Let’s face it: we need to have a better relationship with money.

Many of us often feel the pinch whenever we see our monthly bank statements, and some even find ourselves living paycheck to paycheck.

Yet, some of us continue to spend lavishly. According to an article by Psychology Today, doom spending is defined as when a person splurges to indulge and comfort themselves from stressors such as the tense political climate and growing economic disparities.

This phenomenon is apparent in Singapore, especially amongst those aged 40 and “Henrys”—young high flyers that have yet to become rich.

Financial consultants explained to The Straits Times in May that people spend impulsively to “distract themselves” from the seemingly “dystopian” state of the world and its economy. However, many often forget that they grow deeper in debt and might experience difficulty recovering financially as they age.

With societal concerns such as the lack of job security and inflation, it’s no wonder that almost half of Singapore residents believe that they will never achieve financial freedom.

To decrease the financial literacy gap, many people, including Joey Lim and Chungsoon Haw, founders of sav.finance, have launched their own platforms to combat that issue.

However, with many financial planning businesses dying out in the last few years, how do they intend to sustain?

Sav.finance first started as a podcast

While many might recognise sav.finance as an Instagram account that aimed to engage and help “new adults” in Singapore in navigating money, career and wellbeing, the company actually started out as a podcast—Money Shots.

Joey shared that she started the business on Instagram at the beginning of 2020 and invested approximately S$1,000 with her former business partner. However, the platform was stagnant, and she was desperately trying other ways to grow, which led her to start the podcast.

“We thought there were a lot of interesting money questions that surrounded us in our daily lives that we would sort of gossip with our friends about,” explained Joey. Each episode would focus on a set topic, such as paying on first dates and on Wedding Ang Pao rates, where they would debate and share their opinions.

I’ve personally listened to a few of Money Shots’s episodes prior to speaking to Joey, and let’s just say that it was unfiltered and raw in the most interesting way, which she acknowledged was not “everyone’s cup of tea”.

“I was very unhinged in the podcast,” Joey added frankly. She explained that while she has received criticism from listeners for being “too vulgar,” some enjoyed the contrasting dynamics between the hosts and found the podcast gave a refreshing and casual take on finance.

This allowed sav.finance to grow its audience and expand its community. “I think that gave our audience a peek into sav’s personality as a brand and because of how intimate the podcast was, people started feeling like they could also share their problems and questions,” said Joey.

For Chungsoon, personal finance has been an area of interest since he graduated from university. He notably worked for The Financial Coconut, another homegrown personal finance company, before joining sav.finance.

But wait a minute, didn’t Joey already have a co-founder? How did Chungsoon come into the picture?

New founder, new beginnings

Joey’s journey with sav.finance was marked with many twists and turns, as the platform was founded when many financial lifestyle brands emerged, making it more difficult for them to stand out.

“We went through all the emotions, got angry about copycats, and stressed about constantly coming up with new ideas, but ultimately decided to put our heads down and continue doing what we did best,” reminisced Joey.

Despite her determination, her then-co-founder expressed his desire to leave the company. As Joey solely handled the design aspect of the business, she naturally decided to put sav.finance on hold and posted their “final” Instagram post in 2022.

“There were quite a few encouraging messages that made me feel sad about leaving our little community behind. And this was when Chungsoon (CS) slid into my DMs,” Joey added.

I reached out to Joey when sav.finance was initially going to shut down to better understand the situation. Realising that there is an opportunity, I took over from the previous founder and continued running it with Joey till today.

Chungsoon Haw, co-founder of sav.finance

Since Chungsoon joined the team, the company has focused on building more tech and expanding its presence beyond Instagram—this includes working offline with financial brands or engaging with followers by hosting workshops.

“We’re trying to meet the audience where they’re at—understanding the importance of finances but not having a place that they can connect with or tools that make it easier for them. Our content and workshops are meant for the former, and digital tools like money planners, and goal-setting calculators are meant for the latter,” said Chungsoon.

Sustainability is the goal

Currently, sav.finance’s Instagram page has grown to have 30,700 followers at the time of writing, with 85 per cent being women and 90 per cent being under 34 years old.

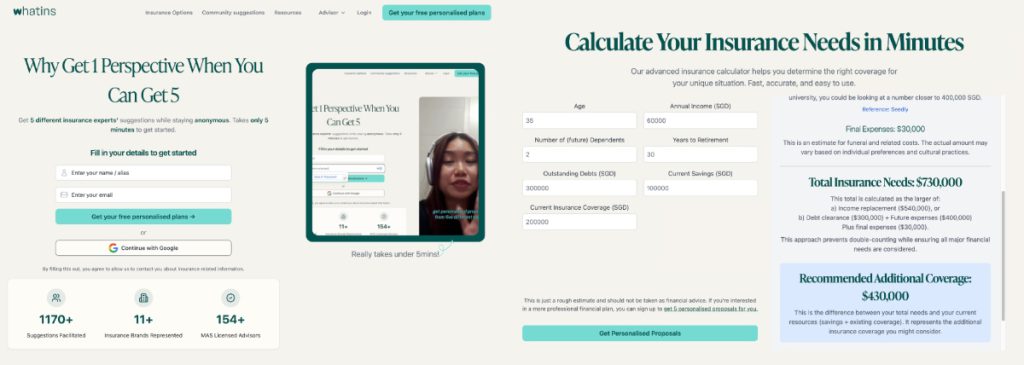

Last year, the company also held workshops, created digital tools such as a budget planner, and launched WhatIns, a digital platform that focuses on connecting people to financial advisors.

Chungsoon shared that they received many messages looking for insurance advice and decided to launch Insurance Diary, an Instagram carousel series that is a spinoff from another series: Money Diary.

“However, Instagram isn’t very good for finding information, so we decided to turn it into a website,” he explained. The online website has since evolved into a platform that provides people with diverse insurance suggestions and helps them find an advisor that matches their needs.

The team decided to monitor the platform for four months to gauge if the site met the needs of their audience, to which they successfully garnered interest from the general public.

Chungsoon quickly clarified that WhatIns solely connects people with insurance advisors as a neutral platform. Rather than persuading users to purchase insurance plans and policies, their goal is to make exploring and understanding insurance options as “easy and seamless as possible”.

However, sav.finance and WhatIns have been unable to break even consistently. Chungsoon explained that the company’s primary source of income is sponsorships and “a bit” from their users’ purchase of digital products and workshop sign-ups.

But that isn’t something we can rely on on a regular basis.

Ultimately, the biggest question for us is how do we plan on staying relevant to our audience while creating the content that the platforms are willing to promote. Right now we’re looking to start creating reels. Besides that, it’s about creating more digital products and other workshop type events that we have full control over.

Chungsoon Haw, co-founder of sav.finance

To increase their efficiency, the team hopes the long-term value will come from kickstarting new products and services using their audience instead of “starting from scratch”.

Nonetheless, their audience has been receptive to their informative posts and events. Last year, over 1,000 people signed up for their Money Spring Cleaning workshops, which touched on three key topics: budgeting, insurance, and investing.

While WhatIns has also facilitated almost 1,000 insurance suggestions since its inception last year, the company has plans to improve both platforms. They have also expressed their desire to expand the range of workshops and the frequency in the future if their audience wants them to.

- Learn more about sav.finance here.

- Read other articles we’ve written about Singaporean startups here.

Featured Image Credit: sav.finance