Alipay and WeChat Pay has now been launched for Singapore, so local businesses will be able to tap onto the Chinese e-commerce market.

Payments platform Stripe announced that online local businesses can now accept payments through Alipay (Alibaba) and WeChat Pay (Tencent) via the Stripe platform.

Aside from facilitating payments, Stripe – whose clients include Grab and CapitaLand – also helps businesses ” mine payments data for business insights“.

Essentially, by using the Stripe platform, businesses can easily carry out transactions with Alipay customers.

Stripe Me Up

The new Stripe bridge into China links up over 25 countries from East to West (which could mean that Singapore would have access to not just China but everyone else as well).

Stripe also released a comprehensive guide for businesses looking to tap into the new service, as well as useful insights on global e-payments trends.

The platform also supports recurring payments, allowing for speedier transactions and a high conversion rate of shoppers to returning buyers.

Typically, adding payment methods can be a tedious process, but what Stripe sells is an one-step process to adding the desired payment modes, i.e. Alipay and WeChat Pay.

“This means no one-off onboarding process, no lengthy underwriting timelines, and no effort spent on tedious contract negotiations,” the guide says.

A Trillion Dollar Market

China boasts over 731 million Internet users, and Alipay and WeChat Pay has control over 92% of the S$7.5 trillion market value of the mobile payments sector.

Despite the vast potential, “the majority of businesses outside of China have been cut off […] because they can’t accept the payment methods preferred by Chinese consumers,” said Piruze Sabuncu, head of Stripe in Southeast Asia and HongKong.

Addressing the limited market size in Singapore, Sabuncu described how connecting Singapore and China would be crucial “for Singapore’s burgeoning economy of Internet-based startups”.

Mobile payments are likely to grow in tandem with e-commerce, or perhaps even faster, and China is all set to lead, with a 2020 e-commerce projection of $2.32 trillion by 2020.

Juxtapose that with Singapore’s S$7.5 billion in 10 years, and Southeast Asia’s S$272 million by 2025.

Why Not?

“If you are an Internet business this unlocks a new vast customer base,” shared John Collison, Stripe’s president and co-founder, in a CNBC interview. Meanwhile, Chinese consumers would also have an “expanded choice” of international merchants from whom to shop.

Breaking into the Chinese market is by now, almost the default route entrepreneurs take in the path to expansion.

The global market for mobile s enjoying an exponential growth, and mobile payment platforms such as PayNow are eagerly jumping onto the bandwagon.

If you’ve not started, there’s really no reason stopping you from at least taking that first step.

Here’s where you can link your business up to China’s S$6.9 trillon dollar market.

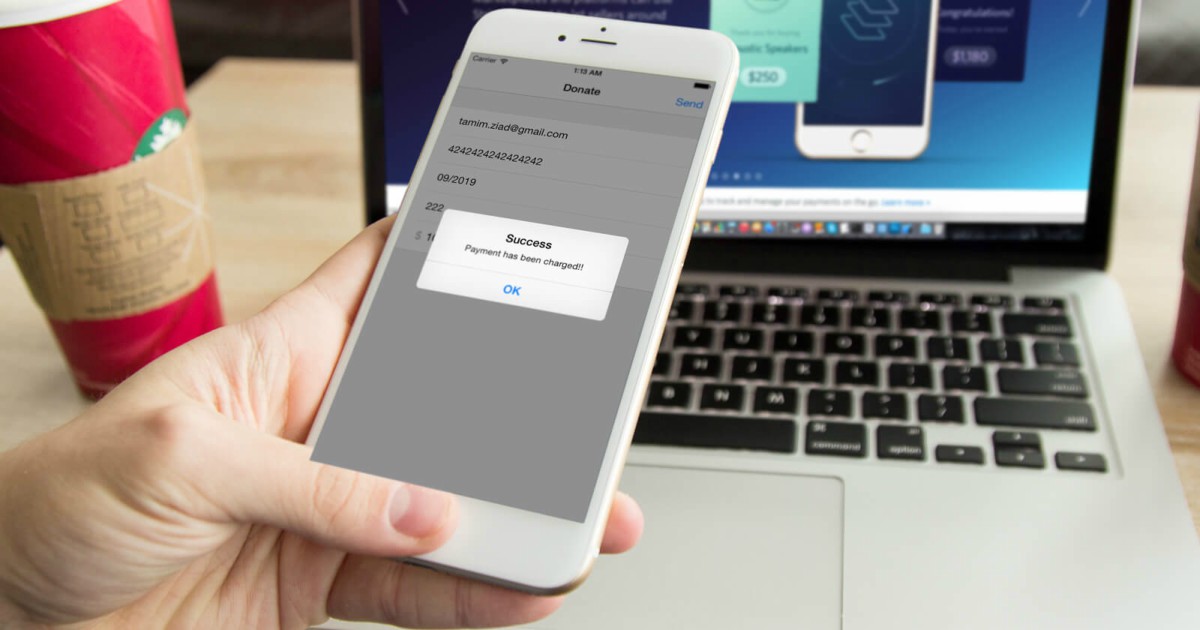

Featured Image Credit: Appcoda