Since its emergence, blockchain technology has preached a vision of financial inclusion — a way to reduce inequalities and barriers to entry. During this time, cryptocurrencies such as Bitcoin and Ethereum have become popular alternative investments, with market caps exceeding hundreds of billions of dollars.

That said, they haven’t quite lived up to the mandate. While they’re readily accessible, cryptocurrencies have proven time and time again that they aren’t safe investments. Today, the crypto market remains incredibly volatile and demands a high risk tolerance. Stable returns have been hard to find even through dedicated funds and staking protocols.

In reality, financial inclusion doesn’t require the creation of new assets – what’s more important is enabling access to existing ones. This is where tokenisation comes in.

How does tokenisation work?

Tokenisation is a method of representing real-world assets in the form of digital tokens. These tokens can be made freely investable, allowing holders to share in profits and ownership of the underlying assets.

For example, an apartment – worth S$1 million – could be represented by a million tokens of S$1 each. Holders of these tokens would be able to share in any rental income generated by the apartment. If the value of real estate were to appreciate in the future, this would also be reflected by an increase in the token prices.

Normally, access to real estate would be limited to those who could afford to buy the entire apartment. However, through tokens, the entry price can be made a lot lower. This opens up a relatively safe investment opportunity to many who’d usually be excluded from it.

Beyond finance, tokenisation can help overcome geographical barriers as well. In countries with a volatile economy, it can be tough for locals to grow their wealth. Local currencies are often subject to drastic fluctuations and can lose their value rapidly. Tokenisation offers access to safer investments which can be found elsewhere in the world.

Access to the world’s safest assets

US Treasury Bills are considered to be one of the safest investments in the world, offering yields of over five per cent at present. They are short-term debt securities issued by the US government and outside of black swan events – such as the recent debt ceiling crisis – they tend to be risk-free.

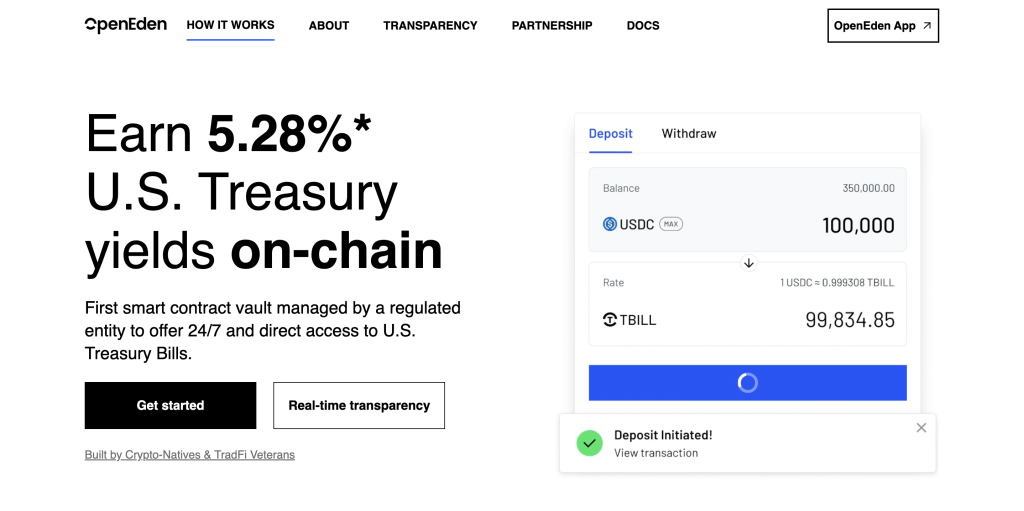

Earlier in April, Singapore-based startup Open Eden launched a smart-contract vault offering access to TBILL tokens, which are backed by US Treasury Bills. The vault is managed by a financial institution regulated by the Monetary Authority of Singapore (MAS).

Currently, OpenEden only allows professional investors on its platform — but it still serves as an example of how tokenisation is changing the world of finance.

It allows investors 24/7 access to Treasury Bills, otherwise limited to US trading hours. In addition, any settlement take place immediately and trades can be made at any time.

OpenEden was founded to address a growing demand in crypto for low-risk, liquid, and transparent assets. As the industry matures and hopes to attract more institutional investment, such projects could be a key driving force.

Along with making transactions more efficient, TBILL tokens could unlock trillions of dollars in value. “There is around US$130 billion worth of stablecoins sitting on the sidelines and not generating any meaningful yield,” OpenEden co-founder Jeremy Ng comments on the current state of the crypto market.

In traditional finance, bear markets don’t demand investors to hold cash. Precious metals, bonds, and other securities offer promising alternatives during the downturn. Tokenisation is helping bring such opportunities to crypto as well. Investors no longer need to park their money in stablecoins while waiting for Bitcoin to push for all-time-highs again.

In the form of tokens, assets can easily be used as collateral too. This would allow investors to gain access to liquidity without having to give up their investments.

The future of tokenisation

As the trend picks up, more and more businesses are looking into use-cases for tokenisation.

In April, Tyrone Lobban, head of JPMorgan’s Onyx, told Coindesk that tokenisation would be a killer app for traditional finance. The company is pushing forward with its efforts to tokenise real-world assets including bonds and mutual funds.

Real estate token offerings are becoming more common as well. For example, CoFund tokenised a US$10 million resort in Bali this April, with minimum investments starting at US$1,000. The company projects an annual return over 10 per cent for investors resulting from rental yield and an increase in property value.

Other assets which could benefit from being tokenised include carbon credits and commodities. OCBC and MVGX are exploring the former, with a partnership announced last year to develop green financing products around such tokens.

As for the latter, Argentinian startup Agrotoken enables the tokenisation of grains such as wheat and corn. Producers can tokenise their harvest online and subsequently use the tokens as collateral or trade them for currency. Spanish bank Santander has been working with Agrotoken on developing loans secured by such tokens.

Although it’s been a meandering road, the blockchain vision of financial inclusion is finally picking up steam.

Featured Image Credit: Built In

Also Read: What the US’ crackdown on crypto means for Singapore and the rest of Asia