In 2004, the United Nations (UN) published a report advocating for businesses and stakeholders to pay closer attention to environmental, social, and corporate governance (ESG). It recommended actions such as implementing ESG principles and factoring them in when making investments. The ultimate goal was to facilitate sustainable development and more resilient financial markets.

In the years since, ESG has grown significantly with a number of countries introducing mandatory ESG reporting standards. For companies listed on the Singapore Exchange, sustainability reporting is required on a ‘comply or explain’ basis. Reports must include information such as sustainability policies and targets, relevant ESG factors, and climate-related disclosures.

Starting 2024, these rules will become stricter for companies in a number of industries – such as finance and transportation – ensuring that they report climate-related risks and opportunities, without exception. This information can prove valuable to investors, lenders, and other stakeholders.

For example, an ESG report could reveal whether a company is at risk of facing regulatory challenges. As governments around the world push for a green transition, sustainability guidelines are gradually being codified into rules and policies. Companies which don’t adequately prepare for these changes risk being left behind when they take effect.

Making ESG reporting simpler

While its benefits are apparent, ESG reporting is no simple task. Especially for small businesses, the cost of collecting and analysing data is a significant hurdle.

Beyond this, data accuracy is another pain point. Unlike financial reports where information can be easily quantified, ESG reporting relies on estimates and subjective evaluation.

As such, in Singapore’s efforts to improve sustainability reporting, these factors must be kept in mind. Companies need support to comply with reporting requirements while running their day-to-day operations.

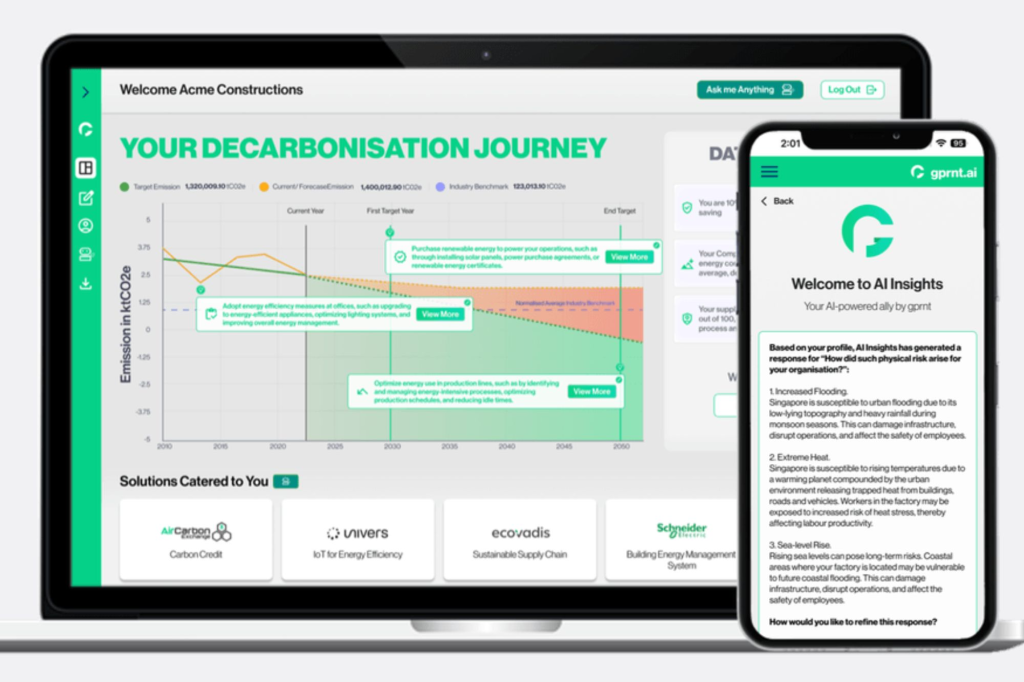

At the Singapore Fintech Festival 2023, the Monetary Authority of Singapore (MAS) unveiled Gprnt.ai (pronounced ‘greenprint’), a platform designed for seamless ESG data collection and access. Using AI technology, Gprnt aims to help companies – both small and large enterprises – automate their ESG reporting process.

It was a combination of tech providers, global banking [companies], and regulators, invited to come together and find a comprehensive way to create a platform where everybody would be able to disclose [ESG] data in the most elegant and frictionless way.

– Sopnendu Mohanty, Chief FinTech Officer, MAS

Microsoft, HSBC, KPMG in Singapore, MUFG Banks, and MAS are all strategic partners in this project, supporting the commercialisation of Gprnt.

The need for standardisation

Gprnt seeks to address a variety of issues which stand in the way of effective sustainability reporting. Among these is the need to standardise the data and metrics used by companies as part of their reporting process.

“Currently, the data sources are very disparate,” explains Sunil Veetil, HSBC’s Regional Head of Commercial Banking Sustainability. There aren’t established proxies to stand in where there’s a lack of data either. “And if you use inconsistent proxies, obviously, the end results will be very different.”

This makes it difficult for banks to provide loans or gauge customers’ credit scores based on existing methods of ESG reporting. For banks such as HSBC, it’ll prove useful if businesses begin using a common platform such as Gprnt for reporting. “This is what we’d like to focus on across the region.”

Banks and investors will be able to make more informed decisions when provided with high-quality data. This will enable money to flow into truly sustainable companies and away from greenwashing projects which have become prevalent in recent years.

For businesses, Gprnt will provide access to data from trusted providers and allow them to select from a curated set of global ESG standards. A dedicated AI tool will help identify ESG risks and areas of improvement as well. This service could help reduce the traditional costs associated with ESG reporting – a key factor to help ensure that small enterprises can keep up with regulatory requirements.

The future of ESG in Singapore

With Microsoft as a technology partner for Gprnt, Mohanty expresses hope that the reporting process will become as simple as the click of a button. “I think [there should be] a single button. You press it, the data gets collected and passed on to Gprnt, the report gets generated, and you take it to the bank to get credit.”

In reality, there are likely to be a ‘few buttons’ involved but the idea remains the same – breaking down the barriers to ESG reporting.

Earlier in November, MAS also announced that Gprnt had entered into a collaboration with Singapore Manufacturing Federation (SMF), an organisation representing around 5,000 corporate members.

“This collaboration signifies a major stride in our ongoing efforts to support the sustainability journeys of our 5,000 member companies,” says SMF President Lennon Tan. By integrating Gprnt into its initiatives, SMF will enable efficient capture and sectoral aggregation of ESG data.

“This advancement greatly simplifies the ESG reporting process, especially for small and medium enterprises,” he concludes.

Featured Image Credit: MAS

Also Read: More merchants are now accepting Alipay+ in S’pore – here’s a look at what it’s about