This S’porean padel startup has bagged 7-figure funds, set to open clubs in M’sia & S’pore

These days, pickleball has been all the rage. Almost every other person I know has tried the sport.

Perhaps arguably underlooked, though, is padel.

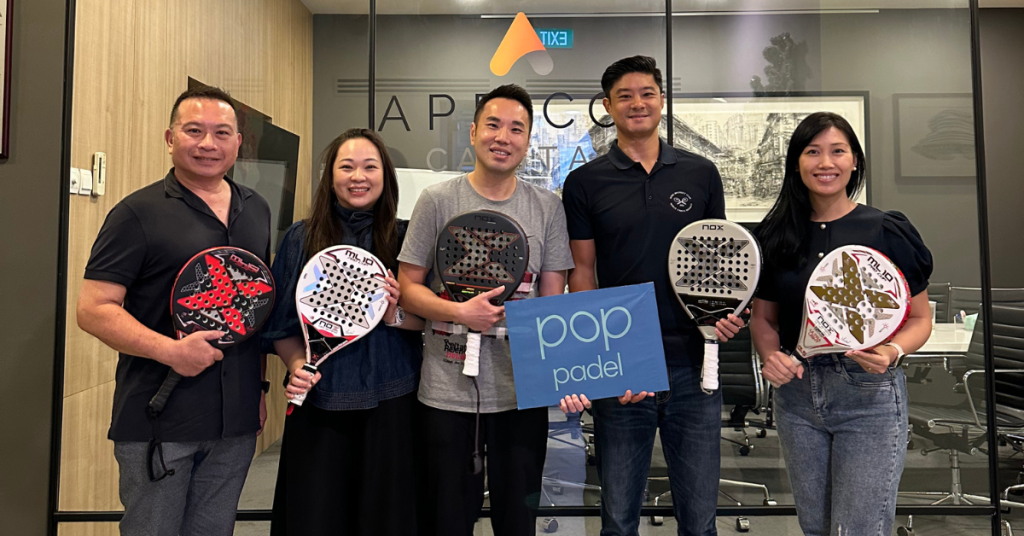

But maybe that’s about to change through the rise of Pop Padel, an upcoming premium padel club that just secured a seven-figure investment from Apricot Capital, a Singapore-based private investment firm.

Pop quiz: Who’s Pop Padel?

Based in Singapore, Pop Padel aims to be present in Singapore and Malaysia, with the vision of establishing both countries’ first premium padel facilities.

The objective is to offer world-class, tournament-standard courts and a vibrant hub for padel enthusiasts of all skill levels to connect, play, and grow.

Originating from Mexico, padel (also known as padel tennis) is a racket sport typically played in doubles on an enclosed court. The court is slightly smaller than a doubles tennis court, and the racquets are made of a composite material without strings, but with perforations (i.e. holes).

The seven-figure investment comes after Pop Padel won a government tender to build Singapore’s first purpose-built fully sheltered social padel club that will host four world-class courts in Redhill.

According to a press release, this was a highly coveted tender. There had been eight bidders, and Pop Padel had bid S$19,000, the second-highest amount. Price aside, the tender was also evaluated based on quality aspects.

What’s popping?

So, what exactly will Pop Padel’s Redhill club offer?

Working with Spanish padel court manufacturer MejorSet, the club will feature panoramic courts equipped with the manufacturer’s latest Mondo turf. They’re also working with NOX, a notable padel brand, to set up a pro shop.

According to Pop Padel’s website, they will also organise various social events and tournaments, as well as a booking app with a rating system.

Beyond the courts’ mats, the club will include an F&B area and a recovery zone with cold plunges for padelists to relax and unwind.

The same will be replicated for the brand’s first Malaysian outlet, which will feature six fully sheltered competition-grade courts in Bamboo Hills.

The fresh funds from Apricot Capital will be key in establishing these state-of-the-art facilities in both Singapore and Malaysia, advancing Pop Padel’s vision of fostering a vibrant padel community across Southeast Asia.

“Securing this buy-in from Apricot Capital is a huge step forward for us at Pop Padel,” said founder Davy Sanh.

Davy has been recognized by the global industry in 2024 as one of the top 50 most influential figures in the emerging world of padel.

“With Apricot’s support and shared belief in our goal of growing padel across countries, Pop Padel is poised to reinvigorate the sports scene and elevate padel as a sport of choice amongst the population living in Southeast Asia in time to come.”

Apricot Capital is the family office of Teo Kee Bock and his family. Teo was formerly founder and chairman of SGX listed company, Super Group Ltd. They’re also the family behind Oatbedient.

The ball’s in their court

Through the support of Apricot Capital, the team hopes to accelerate the adoption of padel in Southeast Asia.

Its multi-country debut is set to happen in March 2025, when both the Redhill and Bamboo Hills clubs will open.

Only time will tell, but perhaps the pickleball hype has helped set the stage locally for padel to take centre stage—or rather, court. And Pop Padel might just be the one to make good on that golden opportunity.

Also Read: CARiNG’s CNY video reminds us what “home” really means, and it’s not about a place

Featured Image Credit: Pop Padel

RHB just launched Malaysia’s 1st “debit card-linked BNPL solution.” What does that even mean?

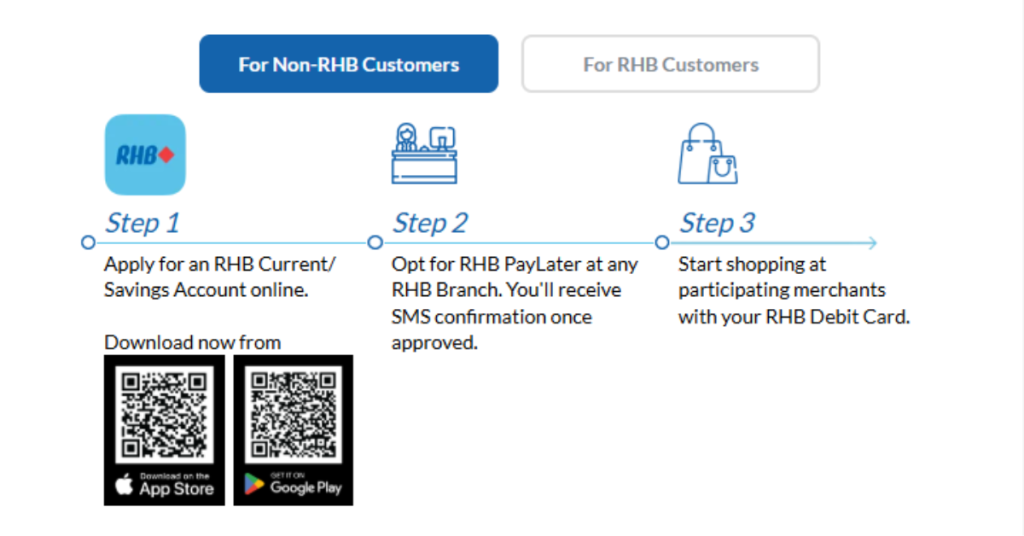

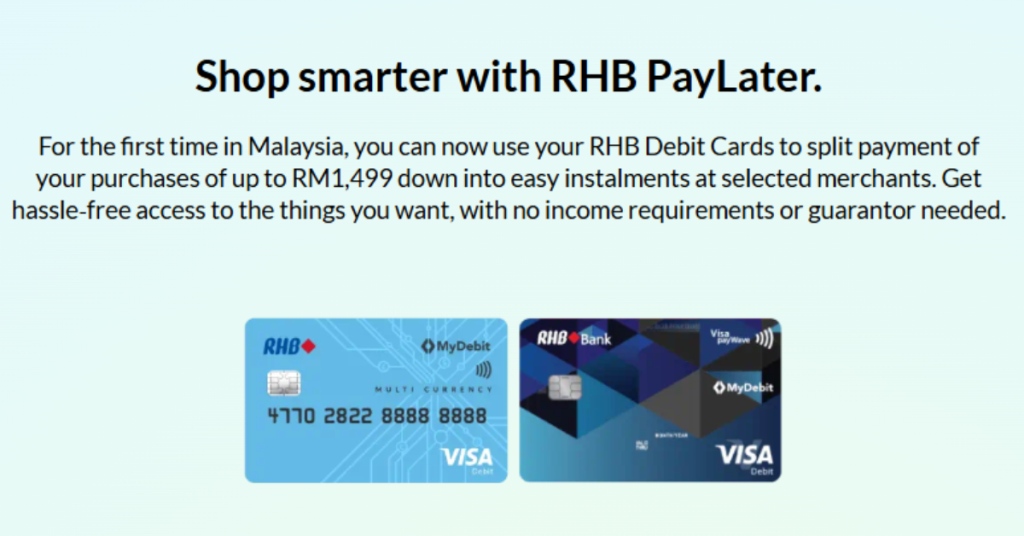

RHB PayLater, Malaysia’s first Buy Now, Pay Later (BNPL) solution directly linked to debit cards, has officially launched.

Now, we don’t know about you, but our first reaction to that was… what does that even mean? And why do we need it?

Doesn’t a “buy now, pay later” debit card just sound like a credit card with different steps?

Well, here’s what we now know about this new innovative solution.

Instalments made easy

Essentially, this offering provides customers with seamless access to interest-free instalment plans of three or six months.

The “seamlessness” means that to use the BNPL features, you just need to checkout using your RHB Debit Cards, no need for a separate app or account creation.

That means RHB Debit Card holders can split payment of their purchases of up to RM1,499 down into easy instalments at selected merchants.

Featured merchants who accept RHB PayLater currently include: Machines, Al-Ikshan Sports, Gamers Hideout, TMT Thundermatch, Bubble Gum Wax, Switch, and many more.

The icing on the cake? No income requirements or guarantor needed.

Instead, RHB is using an “innovative approach” to eligibility assessment, leveraging customer behaviour analysis to pre-qualify over 500,000 existing RHB CASA (Current Account Savings Account) customers for RHB PayLater.

According to RHB, this “unique methodology” evaluates account activities such as deposits, transactions, and savings behaviour to offer seamless access without requiring additional applications.

Based on customers’ savings behaviour and account activities, RHB PayLater provides a revolving limit based, offering personalised instalment plans to suit individual cash flow needs.

By actively using their RHB accounts, customers can unlock higher eligibility and enjoy exclusive rewards, making financial flexibility more accessible and rewarding.

Although the product is “interest-free,” if the customer pays less than the monthly instalment repayment by the repayment due date, the unpaid outstanding balance after the repayment due date will be subject to finance charges.

The charges are 1.25% per month (effective rate of 15% per annum) on the outstanding amount, calculated on daily rest.

It is an alternative to credit cards

The question remains, isn’t this a credit card with different steps?

Well, the press release does actually describe the solution as a “practical alternative to traditional credit cards.”

“Designed as a modern alternative to credit cards, RHB PayLater empowers individuals including those without access to traditional credit cards to achieve financial flexibility and mindful spending habits,” the release elaborated.

By providing practical tools and user-friendly solutions, RHB stated that this product simplifies financial management, enabling customers to better manage their cash flow while enjoying greater convenience.

Dato’ Mohd Rashid Mohamad, Group Managing Director/Group Chief Executive Officer of RHB Banking Group said, “By introducing this seamless and accessible solution, we empower customers to make smarter financial decisions while enjoying greater convenience and flexibility.”

But how exactly does such a product really empower smarter financial decisions?

Smarter, or just more accessible?

Having been covering the BNPL market in Malaysia, we can’t help but notice that the hype around BNPL seems to have calmed down a little.

But that doesn’t actually mean that the industry isn’t active. It just means that BNPL has already been widely accepted in Malaysia as a payment option.

While there’s no doubt that BNPL products such as RHB PayLater help with financial inclusion, do they actually foster financial literacy?

In a conversation with financial bloggers back in 2022, Vulcan Post learnt that using BNPL has its pros and cons—when used wisely, it can be a handy financial tool for users to manage their money.

“The biggest benefit and downside of BNPL is its accessibility,” one financial blogger, No Money Lah by Yi Xuan, said. “It allows people that do not have access to loans/credits to resolve urgent financial matters, yet if misused, it can cause a deep financial spiral.”

However, Suraya Zainudin of Ringgit Oh Ringgit had shared: ““BNPL brings debt culture to the most financially vulnerable in society. Being the lesser evil than loan sharks is not an achievement.”

So, it comes down to education. Users need to know what they’re signing up for and how they should utilise it. There are some tips that the financial bloggers shared from 2022 that are still relevant today, such as only considering BNPL when you can already afford the purchase.

With that, we hope to see RHB Bank educate users on using BNPL and how RHB PayLater works.

Also Read: CARiNG’s CNY video reminds us what “home” really means, and it’s not about a place

Featured Image Credit: [From left to right] Abdul Sani bin Abdul Murad, Group Chief Marketing Officer; Dato’ Mohd Rashid Mohamad, Group Managing Director/Group Chief Executive Officer; Jeffrey Ng Eow Oo, Managing Director, Group Community Banking; and Sien Vee Loc, Head, Consumer Finance of RHB Banking Group, at the launch of RHB PayLater.

Grab & GoTo are allegedly eyeing a 2025 merger, but GoTo denies reports

Grab and GoTo are in advanced discussions for a possible merger, hoping to overcome years of losses in Southeast Asia.

According to Bloomberg, the two firms, valued at over US$25 billion, aim to finalise an agreement by 2025.

However, in a filing on February 4, GoTo has denied any ongoing merger talks, adding that it was not engaged in discussions with any party.

The company, which was formed in a May 2021 merger between ride-hailing firm Gojek and ecommerce platform Tokopedia, also noted separately that it “does not have any material corporate action plans for the next 12 months other than the implementation of share buybacks.”

On-and-off discussions for years

Earlier in 2024, similar reports surfaced about potential merger talks between the two firms, but GoTo also refuted those claims at the time.

The companies have reportedly engaged in on-and-off discussions for years but faced disagreements and potential antitrust challenges due to their dominance in key markets like Indonesia and Singapore.

If the merger proceeds this time, it could help lower costs and ease competitive pressure in the region.

Slower growth

While both firms have made significant progress towards profitability following their stock-market debuts, their growth has slowed significantly in recent years.

With customers cutting back on spending due to high inflation and interest rates, Grab and GoTo have seen lower demand for their services.

In response, both firms have pursued smaller strategic deals to strengthen their financial positions. Grab bought a supermarket chain in Malaysia (Jan 2022) and a reservation app in Singapore (July 2024), while GoTo sold control of its struggling ecommerce business to ByteDance’s TikTok for US$1.5 billion last year.

- Read more articles we’ve written about Singaporean businesses here.

Also Read: Building “boring” solutions is key for tech startups, says Grab’s CTO. Here’s why.

Feature Image Credit: Shalstock/Shutterstock

M’sian startup iMotorbike’s CEO on the fundraising advice that helped them bag US$10 million

When Vulcan Post last covered iMotorbike, we reported on the successful completion of their Series A funding.

Achieving a grand total of US$10 million, the company is set to use these funds for regional expansion.

This time around, co-founder and CEO Gil Carmo has kindly shared with us his insights on successful fundraising as well as plans for iMotorbike’s future.

A Grand Prix in suit and tie

Venture capital (VC) funding is a fast-paced affair, and not all businesses are suited for it, at least according to Gil.

In the case of iMotorbike, this approach works because of the market potential the company has, being part online.

It does of course also come with a pair of nifty benefits—speed and resources.

“VC funding provides us with the means to scale quickly and compete effectively in any market,” he noted.

“When you are addressing a sizable Total Addressable Market (TAM) like ours, where the potential for growth is immense, having access to the right resources and expertise makes all the difference.”

That being said, they weren’t just about to accept any investor under the sun.

Here’s some advice Gil had to give to other entrepreneurs hoping to bag funds this year.

1. Take your time and do your due diligence

The co-founder shared that they specifically looked for individuals that shared their long-term vision and goals.

“This involved several rounds of discussions and due diligence to ensure alignment, which is critical in building strong, collaborative relationships with our investors,” he explained.

2. Find investors who can offer more than just funds

Another criteria was that the investors had to bring some sort of value to the table beyond just funding. Those with useful networks, expertise, or experience in scaling up a business were made top priority.

“Having an investor who understands the dynamics of our industry and can offer insights or connections is crucial for us to navigate challenges and seize opportunities effectively.”

3. A good pitch is no substitute for a good track record

But they needed a lot more than just a good pitch when they found just the people that they were looking for.

He believes their success in securing international investor confidence was rooted in several key factors.

The first was a strong market fit. There was a gap in the pre-owned motorcycle industry, and iMotorbike seized it with a scalable solution.

Second was performance. The company showed consistent and measurable growth in things like revenue and operational efficiency.

The third was transparency. The company was clear to investors about their business plans and outlined achievable milestones. Care was also taken to ensure that everyone’s goals were still aligned.

Lastly, experience. The founding team and management’s successful track record showed that they weren’t just all talk and that they could actually deliver on their promises.

All-in-all, it was a 12-month ordeal for iMotorbike.

Though iMotorbike’s CEO could not disclose any specific challenges, he was able to say how he and his team overcame them.

“Having clarity about what we’re working toward and staying committed to that vision helps us navigate through any obstacles,” he shared.

That, and a whole lot of tenacity.

Into high gear

As mentioned prior, the whole purpose of iMotorbike’s fundraising was to aid in expansion.

Regionally, the company is looking to open new showrooms in Johor and Penang. And outwards, iMotorbike is looking to increase their presence in Vietnam where the CEO notes that the market size of their motorcycle industry is six to seven times that of Malaysia’s.

This, however, only covers pre-existing markets that the company already has their toes in. iMotorbike has also earmarked a part of their new funds for a Taiwan expansion.

“One of the key reasons Taiwan stands out is its developed infrastructure and the entrenched preference for motorcycles as a primary mode of transportation,” said Gil.

“Around 80% of households in Taiwan own a motorcycle, making it a no-brainer for our expansion strategy.”

An expansion here would also serve as iMotorbike’s gateway into the East Asian market. And the better they can establish themselves, the better their chances at tapping into neighbouring regions with similar markets.

Home field advantage

For the foreseeable future, the plan is for iMotorbike to continue operations with Malaysia as their headquarters. Importance to their strategy aside, there is an emotional attachment to the country seeing as it is the company’s starting point.

He also notes, though, that international investors have seemingly become more optimistic about Malaysian startups like his own.

“Malaysia’s growing tech ecosystem is gaining recognition globally, supported by a strong entrepreneurial spirit, a stable regulatory environment, and government initiatives focused on digitalisation and innovation,” he explained.

“Additionally, international investors value the expanding talent pool in Malaysia, which is producing tech-savvy professionals capable of driving innovation and operational excellence.”

Capitalising on this shift, however, will not be an easy task for new startups.

“Fundraising is never easy—whether it is your first time or not,” he said.

“It requires relentless effort, resilience, and the ability to keep going despite hearing a lot of ‘no’s.’ Things will likely take far more time than you initially estimated, so patience is key.”

He further emphasised the importance of looking for opportunities early as sometimes, it comes down to luck. The more you put yourself out there, the better the odds of catching someone’s eye. And as an added benefit, the more experience you’ll get which’ll allow you to better refine your pitch.

It is also crucial to be realistic, he noted. “Understand that you might end up securing only a fraction of the valuation you hoped for or raising half the amount you initially aimed for.”

Lastly, understand your investors’ expectations. “Different regions have different benchmarks for what constitutes a compelling pitch,” he explained.

“Do your research, and tailor your presentation to align with the priorities of investors in the target market.”

With such a strong start to the year, one can only imagine how far iMotorbike will go. Here’s hoping that their story has inspired some to start their engines as well.

Also Read: CARiNG’s CNY video reminds us what “home” really means, and it’s not about a place

Featured Image Credit: iMotorbike

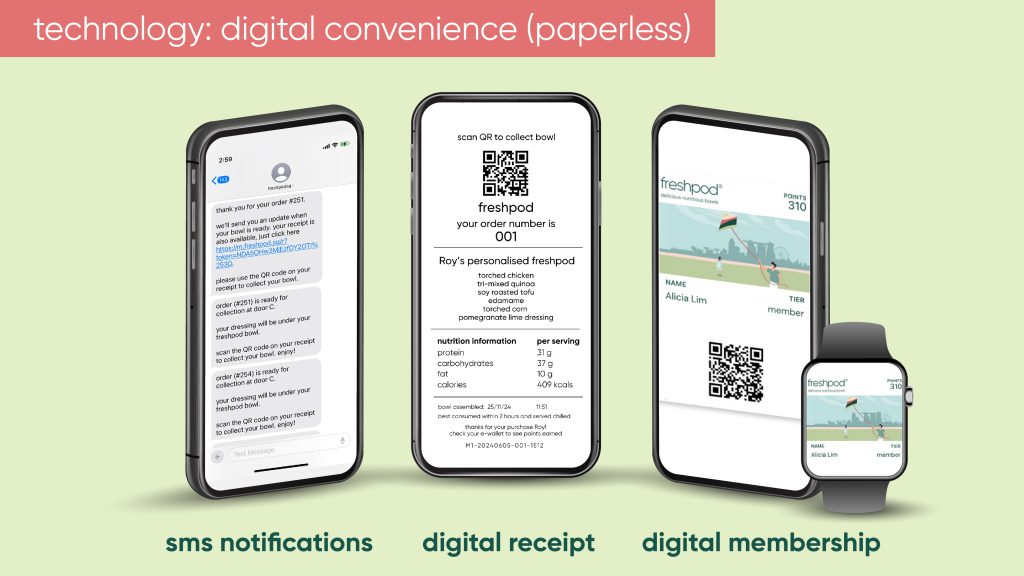

This S’porean biz’s salad bowls sell out daily. Their secret sauce? Autonomous kiosks.

On the rare occasion when I am willing to diet, I opt for salad bowls, specifically the ones that allow me to customise my meal.

However, there were instances where I wondered: Am I genuinely getting a balanced meal that suits my needs? Moreover, some of these places are often inaccessible as they are usually located at more upscale locations such as the CBD.

This is where local startups come in to fill up the gap, including Hit Refresh, who plans to “revolutionise healthy eating in Singapore” through its autonomous kiosks.

A seamless experience

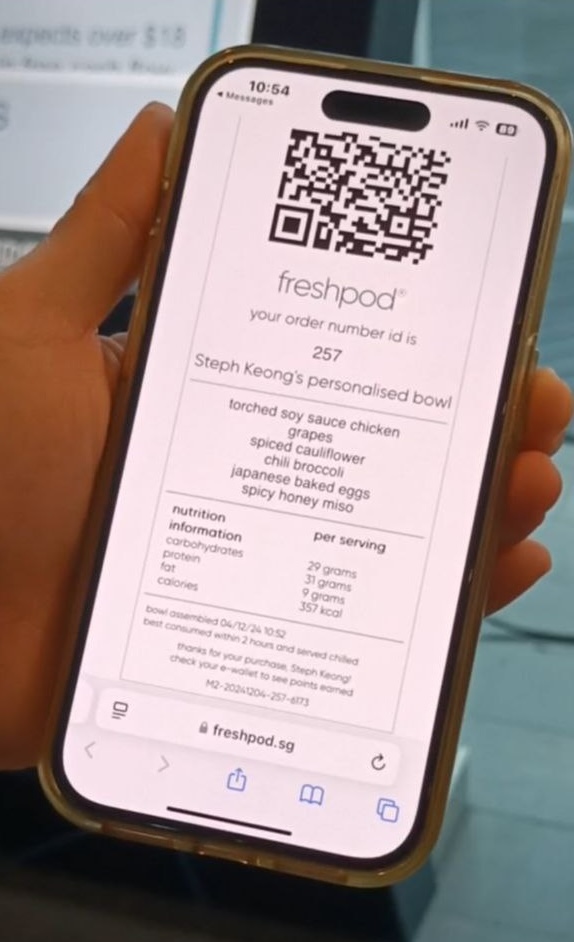

Hit Refresh’s solution is freshpod—an autonomous kiosk that dispenses “fresh and nutritious” ingredients. Customers can customise their own food bowls by choosing from over 20 ingredients and seven dressings or select from a range of chef-curated bowls.

When Vulcan Post headed down to try some of freshpod’s offerings, we did not expect it to be this easy. The kiosk had a simple interface, making ordering more straightforward and less stressful.

We ordered two bowls, and it only took us five and a half minutes from ordering on the kiosk to collecting them from the pods via a designated QR code.

On top of that, we were given a breakdown of the macros and calories in our order receipts, so we thought it was a good touch, especially for those who want to track their dietary intake and personalise their meals based on their requirements.

Keeping things fresh

Given that food and produce in vending machines tend to lose their freshness over time, we were curious about how freshpod stores ingredients in its kiosks.

When we sat down with Joe Ryan, CEO and co-founder of Hit Refresh and freshpod, he shared that the startup worked alongside the Singapore Food Agency (SFA) and food scientists and professors from the National University of Singapore to ensure their kiosks can keep food safe and fresh.

“It’s fully refrigerated, between one and five degrees [Celsius] at all times, which prevents bacteria from multiplying. We replenish daily and use air filtration systems to keep the food fresh,” he explained.

In addition, the kiosk’s ingredients are packed in individual “pods,” which prevents cross-contamination to account for customers’ allergies. freshpod also uses its in-house predictive analytics system to track and manage food inventory, allowing easy replenishment to meet real-time demand.

“It takes us about 12 minutes to replenish the entire kiosk of 20 ingredients. So let’s say there is a huge demand for cucumbers, [and during] lunch we see that it’s dropping low, we can easily deploy a pod—we can just install it, and then by dinner time, it’s replenished. So it’s easy for us to do,” added Joe.

Consistency was the goal

It took Hit Refresh three years of R&D and over 200 machine trials to launch the first freshpod kiosk in August 2024.

The first hurdle that stood in the way of launching their autonomous solution was refining their dispensing technology. Different ingredients have varying densities, viscosities, stiction, and sizes, so the company needed to ensure that each component is dispensed consistently.

“What we wanted to achieve was consistency with our bowls; we wanted to provide macros for the bowls for every single user. People want to know how much protein they are getting today? How many carbohydrates are they getting? How much fat is in their bowl?” explained Joe.

Another challenge was developing a flexible, “one-stop-shop” software for their inventory management system. It leverages algorithms to assist in stocking ingredients to track the performance of the kiosks and prevent unnecessary food wastage.

Joe highlighted that depending on the location, different kiosks have varying quantities of specific ingredients, as different communities have specific demands that diversify from one another. “We don’t have to just cookie cut, put the same menu everywhere.”

Growing their fleet

Since launching their first kiosk, freshpod has garnered loyalty from the local office crowd and set up two kiosks at Singapore Science Park and Grab Headquarters at one-north.

According to Joe, their kiosks sell out daily, with 35% of their customers ordering repeat bowls weekly.

The company has also found popularity in an unlikely audience: the elderly. According to Steph Keong, freshpod’s Chief Operating Officer, a 70-year-old staff member working at the Ascent building at Singapore Science Park orders two bowls thrice or four times a week—one for himself, one for his wife.

She added that this surprised the team because when it comes to health food, it’s expected that the typical customer will be a health-conscious worker who goes to the gym. However, there’s a growing consciousness for health food, even among the elderly.

Joe highlighted that one-third of their customers are over the age of 40, and there is an awareness of health issues, such as high cholesterol and high blood pressure, that are perpetuated by poor diets amongst the Singapore population.

“The demand is there. We are just trying to match up with supply,” he emphasised.

“We have collected data continuously since our launch and are proud [to share] that 36% of customers since the launch at Grab came back more than two times a week, and 8 of 10 would recommend freshpod,” added Steph.

Looking forward, freshpod is working to grow its fleet of autonomous kiosks at universities, schools and high-density condominiums. The company is also working with CapitaLand to launch its kiosks in their buildings and others over the next two years.

According to Joe, the company has 60 locations “already locked in” and is exploring another 40 locations to achieve mass production for Singapore. freshpod is also garnering interest from overseas, specifically Australia, Japan, and South Korea.

As for Hit Refresh, they are looking to develop additional products such as hot food, fruit juice, and many more down the road. “[It’s a] long journey. I don’t think it ever ends,” he joked.

- Learn more about Hit Refresh here.

- Learn more about freshpod here.

- Read more stories we’ve written on Singaporean businesses here.

Also Read: SaladStop! Group started out as a family biz, now it’s grown to 75 outlets in S’pore & beyond

Featured Image Credit: freshpod

Noticing a gap for Western food in their KL neighbourhood, this couple opened a brekkie spot

Some say that variety is the spice of life. For a certain couple in Taman Keramat and their customers, that should apply to breakfast as well.

Located at postcode 54200, 54200 Breakfast is the dream project of Mohammad Alif and Rafidah.

The business offers Western food, a rarity amongst their local-dish-selling peers in the area.

Both born in 1987, the couple had drastically different careers before choosing to pursue F&B.

Alif had worked 18 years in the retail industry, handling sports apparel to luxury goods.

Rafidah, on the other hand, started off as a flight attendant. She went on to open an online business as a side hustle after becoming a full-time housewife.

But with family histories rooted in the industry, food had and always will be their passion.

Daring to dream

The inspiration for 54200 Breakfast first came about when they realised that their area lacked any Western food options for breakfast.

You could easily get nasi lemak and roti canai, but something like an English breakfast was nowhere to be found.

It was a golden opportunity, but the timing of it couldn’t have been any worse.

“If I’m not mistaken, it was right before the lockdown,” Alif explained.

Their hearts were set on a physical store, which would have been a death sentence for a budding business when there was a virus going around.

So, the idea had to be shelved.

As luck would have it, though, that gap in the market for Western food still remained years on.

The decision wasn’t immediate as it was still a risk. Though they assumed that those looking for more simple food options existed, there were no guarantees.

But they weren’t just about to let their dream go a second time.

So, at the tail end of September, 2024, the two founders would drop everything that they were doing and go all in.

Fried-up with confidence

Step in, and you’ll find that the two have their fingers in every pie.

From purchasing ingredients to preparing the food, the pair are involved in just about everything at 54200 Breakfast.

Starting small, their initial target audience was, quite reasonably, their fellow neighbours in the area.

Three months on, though, and now they have people coming in from Ampang, Melawati, Wangsa Maju, and Cheras. Some even come all the way from Johor to have a taste of what they have to offer.

And that is something that they take immense pride in.

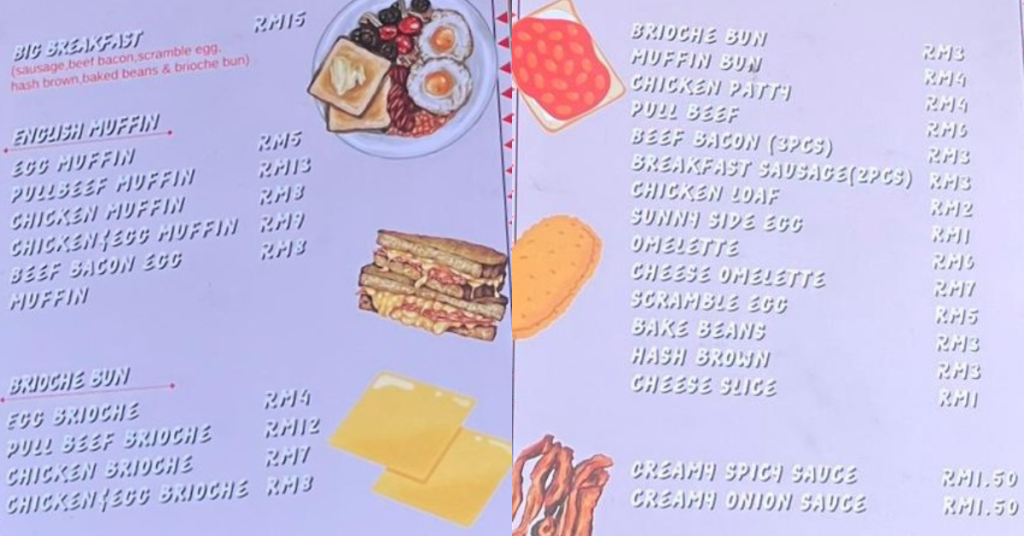

Most of the food on 54200 Breakfast’s menu is made completely from scratch. There are exceptions, but their chicken patties, pulled beef, and even English muffins are all “homemade” according to Alif.

This, in his opinion, gives their food a special flavour that can’t be found anywhere else.

“We believe that the quality of our food is on par with more fancy or larger restaurants,” said Alif.

“Quality in this context is in terms of taste.”

For first-time customers, he suggests giving their Chicken & Egg Muffin (RM9.00) a shot. For meat lovers, he recommends their Pull Beef Brioche (RM12.00).

Custom orders can also be made with the full breakdown of ingredients being listed on their menu.

At the moment, 54200 Breakfast is unavailable on any online food delivery platforms.

Nevertheless, orders can be made through WhatsApp with deliveries through either Grab or Lalamove.

Down-to-earth

The fact that Western food is less popular than local dishes here in Malaysia is not lost on Alif and Rafidah.

But according to them, competing was never the intention.

“The idea in the first place was to give our customers more options,” Alif claimed. “We believe in the idea that quality food can retain customers.”

Expansion is on the cards for 54200 Breakfast. But the now 38-year-old founders are keen on taking things one step at a time.

Currently, they are set on making their restaurant more popular before putting any of their other plans into motion.

To that end, they are looking to add more items to their menu. Rafidah particularly has a few ideas in the tank for customers old and new to try out.

Once better established, the next step for them would be to extend business hours into lunch.

In the near future, the dream is to open another branch.

Though the two are facing an uphill battle, they are confident that their food will be able to win the hearts of locals and tourists alike.

Also Read: CARiNG’s CNY video reminds us what “home” really means, and it’s not about a place

Featured Image Credit: 54200 Breakfast