RHB PayLater, Malaysia’s first Buy Now, Pay Later (BNPL) solution directly linked to debit cards, has officially launched.

Now, we don’t know about you, but our first reaction to that was… what does that even mean? And why do we need it?

Doesn’t a “buy now, pay later” debit card just sound like a credit card with different steps?

Well, here’s what we now know about this new innovative solution.

Instalments made easy

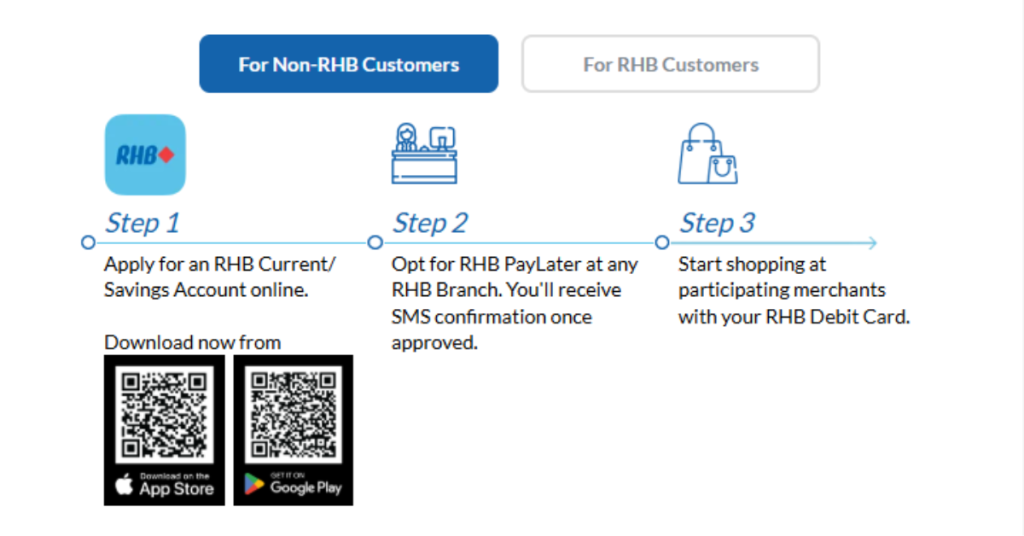

Essentially, this offering provides customers with seamless access to interest-free instalment plans of three or six months.

The “seamlessness” means that to use the BNPL features, you just need to checkout using your RHB Debit Cards, no need for a separate app or account creation.

That means RHB Debit Card holders can split payment of their purchases of up to RM1,499 down into easy instalments at selected merchants.

Featured merchants who accept RHB PayLater currently include: Machines, Al-Ikshan Sports, Gamers Hideout, TMT Thundermatch, Bubble Gum Wax, Switch, and many more.

The icing on the cake? No income requirements or guarantor needed.

Instead, RHB is using an “innovative approach” to eligibility assessment, leveraging customer behaviour analysis to pre-qualify over 500,000 existing RHB CASA (Current Account Savings Account) customers for RHB PayLater.

According to RHB, this “unique methodology” evaluates account activities such as deposits, transactions, and savings behaviour to offer seamless access without requiring additional applications.

Based on customers’ savings behaviour and account activities, RHB PayLater provides a revolving limit based, offering personalised instalment plans to suit individual cash flow needs.

By actively using their RHB accounts, customers can unlock higher eligibility and enjoy exclusive rewards, making financial flexibility more accessible and rewarding.

Although the product is “interest-free,” if the customer pays less than the monthly instalment repayment by the repayment due date, the unpaid outstanding balance after the repayment due date will be subject to finance charges.

The charges are 1.25% per month (effective rate of 15% per annum) on the outstanding amount, calculated on daily rest.

It is an alternative to credit cards

The question remains, isn’t this a credit card with different steps?

Well, the press release does actually describe the solution as a “practical alternative to traditional credit cards.”

“Designed as a modern alternative to credit cards, RHB PayLater empowers individuals including those without access to traditional credit cards to achieve financial flexibility and mindful spending habits,” the release elaborated.

By providing practical tools and user-friendly solutions, RHB stated that this product simplifies financial management, enabling customers to better manage their cash flow while enjoying greater convenience.

Dato’ Mohd Rashid Mohamad, Group Managing Director/Group Chief Executive Officer of RHB Banking Group said, “By introducing this seamless and accessible solution, we empower customers to make smarter financial decisions while enjoying greater convenience and flexibility.”

But how exactly does such a product really empower smarter financial decisions?

Smarter, or just more accessible?

Having been covering the BNPL market in Malaysia, we can’t help but notice that the hype around BNPL seems to have calmed down a little.

But that doesn’t actually mean that the industry isn’t active. It just means that BNPL has already been widely accepted in Malaysia as a payment option.

While there’s no doubt that BNPL products such as RHB PayLater help with financial inclusion, do they actually foster financial literacy?

In a conversation with financial bloggers back in 2022, Vulcan Post learnt that using BNPL has its pros and cons—when used wisely, it can be a handy financial tool for users to manage their money.

“The biggest benefit and downside of BNPL is its accessibility,” one financial blogger, No Money Lah by Yi Xuan, said. “It allows people that do not have access to loans/credits to resolve urgent financial matters, yet if misused, it can cause a deep financial spiral.”

However, Suraya Zainudin of Ringgit Oh Ringgit had shared: ““BNPL brings debt culture to the most financially vulnerable in society. Being the lesser evil than loan sharks is not an achievement.”

So, it comes down to education. Users need to know what they’re signing up for and how they should utilise it. There are some tips that the financial bloggers shared from 2022 that are still relevant today, such as only considering BNPL when you can already afford the purchase.

With that, we hope to see RHB Bank educate users on using BNPL and how RHB PayLater works.

Featured Image Credit: [From left to right] Abdul Sani bin Abdul Murad, Group Chief Marketing Officer; Dato’ Mohd Rashid Mohamad, Group Managing Director/Group Chief Executive Officer; Jeffrey Ng Eow Oo, Managing Director, Group Community Banking; and Sien Vee Loc, Head, Consumer Finance of RHB Banking Group, at the launch of RHB PayLater.