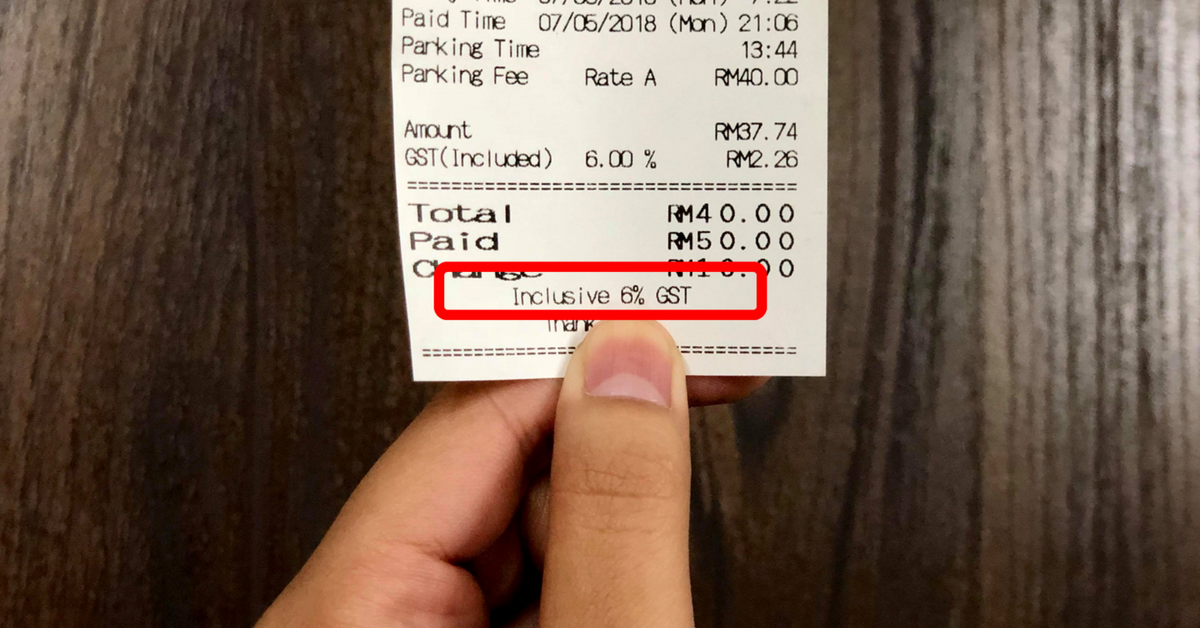

Following rumours of GST being rescinded, Malaysia’s Ministry of Finance (MoF) have just announced that all GST rates would be reduced from the current 6% down to 0% effective June 1 this year.

This will apply to all goods and services from within Malaysia as well as imported items from overseas, with items exempted from GST in the Goods and Services Tax Act 2014 remaining unaffected by the new ruling (and thus continuing to be tax-free).

And while it does seem that the GST is finally going away, this does not mean its complete dismissal, as there still remains certain protocols for tax filing and claims to be heeded by individuals and businesses.

Update, May 17:

The MoF has also released a statement to confirm that SST will be reintroduced.

“Fiscal renewals are in progress. Reductions in yield from the zero-rated GST beginning 1st of June will be accommodated by special steps and a budget that will be announced shortly.

SST will be reintroduced. Spending will be reduced by taking steps towards rationalisations and efficiency while reducing leakages. Not to mention, the world price for raw oil has seen a more significant increase compared to the Budget estimate of 2018 which was at USD52 a barrel.

This will create fiscal space in the near future. Fiscal responsibility, transparency and governance will be given priority in the implementation of fiscal renewal programs.”

All this comes in the wake of Pakatan Harapan’s win in the recently concluded GE14, where in their pre-election manifesto they pledged to completely do away with GST within a 100 days should they win, and return the Sales and Services Tax which the GST replaced in 2015.

In the meantime, Malaysian netizens have raising some questions regarding the new adjustment:

Some are now wondering if this affects the prices of daily-use items—can Malaysians expect to see the prices of their nasi lemak and teh tarik drop?

Some others were curious as to how this change would impact homeowners selling their houses, and if the pre-existing sales tax of 6% would remain.

A few were concerned about the possibility of unscrupulous business owners simply adding the cost of GST into their base prices, and if any actions would be taken against such practices.

And surprisingly or unsurprisingly, some still questioned the authenticity of the announcement considering that Minister of Finance-to-be Lim Guan Eng had still not been sworn in.

Also, some were just relieved to be able to stop dealing with pesky wang syiling every so often.

And on our side, we had some questions of our own, such as:

“What if a business were to continue charging GST beyond June 1?”

“What can Malaysians do to protect themselves against businesses refusing to obey the new ruling?”

With the announcement of the change still fresh and with so many questions left to be answered, we hope to see more clarifications from official sources in the days to come. We’ve also reached out the Ministry of Finance for comment, and will update this piece with information as we receive it.

- In the meantime, you can read more about our new government’s manifesto and its other effects on Malaysian businesses here.