- BrandMenuMenuMenuMenuMenuMenu

See All Products

Discover new favourite products from more than 20 brands

- Contact Us

- Vulcan Post

Discover new favourite products from more than 20 brands

Remember the days of lugging around a bulky wallet stuffed with cash and receipts? Or waiting in line at the bank for a simple transaction? Thankfully, those days are fading into the rearview mirror thanks to the innovative world of fintech. But what exactly is fintech, and how is it changing the way we handle our money online? Buckle up, because we’re about to take a deep dive into this exciting world!

Fintech, short for financial technology, refers to companies that use cutting-edge technology to revolutionize the financial services industry. These startups are creating new ways to manage money, make payments, and access financial products – all with a tap, swipe, or click.

As we embrace these advancements, it’s interesting to see how they impact various sectors, including online casinos. Just as the best German online casinos provide top-notch gaming experiences, fintech startups are enhancing our financial interactions. These changes are not only reshaping how we handle money, but also how we view online casinos and other digital services.

The expert team at Casino Test shares their insights: “Integrating fintech solutions into online casinos can significantly improve the user experience. With faster and more secure transactions, players can enjoy their gaming experience without worrying about financial issues. Our website is dedicated to reviewing and providing information about the best German online casinos for players to explore. There is no doubt that we see fintech as a key factor in enhancing the overall gaming environment.”

Here are some ways fintech startups are redefining online transactions:

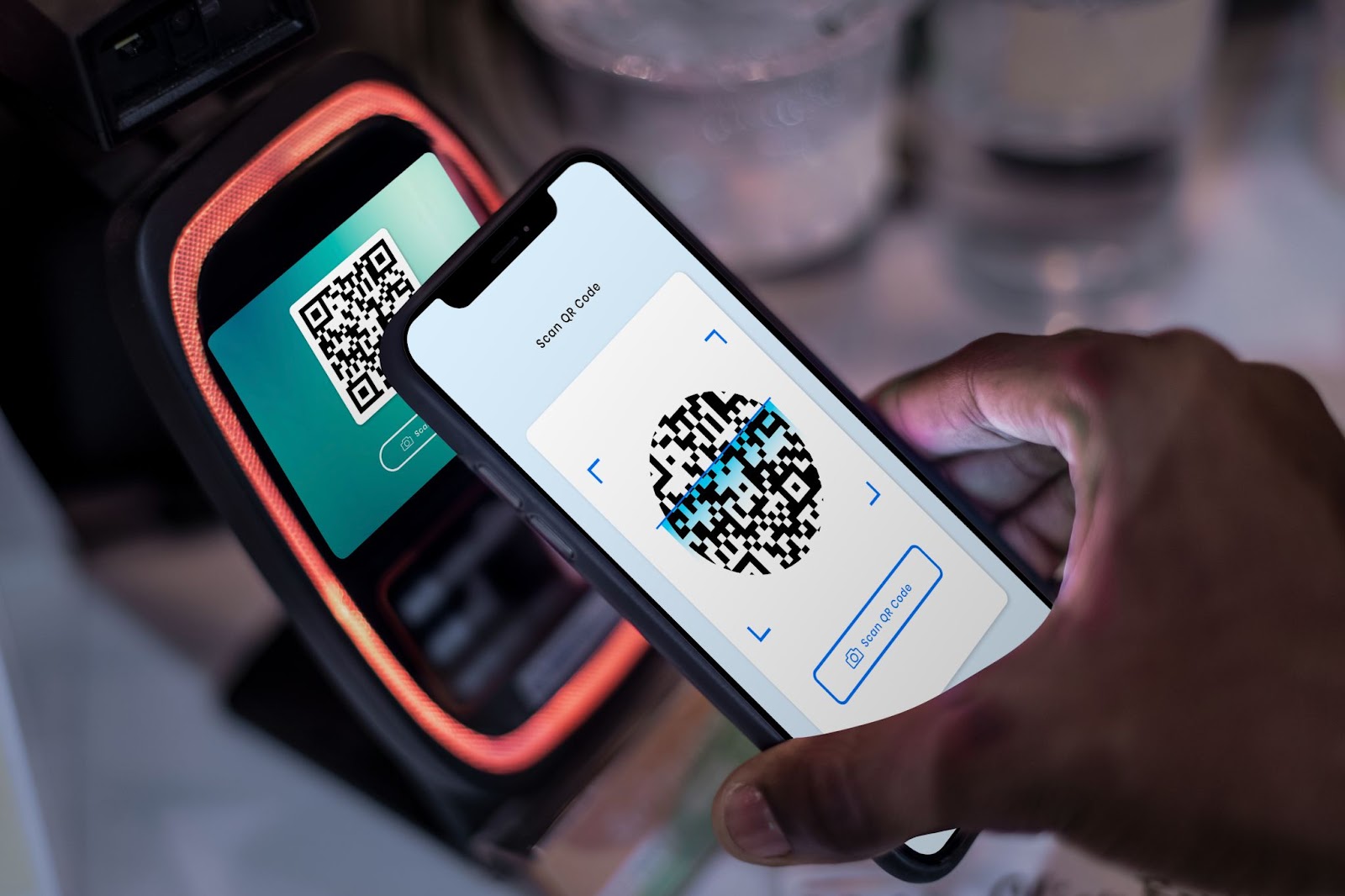

Forget fumbling for your wallet – mobile payment solutions like Apple Pay and Google Pay allow you to pay for anything with a simple tap of your phone. This technology is incredibly convenient and secure, making it a perfect fit for online transactions, including those at reputable German online casinos.

Remember the days of waiting for a package and having to come up with exact change? Fintech has brought us secure online payment gateways that streamline the checkout process, making online shopping (and potentially, online casino play in Germany) a breeze.

Sending money to friends or splitting a bill has never been easier. Fintech apps like Venmo and Zelle allow for instant peer-to-peer transfers, eliminating the need for cash or bank transfers. While online gambling should always be done responsibly, these apps offer a convenient way to manage your finances for various online activities, including potentially playing at licensed German online casinos.

The Power of Biometric Authentication: Forget complex passwords – fingerprint scanners and facial recognition are becoming increasingly popular for secure online transactions. This technology adds an extra layer of security to your online activities, which can be reassuring when it comes to online transactions, including those at well-respected German online casinos.

In the world of online casinos, secure and efficient transactions are crucial. Players want to deposit and withdraw money quickly and safely. This is where fintech comes into play. Many online casinos are now integrating fintech solutions to enhance their transaction processes. For instance, the best German online casinos use advanced payment gateways and digital wallets to ensure smooth and secure financial interactions. These innovations not only make transactions faster, but also build trust with players, knowing their money is handled securely.

The rise of fintech means faster, more convenient, and more secure ways to manage your money online. From effortless shopping experiences to seamless peer-to-peer transactions, the benefits are undeniable. But how can you leverage this new wave of innovation in your everyday life?

The impact of fintech extends beyond online casinos and financial services. It’s becoming an integral part of our daily lives. For instance, mobile payment apps like Venmo and Apple Pay allow us to pay for groceries, split bills with friends, and even pay rent, all from our smartphones. These services are making everyday transactions more convenient and efficient.

As fintech startups continue to innovate, they are redefining the way we conduct online transactions. Their solutions are making financial interactions faster, more secure, and more convenient. This transformation is not limited to traditional financial services but extends to various sectors, including online casinos. The best German online casinos are embracing fintech to enhance their transaction processes, providing players with a seamless and secure gaming experience. As we explore these advancements, it’s clear that fintech is shaping the future of online transactions. By integrating these technologies, we can look forward to a more efficient and trustworthy digital world.

Share this story: