Budget 2025 roundup: 20 quick facts entrepreneurs in Malaysia need to know

Following the theme of “Ekonomi MADANI: Negara Makmur, Rakyat Sejahtera”, Budget 2025 has been tabled on October 18, 2024, by Malaysia’s Prime Minister and Finance Minister, Datuk Seri Anwar Ibrahim.

If you missed it, here are the must-know topics for entrepreneurs and startups to note.

1. The government has allocated RM421 billion for Budget 2025

The 2025 budget is the highest ever announced at RM421 billion.

RM335 billion is going towards operating expenses, while RM86 billion as development expenditure, and RM2 billion is in contingency savings.

2. The government is introducing a new Investment Incentive Framework

The government agreed to introduce a new Investment Incentive Framework that focuses on high-value activities.

This framework is expected to be implemented in the third quarter of 2025. It involves the following points:

- Tax incentives for high-added value activities in the electrical and electronics (E&E) sector, such as integrated circuit (IC) design services and advanced materials.

- Special tax deductions for people in the fields of artificial intelligence (AI), robotics, internet of things (IoT), data science, fintech, and sustainable technology.

- Incentives will be given to multinational enterprises (MNEs) spending up to RM2 million per year. There’ll also be an investment matching fund of more than RM100 million ringgit provided through an equity public funding platform for the development of local suppliers in the E&E, speciality chemicals, and medical devices sectors.

- Economic groups to be created according to state specialities—such as renewable energy in Perlis and Sabah, and specialised chemical industry in Pahang and Terengganu—to reduce the economic gap between regions.

- Income tax incentives are offered at a special rate for investment in 21 economic sectors in states such as Perlis, Kedah, Kelantan, Terengganu, Sabah, and Sarawak, subject to successful economic spillover.

- To ensure investment based on ESG, tax incentives such as investment tax allowances or income tax exemptions are given for Carbon Capture, Utilisation, and Storage (CCUS) activities.

3. Government agencies to be combined

If you’re a startup founder, you’ve likely gotten confused by all the various government agencies that exist. Well, our Prime Minister announced that several governmental entities are being combined so that they can operate more effectively. This includes:

- MAVCOM and CAAM

- InvestKL and MIDA

- Razak School of Government and INTAN

- HDC and MATRADE

4. RM200 million for CoSIF and NIDF

Next year, a total of RM200 million will be provided, covering the Strategic Joint Investment Fund (CoSIF) and the NIMP Industrial Development Fund (NIDF).

Both of these will go towards supporting the growth of SMEs and mid-sized companies and encouraging innovation.

5. KWAP to receive RM1 billion for its Dana Perintis fund

KWAP, under its Dana Perintis fund, will be allocated RM1 billion to support the activities of local startup companies, with RM200 million specifically for 2025.

6. RM300 million for the National Fund of Funds under Khazanah in 2025

The National Fund-of-Funds (NFOF) will be established under Khazanah to operate with a fund of RM1 billion.

NFOF will support venture capital fund managers investing in start-up companies with RM300 million ringgit provided for 2025.

7. Cradle Fund gets an allocation of RM65 million

The Cradle Fund is allocated RM65 million to help start-up companies with the potential to expand to regional and global levels. This also includes a 15 million ringgit grant as an incentive for GLC to work with start-up companies through corporate venture capital efforts.

8. RM50 million for Madani Micro, Small, and Medium Enterprises (PMKS) Digital Grant

RM50 million is provided as PMKS’ digital matching grant and digital vendor grant under BSN for local entrepreneurs to remain competitive in the market.

9. MCMC to receive RM100 million for online entrepreneurship

MCMC will receive RM100 million over five years to enhance Nadi (National Information Dissemination Centre) nationwide as a community platform for online entrepreneurship.

10. Forest City gets a revamp in the Johor-Singapore Special Economic Zone (JSSEZ)

The government approved Forest City as a “Duty-Free Island” to support tourism and local economic activities. A tax incentive package for the Forest City Special Financial Zone was also announced to boost financial services activities such as financial global business services and fintech.

A Single Family Office Scheme has been launched for the Forest City Special Financial Zone to promote family fund management.

An Invest Malaysia Facilitation Centre – Johor (IMFC-J) is also being established to facilitate investment in JSSEZ. This centre aims to reduce bureaucracy at various levels to speed up approval.

11. RM1 billion for Khazanah to launch the Mid-Tier Company Programme

Khazanah will launch the Mid-Tier Company Programme with a fund of RM1 billion, aimed at providing financing that supports the building of local companies’ capabilities.

12. RM40 million for Malaysian exporters promoting locally made products internationally

RM40 million is also provided under MATRADE as a “refund grant” to help Malaysian exporters promote Malaysian-made products and services on the international stage, particularly exploring new markets in Africa, Latin America, and the Middle East.

13. RM20 million for i-Tekad

According to the Prime Minister, the i-TEKAD programme offered by 13 banks and 70 implementing partners has helped more than 8,000 low-income micro-entrepreneurs.

Next year, RM20 million matching grants will be provided, with RM5 million specifically to contribute to insurance or takaful contributions for micro-entrepreneurs.

This will be matched with contributions from insurance companies or takaful operators to benefit small traders and hawkers, shippers of goods and food, as well as People’s Income Effort participants whose crops were damaged due to disasters.

14. RM40 million in matching grants for social impact investments

Supporting various social impact investments, including Shariah-compliant P2P financing and public equity financing under the MyCIF programme, the government is providing a matching grant of RM40 million.

15. RM40 billion in total for loan facilities for businesses

In total, RM40 billion is allocated as loan facilities as well as business financing guarantees under government agencies.

Micro-sized loans are available up to RM3.2 billion ringgit, among them by TEKUN and BSN to help small vendors, including the disabled, Chinese, and Bumiputera communities.

Meanwhile, Bank Pembangunan Malaysia Berhad will be providing funding of RM6.4 billion to support the financing of the infrastructure development sector, digitalisation, tourism, logistics, and transport, as well as renewable and transitional energy.

The government, through the Syarikat Jaminan Pembiayaan Perniagaan (SJPP) will continue to guarantee SME financing of up to RM20 billion, including an RM5 billion guarantee for Bumiputera SMEs.

An SME loan fund of RM3.8 billion, provided by BNM, will support entrepreneurs to move towards digital and automation in addition to continuing to help the agro-food sector and sustainable practices.

RM650 million will also be earmarked to support women and youth in entrepreneurship.

RM130 million is provided specifically to implement various programmes, including community business financing for Indian entrepreneurs.

16. Various allocations for Bumiputera entrepreneurs

For 2025, RM800 million in funding under MARA and PUNB is available for more Bumiputera entrepreneurs, including to support local artisans.

The government will also allocate RM1.3 billion to empower G1-G4 contractors (referring to the different grades of contractors), especially Bumiputera.

This gives contractors the opportunity to carry out small and medium projects such as road construction as well as the repair and maintenance of public infrastructure.

17. Minimum wage has increased to RM1,700

The government agreed to increase the minimum wage rate from RM1,500 per month to RM1,700 per month, to come into effect on February 1, 2025.

For employers with less than five employees, the government will postpone the effective date for a period of six months, making it effective on August 1, 2025.

18. RM470 million financing for female entrepreneurs

A total of RM470 million in financing funds are provided by SME Bank, BSN, Bank Rakyat, and MARA to support women MSMEs to obtain working capital, purchase assets, and further increase business capacity to a higher level.

19. Proposed tax incentives for better work-life balance

To promote work-life balance, the government is providing an additional 50% tax deduction on the cost of capacity development and software procurement incurred by employers in implementing flexible work arrangements.

An additional 50% tax deduction will be given for additional care leave facilities paid by the employer for up to 12 months to employees who care for sick or disabled children or family members.

20. RM25 million to provide financing for creative social entrepreneurs

MyCreative Ventures also provided RM25 million to support the creative industry through equity injection to high-potential companies and provide financing for creative social entrepreneurs.

-//-

At the beginning of his presentation, the Prime Minister quoted Aristotle’s Nicomachean Ethics: “The virtue of wealth is not to have it but to use it rightly.”

Truly, it’s important to make sure that funds are being allocated appropriately in order to propel Malaysia forward. We hope that with all the strategic measures, initiatives, incentives, and policies tabled at the Budget 2025, we will be able to do just that.

- Read other articles we’ve written about Budget 2025 here.

Also Read: SDEC 2024 will explore the latest trends in semicon, AI & ecommerce, here’s how to join

Featured Image Credit: Prime Minister Anwar Ibrahim

Budget 2025: What M’sians need to know about tax redemptions, subsidies & more

Prime Minister Datuk Seri Anwar Ibrahim, who is also Malaysia’s Finance Minister, has tabled the 2025 Budget in parliament today (October 18, 2024).

Here’s a breakdown of what you need to know, from tax changes and subsidy adjustments to incentives.

Taxes

Sales tax on luxury goods

While basic food items will be spared, expect to see a sales tax on non-essential, premium imported goods like salmon and avocados starting May 1, 2025.

New dividend tax for high earners

For those earning more than RM100,000 in dividend income, a 2% tax will kick in from 2025 onwards.

However, there’s good news for those investing in government-linked savings like Employee Provident Fund (EPF) or Permodalan Nasional Berhad (PNB) unit trusts, as these may be exempted, as well as dividend income from abroad.

Excise duty hike on sugary drinks

In an effort to combat rising diabetes rates, the excise duty on sugary drinks will rise by 40 cents per litre from January 2025.

Funds raised from this increase will go towards healthcare initiatives like diabetes treatment and dialysis care, especially for rural areas like Felda settlements.

Subsidies

RON95 petrol and electricity subsidies stay (for most)

Most Malaysians will continue to benefit from RON95 petrol subsidies well into 2025.

The government’s plan to introduce targeted subsidies for RON95 will likely kick in mid-2025, but 85% of the population, especially lower-income groups, won’t feel the pinch. Similarly, electricity subsidies remain untouched for the vast majority.

Education and healthcare subsidy adjustments

For the top 15% of earners, or what the government calls the T15 income group, subsidies on education and healthcare will be gradually reduced.

Savings from this cut will be redirected to upgrade public university infrastructure and boarding school facilities, ensuring those who need it most still receive support.

Incentives

Tax breaks for homeowners

First-time homebuyers have a reason to celebrate. The government is offering tax relief on loan interest payments, up to RM7,000 for homes valued at RM500,000 or less, and up to RM5,000 for homes between RM500,001 and RM750,000.

This incentive is available for three years for those who sign sale and purchase agreements from January 1, 2025, to December 31, 2027.

High-value jobs and smart logistics

A new Investment Incentive Framework, rolling out by Q3 of 2025, is set to boost high-value sectors. Tax incentives will target export growth, particularly in integrated circuit (IC) design.

Special tax deductions will be offered to private higher education institutions developing cutting-edge courses in digital technology, artificial intelligence (AI), fintech, and other future-focused areas.

Green technology incentives

To support sustainable development, companies involved in Carbon Capture, Utilisation, and Storage (CCUS) activities can look forward to tax breaks.

Additionally, the introduction of a Carbon Tax in 2026 will apply to the iron and steel industry as well as the energy sector, encouraging a shift towards low-carbon technologies.

RM1 billion for startups and venture capital

Khazanah is launching the National Fund-of-Funds (NFOF) with RM1 billion to boost startup investments, with RM300 million earmarked for 2025.

KWAP’s “Dana Perintis” initiative will further inject RM1 billion, including RM200 million in 2025, specifically to support local startups.

Regional development in focus

The government is also focusing on reducing economic gaps between regions, particularly in Perlis, Kedah, Kelantan, Terengganu, Sabah, and Sarawak.

Special income tax incentives will be granted to investments in 21 key sectors within these states. In Johor, a new Special Economic Zone is being developed, with further incentives expected by year-end to create high-value jobs.

- Read other articles we’ve written about Budget 2025 here.

Also Read: SDEC 2024 will explore the latest trends in semicon, AI & ecommerce, here’s how to join

Featured Image Credit: Prime Minister Datuk Seri Anwar Ibrahim Facebook

Budget 2025: Cash aid and other financial assistance for Malaysians of all ages

Prime Minister Datuk Seri Anwar Ibrahim, who is also Malaysia’s Finance Minister, has tabled the 2025 Budget in parliament today (October 18, 2024).

Here are key things to note when it comes to cash aid for Malaysians (regardless of age) and initiatives that will help the youths.

Cash aid for Malaysians of all ages

In 2025, the Sumbangan Tunai Rahmah (STR) and the Sumbangan Asas Rahmah (SARA) programmes will see their highest handout rates ever. The government increased the budgets for these from RM10 billion to now RM13 billion.

Our PM shared that this will support 9 million beneficiaries, or equivalent to 60% of Malaysia’s adult population.

This increase in budget allows households to receive more financial aid, from RM3,700 in 2024 to RM4,600 in 2025.

Starting next year, 4.1 million households qualify as STR recipients, and will receive cash aid of RM100 per month under the SARA programme. This is a large increase from the 700,000 recipients in 2024.

The monthly cash aid will be credited into each recipient’s MyKAD starting April 2025. This can be spent on basic necessities such as F&B, medicines, and school supplies in over 600 supermarkets and retail stores nationwide.

Single, non-married Malaysians will receive a one-off aid of RM600 under the STR programme.

Besides those programmes, Budget 2025 also increased cash aid allocations under the Social Welfare Department (JKM), from RM2.4 billion in 2024 to RM2.9 billion in 2025.

RM600 per month will be given to senior citizens. This is a RM100 increase from this year’s rate.

Poor families with children aged up to 18 years old will receive cash aid of up to RM1,000 per household:

- RM200 to RM250 per child, aged 6 years and under

- RM150 to RM200 per child, aged 7 to 18

For Federal Territories, the General Assistance Rate (Kadar Bantuan Am) is increased to RM150 per month in 2025. The maximum rate per family is RM500 ringgit per month.

Combining all the assistance offered under STR, SARA, and JKM:

- Poor households with three children are eligible to receive assistance of over RM13,000 a year. This is a slight increase compared to the RM11,000 aid at the moment.

- Poor senior citizens are eligible to receive assistance of over RM10,000 a year. This is also a RM2,000 increase from this year’s financial aid.

“This means that no one in Malaysia will have an income of less than RM1,100 per month. And this doesn’t even take into account the aid from the State Government, Zakat, and Yayasan,” Anwar stated.

“So, our responsibility is to make sure there is no drop out. Therefore, JKM and the Prime Minister’s Department (JPM) should work together and double the efforts to verify the poor.”

Other initiatives to help Malaysia’s youth

In other youth and working adult-related news, the government is increasing the minimum wage to RM1,700 per month. This will take effect starting February 1, 2025.

However, companies with less than five employees are given a 6-month postponement of this (takes effect August 1, 2025).

The Ministry of Human Resources (KSM) will publish a starting salary guide for all job sectors.

A few examples of starting salaries he listed are:

- RM2,290 for Industrial Technician and Production

- RM3,380 for Mechanical Engineer

- RM2,985 for Professional Creative Content Designer

Other initiatives to improve the people’s welfare under Budget 2025 include distributing motorcycle helmets to 67,000 poor families for children’s safety.

The government will subsidise the cost of motorcycle licence for 15 million disadvantaged youths (like students and fresh graduates).

60,000 underprivileged students who need flight tickets to return home, such as those from Sabah and Sarawak will also receive financial aid.

- Read more Budget 2025 content here.

Also Read: Sidec handpicked these 9 M’sian startups to pitch to the Tokyo govt. Here’s what they learnt.

Featured Image Credit: Anwar Ibrahim

Budget 2025: Almost RM600 million in financing allocated for halal-certified MSMEs

According to MATRADE, Malaysia’s halal industry is expected to reach a market size of US$113.2 billion by 2030.

In line with that, the MADANI government is allocating part of the RM421 billion Budget 2025 to growing the halal sector.

Bank Pembangunan Malaysia Berhad (BPMB) and SME Bank will offer special financing to halal MSMEs with available funds of almost RM600 million.

In order to speed up the issuance of halal certificates, JAKIM’s halal auditors will be increased by 100 people. The MYeHALAL system will also be improved to centralise 20 government agencies and 100 overseas halal certification bodies under one platform.

Syarikat Jaminan Pembiayaan Perniagaan Berhad (SJPP) is also ready to guarantee up to 80% of halal SME financing with a guarantee value of up to RM1 billion ringgit.

Meanwhile, MATRADE is tasked with driving the development of the capacity of more halal companies to be more competitive with an allocation of RM20 million.

- Read more Budget 2025 content here.

Also Read: Sidec handpicked these 9 M’sian startups to pitch to the Tokyo govt. Here’s what they learnt.

AI could bring in US$826bil globally by 2030. Here’s why M’sian startups should get on board.

[This is a sponsored article with MDEC.]

You read the title right.

According to Statista, the market for artificial intelligence (AI) grew beyond US$184 billion in 2024, a considerable jump of nearly US$50 billion compared to 2023.

In 2030, it’s predicted that the market will “race past” US$826 billion.

This all points to there being no better time than now to tap into the market, and the good news?

Malaysia has already set the foundations for local startups to capitalise on this growth. Here are three reasons why this is an opportunity entrepreneurs wouldn’t want to miss.

1. Malaysia is a burgeoning AI hub

This year alone—and in the span of just over a month—Malaysia saw three separate billion-dollar investment plans from global tech giants to set up data centres and drive AI initiatives:

- Microsoft: US$2.2 billion

- Google: US$2 billion

- ByteDance (parent company of TikTok): US$2.1 billion

Shiny investments aside, important work is also being done at the grassroots level.

The recently-held Malaysia Digital (MD) Tech Adoption Summit: Artificial Intelligence (AI), or MDTAS: AI, by Malaysia Digital Economy Corporation (MDEC) is one such example.

Entrepreneurs, startups, industry leaders, policymakers, academics, and other key players in the digital economy came together at this event to foster cross-industry collaboration.

Breakthrough AI innovations were showcased, business connections were fostered, and the message promoting widespread adoption of AI tech across diverse sectors rang loud and clear throughout the summit.

And this is only the beginning.

MDTAS: AI is just the first in a series of high-impact events aimed at accelerating AI adoption across industries.

2. Be the catalyst for other SMEs & MSMEs to adopt AI

Malaysia is already home to innovative companies making remarkable strides in AI, YB Tuan Syed Ibrahim Syed Noh, Chairman of MDEC, shared during his speech at MDTAS: AI.

For example, we have NextMind.AI, a homegrown company whose solution allows users to create a fully functional, multilingual website in under three minutes.

This is done through its Text2Site solution, which, as its name suggests, turns a business concept into a website that’s ready for roll-out in minutes.

Supposedly, this is a process that traditionally takes over 10 working days, so a solution like this can quickly boost businesses’ online presence and global reach.

Then there’s also Peasy AI, which provides tools such as customer segmentation, sales prediction, natural language processing for chatbots, and more, enabling businesses to optimise their operations and cut costs by up to 30%.

In particular, their solution is geared towards making online-to-offline sales lead generation much easier.

The summit was a chance for these startups to showcase how their solutions have real-world applications and how they’ve impacted the way other SMEs and MSMEs do business.

3. Shape the tech in various industries

As AI adoption picks up in the region, there’s a clear advantage for first movers who can quickly offer their AI-powered solutions to SMEs and MSMEs—you could shape the tech in various industries.

We’re talking digital banking, fintech, healthcare, and so much more.

AI adoption in Malaysia is still in a nascent stage, but there’s little doubt that it’s poised to reshape business landscapes, and those who choose a “wait-and-see” approach could miss out on reaping the benefits.

-//-

Minister of Digital, YB Gobind Singh Deo, said at MDTAS: AI, “We envision a country where all layers of society can adopt technology and utilise AI.”

It’s a challenging ambition, but one that the nation isn’t backing down from realising.

Through its AI initiatives, MDEC has already successfully onboarded 140 AI solution providers into the MD AI ecosystem. Additionally, these companies have generated RM1 billion in revenue.

Malaysia’s ASEAN chairmanship is right around the corner, and these moves show that our nation is determined to walk the talk when it comes to bolstering AI growth.

Now, the ball is in the court of our local entrepreneurs and startups to step up and be a part of this transformative journey.

- Stay up to date with future MDEC events here.

Also Read: SDEC 2024 will explore the latest trends in semicon, AI & ecommerce, here’s how to join

Featured Image Credit: MDEC / (left to right) Ts. Datuk Fadzli Abdul Wahit, Head of Transformation, MDEC (Moderator); Dato’ Fahri Aminudi, Resource Director, GDS IDC Services; Tiensoon Law, Deputy CEO, Innov8tif; and Ts. Tan Aik Keong, CEO, Agmo Group

Gaining US$34 billion this year alone, Sea is back on top & second only to DBS in S’pore

Disclaimer: Unless otherwise stated any opinions expressed below belong solely to the author, who doesn’t hold any stake in Sea Ltd. or any of its competitors.

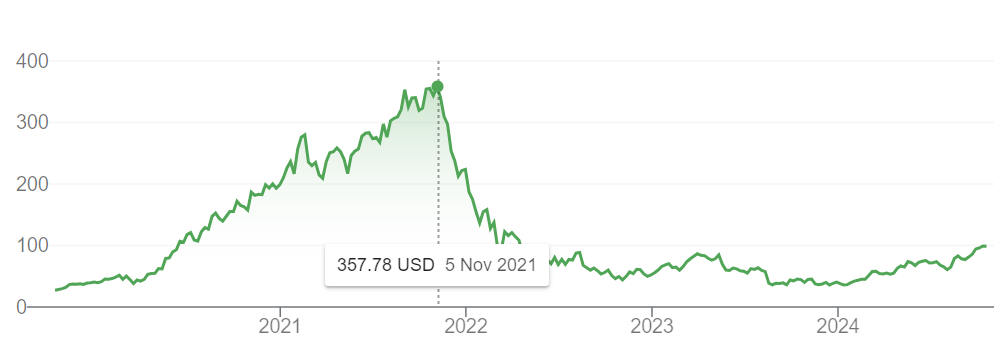

Following the implosion of the inflated tech stocks in late 2021 Sea Ltd. lost around 90 per cent in value at its lowest point, as money hastily receded. Now, however, the one time darling of the investors is gradually clawing back its position.

The stock is once again trading at close to US$100 per share—perhaps a far cry from the $350 it hit three years ago, but certainly a lot more respectable than the mid-30s it saw last year. Yes, if you invested in Sea last August you would have nearly tripled your money by now, after the stock gained over 170 per cent (over 150 this year alone).

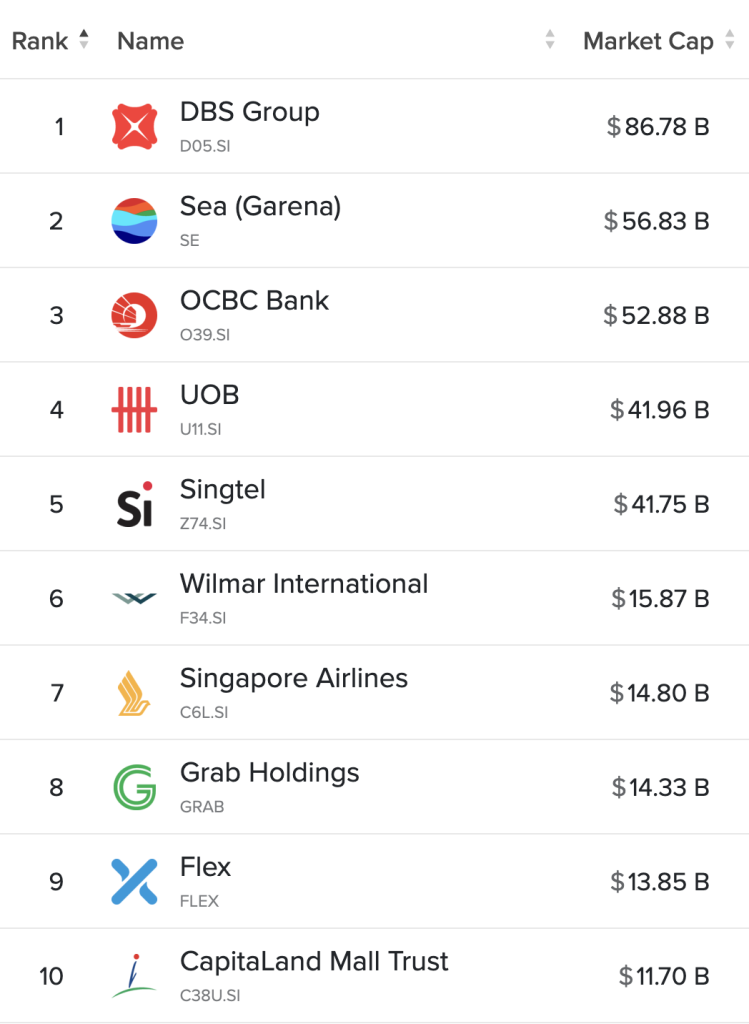

Its 2024 rally added more than US$34 billion to its value, putting its market capitalisation above US$56 billion, more than OCBC’s US$52 billion and second in Singapore only to DBS:

Why is Sea attractive again?

In one word? It matured. We could dissect the quarterly earnings reports to seek guidance in figures going up or down, but in reality it’s about the bigger picture.

The last time Sea was red hot it was not only on the back of a huge surge in capital flooding stock markets back in 2021, on the back of a Covid rebound fueled by government stimulation of the economy in the USA, but it was one of those hyper-growth startups which bode well for the future.

It didn’t make any money but it grew rapidly and expanded to new markets.

But once the bull market turned into a collapse, as investors realised their gains and turned more cautious as tech industry in general saw huge drops in value, Sea had little to prop it up.

What’s worse, the post-Covid thawing of lockdowns meant that people neither spent as much time gaming online as before (hurting Garena) nor shopping (what slowed Shopee’s rapid growth).

Add to that the fact that Sea wasn’t turning a profit and the cash reserves it had built up could last for two to three years of its high burn rate, the prospects weren’t very good, including a non-trivial risk of bankruptcy, given that raising capital was no longer cheap.

The subsequent two years had been spent on addressing the fundamentals, cutting costs and pushing the company into the black—which it, amazingly, achieved already in Q4 of 2022.

However, concerns grew again, this time over growth.

After all, investors are not looking for dividend payouts from a company that barely breaks even. They seek high return on investment in the form of stock appreciation, which depends on its growth.

But growth had slowed down and Forrest Li had to abandon prudence and spend more again to support revenue in the middle of 2023, what put Sea back in the red and sent the stock tumbling again, from over $80 in May to just $36 in August of that year.

Today, however, it seems that investors have grown comfortable that the company is, a) able to survive, so their downside risk has been significantly reduced, and b) presents attractive prospects, increasing its results by healthy two digits year on year.

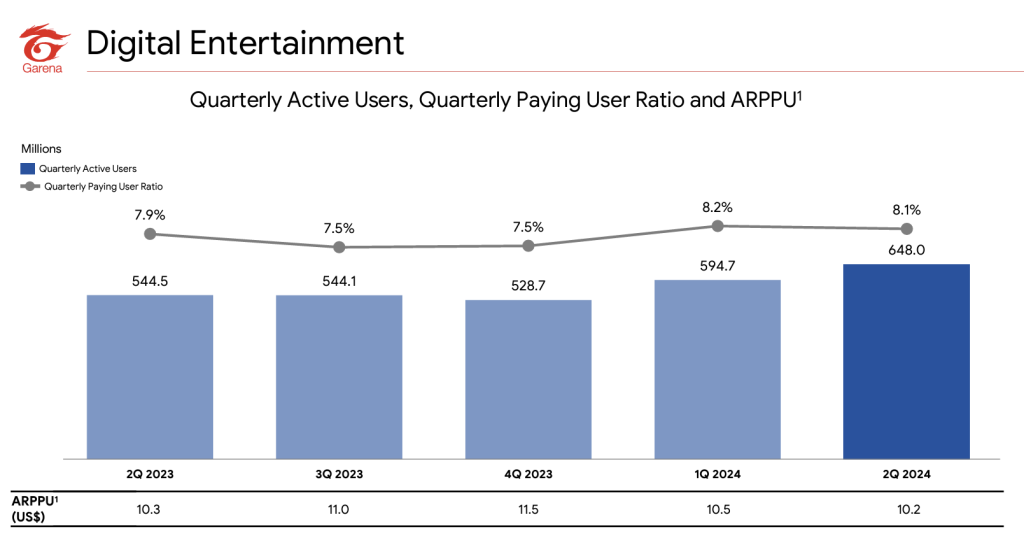

As of last quarter all of its business units are growing, including Garena, which suffered a painful post-Covid slip that it has now rebounded from.

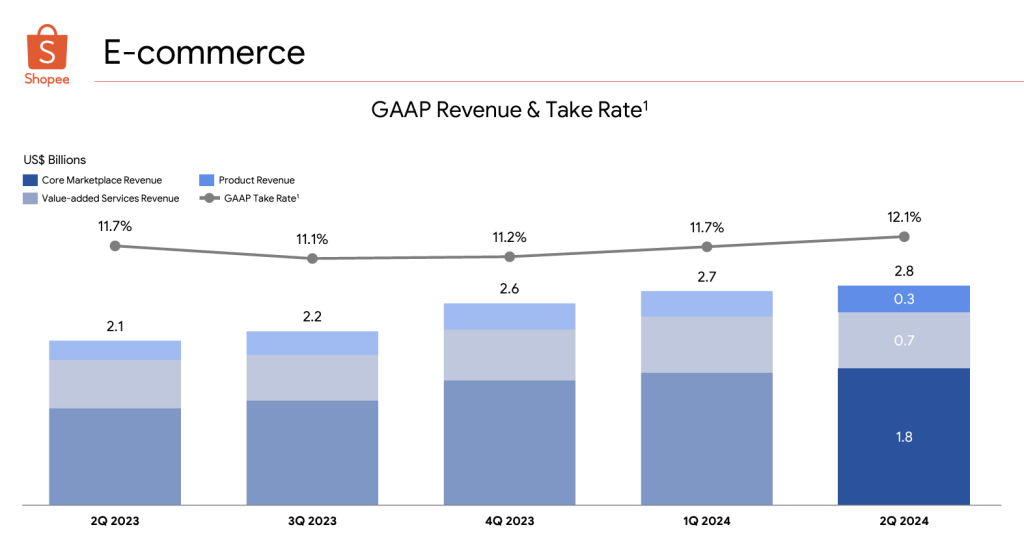

Shopee maintains its trajectory, seeing its revenue increase by $700 million year on year—or by one third—while bumping its take rate, which is expected to further increase as Sea hiked its commissions recently.

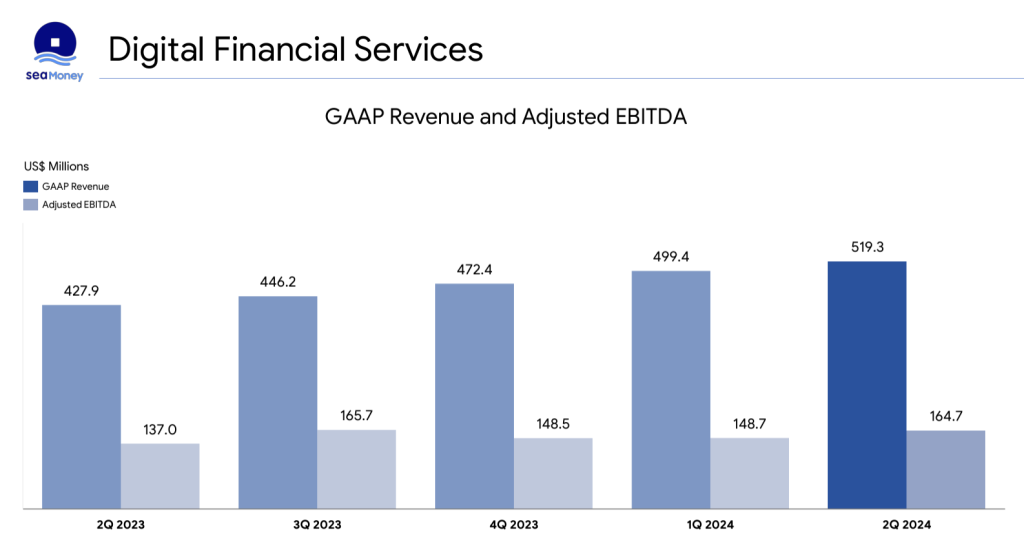

Finally, SeaMoney, the digital finance arm of the business holds its upward course as well, generating over half a billion in quarterly revenue already.

Moreover, Sea didn’t have to dip into its cash reserves too deep even in the most demanding of times, meaning that it still holds onto US$9 billion, giving it a healthy margin for adjustments and investments on a needs basis.

The spectre of bankruptcy appears to have been extinguished and the company is here to stay, while still capable of producing high growth amid less than ideal conditions.

It’s a mature business now and is treated as such.

Also Read: Sea Ltd. is growing again, doubles in valuation to US$40 billion in just 4 months

Featured Image Credit: Sea

How Petite Fleur’s founder grew her side hustle to a full-fledged business in Singapore & beyond

[This is a sponsored article with Visa.]

Not many florists can say they’ve had the privilege of arranging flowers for magazine covers or designer runway shows. But Petite Fleur can, as one of the few local florists that has successfully branched out beyond Singapore.

Patricia Tanuwijaya, founder and CEO of Petite Fleur, would’ve never imagined how her love for flowers would evolve into the thriving business it is today.

Looking back, she needed more than just passion to succeed—she had to learn how to run a business quickly as a young entrepreneur.

While juggling her career as an accountant at PwC, Patricia established Petite Fleur in 2017 after gaining an interest in floristry and creating her flower arrangements for her family and friends. However, Patricia soon found herself working around the clock as the business grew and orders started to come in.

“It got to a point where I felt very burnt out juggling two jobs with very little sleep,” lamented Patricia, adding that she was always rushing home after work to order her flowers, arrange deliveries, and often worked until 2 a.m. every morning to fulfil her orders on time.

Eventually, Patricia decided to take a leap of faith and leave her auditing career behind to become a full-time florist and grow Petite Fleur.

Managing finances was her biggest pain point

Branding themselves as an “online flower delivery shop”, Patricia not only had to learn how to be her own boss on the fly, but she also struggled to manage the business’s financial operations effectively.

At the start, Petite Fleur solely accepted cash on delivery and bank transfers, which made the bookkeeping process tedious and time-consuming. “I had to remember each and every cash transaction if I did not record it down right away,” said Patricia.

This also led to frequent payment collection issues with customers, especially when some cancelled their orders at the last minute, while others required multiple follow-ups before making payment, or even refusing to pay for their orders after delivery, which was the last straw for Patricia.

Hence, she decided to stop accepting cash and bank transfers altogether and pivot to Visa’s card payment acceptance solutions. This allowed Petite Fleur to establish greater trust and transparency with her customers, as they had to confirm their orders and make payments before their flowers were delivered.

“Accepting Visa card payments legitimises the business and empowers us to focus our efforts on running the business,” added Patricia.

This turned out to be the right move as Petite Fleur saw a significant increase in revenue, achieving a steady year-on-year growth of 20 to 30 per cent since they started to accept Visa card payments.

Making it easier to run the business

In line with digitalising her finance operations, Patricia also uses a Visa business card to simplify her business payments.

Previously, she was using her personal credit card to make business expenses, and it was time-consuming as she had to look through monthly bank card statements to segregate her personal and business expenses.

Having a business card makes Petite Fleur’s business expenses and cash flow more visible and relieves Patricia from redundant administrative tasks.

Aside from having dashboards and generating reports, it also allows her to perform bulk or scheduled payments to ensure bills are paid on time.

With separate business cards, I can easily track expenses, generate reports, and reconcile finances. I don’t have to worry if my cash expenses or income got recorded properly.

Patricia Tanuwijaya, founder of Petite Fleur

Another key benefit of a business credit card is the ability to unlock instant cash flow with zero interest for up to 55 days, which is critical for small businesses like Petite Fleur.

Leverage digital payment solutions to grow your business

With the help of Visa’s payment solutions, Patricia was able to expand her operations, move into a bigger studio in Singapore, and branch out to Jakarta, Indonesia, last year with a larger team of florists supporting its operations.

Moving forward, she hopes to expand beyond Singapore and Indonesia, with plans to open new offices in Kuala Lumpur, Malaysia, and Melbourne, Australia, in the next two years.

She also expressed her confidence that Petite Fleur will continue flourishing and bringing joy to many more customers.

As a working mother of two children, Patricia recognises the benefits of digital payment solutions to optimise her finance processes and free up valuable time in her busy schedule.

“If I can run the business efficiently, I have more time to spend with my kids,” she said.

By improving the business’s overall efficiency and productivity, Petite Fleur can concentrate on fulfilling orders and generating revenue, supporting their growth ambitions to expand further across the region.

Learn more about Visa’s solutions for small businesses here and read more insights below.

- Read more insights from Visa here.

- Read other articles we’ve written about Singaporean startups here.

Also Read: This S’porean biz isn’t just making bar soaps, it’s saving the environment while at it too

Featured Image Credit: Petite Fleur

Here are the 5 M’sian winners that bagged RM35K each from MYStartup’s 4th pre-accelerator

[Written in partnership with MYStartup, but the editorial team had full control over the content.]

Powered by Cradle and WatchTower and Friends, the MYStartup Pre-Accelerator Cohort 4 successfully concluded its Demo Day on October 4.

This marks the culmination of over three months of intensive mentorship, training, and business development.

11 finalist startups presented their minimum viable products (MVPs) to a panel of judges, showcasing innovative solutions spanning industries such as fintech, healthtech, and agritech.

These startups were among the 30 initially shortlisted for the programme, having undergone a rigorous process to refine their business models and strategies for market entry.

The judging panel featured key figures from Malaysia’s startup ecosystem. This includes:

- Zehan Teoh, Head of Ecosystem Development at Cradle

- CK Chang, founder of OXWHITE

- Audra Pakalnyte, Partner at First Move

- Yeoh Chen Chow, an hourly advisor and angel investor

- Steven Wong, Chief Technology Officer (CTO) of pitchIN

Each startup was evaluated based on criteria such as level of innovation, market potential, and execution capability.

From the 11 startups, five startups were crowned the top winners, each receiving RM35,000 in cash prizes alongside additional support and access to MYStartup and partner perks.

The top five startups are as follows:

1. DashAdd

DashAdd provides AI-powered dashboards that help businesses track financial performance, forecast cash flow, and secure funding for smarter growth.

The startup is led by co-founder and CEO Awzair Hamid, who has a wealth of experience in auditing and financing roles.

2. IOXTECH Global

IOXTECH Global is a startup revolutionising construction management with real-time monitoring, seamless progress reports, and efficient workforce tracking for on-time, on-budget completions.

Muhd Amin Rafiq, the co-founder of IOXTECH Global, shared that before the programme, he had felt uncertain about where to start but shared that the structure and tools provided have been invaluable in building the startup’s MVP.

“We’ve gained critical insights into startup development, and the mentors’ feedback has helped us fine-tune our business model and validate our strategies for the market.”

3. Faradays Energy

Creating a new generation of green technologies, Faradays Energy enables clean, abundant, and low-cost hydrogen.

With the goal to provide a cost-effective alternative to traditional energy sources, Faradays Energy’s solution will reduce greenhouse gas emissions and improve air quality, ending the age of fossil fuels.

The company is led by co-founders Yoghen Pillai C Manoharan and Viknesh S Balachandran.

4. Nanofertech

Nanofertech’s solution involves AI-powered controlled-release technology for precise fertilisation in agriculture.

Co-founder of Nanofertech, Nisha Govender, shared, “Throughout the programme, we connected with successful founders who generously shared their insights, especially the mistakes they made along the way. Learning from their experiences helped us avoid common pitfalls and gain valuable insights.”

“It was incredibly motivating and relatable as a young startup. I highly recommend the pre-accelerator to anyone starting or running a business, as it provides powerful validation and mentorship that refines your business plan to ensure market relevance.”

5. Vidanex

This startup is pioneering AI-driven cancer diagnosis with faster results and personalised treatment using advanced digital imaging.

“Incorporating digitalisation into our workflow revolutionises the traditional processes of pathology and diagnostic interpretation,” its website stated. “Through advanced digital platforms, we streamline the entire diagnostic workflow, from sample collection to result analysis.”

Vidanex is reported to be the first spin-off company of the International Medical University. The Kuala Lumpur-based startup is led by co-founder Daniel Lim.

No shortage of talent in Malaysia

Speaking at the event, Norman Matthieu Vanhaecke, Group CEO of Cradle, praised the quality of the pitches.

He said, “The innovation and entrepreneurial spirit demonstrated by this cohort reaffirms our confidence in Malaysia’s talent pool. Startups are the pioneers who see opportunities where others see obstacles, and at Cradle, we understand their vital role in shaping the future of Malaysia’s economy.”

Sam Shafie, CEO and co-founder of WatchTower and Friends, shared that the team has been running programmes for entrepreneurs since 2015. Throughout the years, they can attest that there’s no shortage of talent in Malaysia.

This much is obvious by just looking at the top five winners on the recent demo day.

In any case, this is just the first step for all the startups, including other finalists and participants of the pre-accelerator. With the support of platforms like MYStartup, the road ahead for them will hopefully be long and fulfilling.

On that note, applications for Cohort 5 of this pre-accelerator are open from now until November 6, 2024, more details here.

Also Read: SDEC 2024 will explore the latest trends in semicon, AI & ecommerce, here’s how to join

Featured Image Credit: MYStartup