These days, pickleball has been all the rage. Almost every other person I know has tried the sport.

Perhaps arguably underlooked, though, is padel.

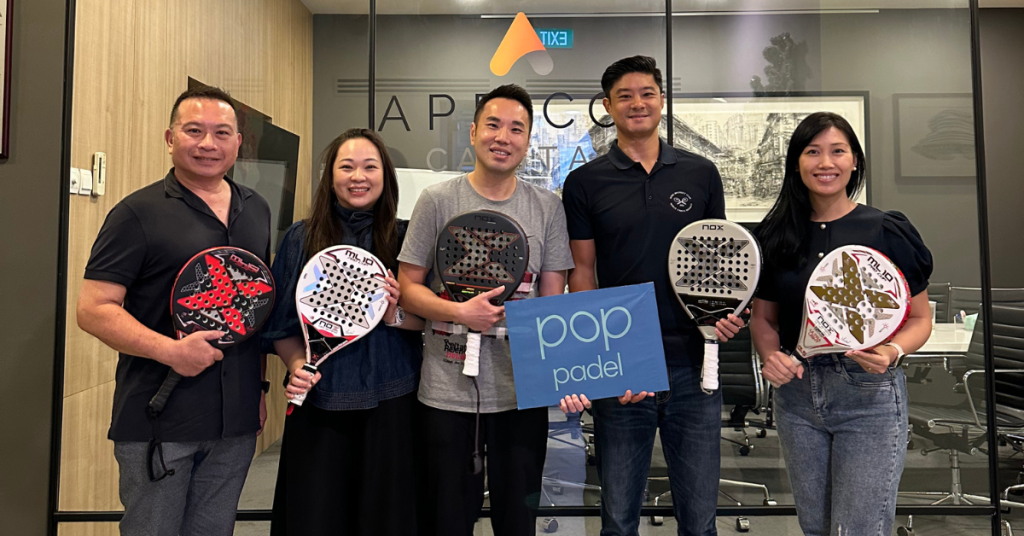

But maybe that’s about to change through the rise of Pop Padel, an upcoming premium padel club that just secured a seven-figure investment from Apricot Capital, a Singapore-based private investment firm.

Pop quiz: Who’s Pop Padel?

Based in Singapore, Pop Padel aims to be present in Singapore and Malaysia, with the vision of establishing both countries’ first premium padel facilities.

The objective is to offer world-class, tournament-standard courts and a vibrant hub for padel enthusiasts of all skill levels to connect, play, and grow.

Originating from Mexico, padel (also known as padel tennis) is a racket sport typically played in doubles on an enclosed court. The court is slightly smaller than a doubles tennis court, and the racquets are made of a composite material without strings, but with perforations (i.e. holes).

The seven-figure investment comes after Pop Padel won a government tender to build Singapore’s first purpose-built fully sheltered social padel club that will host four world-class courts in Redhill.

According to a press release, this was a highly coveted tender. There had been eight bidders, and Pop Padel had bid S$19,000, the second-highest amount. Price aside, the tender was also evaluated based on quality aspects.

What’s popping?

So, what exactly will Pop Padel’s Redhill club offer?

Working with Spanish padel court manufacturer MejorSet, the club will feature panoramic courts equipped with the manufacturer’s latest Mondo turf. They’re also working with NOX, a notable padel brand, to set up a pro shop.

According to Pop Padel’s website, they will also organise various social events and tournaments, as well as a booking app with a rating system.

Beyond the courts’ mats, the club will include an F&B area and a recovery zone with cold plunges for padelists to relax and unwind.

The same will be replicated for the brand’s first Malaysian outlet, which will feature six fully sheltered competition-grade courts in Bamboo Hills.

The fresh funds from Apricot Capital will be key in establishing these state-of-the-art facilities in both Singapore and Malaysia, advancing Pop Padel’s vision of fostering a vibrant padel community across Southeast Asia.

“Securing this buy-in from Apricot Capital is a huge step forward for us at Pop Padel,” said founder Davy Sanh.

Davy has been recognized by the global industry in 2024 as one of the top 50 most influential figures in the emerging world of padel.

“With Apricot’s support and shared belief in our goal of growing padel across countries, Pop Padel is poised to reinvigorate the sports scene and elevate padel as a sport of choice amongst the population living in Southeast Asia in time to come.”

Apricot Capital is the family office of Teo Kee Bock and his family. Teo was formerly founder and chairman of SGX listed company, Super Group Ltd. They’re also the family behind Oatbedient.

The ball’s in their court

Through the support of Apricot Capital, the team hopes to accelerate the adoption of padel in Southeast Asia.

Its multi-country debut is set to happen in March 2025, when both the Redhill and Bamboo Hills clubs will open.

Only time will tell, but perhaps the pickleball hype has helped set the stage locally for padel to take centre stage—or rather, court. And Pop Padel might just be the one to make good on that golden opportunity.

Featured Image Credit: Pop Padel