“Unfortunate but necessary”: S’pore fintech firm MoneyHero Group axes 80 employees to cut costs

Singapore’s MoneyHero Group, the known operator of homegrown fintech platforms Seedly and SingSaver, has laid off 80 employees to reduce expenses, The Business Times reports.

The company’s website states that it has over 300 staff across five markets, including Singapore. However, the firm has yet to respond to media queries on where the affected employees are located.

In an e-mail to staff sent yesterday (Jul 24) evening, CEO Rohith Murthy described the decision to downsize the “enterprise-wide team” as “unfortunate but necessary.”

“These layoffs are strictly about enhancing MoneyHero’s long-term financial health and profitability. There are no larger issues at play here,” he said in the e-mail, seen by The Business Times.

Murthy added that the company is still in growth mode and boasts “a strong leadership team, dominant market share, a proven strategy, strong cash position and powerful access to capital that no other peer can match”.

“This is simply a required business action taken to address inefficiencies and safeguard our future,” he said.

The Nasdaq-listed firm operates online personal finance platforms recommending financial products in Singapore, Hong Kong, the Philippines, and Taiwan.

An October 2023 report in The Straits Times stated that the group employed 349 staff across five markets, 99 of them in Singapore.

Murthy, who became CEO in February, cited strategic realignment as a key reason for the layoffs.

“Our next chapter of growth demands stronger platform efficiencies and more investments in technology, including artificial intelligence and automation,” he said. The company must “reduce redundancy, enhance performance, and eliminate unnecessary layers” to operate more efficiently, he added.

Murthy clarified that affected employees were not chosen based on performance and that the company will support laid-off employees with a “comprehensive” package, which includes the following:

- Immediate garden leave OR an ex-gratia payment for a transition period

- Insurance coverage through December 2024

- Professional and mental health counselling

- Outplacement support

- Recommendation letters from senior leaders

- A laptop computer

However, according to the company’s LinkedIn page, the firm has 33 positions for hire, with eight jobs in Singapore at the time of reporting. Some positions were reposted within four days to two weeks prior.

Struggling since Nasdaq debut, most recent layoffs in 2022

MoneyHero made its debut listing on Nasdaq in October 2023 after merging with Bridgetown Holdings, a special-purpose acquisition company backed by PayPal co-founder Peter Thiel’s venture firm and Hong Kong tycoon Richard Li’s Pacific Century Group.

However, the company has struggled with weak investor sentiment. Its share price has dropped about 52 per cent since its first listing, closing at US$1.62 on Tuesday (July 23).

MoneyHero first launched as a fintech startup in Singapore in 2014 under the name CompareAsia Group, later rebranding as Hyphen Group. According to past media reports, the company also conducted two rounds of layoffs in 2022 to cut costs.

It is also worth noting that Yeap Ming Feng, the former Head of Seedly, announced in a LinkedIn post two weeks ago that he would step down from his position, with July 22 as his last day.

Yeap expressed his gratitude in a follow-up post on Facebook on Monday, stating that it was time to “say goodbye to this meaningful seven-and-a-half-year chapter.” and will “hand over the reins to Seedly’s parent’s MoneyHero group.”

From being tasked with growing users on our expense tracking app back in 2016, experiencing two acquisitions with ShopBack in 2018 and MoneyHero Group in 2020, to hitting our first million visitors, launching our own travel insurance, and organizing Singapore’s largest personal finance festival—I am glad to have helped build a platform that enhances our users’ lives every day.

The Seedly story will continue firmly in the safe hands of MoneyHero Group, where it will thrive under a new organizational structure. I will be handing this Facebook Group in the good hands of Vernice Ng and Diviya Tharani whom you all are already very familiar with.

Please continue to contribute and benefit from this community. Cheers!

Yeap Ming Feng, former Head of Seedly in a Facebook Post

Featured Image Credit: Money101 via LinkedIn

Also Read: 77% of S’poreans claim that they can spot deepfakes, study shows

Singapore could abolish all taxes and still pay each family $1,500 per year. Here’s the math

Disclaimer: Opinions expressed below belong solely to the author. Data sourced from the Singapore Department of Statistics.

Much is being said about how rich Singapore is as a country but I often come across people who say they don’t see or feel it in their lives.

Singapore’s tax system, while attractive compared to the rest of the world, is still quite complex, and there seems to be a sense that Singaporeans are asked to pay extra everywhere they turn. There’s income tax, GST, property taxes, COE, vehicle taxes, etc., all add to the cost of living.

So, how much are you getting for all the money paid into the system? Quite a lot, it turns out.

Taxes begone

In recent years the government has become so generous that, on average, each Singaporean receives more money than they pay into the budget in all taxes.

Yes, all of your income taxes, the higher GST, water conservancy, property and so on, are less than you receive back.

It wasn’t always this way. Prior to 2016, Singaporeans paid a bit more than they received before both lines converged and, ultimately, diverged in opposite directions following the pandemic.

These changes can be linked to the increase in Net Investment Returns Contribution (NIRC), the returns contribution from investment of the reserves, as well as Covid and post-Covid, inflation-related aid programs, whose role is to reduce the impact of the global inflation crisis that followed.

The side effect is that today the government could theoretically abolish all taxes (affecting individuals, not the corporate tax, of course) and would still pay a net ca. $500 to each Singaporean every year.

Yes, that would mean zero PIT, zero GST, zero property, vehicle, alcohol, tobacco, or water taxes, and still $1,500 cash per average 3 pax household.

Wouldn’t that be nice? So, why isn’t it?

Pay up

Of course, given that you wouldn’t pay into the system, you would receive much less in numerous public services. Forget about healthcare or education subsidies, CPF top-ups, Workfare Income Supplement, Baby Bonuses and so on.

The list is so long, in fact, that it takes two pages in the official government document listing all programs qualifying as government transfers. You can check this list in last year’s Key Household Income Trends report here, at the very end of the document.

The other thing to remember is that all of these numbers are averages. This means that a small group of wealthy residents is paying a lot more in taxes, supporting the rest of the country.

If taxes were abolished, then this burden would have to be evenly distributed amongst everyone, leaving a large majority of the society with much higher bills to pay.

How large?

Around 80 per cent, because that’s how many people live in HDB apartments.

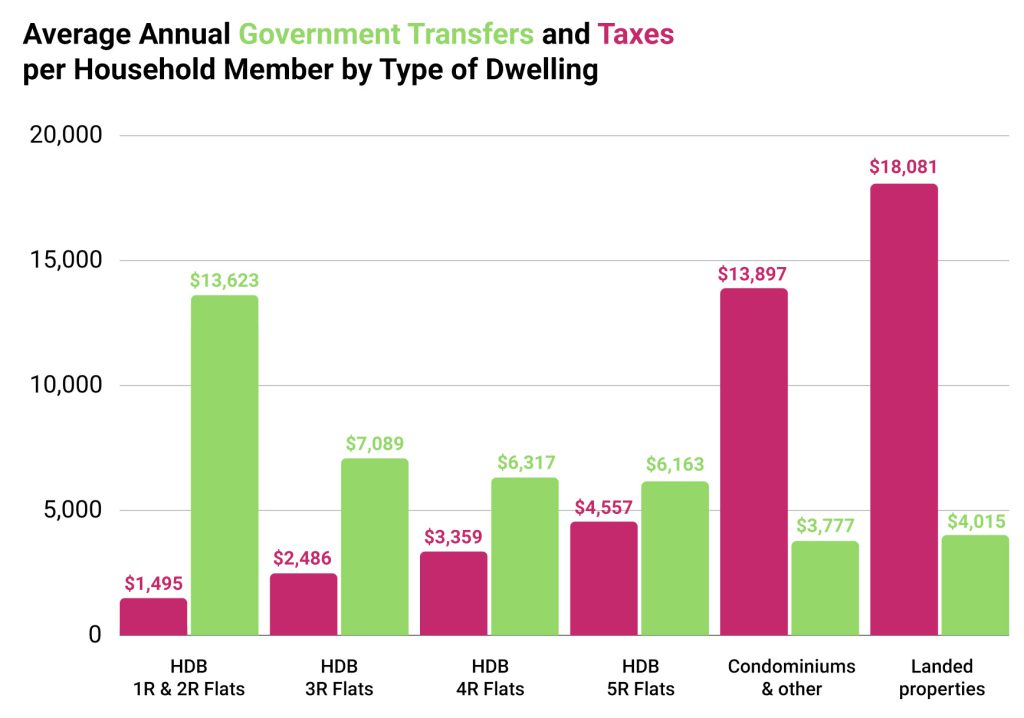

As it turns out, even those enjoying the most spacious, 5-room HDB apartments are, on average, net recipients of government support, to the tune of $1,500 per person, each year.

It’s those wealthy enough to afford private properties who, unsurprisingly, fall into the top tax brackets and consume the most, together paying between $10,000 and $14,000 more for each household member than they receive back.

If taxes were gone, they would stand to gain the most, at the expense of everybody else.

Taking grants for granted

Not enough time seems to be spent on communicating these numbers to broader audiences. We all know that the rich pay more in taxes—but how much more? And what does this buy for the rest of society?

This often appears murky, lost in the dozens of government support programs designed for various demographics. But it’s there.

Subsidies, grants, vouchers, and transfers have become an entitlement that isn’t questioned. But the money has to come from somewhere.

Besides taxation, there’s of course, the NIRC—returns from reserves invested for profit by GIC, MAS, and Temasek, which contributes to over 20 percent of the national budget. Taking from the rich and giving to the poor would not be enough. That’s why the government had to find some money of its own, and thankfully so.

There’s a limit on taxing the rich, after all.

At 24 percent the top income tax rate may seem relatively low compared to many developed countries, but there are always tax havens competing for the same people. Squeeze them too much and they will leave with all of their money, never to pay taxes here again.

This is why taxes are here to stay: to create a common pool of funds, redirected to the majority of the population, a share of the success of those at the top, in the private and public sectors alike.

Featured image: ixuskmitl / depositphotos

Confidence breeds confidence: 500 Global’s Khailee Ng on “entrepreneurs’ superpower”

Setting the stage of Tech In Asia’s inaugural conference in Malaysia, 500 Global managing partner Khailee Ng took to the stage to deliver his keynote speech titled “Malaysia on the Rise”.

During that keynote speech, Khailee shared many inspiring pearls of wisdom for entrepreneurs and investors alike.

One particular value that he not only embodied but championed was: confidence.

Don’t base your confidence on the news

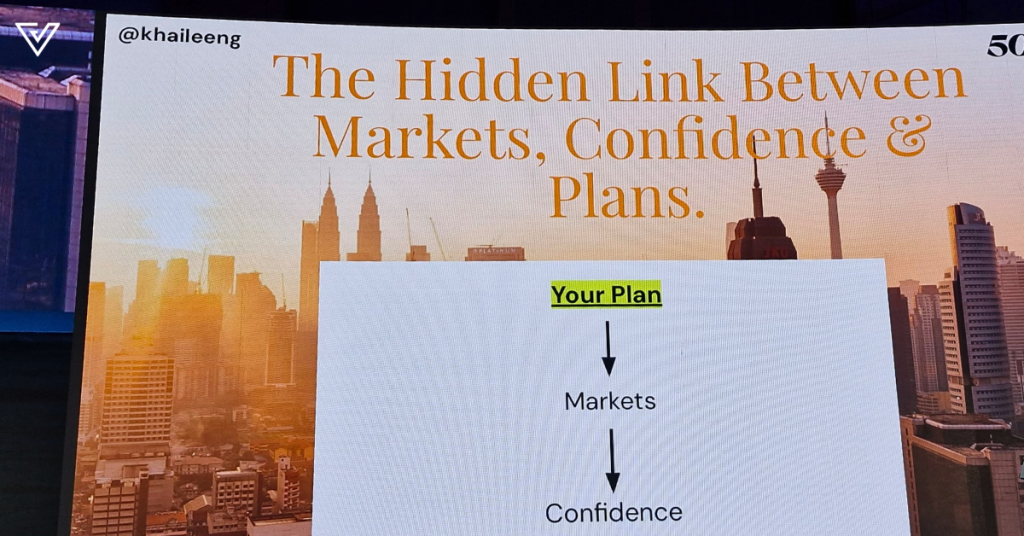

Calling this “probably the most important lesson of this whole presentation”, Khailee spoke about the subtle hidden link between market outlooks, confidence, and plans that are being made.

“I observed that for most people, when there’s good news in the market, the confidence rises,” he pointed out. “And then, they make plans based on the confidence that is derived from the markets.”

Likewise, when there is bad news, then these people will lose confidence and may play small. This is not a bad thing, just how the world works.

“Very few people have a different relationship between market outlooks, plans, and confidence.”

Some people would wait to see how markets go up and down, and then they adjust their plans—not necessarily based on their confidence.

But Khailee pointed out, “Most fortunes are made because of the plans they made when the economy was down. So, when markets change and shift, what are your plans?”

For companies that have made it into the top percentile, their plans will end up shaping the market, and thus give rise to confidence in others.

“A lot of regional champions are built in the worst of times and without any good news,” Khailee said.

So, like them, Khailee believes that Malaysian entrepreneurs, investors, and talents must not let their confidence waver in the face of the news, but rather, make their own plans rationally and have confidence in those plans.

Power of confidence

Although there are many reasons for Malaysians to be confident, a lot of VCs and investors may not be.

“This is the game of confidence,” Khailee said. “This is where confidence should rise. We’re going to need a way to build this confidence and let it spread, because confidence breeds confidence.”

Recently, Khailee found himself in a due diligence call, where a foreign VC was checking in on his experience with a startup he invested in.

To that, Khailee shared the candid initial experience he had with the startup founder.

While walking in Bangsar one day, he was suddenly stopped by a man on the street. Although he initially thought he was being robbed, that man turned out to be a startup founder and just wanted to pitch his business.

His confidence and ability to accost Khailee in public—though Khailee does not recommend this at all—got him the start he needed.

After raising his seed round, though, he was unable to raise for another six years. The seed funding was not enough to instil confidence in others.

But the founder kept his core team together and continued to bootstrap to sustain the business. One day he called Khailee up again. He requested for just $50K (the currency was not clarified) to pivot his business.

This business would be iMotorbike, a Series A startup that most recently raised US$2.6 million.

This story just goes to show how you shouldn’t let the industry trends sway you, but rather shift your business accordingly and find a way to build confidence.

Hopefully, founder Gil Carmo’s confidence may inspire yours too.

In any case, to Khailee, confidence is a superpower to entrepreneurs.

“Keep up the confidence,” he said. “Rain or shine, good news bad news, keep up the confidence. Confidence in your plans. And keep executing.”

Also Read: Meet the startup that powers the backbone operations of over 7K M’sian F&B outlets