflation in 2022).

Garena shrinks in half…

All of the above is particularly good news given that Sea’s cash cow, the digital entertainment arm Garena, has suffered a slump in the post-pandemic world, where people are no longer stuck at home playing video games.

Revenue in the segment fell by over 46 per cent, from US$948 million to just US$510 million for the last quarter, and by 44 per cent, from US$3.87 to just US$2.1 billion for the entire year.

All of these figures are below 50 per cent of what the company pulled in from gaming in 2021, when annual revenue topped US$4.3 billion, at the height of COVID-19 lockdowns.

…but SeaMoney fills the gap

Sea Ltd. is in a constant state of flux between its three constituent businesses. When one struggles others pick up.

It all started with gaming, which evolved into e-commerce — that now provides the bulk of the revenue and is likely seen by investors as the most valuable part — and digital finance, growing at a decent pace, having provided US$1.8 billion in revenue, an increase of 44 per cent over 2022.

This means that even as the composition of Sea’s revenue flows changes, the total figure keeps climbing.

In 2022 Garena brought in three times as much money as SeaMoney did, but a mere year later they were almost neck and neck.

If the trend continues (as it might given the stagnation in mobile gaming) the business that Sea was founded on may be the smallest of all by the end of 2024.

Nevertheless, Sea is seen mainly as an ecommerce company and the fortunes of Shopee are likely to dictate how it fares in the next few years, before digital banking can establish itself as a potent money maker. By then, digital entertainment might become a side note in its books.