I’m sure you’ve been in this situation before: You’re waiting in line to pay for a single product, but the person in front of you is taking ages to pull out their wallet and count their change. In this scenario, you’d wish they were using payWave or an e-wallet.

Sadly, not many people are tech-savvy. In 2019, imoney.my said that an overload of e-wallet options could make people apprehensive in adopting an e-wallet.

Even the government had to step in to increase the adoption rate with their “E-Tunai Rakyat” initiative a while back.

However, according to The Star, citizens are quickly adopting the usage of e-wallets in their daily lives thanks to the rise of online orders and deliveries during the MCO period.

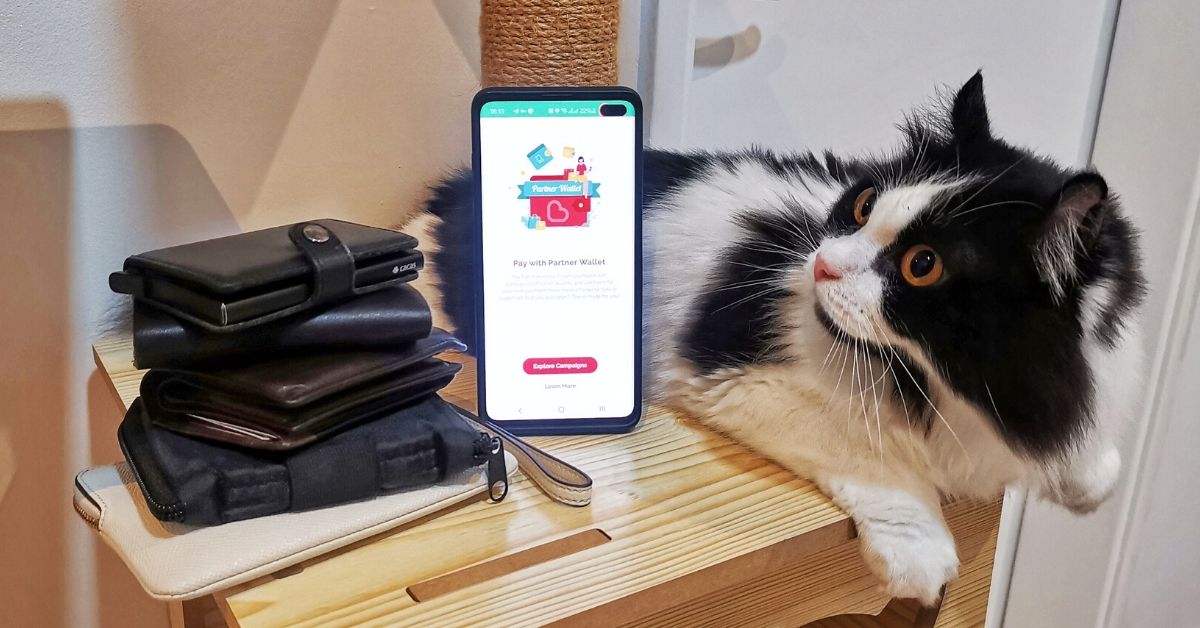

In order to add value to their users, Boost, one of Malaysia’s first local e-wallets, added a new feature called Boost Partner Wallet, of which we’ll be checking out below.

What Exactly Is Boost Partner Wallet?

Boost Partner Wallet is a new sub-wallet within the Boost e-wallet app.

It allows you to get instant cashback from some of your favourite brands such as Tesco, Watsons, and Caring. The cashback can then be used for your next purchase from these brands. So on Boost, it pays to be loyal.

The cashback amount varies and you should take note of the T&C and expiry dates on the cashback to maximise on your savings. If unused, the cashback will be forfeited. And speaking of cashback, here’s how you can get them through Boost Partner Wallet.

Get Cashback Immediately Added To Your Boost Partner Wallet

Cashback from Boost Partner Wallet is fairly simple to get.

When checking out with Boost from the participating partners, you will be eligible for a Shake Reward that will give you Boost Coins and cashback.

The best part of Boost Partner Wallet is that the cashback will be automatically deducted from your next purchase with the same partner, so you will not have to worry about missing a saving.

For example, spending RM50 at Watsons and paying with Boost could get you RM5 added into your Boost Watsons Wallet, which can then be used on your next transaction at Watsons.

Example: On your next purchase at Watsons, if you’re checking out RM30 worth of products using Boost, you will only be required to pay RM25 with your main Boost Wallet. This is because the RM5 Partner Wallet cashback has been automatically deducted from your Boost Watsons Wallet.

Do note that the cashback cannot be transferred into your bank account and it remains exclusively in the Partner Wallet till your next purchase from the same partner.

Who’re The Current Partners?

We’ll be listing down the current partners that are on board for the Boost Partner Wallet Programme that can be utilised immediately to cater to your different needs. By going through all the promos, you could potentially save more than RM90.

Groceries

| Brand | Cashback |

| Tesco (Offline) | RM10 with min spend of RM100 |

| Giant (Offline) | RM5 with min spend of RM50 |

| Mydin (Offline) | RM5 with min spend of RM50 |

Health

| Brand | Cashback |

| Watsons (Online) | 10% cashback of up to RM5.5 with no min spend |

| Caring eStore (Online) | RM5 with min spend of RM50 |

| Caring Pharmacy (Offline) | RM8 with min spend of RM60 |

| Alpro Pharmacy (Offline) | RM5 with min spend of RM100 |

Investments

| Brand | Cashback |

| HelloGold (Online) | RM5 with min spend of RM150 |

Prepaid Mobile

| Brand | Cashback |

| Yoodo | Chance to get RM20 cashback with min spend of RM35 |

Department Stores

| Brand | Cashback |

| The Store | RM6 with min spend of RM60 |

| PACIFIC | RM6 with min spend of RM60 |

| MILIMEWA | RM6 with min spend of RM60 |

Note: Terms and conditions apply, please check with the current cashback promotions for more details. The campaigns listed here started on May 20 will run for more than a month.

Future Updates To Boost Partner Wallet

A representative from Boost informed Vulcan Post that they are working on adding new and popular partners to their Boost Partner Wallet whenever possible to give the best offers to their users.

But if you’re shopping from any of the brands above, you might as well make the most out of the Partner Wallet’s cashback.

- For more info on the Boost Partner Wallet click here.

- Download Boost on Apple App Store and Google Play Store.

- Read more on what we’ve written about Boost here.