Having established itself as a hub for international business and trade, Singapore has long been a popular destination for expats, attracting a diverse pool of foreign talents to work and live here.

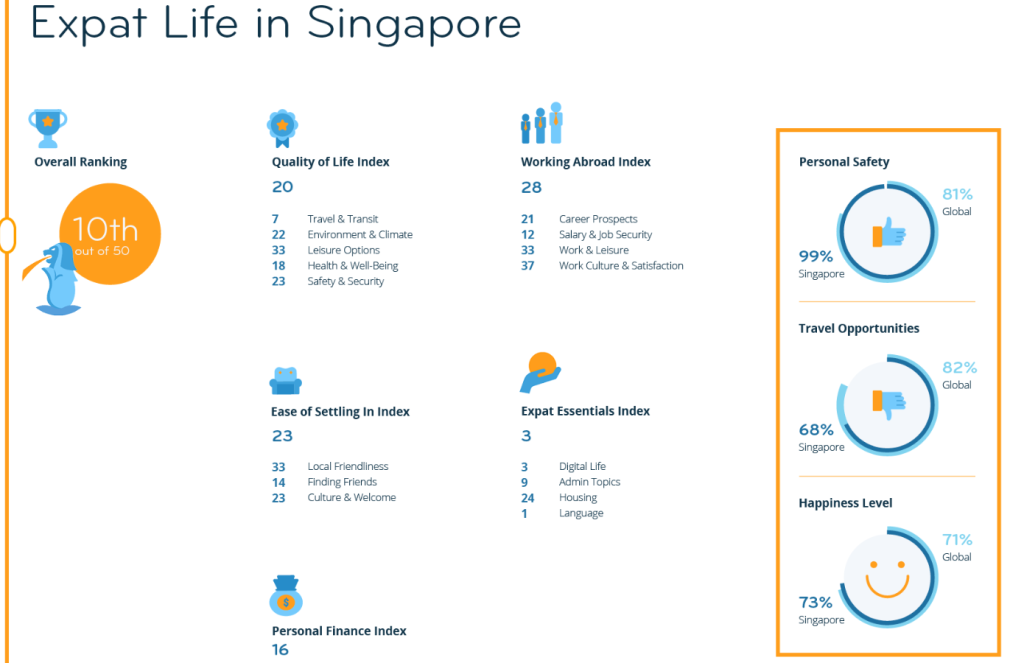

Coming in the 10th place out of 50 cities in InterNation’s Expat City Ranking 2022, foreign talents find it incredibly easy to navigate their life in the city state, with an overall 73 per cent of them happy with their lives in Singapore.

From accessible public transport and world-class healthcare services to low crime rates, Singapore is an expat’s haven, offering them a high standard of living.

Finding a place to call home is also a breeze for expats in Singapore, with a whopping 73 per cent of them describing it as “easy to find housing in Singapore” — which is 19 per cent higher than the global average.

But that being said, the affordability of these dwellings can be a thorny issue for expats, especially after COVID-19. A staggering 71 per cent of these expats find that housing in Singapore is unaffordable — a figure that dwarfs the global average of 43 per cent.

Coupled with the fact that over half of expats (56 per cent) find the general cost of living in Singapore exorbitant, living in Singapore can cause major financial strains for foreign talents.

What is driving increasing property rentals in Singapore?

It would be safe to assume that the majority of expats and holders of various work passes turn to rentals after relocating to Singapore, considering that foreigners account for just three per cent of private housing transactions, according to the Minister for National Development, Desmond Lee.

A PropertyGuru article estimates that foreigners make up about 65 per cent of all rented properties, playing a vital role in the rental market.

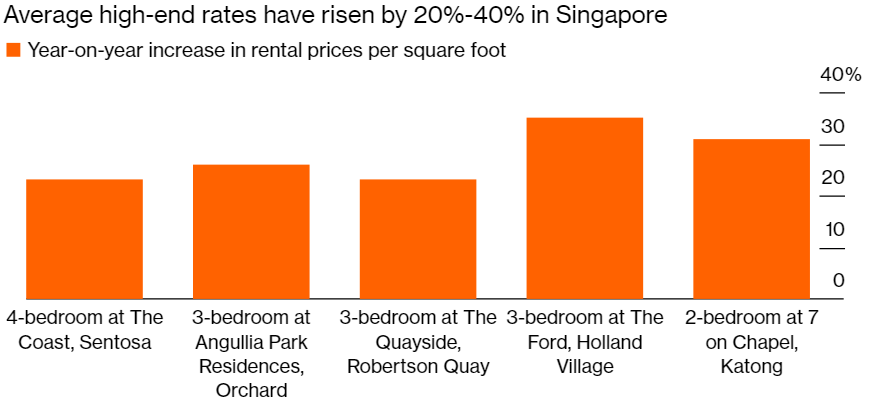

However, as of late, rental rates have been skyrocketing in Singapore. Condominium rents increased 34.4 per cent year-on-year, while HDB flat rents went up 28.5 per cent in 2022 — shooting up at the fastest pace since the 2007 financial crisis, according to the Urban Redevelopment Authority (URA).

In January 2022, the rental price for a bungalow in a high-end residential area on Sentosa island experienced a staggering increase of S$11,000 in just one day, according to a PropNex Realty agent.

This year, analysts still expect rents to rise, but at a slower pace as compared to 2022. Nonetheless, the increase is still burning a hole in the pockets of expats.

But what’s causing this rise?

1. Increased demand for housing after COVID-19

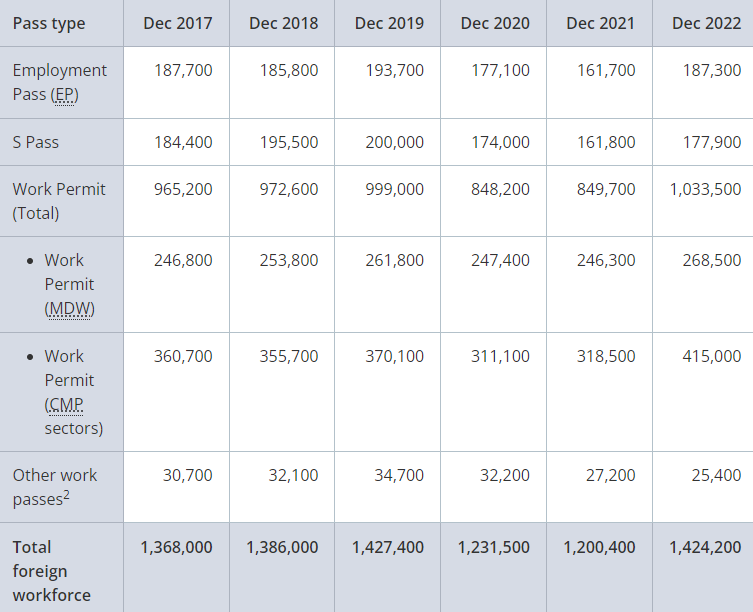

During COVID-19, Singapore saw foreign PMETs (professionals, managers, executives and technicians) leave in the masses. According to Ministry of Manpower (MOM) figures, the number of EP (employment pass) holders fell by about 14 per cent from 193,700 in December 2019 to 166,900 in June 2021.

Meanwhile, the numbers of mid-skilled foreign workers also fell significantly, with the number of S Pass holders falling by more than 18 per cent from over 200,000 in December 2019 to 164,200 in June 2021.

However, this drastically changed when Singapore’s border restrictions were eased in April 2022. “Non-resident employment has increased more quickly as employers backfilled their positions,” explained Minister of Manpower, Tan See Leng.

From December 2021 to September 2022, non-resident employment in the country increased by 167,000, driving up the demand for housing in Singapore.

By end-2022, Singapore’s total foreign workforce was at 1,424,200 including work pass holders, a figure that has exceeded pre-pandemic levels. Due to this spike, rental prices have been steadily rising across the city state.

2. Interest rate hikes

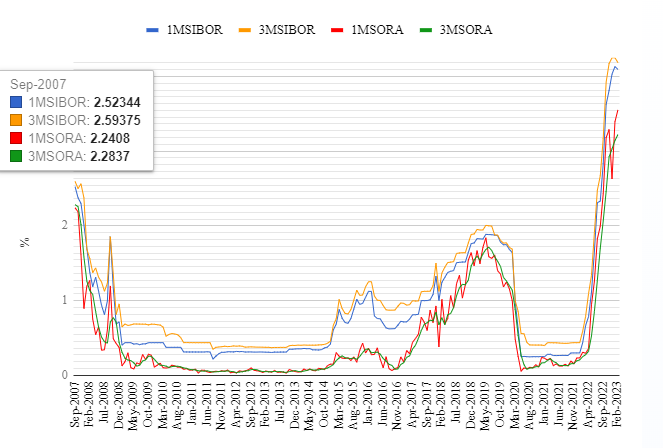

As the world faces inflation and economic headwinds from the aftermath of COVID-19, interest rates in Singapore are also rising as the U.S. Fed raises its rates to curb inflation. What this means is that housing loans from banks will be affected — property owners and seekers can expect to pay more in interest if they are not on fixed home loans.

In fact, by the second quarter of 2022, one in three property owners with outstanding mortgages were affected by this rise. PropertyGuru expects more interest rate hikes this year, although more modest as compared to the previous year.

According to Jeremy Williams, Managing Director, Marketplaces, PropertyGuru Group, these rate hikes have not only increased the costs of home ownership, but is also pushing more young buyers to rent while they build savings. In fact, about 66 per cent of young Singaporeans are choosing to do so.

As more young Singaporeans compete for rental properties alongside foreigners, who make up an estimated 65 per cent of all rented properties, the price of these properties are pushed higher.

But what makes this worse is that landlords who are already facing the pressure from mortgage repayments are already pricing their rental rates higher, leaving expats (as well as young Singaporeans) to bear the brunt of this.

3. Delay in completion of new condos and HDB flats

PropertyGuru’s Jeremy has also attributed the delays in the completion of new condos and HDB flats to the increased prices of rentals in Singapore.

Due to manpower shortages and supply disruptions during COVID-19, there were delays in many BTO projects, such as Northshore Edge in Punggol.

In 2021, the proportion of projects delayed beyond their estimated completion date was more than 90 per cent, but this has been reduced to about 40 per cent as of January this year.

Although there is progress in the space, this has increased the demand for temporary accommodation in the interim.

With this, expats are not only competing with young Singaporeans who decide to build savings while renting, but also those who have moved out while waiting for the completion of their HDBs, hence driving up rental rates.

Expats and businesses mull Singapore exit as rental rates increase

Feeling the pinch from the rising costs and rent, three out of five expats interviewed by Today have expressed that they were thinking or planning of leaving the country, adding that many in the expat community intend to do the same.

An expat who goes under the handle @salshoult on TikTok expressed her shock and frustration when she found out that her landlord intended to hike up rental rates by 75 per cent. According to the landlord, the new rental rate was an “excellent deal” as he would otherwise relist the property in the market at a 100 per cent mark-up.

Other expats have also shared similar experiences, with some of them even moving their families into smaller and more humble abodes (including public housing) as a result.

In a survey conducted by the European Chamber of Commerce in Singapore (EuroCham), a total of 97 per cent of foreign businesses operating in Singapore polled that their employees were exhibiting visible anxiety and psychological distress over the higher residential rental costs.

About half of the employees who had to renew their residential housing lease in 2023 or 2022 saw a rise of more than 40 per cent in rental costs.

In addition to this, these foreign businesses, namely European businesses, are also considering shifting their operations and personnel outside of the city state.

The survey, which polled 268 businesses in total, found that about 70 per cent of them are facing increasing difficulty in maintaining operations in Singapore due to rising rental and operational costs, including rising salaries.

If operational costs do not decrease, or if these companies do not get the necessary help from the Singapore government, they “would be ready to relocate”.

But assuming that things take the turn for the worse, and expats as well as foreign businesses leave Singapore — how would the city state fare?

Singapore needs its expat population

Many may assume that the decrease in the number of expats would benefit Singapore, but is that really the case?

Back in December 2022, Chee Hong Tat, Senior Minster of State for Finance and Transport Singapore said that Singapore needs to remain open to foreign talent to ensure the city state’s economy continues to grow over the longer term. “To remain open and connected is just one of the elements of a sustainable growth model for Singapore,” he said.

But how exactly do they ensure the growth of Singapore?

1. Singapore’s population is declining

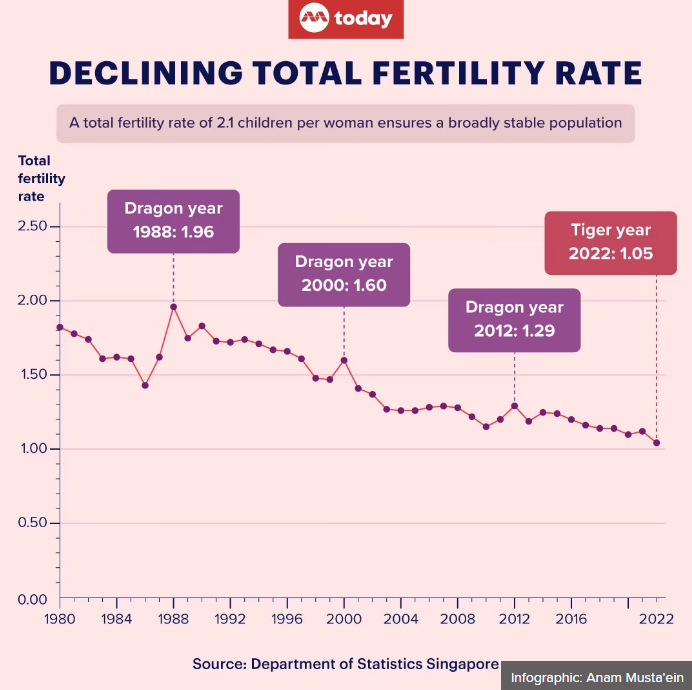

The resident fertility rate in Singapore is gradually declining. It hit an all-time low of 1.05 last year, falling below 2020’s record of 1.1 children per woman.

But you may question, what has this got to do with expats?

Well, to ensure a broadly stable population, a fertility rate of 2.1 children per woman is required — which Singapore significantly falls short of.

What this entails is that Singapore’s manpower will inevitably fall, considering that the fertility rate has been declining since 1980, according to data from the Department of Statistics Singapore.

With foreign talent, however, we can bolster the city state’s falling birth rates with experienced expats.

2. Singapore’s population is ageing

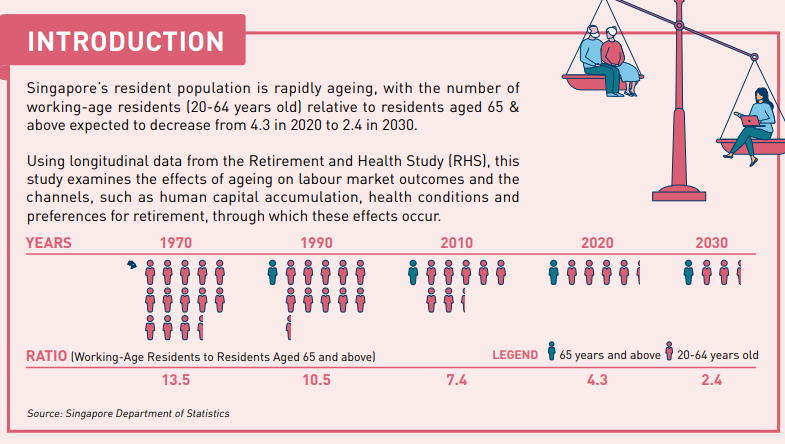

Singapore’s lower fertility rate is also coupled with its ageing population, as resident life expectancy continues to grow.

The city state is one of the world’s fastest growing ageing society, with Singaporeans over the age of 65 years old making up one-sixth of the population. This figure is expected to rise to an estimated one-quarter by 2030.

Given the fact that older workers may find it hard to retain their jobs due to deteriorating health conditions, expats and foreign talent can come in to fill the gaps in the workforce.

In addition to this, the age dependency ratio (the number of people capable of providing economic support to the elderly who may be dependent on others’ support) is also increasing as the population ages.

This ratio has fallen from 10.5 to 4.0 from 1990 to 2021 — putting pressure on the working force as there are fewer working adults to support the elderly. Importing foreign talent may be a solution to this, as it increases this ratio.

3. There just aren’t enough Singaporeans to fill jobs

Singapore’s declining birth rates and ageing population make a deadly combination — they significantly reduce the supply of labour in the market, and not to mention, skilled labour.

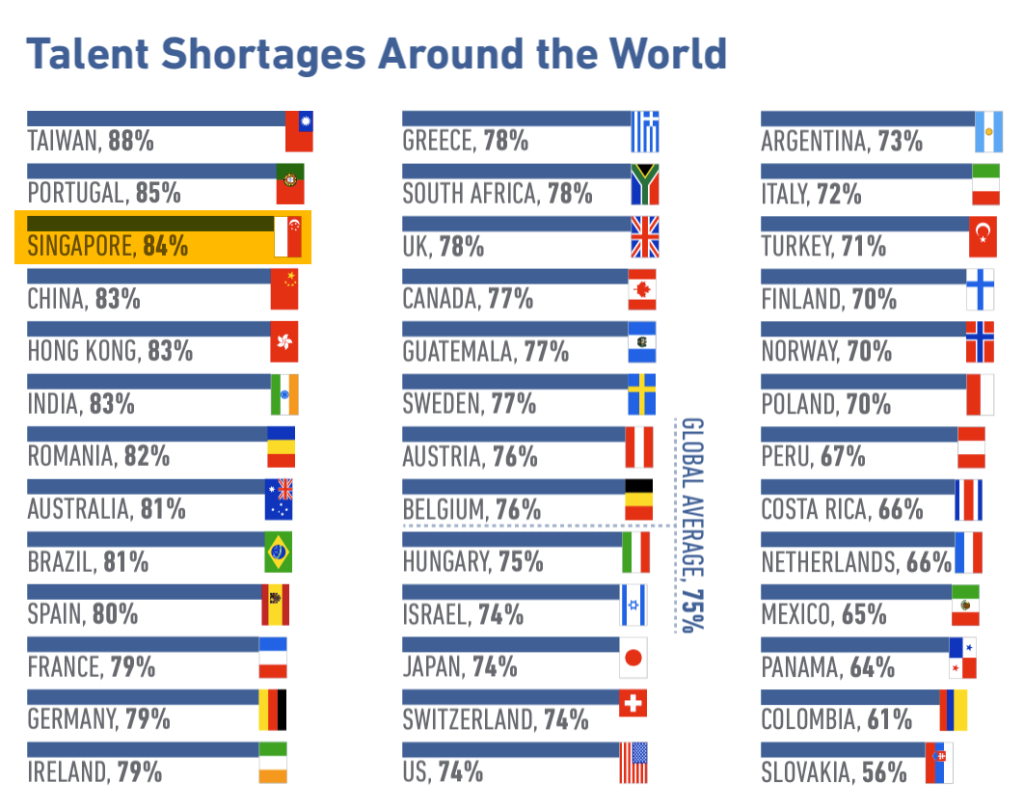

While unemployment is down to pre-pandemic levels, as many as 84 per cent of local employers report problems with finding the right talent. This is one of the highest ratios in the world, according to Talent Shortage 2022.

Hence, with Employment Passes and S Passes, companies in Singapore can bring in foreign professionals to plug skills gaps and supply shortages.

For example, to develop our ICT and software industries, which require highly specialised skills and knowledge, global companies like Google, Grab, and Facebook need workers with the relevant skills and experience to fill all the jobs they create.

There may not be enough Singapore citizens with these skills and experience to anchor these global companies’ investment.

– Ministry of Manpower

In addition to supplying shortages, expats and foreign talent can also attract foreign investments — which, in turn, create more jobs in the economy.

Striking a balance between foreign and local talent

Expats make up an integral part of Singapore’s economy, but it is also important to strike a balance between foreign and local talents.

This is why the MOM has implemented a couple of measures to ensure fair employment of local talents. For instance, to ensure that Singapore citizens do not have their salaries undercut by foreigners, the ministry requires Employment Pass and S Pass applicants to meet salary thresholds.

These thresholds are updated regularly, after taking reference from the salaries of locals with similar experience and seniority.

Jobs also need to be accessible to Singaporeans, which is why MOM requires employers to advertise on MyCareersFuture.sg before they make an Employment Pass application, under the Fair Consideration Framework (FCF).

Ultimately, Singapore’s success as a global business hub depends on attracting and retaining a diverse pool of talent. As the country’s population ages and fertility rates decline, it will become increasingly important to balance the needs of local and foreign workers.

While foreign professionals can help plug skills gaps and supply shortages, policymakers must also work to ensure that Singaporeans are not left behind in the job market.

By striking a balance between foreign and local talent, Singapore can maintain its competitive edge while also ensuring a prosperous and inclusive future for all.

Featured Image Credit: Getty Creative