Due to its low public profile and general opaqueness shielding the hundreds of billions of dollars it has under its management (how much exactly is not made official), few people outside of the business/finance sphere may realise that Singapore’s GIC is the world’s most active state-owned investor.

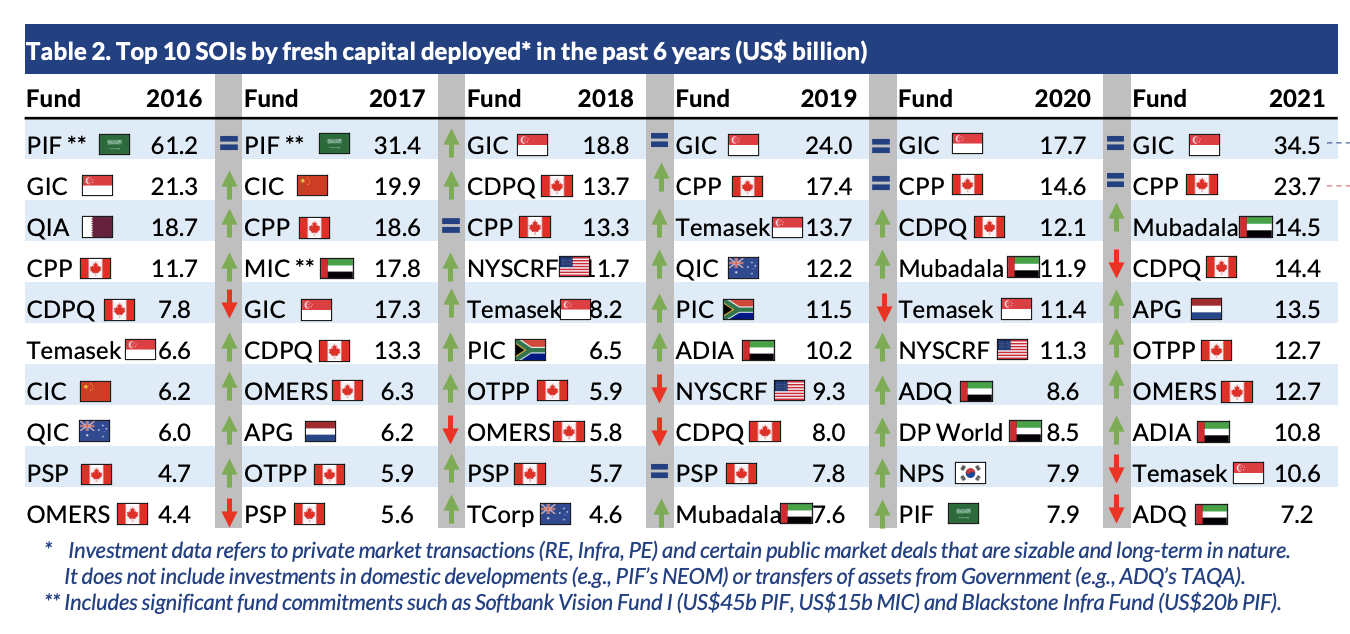

In fact, it has topped this particular ranking for four consecutive years, according to Global SWF:

Last year, it pretty much doubled its 2020 tally of US$17.7 billion (S$24.3 billion), investing over US$34.5 billion (S$47.4 billion) across a whopping 110 global deals, which accounted for nearly 13 per cent of the global total of 854 SOI investments.

Just to better understand how GICs’ 1,800+ employees are earning their pay, consider the following: the fund spent an average of US$313 million (S$430 million) once every three days throughout the entire year.

…Or about 10 deals and close to US$3 billion (S$4 billion) every month.

Inflation destroys returns in more ways that one

It was right to have been busy, as the threat of high inflation started manifesting itself early on in the year and got progressively worse with time.

Inflation is mainly known for its ability to silently erode value (at least in stable, developed countries, which typically don’t have to grapple with catastrophic crises). It’s a quiet tax on everything we do, chipping away a few cents and dollars here and there.

Naturally, it applies to investments as well, which may yield relatively high nominal returns only for them to turn negative when corrected for rising prices.

That’s all basic economics, but last year gave us a taste of what it may lead to after many years of loose monetary policies around the world, and it’s not a pretty sight for any investor.

While global inflation may eat away five to 10 per cent per year, a sudden stop or even reversal of monetary easing that is done in response to it can make some assets lose more than half of their value within mere months.

New York Stock Exchange’s tech index NASDAQ is down close to 20 per cent from its peak six months ago. Several companies listed in New York, like recent darlings of international investors Sea Ltd, Alibaba, or even Grab, have lost around three-quarters of their value from their recent peaks.

Sea’s Argentinian competitor, Mercado Libre, is down 44 per cent, just like America’s Uber. The cheap, low-end goods marketplace Wish is down a whopping 94 per cent since early 2021.

Even big names like Amazon, Microsoft and Google have not been spared, each losing around 20 per cent from their 2021 highs.

To combat inflation, central banks have turned the taps of free-flowing money off — and the impact is by far the most serious in America, where “quantitative easing” (as it is known), was deployed after the financial meltdown of 2008/09 and never really reversed.

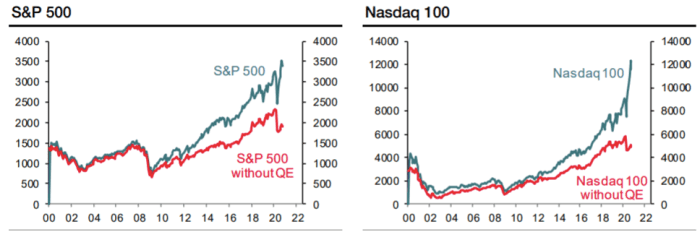

As you can see, the stock market rallies appear to be well-correlated with each injection of money by the Federal Reserve. The latest boom recorded over 2020 and 2021 coincided with enormous monetary action to relieve the pain of the pandemic and support the frozen economies.

Now, all of this cash has led to unsustainable inflation levels and a sharp reversal by central banks, which pushed many assets into a downward spiral. That’s how public policy has enormous impact on private markets and, by extension, investments by companies like GIC representing far-flung nations seeking a good ROI.

In 2020, French investment bank Société Générale estimated the exact impact of QE on American stocks:

As you can see, the broad S&P500 index would be close to 50 per cent lower, and tech-oriented NASDAQ barely over a third of what it is.

And since QE is being rolled-back now, it’s only natural for stocks to retreat, what is compounded by investors’ expectations of this bear run.

This is how inflation has shaken financial markets that investors like GIC depend on.

We won’t know the exact performance of the fund until some time in July, when it releases the latest report for the year ending on 31 March 2022, but the record gains of 37.5 per cent it published last year are likely a thing of the past now.

Back to basics

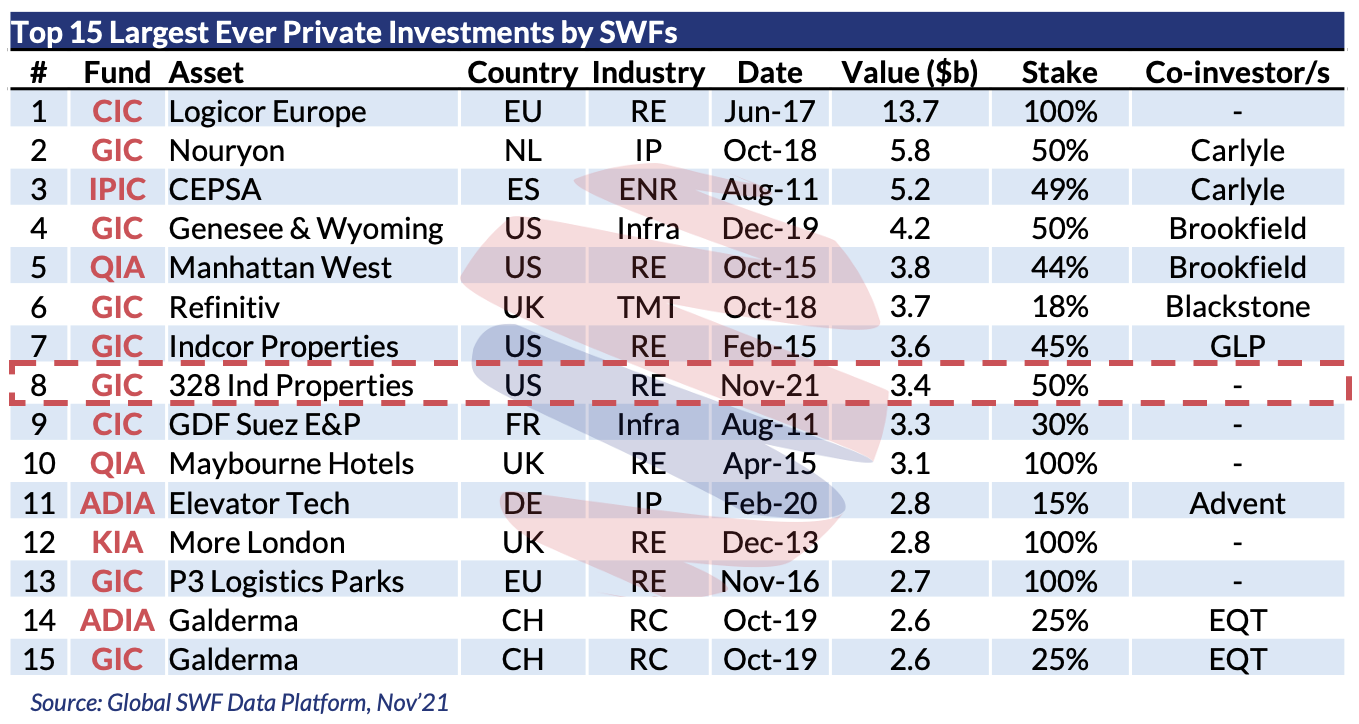

Out of the US$34.5 billion GIC invested last year nearly half went into real estate, with over US$9.1 billion making its way into logistics-related properties in Europe, USA and Australia.

This includes one of the largest private deals by a state-owned investor in history, with the purchase of 328 industrial properties in the US (primarily logistical hubs) from a Swedish fund EQT, that GIC led with other investors for a total of US$6.8 billion (with a 50 per cent GIC stake) last year.

“The portfolio is comprised primarily of logistics properties that serve the supply chains of major corporations, including facilities for “big box” regional distribution, e-commerce fulfilment, and last mile distribution.

The portfolio spans the top five US distribution hubs of New York, Dallas, Atlanta, Chicago, and Los Angeles and the key e-commerce and air cargo hubs of Memphis, Indianapolis, Columbus, and Louisville.”

Source: EQT Exeter

Given the supply-chain issues still plaguing the global economy and the anticipated continued growth of e-commerce services, investing in the infrastructural backbone of warehouses and distribution centres seems a no-brainer.

Nevertheless, even an estimated US$15 billion spent on real estate last year is still a drop in the bucket for GIC, whose assets under management topped US$744 billion in 2021 and are expected to receive an additional injection from official foreign reserves held by the Monetary Authority of Singapore (MAS) – to the tune of US$137 billion (S$188 billion) extra.

So far, US$55 billion (S$75 billion) have been transferred by MAS to the government earlier in 2022 before it can make its way to GIC.

What to do with all this money when inflation is eating so much of it away?

With a stock market bonanza over for the time being and growing uncertainty in the wake of the Russian invasion of Ukraine, China’s problems in handling the latest outbreaks of Omicron on the mainland and a global pandemic of high inflation, it seems that having so much money to spend can cause headaches too.

Deploying tens and/or redeploying hundreds of billions of dollars in this new reality will be a challenge unlike any before. That’s why GIC’s latest annual report may be one of the most important in history.

Featured Image: Wirestock / Depositphotos