BNPL for fried chicken? That’s exactly what KFC M’sia & Boost have teamed up to offer.

KFC Malaysia just dropped something that had us doing a double take and wondering if it was an early April Fools joke, but perhaps the joke is on us.

Earlier today, KFC introduced its very own Buy Now, Pay Later (BNPL) payment scheme, QSR PayFlex, powered by Boost.

Through the scheme, fried chicken lovers would be able to split their KFC bill into three monthly installments, with a RM5 service fee (Wakalah fee) for totals below RM100, going up to RM10 for those at RM100 or more.

Certified Shariah compliant, a 2.5% profit rate would also be incurred, paid on each installment date.

Like most other BNPL schemes, a late payment would also be subject to a 1% p.a. interest rate, calculated daily on the outstanding balance.

To register for the service, you can do so via PayFlex’s website, and upon entering your credentials, a check will be done to see if you meet the eligibility criteria.

These criteria include:

- Being a Malaysian citizen

- Aged between 21-60 years old

- Passed the internal credit score eligibility and assessment

Editor’s Update: The information above has been updated to reflect greater accuracy.

QSR PayFlex currently only accepts debit cards for repayment, which can be made manually through the website or via automatic deductions.

Maybe KFC was inspired by American food delivery service, DoorDash’s announcement to partner with financial company, Klarna, offering users to pay for their food deliveries in small, regular installments.

When the option launches “soon,” DoorDash users can use Klarna to pay in four, interest-free payments or defer payments and let people pick a “date that aligns with their paycheck schedules, according to DoorDash’s press release.

As expressed by Business Insider writer, Emily Stewart, “this scenario might involve more risk than reward for consumers, many of whom are already drowning in debt.”

Part of the way BNPL companies make money is through merchant fees, where the platform that actually books the sale pays a fee to the payment partner, like Klarna or Affirm.

This is similar to credit card swipe fees, but the payouts tend to be even higher. Businesses sign up for merchant fees because giving consumers expanded payment options like BNPL makes them likelier to buy and increases the size of their baskets.

As such, opinions on the ethics of KFC Malaysia making such a move are divided, with some social media users expressing the risk of going into debt from impulsive purchases, while others claim it improves accessibility and convenience for those living paycheck to paycheck.

Also Read: This HP smart printer proves that M’sian SMEs don’t have to break the bank for reliability

Featured Image Credit: KFC Malaysia

This S’porean worked 3 jobs to fund her jewellery biz, now it fully occupies 3 storeys

Vidhi Modi has always had a knack for business.

At just seven years old, she was already selling garam masala-flavoured popcorn and handmade bookmarks to her classmates to earn extra pocket money.

By 16, she had launched a dropshipping business, followed by her own apparel and candle brands. While these early ventures didn’t take off, they didn’t dampen her drive—instead, they fueled her hunger to keep going, eventually leading her to jewellery.

In 2020, with just S$500 in savings from juggling three part-time jobs while pursuing a university degree, Vidhi started XVXII Jewellery from her bedroom, launching through a website she built on Wix.

What started as a side project has now grown into a full-fledged business, occupying a three-storey building at Haji Lane.

“We sold out within a month”

When Vidhi, now 25, first started XVXII Jewellery, she shared that she had little expectation of where the brand would go.

“I thought I might get one or two sales, but to my surprise, we sold out within a month,” she shared.

The brand initially focused on Indian-inspired jewellery, sourcing pieces from India to sell in Singapore.

However, Vidhi soon came to realise that demand in Singapore was “seasonal,” and sustaining the business solely on Desi jewellery would be “difficult” in the local market.

“That led me to explore Western jewellery, which allowed us to cater to a broader local audience,” she added.

As customer demand grew, she also brought in men’s jewellery, working with global manufacturers, primarily Hong Kong-based factories, to produce the brand’s offerings.

By 2021, Vidhi had rebranded XVXII Jewellery as a “100% waterproof and tarnish-free jewellery brand.” “That shift marked a turning point for the business, and we haven’t looked back since,” she added.

Following the rebrand, she opened an outlet at Haji Lane the same year, signing a lease for a ground-floor unit.

But what drove her to establish a physical presence, especially when local and even international brands were closing their doors at that time due to the COVID-19 pandemic?

From pop-ups to a permanent space

When XVXII Jewellery first started, online shopping was the norm, but as pandemic restrictions eased, Vidhi saw an opportunity to expand the brand’s reach through pop-up booths, allowing customers to experience her pieces firsthand before purchasing.

The brand made its pop-up debut in March 2021 at Violet Fair, an event that showcased female-owned local brands in conjunction with International Women’s Day, where it “garnered high sales and more [social media] followers.”

She also held a one-day pop-up at a small lash studio in Chinatown, where the brand paid a rental fee of S$70. “I was hesitant about whether we would even make that amount back, but to my surprise, nearly 20 customers visited,” she shared.

Encouraged by the turnout, she took a bigger leap and rented a pushcart at Paya Lebar Quarter Mall for a week in June 2021—and the business had managed to successfully generate S$10,000 in sales, according to Vidhi.

That success reinforced the importance of physical retail, so after that, I began searching for a permanent retail space. One night, while at Haji Lane, I noticed a “For Rent” sign on a ground-floor unit—after negotiations, I took the leap and signed the lease.

Vidhi Modi, founder of XVXII Jewellery

However, opening a physical outlet came with its own set of challenges. The retail lease required a security deposit of S$4,500, but Vidhi only had S$2,000 saved from her sales, so she turned to her parents for a loan.

With her remaining savings, she had to be resourceful and “budget carefully” for inventory, furniture, and flooring.

“We cut costs wherever possible—the flooring was a Shopee sticker that my dad and I painstakingly laid down strip by strip over five hours. The furniture was from IKEA, as it was the most affordable option for display racks.”

After drawing over 20,000 customers since opening, the business has recently made the decision to move out and expand into a three-storey building at the entrance of Haji Lane, with the entire space now dedicated to the brand.

The brand opened the doors to its new location on March 8, 2025.

Opening more outlets

At XVXII’s new store, you’ll find over 500 jewellery variants to choose from, and you can even personalise your own accessories with charms.

Most recently, the brand has started offering jewellery workshops, which have since become a “core part” of its offerings.

According to Vidhi, the business receives an average of 25 to 30 bookings per month and also accommodates large private events every two to three months—their largest workshop to date hosted about 120 participants.

Looking forward, Vidhi plans to open two more permanent retail outlets in Singapore by the end of 2025 or mid-2026.

In the long term, we aim to expand internationally, with plans to establish either an e-commerce presence or a physical store in Bali or Sydney.

Vidhi Modi, founder of XVXII Jewellery

- Find out more about XVXII Jewellery here.

- Read other articles we’ve written about Singaporean startups here.

Also Read: Colour analysis studios are everywhere, but this S’porean biz has a plan to stand out

Featured Image Credit: XVXII Jewellery

Can M’sian bizs play any music or show they want on their premises? Here’s what the law says.

Disclaimer: This article is for general informational purposes only and is not meant to be used or construed as legal advice in any manner whatsoever. All articles have been scrutinised by a practising lawyer from Tristan & Partners to ensure accuracy.

When it comes to restaurants, it’s often more than just about the food. It is the experience as a whole that crafts that picture perfect scene that has you coming back for more.

Service, atmosphere, and interior design all go without saying, but another crucial aspect is, of course, music.

But playing music for non-personal uses, or any media for that matter, is always a touchy subject.

It’s not uncommon to see YouTubers, for instance, have videos taken down because of this exact issue. Be it using an unlicensed song as their background music or a clip from a show they like to emphasise their point, if they get three strikes, they’re out.

Even celebrity artists are not exempt from the wrath of the music labels that they are affiliated with.

But if that’s the case, is it legal for restaurants in Malaysia, or any business for that matter, to play whatever they want on their premises?

The short answer, as you could probably guess, is a resounding “no.”

The “right” in “copyright”

When it comes to licensing media such as literary works, musical works, artistic works, films, sound recordings, broadcasts, and derivative works, the key word that it always cycles back to is “copyright.”

According to the Intellectual Property Corporation of Malaysia (MyIPO), copyright is the “exclusive right to control creative works created by the author, copyright owner and performer for a specific period governed under the Copyright Act 1987.”

“Infringing on copyright” would thus mean to use copyrighted works that fall under the Copyright Act without the consent or permission from its respective copyright holder.

This includes playing copyrighted work publicly, as noted by Public Performance Malaysia (PPM).

Licences to legally use copyrighted works in Malaysia can be obtained from Collective Management Organisations (CMOs), who are given the authority by copyright owners to administer the rights to use their respective works.

CMOs are also responsible for collecting the respective royalty fees that come with the usage and licence of each copyrighted work. This can range anywhere between 5% to 15% of net sales depending on the type of IP, market demand, and negotiation, as noted by Bestar.

MyIPO lists the following CMOs that individuals can apply for licences from:

| Collective Management Organisation | Represented Parties | Media Type |

| Music Authors Copyright Protection Berhad (MACP) | Songwriters, composers, and music publishers | Musical/sound recording works |

| Public Performance Malaysia Berhad (PPM) | Recording companies | |

| Recording Performers Malaysia Berhad (RPM) | Recording performers | |

| Music Right (Sarawak) Berhad (MRSB) | Recording companies, songwriters, composers, music publishers, and recording performers for ethnic songs in Sarawak | |

| Music Rights Sabah Berhad (MRS) | Recording companies, songwriters, composers, music publishers, and recording performers for ethnic songs in Sabah | |

| Malaysia Reprographic Rights Centre Berhad (MARC) | Writers, publishers, and authors in the publishing industry | Literary and artistic works |

Note that a licence from the MACP, PPM, and RPM each needs to be obtained in order to legally play music on business premises. This is because they each collect royalties for different parties.

“Your subscription with these platforms (Astro, Spotify, YouTube Music) and similar services only allows you to use them in your personal capacity,” states MACP on their FAQ page.

“An MACPLicense allows you to play those subscription music in a public setting and the fees vary depending on your usage.”

One closed eye

All that being said, there do exist special circumstances where copyright laws can be bypassed, allowing for the usage of copyrighted works without a licence.

Among many others, Section 13(2)(a) of the Copyright Act 1987 specifically highlights purposes of research, private study, criticism, review or the reporting of news or current events.

The “incidental inclusion of a work in an artistic work, sound recording, film or broadcast” will likewise also not be punished if it’s for charitable or educational purposes.

On a related note, the punishment for breaking copyright law in Malaysia is either a fine, imprisonment, or both where the punishment to be meted is dependent on the type of offence committed.

As per Section 41 of the Copyright Act 1987, playing music without a proper licence in public specifically will net you a fine not exceeding RM10,000 for each infringing copy, imprisonment for a term not exceeding five years, or both.

Subsequent offences will cost a fine not exceeding RM20,000 for each infringing copy, imprisonment for a term not exceeding 10 years, or both.

Flying too close to the sun

So then, you might be wondering, how do businesses get away with breaking copyright law?

There are plenty with speakers and TV screens livening up their premises with a touch of unpaid content, after all.

Well, to put it simply, it’s not that they are allowed to. They’re playing with fire.

And some have gotten burnt for pushing their luck too far.

As reported by Astro themselves, the company won a copyright infringement case on November 27, 2024.

The lawsuit was filed against Selangor-based bar and restaurant Brew Nation for reportedly streaming “exclusive live sports content, including football matches, to attract customers” as per the report.

The High Court of Malaya ordered the business to pay a fine of RM75,000 as punishment, and Astro was awarded an additional RM5,000 in legal costs.

Something not being heavily enforced doesn’t make it legal by default. That, perhaps, is the greatest takeaway from all this, and why it is important beyond an ethical standpoint to respect intellectual property rights and pay your dues.

- Read other articles we’ve written about Malaysian startups here.

Also Read: This Sabahan serial entrepreneur built 6 brands, here’s his business playbook

Featured Image Credit: Image used under licence from Shutterstock

Moved by their mums’ struggles, they launched a S’porean startup helping women with menopause

Hot flushes and erratic mood swings—these are the two things that come to mind whenever I think about menopause, and I used to dread it as I think about growing older.

That was until I came across a clip from the Amazon Prime series Fleabag when a monologue by British actress Kristin Scott Thomas changed the way I think about it:

We have pain on a cycle for years and years and years, and then just when you feel you are making peace with it all, what happens? The menopause comes. The f***ing menopause comes and it is the most wonderful f***ing thing in the world.

Yes, your entire pelvic floor crumbles and you get f***ing hot and no one cares, but then you’re free. No longer a slave, no longer a machine with parts. You’re just a person. In business.

An excerpt from Kristin Scott Thomas’s monologue on menopause in Fleabag Series 2

But as empowering as the speech was, we cannot deny that the taboo surrounding menopause still remains, leaving some ladies to their own devices to deal with the physical and mental pains that come with it.

That said, it seems that Surety‘s founders, Valery Tan and Elmer Yap, have found a way to make it easier and less lonely for women to navigate the daunting changes.

Finding a niche

Surety first started in 2022 as part of a venture builder program at the Singapore University of Social Sciences (SUSS), where the founders had originally studied. The startup initially focused on general women’s health, particularly in the area of contraceptives.

However, Valery quickly realised that the field of contraceptives was saturated with many players, leaving her to find a more “distinct, unique selling point.”

It was also around that time that she learned that her mother hadn’t had her period for six months.

Concerned, Valery urged her mother to visit the doctor, and they soon found out that she was going through perimenopause, the transitional phase leading up to menopause—something that Valery barely knew anything about.

That conversation opened my eyes to how little is discussed about menopause, especially in Asia, where it’s often considered a taboo subject. My mum’s experience of mood swings, hot flashes, and other symptoms affected not only her but also our relationship, and that’s when I realised this topic needed more attention.

Valery Tan, co-founder of Surety

Valery then shared her experience with Elmer, spurring the latter to reflect on his own relationship with his mother.

His mother was also experiencing “midlife changes,” however, he realised that his “knowledge of menopause was inadequate,” making it difficult to start a conversation on the topic.

Recognising that menopause care was a “true blue ocean market” that remained largely unexplored and underserved, Valery and Elmer decided to invest S$10,000 of their personal savings to pivot Surety’s focus towards menopause care.

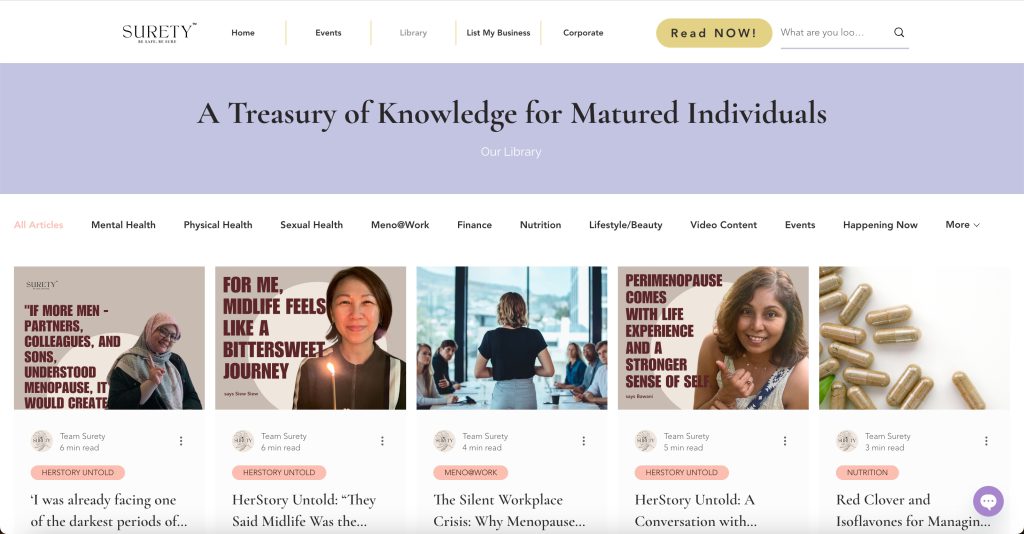

A platform, mobile app and festivals

Surety’s platform offers a variety of resources, including expert advice and curated content to assist women navigating perimenopause and menopause.

Their resources are also culturally relevant and personalised for women in Asia. In a separate interview with CNA Women, Valery brought up that most resources on menopause and perimenopause originated from Western countries, and the cultural nuances and specific challenges faced by Asian women were often missing.

“While medical professionals provide treatment, they often lack the time to dive into the holistic needs of midlife women, including emotional, social, and day-to-day challenges,” she added.

As an online platform, Surety’s goal is to bridge the gap by combining expert advice with peer support and insights.

Surety also reaches out to its audience through informative events, particularly through its Menopause Festival, which is its flagship event launched in November 2024.

According to the founders, the Menopause festival is “the first of its kind” in Asia. However, making the festival a reality was an ambitious plan—one that required the team to be meticulous in their pitches.

“One major obstacle was educating sponsors and stakeholders on the importance of menopause/midlife-related events. Convincing them required data-backed pitches and aligning the event’s goals with their CSR or ESG objectives,” shared Elmer.

He added that it was difficult to generate conversations about menopause among the younger audience, as they have not had the experience or actively taken notice of others going through the change.

But to their pleasant surprise, the festival was well-received, with over 150 individuals attending the festival last year, which was a mix of midlife women, medical professionals and partners.

Building on this momentum, the founders shared that they are looking to have more interactive sessions through workshops and Q&A panels for their upcoming festival in 2025.

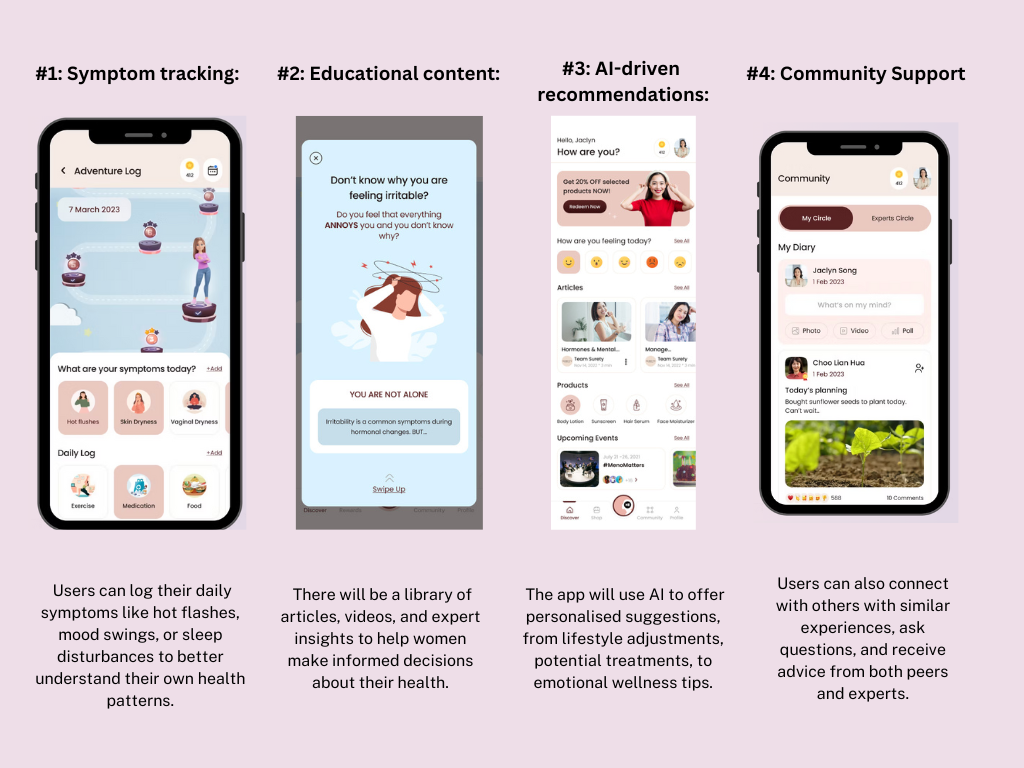

Surety is also currently in the works of developing PausePlay, an all-in-one menopause and midlife care app that leverages artificial intelligence (AI), designed to be a comprehensive tool for women navigating the complexities of menopause.

Currently, the startup is “fine-tuning” some of PausePlay’s features to create a seamless experience for its users as they navigate through perimenopause and beyond. When asked when they plan for the app to be launched, both founders shared that they have their eye on the first quarter of 2025.

As the startup has yet to reach profitability, both Valery and Elmer are looking to establish Surety beyond Singapore, with a key focus on countries such as Thailand, Malaysia and Indonesia, to increase its user base and obtain a more sustainable revenue stream.

In fact, the startup will hold its Menopause Festival in Kuala Lumpur, Malaysia, in October 2025 and is actively seeking local partners to curate products and services that resonate with the local audience.

It is scary to think about how much pain I might experience when I grow older, but with platforms like Surety around, menopause doesn’t seem like the terror that many make it out to be.

Also Read: How this S’porean created Asia’s leading fertility, reproductive and family health platform

Featured Image Credit: Surety

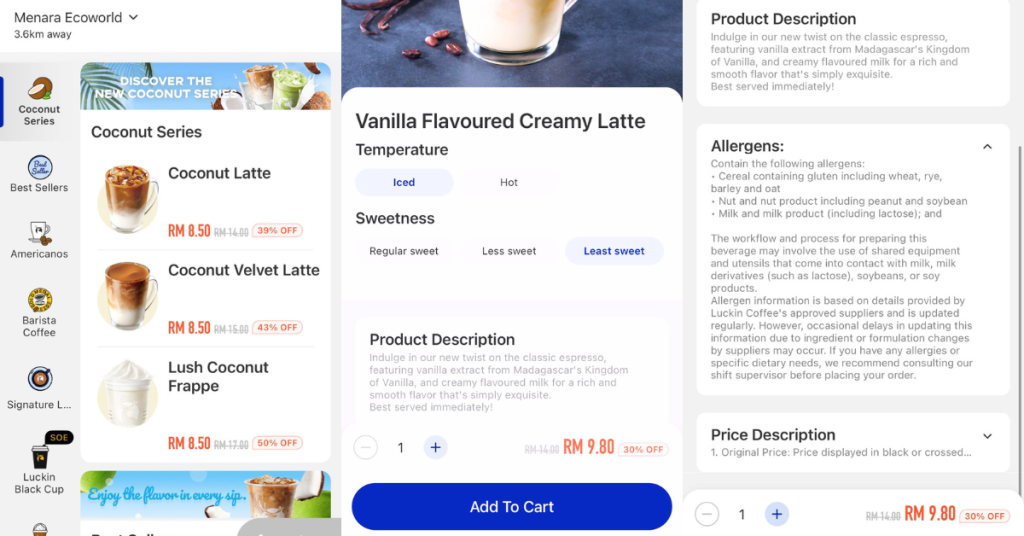

China’s famous Luckin Coffee entered Malaysia 2 months ago, we find out if it’s worth trying

It’s white and blue, has an app, and sells coffee. What brand is it?

If you’re Malaysian, you might be inclined to say ZUS Coffee. But those in China might think you’re referring to one of the country’s 18,360 Luckin Coffee outlets. Yes, you read that number right.

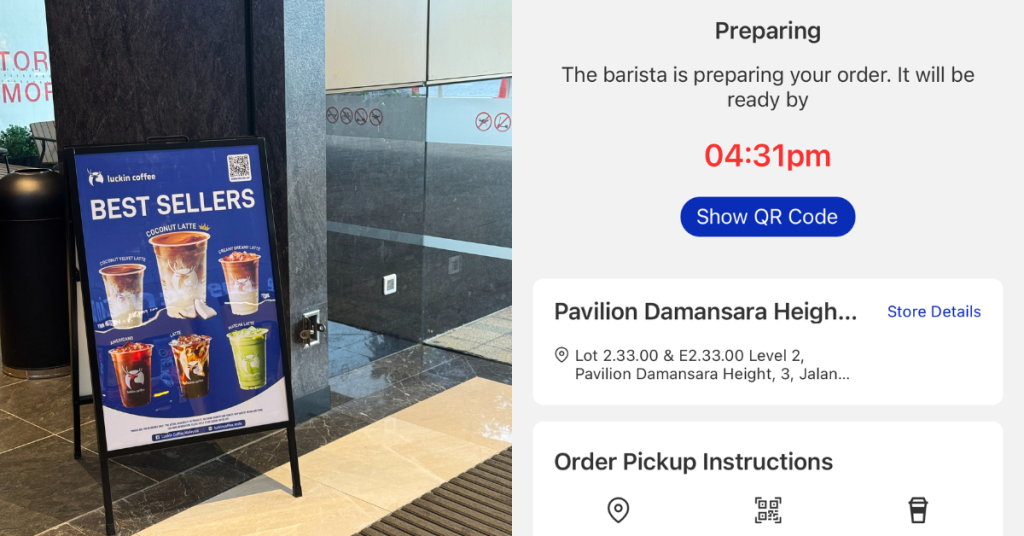

I’m writing this with a cup of Luckin Coffee’s velvet latte in hand, ordered after a five-minute battle with the Luckin Coffee app I was forced to download.

When approaching the barista some 10 minutes earlier, she had pleasantly asked, “Can I help you?” rather than “What can I get for you?” After asking for an iced latte, she told me I had to download the app.

“Sure,” I replied, unaware at the time that it was not a suggestion so that I could get the RM2.99 drink deal, but rather a command, as they themselves cannot order for me.

It appears that Luckin Coffee is not just a tech-enabled coffee chain, but a tech-enforced one.

Its mobile-first, technology-driven approach is the norm in China now, but admittedly, I wonder if it’s really all that friendly for Malaysian consumers. Is it just a matter of getting used to it? Do I want to get used to it?

I can see how its enforcement of the app would bring a high volume of downloads, but could it also have adverse impacts? To be honest, as I stood there trying to link my phone number to my new account, I had half the mind to leave and go to ZUS instead.

And I’m not the only one.

“Ma de, dian ge dan zhe me ma fan,” someone said as he passed by me, leaving the shop with his friend. Damn, it’s so troublesome just to place an order. How curious, I thought. By his accent, he sounded like he was from China himself.

But perhaps he had hit a snag if he didn’t have a local number to create an account. It took me some four attempts before I got the verification code.

It’s still early days for the brand in Malaysia, I suppose, so I’m inclined to give it a little bit of grace. At least the RM2.99 deal for first-time users is pretty attractive.

Meet the Malaysian operators

For those who have no idea what Luckin is, lucky for you, here’s a quick explanation.

Luckin was founded back in 2017 in Beijing, bagged a lot of funding, ran into an accounting scandal that led to them filing for bankruptcy, but then emerged from it in 2022. In 2023, they opened in Singapore, their first overseas market, then earlier this year, they ventured onto Malaysian soil.

In Malaysia, Luckin Coffee’s operator is Hextar Industries Berhad’s subsidiary Global Aroma Sdn Bhd (GASB). It owns exclusive rights to develop, open, and operate coffee shops under the Luckin Coffee brand nationwide.

If Hextar Industries doesn’t ring a bell, it’s a group that primarily deals in the manufacturing and distribution of fertilisers, turnkey products for the quarry and mining industry, and equipment rental and lifting solutions. Yeah, not really coffee-related.

But it doesn’t necessarily matter what they do—as long as they follow the proven recipe that has worked for Luckin in China.

Grab and please go

One big thing about Luckin is that the number of seats, at least at their current array of shops, is extremely few. And none of the seats really accommodate the working crowd. I have to sit with my laptop on top of my lap. Blasphemy.

Paired with the fact that you are forced to place your orders online, Luckin doesn’t intend to be a third space of any kind—just a convenient spot to get decent coffee.

Which brings me to: Is the coffee any good?

I ordered the velvet latte, which Google claims is “known for its creamy and silky texture, achieved through the use of Hokkaido milk.” Certainly, the drink tastes pretty darn delicious, albeit a bit too sweet, despite me already opting for the “less sweet” offering.

The array of drinks is pretty attractive, with the coconut latte being their bestseller. I’d say that this is fairly unique in the sense that it isn’t a top product for competing chains.

However, they don’t appear to have any hot foods, which once again solidifies the “grab-and-go” concept.

There are no non-dairy options just yet, though, so to my lactose intolerant friends, you’ll have to sit this one out right now (or bear the consequences).

Competition is good for consumers

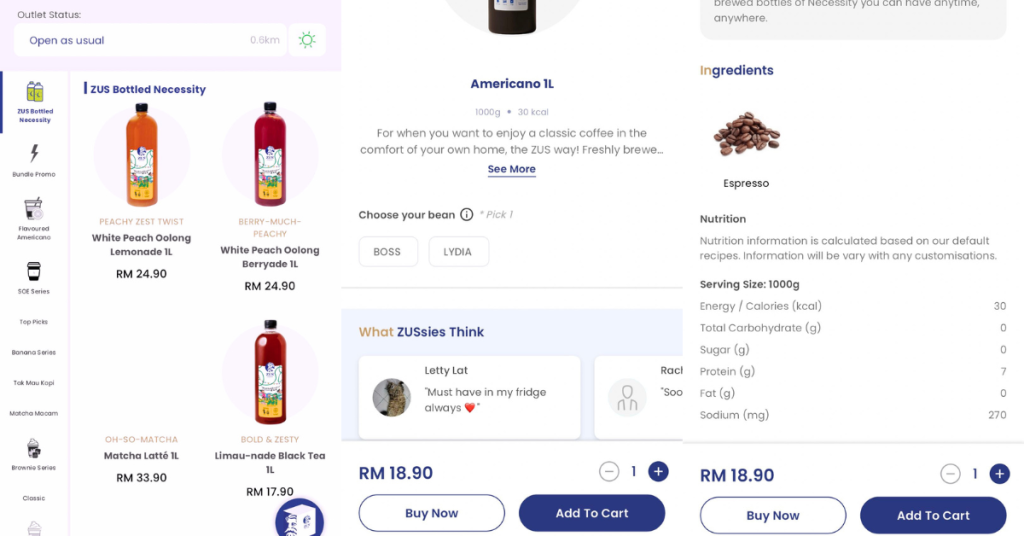

There’s a lot of parallels to be drawn between ZUS and Luckin. For one, the app’s UI and features are kind of similar. ZUS’ one is currently a lot more fleshed out, though.

And dare I say, the coffee of both chains are of the same-ish calibre, but in terms of product range, ZUS has them beat right now too.

Luckin has a pretty competitive price, especially right now as it’s offering much of their menu at a discounted rate.

That said, I still do have that slight streak of patriotism in me, and would much prefer supporting our homegrown blue-and-white coffee brand.

With how Luckin has mushroomed across China, there’s a chance the same will happen here in Malaysia. If Luckin really hones in on localising their branding as well as their products, I could see a future where it dominates our market.

I mean, just look at how China’s Mixue has boomed nationwide. Their small, efficient kiosks have made them a go-to destination for desserts and drinks. I could see the same working for Luckin.

Should established brands such as ZUS, Gigi, or even Starbucks be worried? Well, kind of. But ultimately, having more options and competition is good for the end consumer. It’s more options for us, and hopefully forces each brand to really put their best foot forward.

Also Read: This HP smart printer proves that M’sian SMEs don’t have to break the bank for reliability

Featured Image Credit: Vulcan Post