It is clear to see that the aviation industry has been badly impacted by the Covid-19 pandemic.

In fact, there was less than half the passenger traffic in the whole of 2020 as compared to 2019. Airlines around the world therefore have had no choice but to pivot in order to survive.

For Southeast Asia’s low-cost carrier AirAsia, the pandemic served as an opportunity for them to speed up its digital transformation and evolve to go beyond being just an airline.

It has boldly dubbed itself as “the Asean super app”, which now includes an ecosystem of new services including food delivery, grocery delivery and even online shopping, in addition to its usual lineup of flight tickets and hotel booking services.

On March 2, AirAsia food made its debut in Singapore, marking its first overseas foray.

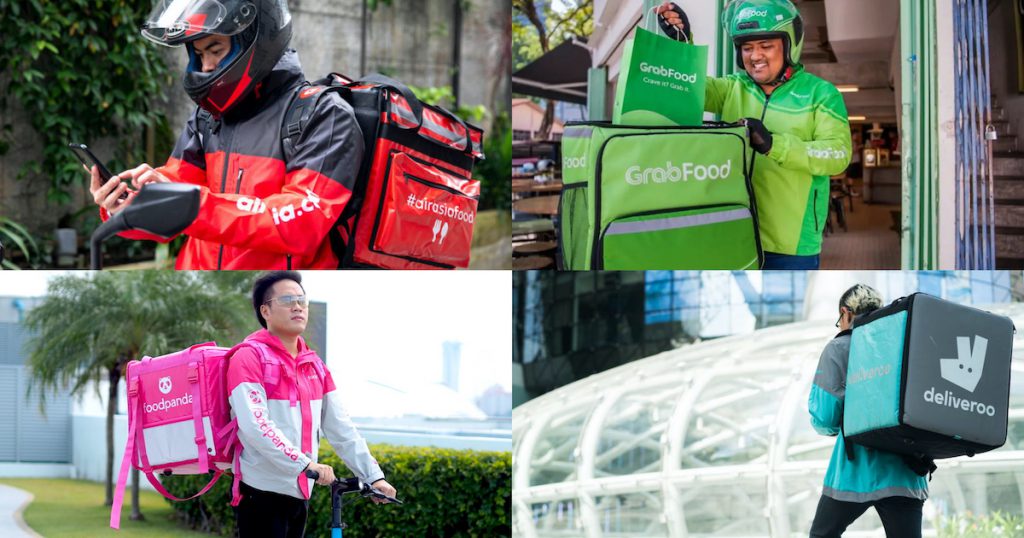

As the newest player in Singapore’s saturated food delivery market, how does it stack up against the big players?

Initial Thoughts And Experience On AirAsia food

When a new player joins the arena — much like when Gojek first entered Singapore — consumers are undoubtedly excited at the prospects of an additional option for them to choose from, and promo codes to entice new users.

For AirAsia food, it is offering free unlimited food delivery until March 16 — this is applicable only for deliveries within 8km from the order point.

At launch, AirAsia food is featuring about 80 restaurants, including Swee Choon Tim Sum Restaurant, No Signboard Seafood, The Shepherd’s Pie, Maki-san, Pizza Express and more.

Another 300 restaurants will be onboarded onto the platform at a later stage.

Although there are no promo codes per se, the lure of free delivery is enough to entice users to at least download the app and check out the food offerings available.

However, I was disappointed with my virgin AirAsia app experience — it was very laggy and took awhile to load. Apparently, I wasn’t the only one to experience this, as seen by the app reviews on Apple App Store.

To add on, the location feature seems buggy. It couldn’t detect my exact address and accurately list the nearby restaurants. However, it seemed to work fine on the web platform.

My takeaway is that the app is not yet optimised and requires an update. If you want to check out AirAsia food, log on to airasia.com/food instead of downloading their app.

To add on, the interface (for both mobile and web platforms) is not very user-friendly.

For instance, the list of restaurants is not sorted according to distance. At the top of the page, I’m being recommended restaurants that are 15km away from my location.

A quick workaround to this is to filter the list of options by distance — when you filter to 8km, you are technically shown restaurants that are eligible for the free delivery promo.

Regardless, the existing food options is very limited and I actually observed price discrepancies between two same brands from different outlets for the same menu.

The first time round, I tried ordering from 7 Wonders restaurant and it turns out that it only accepted pre-orders (but it didn’t have the pre-order tag on the listings page). To add on, the earliest timing for the pre-order delivery was 1.30pm to 2pm, which is way after my lunch hour.

When I tried ordering from AirAsia food again on another day, the payment page took very long to load (more than 15 minutes). It was such a long wait that I ended up giving up on the order and exiting the app.

A Comparison Against Its Key Rivals

AirAsia food aims to give better value by offering low-cost options, much like the mantra of the budget airline.

It’s charging restaurants only 15 per cent commission per delivery, which is much lower than rivals GrabFood, Foodpanda and Deliveroo, which ranges between 25 to 35 per cent.

AirAsia food reasoned that lower commission fees will lead to more savings, which are passed on to the consumers.

While the selection of restaurants is currently not as vast as the other players, it is a short-term problem that will gradually diminish as new merchants come onboard.

Moreover, with low commission fees, more merchants are expected to jump on AirAsia food.

While AirAsia food said that its delivery fee is “five per cent lower” for customers as compared to other platforms, it cited delivery fees ranging between S$2.99 and S$20.

It’s also worthy to note that Deliveroo and foodpanda deliver within a restricted radius of 2km to 6m, while GrabFood delivers islandwide only for selected partners.

In contrast, AirAsia food offers delivery from restaurants up to 20km away. A bigger delivery radius however, will mean a longer delivery time. This could explain why it promises delivery within 60 minutes.

Acknowledging that a one-hour delivery time is lengthy, AirAsia food has said that it will strive to shorten it over time.

To shorten the delivery time, AirAsia food needs to beef up its fleet of riders. It has recruited only 500 riders now (while GrabFood, Deliveroo and foodpanda has thousands of riders), but aims to double that number by third quarter of 2021.

The main difference you’ll notice on AirAsia food compared to other platforms is the inability to track your order in real-time.

AirAsia CEO Tony Fernandes sees this ‘maps’ feature as an “unnecessary frill” that can help to keep operating costs and prices low. He added that customers can still chat with their riders in-app to find out the status of their delivery.

Another interesting feature of AirAsia food is that customers can earn reward points that can be used for AirAsia flights.

Customers can earn 1 BIG point for every S$0.30 spent, and redeem 405 BIG points for every S$1 (or 125 BIG points for every S$1 until March 16). This is equivalent to a rebate of 0.8 per cent (or 2.7 per cent until March 16).

This is nothing unique to AirAsia food though — you can also earn airline miles on GrabFood or foodpanda.

Every 1,000 GrabRewards points can be redeemed for 100 KrisFlyer miles, while every S$1 spent on foodpanda can earn you 1 KrisFlyer mile (with a minimum spend of S$20).

Will AirAsia Food Succeed In S’pore?

AirAsia is very much aware of the stiff competition it will face from the current dominant food delivery players.

While CEO Tony Fernandes don’t think that they will be the largest food delivery service in Singapore, he is confident that they will be a “useful segment for small restaurants”.

That said, it will indeed not be easy for them to earn a lion’s share of the food delivery pie here. Even in its home country Malaysia, it is considered a smaller player.

According to Li Jianggan of Singapore-based venture builder Momentum Works, AirAsia food delivered only 150,000 orders for the first quarter in Malaysia — this is a fraction of the overall market there, which is dominated by Grab and foodpanda.

The advantage that they have however, is that it is a well-known company so it does not have to market themselves as much as fledgling startups and consumers already have trust in their brand.

In addition, it is unlikely for AirAsia food to be financially viable anytime soon — even GrabFood, which has been around since 2018, is not yet profitable.

Earlier this year, Grab president Ming Maa said that he expects Grab to break even in food delivery only by the end of this year.

Furthermore, any revenue that they make will just be a drop in the ocean for the loss-maklng budget airline.

Regardless, it seems like AirAsia is exploring other revenue streams. Beyond food delivery, AirAsia is looking at expanding into the fresh produce delivery market in Singapore.

This means that consumers can soon have fish from Japan or short ribs from Korea imported and delivered to their doorsteps within 48 hours.

However, its rivals have already made their foray into the grocery delivery space. Grab offers GrabMart, while foodpanda offers PandaMart.

In October last year, Deliveroo also launched its first ever on-demand grocery delivery service amid the ongoing COVID-19 pandemic. It onboarded specialty stores like Kuriya Japanese Market and Ryan’s Grocery, in addition to its tie-up with British retailer Marks & Spencer.

In any case, competition breeds innovation and only time will tell if AirAsia food has what it takes to shake up the saturated food delivery market here.

Featured Image Credit: AirAsia food / GrabFood / foodpanda / Retail News Asia