Disclaimer: Any opinions expressed below belong solely to the author.

One of the advantages of crypto, we have always been told, is its inherent transparency. After all, most information is freely available on the blockchain, so anybody can track transaction volume, market capitalisation, prices and so on.

It has, indeed, come in very handy in reviewing the current state of arguably the most overhyped of all crypto inventions — Non-Fungible Tokens (NFTs). According to numbers collected and reviewed by dappGambl, published a few days ago, as many as 95 per cent of NFT collections have a value of US$0 — nothing, zilch, nada.

“Of the 73,257 NFT collections we identified, an eye-watering 69,795 of them have a market cap of 0 Ether (ETH). Having looked into those figures, we would estimate that 95 per cent to include over 23 million people whose investments are now worthless.”

In other words, even if we ignore the absurdity of paying millions of dollars for randomly generated images of monkeys, vast majority of tokens don’t even have a value of a few bucks and billions of dollars have been literally wiped out (leading to some lawsuits against celebrities like Madonna, who promoted NFTs during the craze).

What about the top collections?

You might be thinking that the figures are somewhat misleading, given that in every industry there’s a limited number of real performers, while everything else is just a long-tail of failures adding to the noise, but not being representative of the market.

After all, any wannabe could have thrown together an NFT project that turned out to be a dud and is now polluting data.

Well, the authors of the report decided to take that into account and looked more narrowly at the top 8,850 collections according to CoinMarketCap, to see if things are any different at this upper end of the scale.

Instead of ownership, this time they examined the floor price of listed NFT assets within these collections, to estimate how much their current owners think they might be worth (and are willing to sell for).

They found that over 1,600 of the listed projects were completely dead, with a floor price of US$0, which means you could technically get them for free.

The most common expected price range was up to US$100 and less than one per cent of all listings had a listed floor price of more than US$6,000. That’s just 80 listings out of this narrow band of 8,850.

Trading volume down by 96 per cent

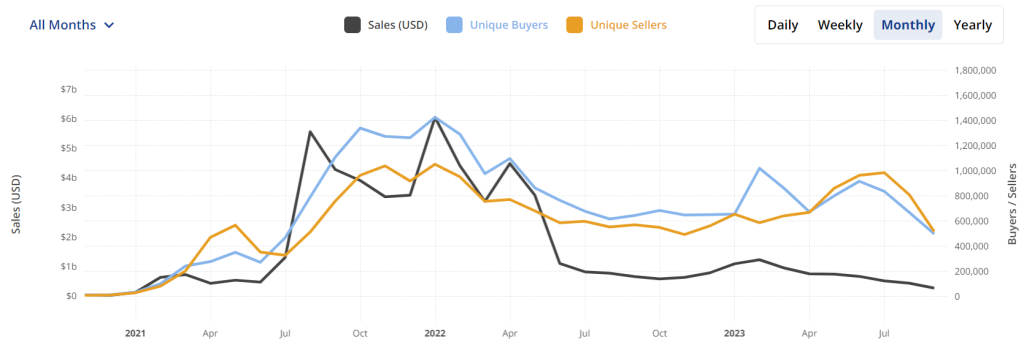

Even if you were somewhat sceptical about these findings, there’s one other piece of independently verifiable data — current, monthly trading volume. And it appears to be strongly correlated with the collapse, having fallen to just four per cent from its peak in 2022.

Transaction value has just hit its latest low of US$253 million in the previous month, down from the peak of slightly over US$6 billion reported in December 2021. This is a drop of 95.8 per cent.

Curiously, the number of unique buyers shrank only by around 65 per cent — from around 1.4 million to under half a million — which means that there are still relatively many people transacting in NFTs, just at much, much lower values than before.

And it doesn’t seem that the trend is going to be reversed in the nearest future — or, in fact, ever.

Featured Image Credit: MininyxDoodle / depositphotos